Best Mortgage Lenders for Self-Employed: Top-Rated Picks 2026

If you are self-employed, you probably know the drill: you have a great year in business, you work with your CPA to maximize your write-offs to save on taxes, and you feel financially secure. Then, you walk into a bank to apply for a mortgage, and suddenly, you're "poor" on paper.

I've seen this frustration play out countless times. Just recently, I was reading a thread on Reddit where a business owner with excellent cash flow was rejected because their "Net Income" on line 31 of their Schedule C didn't meet the bank's rigid algorithm. It is a common, maddening scenario. But here is the good news for 2026: the market has evolved. You no longer have to rely solely on tax returns to prove you can afford a home.

In this guide, I have curated a list of the best lenders for self-employed borrowers this year. I didn't just look for the lowest advertised rates. I looked for flexible underwriting, "Bank Statement" programs, and lenders who actually understand that Gross Revenue is not the same as Net Income.

Top Self-Employed Mortgage Lenders

Finding the right partner is less about who has the biggest billboard and more about who understands complex income structures. Below, I've categorized lenders ranging from massive retail banks with decent tech to specialized "Non-QM" (Non-Qualified Mortgage) experts who don't require tax returns at all. Whether you are a freelancer, a small business owner, or a gig worker, one of these options should fit your unique financial puzzle and get self-employed mortgage loan.

1. CrossCountry Mortgage

Best for: Broad range of proprietary self-employed loan products.

NMLS ID: 3029

I often recommend CrossCountry Mortgage (CCM) because they sit in a "sweet spot" between a large lender and a flexible boutique shop. Unlike big banks that might auto-decline a complex file, CCM has invested heavily in proprietary products specifically for business owners. They are massive across the U.S. but operate with a localized feel. Their loan officers are generally well-trained in dissecting tax returns to add back non-cash expenses (like depreciation), which can magically boost your qualifying income.

Features:

- Bank Statement Loans: Qualify using 12 or 24 months of business bank statements.

- Asset Qualifier: Use liquid assets (stocks/cash) to qualify instead of income.

- Construction Loans: Great if you are building your own home.

- Fast Closing: Known for their "FastTrack" credit approval program.

2. Guild Mortgage

Best for: First-time self-employed homebuyers.

NMLS ID: 3274

If you are buying your first home and your business is relatively young (but at least 2 years old), Guild Mortgage is a fantastic starting point. They have a reputation for being "high touch," meaning they will hold your hand through the document gathering process. They are particularly good at handling government-backed loans (FHA/VA) for self-employed people, often finding ways to make the debt-to-income (DTI) ratios work where others can't.

Features:

- FHA Flexibility: More lenient on credit scores (down to 540 in some cases).

- Digital Verification: Can sync directly with some bank accounts to save paperwork.

- Lock & Shop: Lock your interest rate before you even find a house.

- Local Servicing: They often service their own loans, keeping things personal.

3. New American Funding

Best for: Manual Underwriting & Non-Traditional Credit.

NMLS ID: 6606

New American Funding is a powerhouse for borrowers who don't fit the standard "credit box." Their biggest strength is Manual Underwriting. While most lenders let a computer algorithm (Desktop Underwriter) decide your fate, New American Funding has human underwriters look at the full picture. If your credit score is bruised or your income is seasonal, having a human review your file can make the difference between an approval and a denial.

Features:

- Manual Underwriting: Human review for complex income stories.

- I-CAN Mortgage: Flexible terms tailored to your budget.

- Latino Focus: specialized support and bilingual loan officers.

- Non-QM Options: They offer products that don't require tax returns.

4. LendFriend Mortgage

Best for: Personalized service and speed (Boutique experience).

NMLS ID: 2508873

LendFriend is a smaller, boutique mortgage company based in Austin but serving several states. I included them because self-employed borrowers often get lost in the shuffle at big corporate banks. LendFriend is known for speed and direct access to senior loan officers. Reviews consistently mention their ability to "save deals" that other lenders dropped. If you want a Loan Officer who gives you their cell phone number and answers it on weekends, this is a strong contender.

Features:

- Concierge Service: Direct access to your loan team, no call centers.

- Fast Turnaround: often close faster than the industry average (21 days or less).

- Broker Flexibility: Can shop multiple wholesale lenders for you.

- Tech-Enabled: Easy digital document upload portal.

5. First National Bank of America (FNBA)

Best for: Non-QM & Difficult Income Scenarios (ITIN).

