ITIN Mortgage Loan Guide 2026: Definition, Requirements, Process

I've spoken to countless hardworking individuals who feel stuck in a rental trap. They have steady jobs, they