NMLS ID: 413209

Don't let the name "Bank" fool you. FNBA is a Non-QM specialist disguised as a bank. They are incredibly unique because they portfolio their loans (keep them rather than selling them to Fannie Mae). This allows them to make their own rules. They are arguably the best option if you have had a recent "credit event" like a bankruptcy or foreclosure, or if you are an immigrant business owner using an ITIN instead of a Social Security Number.

Features:

- ITIN Loans: Specialized programs for non-permanent residents.

- Recent Credit Events: Flexible on recent bankruptcies or foreclosures.

- No Tax Returns: Strong "Bank Statement" loan programs.

- Common Sense Underwriting: They look at the "whole story," not just the score.

Also Read: 8 Best ITIN Mortgage Lenders Near Me: How to Choose?

6. Angel Oak Mortgage Solutions

Best for: Bank Statement Loans (The Industry Leader).

NMLS ID: 1160240

In the world of self-employed mortgages, Angel Oak is legendary. They practically invented the modern Non-QM market. If you have zero taxable income on your returns but $500,000 flowing through your business bank account, Angel Oak is where you go. They are strictly focused on non-traditional loans. Note that Angel Oak often works through mortgage brokers, so you might access their products through a local broker rather than directly.

Features:

- Bank Statement Loans: Up to $3M loan amounts using 12/24 months of statements.

- 1099 Income Loan: Qualify using just your 1099 forms (no tax return needed).

- Investor Cash Flow: Loans for rental properties based on rent, not your income.

- 40-Year Terms: Options to lower monthly payments with a 40-year mortgage.

7. Rocket Mortgage

Best for: Tech-Savvy Borrowers with Clean Tax Returns.

NMLS ID: 3030

Rocket Mortgage is the largest lender in the country for a reason: their technology is unmatched. If your business is organized, your tax returns are filed, and your income is solid, Rocket is the fastest way to get a loan. Their app allows you to link your bank accounts and import tax docs instantly. However, be warned: their system is highly automated. If your tax situation is extremely messy, their "computer-first" approach might struggle to calculate your true income correctly.

Features:

- Fully Digital: Apply from your phone in minutes.

- ONE+ Program: 1% down payment options for qualified buyers.

- Verified Approval: A strong pre-approval letter that sellers trust.

- Volume Lender: efficient, but less flexible on "weird" scenarios.

8. Freedom Mortgage

Best for: Self-Employed Veterans (VA Loans).

NMLS ID: 2767

If you served in the military and are now your own boss, Freedom Mortgage should be your first stop. They are the top VA lender in the nation. VA loans are already tricky for self-employed folks, and you need a lender who knows the specific VA handbook rules on "residual income." Freedom specializes in this niche and can often help veterans maximize their benefits even with variable self-employment income.

Features:

- VA Expertise: Deep knowledge of VA residual income calculations.

- VA IRRRL: Streamlined refinancing if rates drop in the future.

- FHA Loans: Also very strong in government-backed lending.

- Credit Flexibility: Willing to work with lower credit scores (550+).

What are the Best Mortgage Loans for Self-Employed?

When you speak to these lenders, you shouldn't just ask for a "mortgage." You need to know what product to ask for. Here are the best loans for self-employed winning in 2026:

-

Bank Statement Loans: This is the Holy Grail for business owners. The lender ignores your tax returns completely. Instead, they look at 12 to 24 months of your business bank statements. They usually count 50% to 100% of your deposits as "income." If you write off a lot of expenses, this is the loan for you.

-

1099 Income Loans: Perfect for independent contractors (like Realtors or gig workers). If you receive 1099 forms, lenders can use the gross amount on those forms to qualify you, often applying a standard expense factor (e.g., assuming 10% overhead) rather than dissecting your Schedule C.

-

Asset Depletion Loans: If you are "income poor" but "asset rich" (e.g., you have $1M in stocks or crypto but low monthly income), this loan uses your assets to calculate a theoretical monthly income to help you qualify.

-

Traditional Conventional Loans: Don't rule these out! If your Adjusted Gross Income (AGI) is high enough after deductions, a traditional Fannie Mae/Freddie Mac loan will always offer the lowest interest rates.

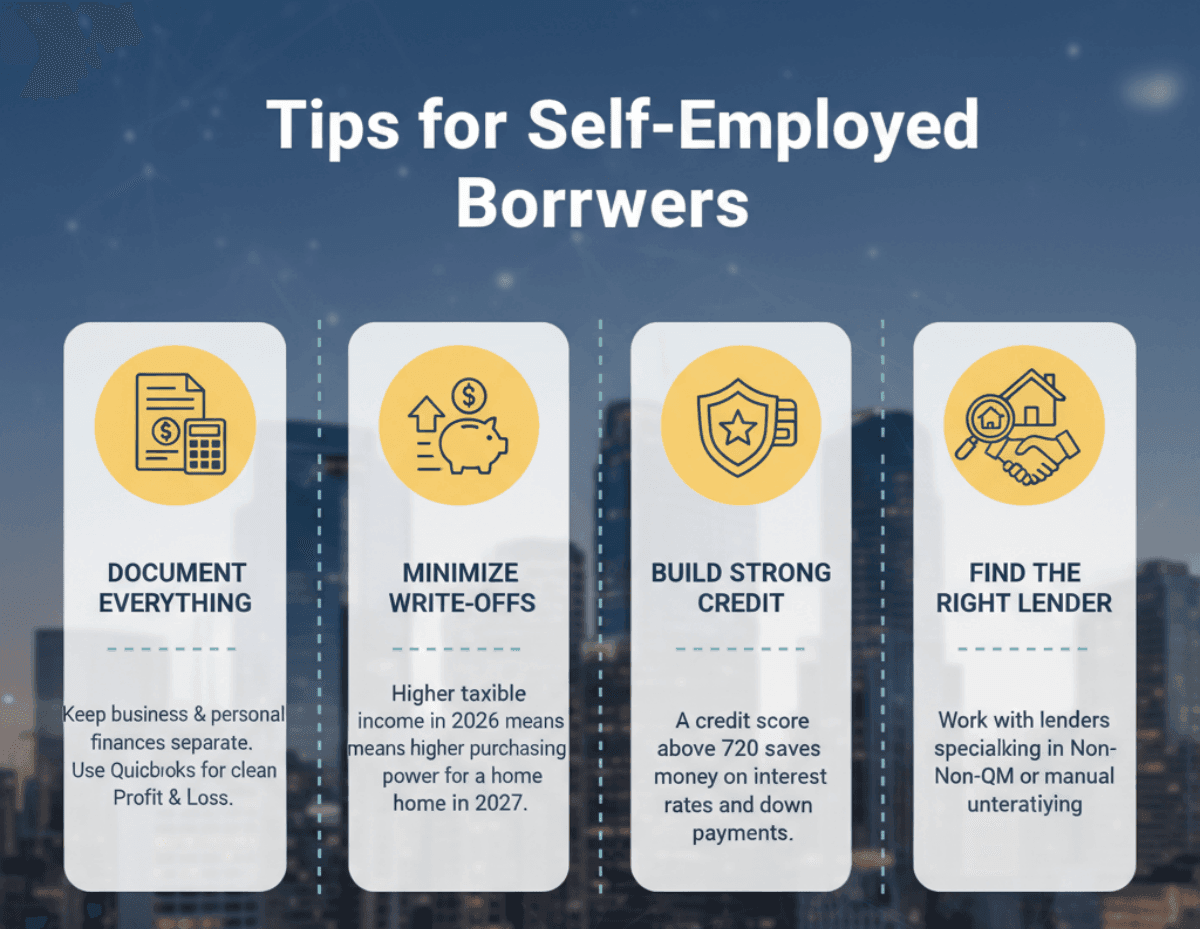

Tips for Self-Employed Borrowers

Getting approved requires a bit of strategy before you apply. Here are my top tips:

-

Document Everything: Keep your business and personal finances strictly separate. Commingling funds (paying for groceries with the business card) is a red flag for underwriters. Use software like QuickBooks to generate a clean Profit & Loss (P&L) statement.

-

Minimize Write-Offs (Temporarily): I know it hurts to pay taxes, but if you plan to buy a home in 2027, you might want to claim fewer deductions on your 2026 tax return. Higher taxable income equals higher purchasing power.

-

Build Strong Credit: Since self-employed loans are considered "riskier," lenders rely heavily on credit scores. A score above 720 can save you significant money on your interest rate and down payment requirement.

-

Find the Right Lender: Do not just go to the bank where you have your checking account. They are often the most conservative. Work with lenders, like the ones listed above, who specialize in Non-QM or have manual underwriting teams.

Conclusion

Being self-employed shouldn't disqualify you from the American Dream. The market in 2026 has adapted to the "gig economy," and there are more options now than ever before. Whether you need the flexibility of an Angel Oak bank statement loan or the manual underwriting expertise of New American Funding, the solution is out there.

However, every business is unique. A freelance graphic designer has a very different financial profile than a construction company owner. Instead of calling ten different banks yourself and explaining your story ten times, it is often better to find a local expert who already knows the landscape.

You can search for a top-rated, local loan officer who specializes in self-employed mortgages on Bluerate.ai. It's free, faster, and connects you with professionals nearby who know your specific state's market nuances. Good luck---your new home is within reach!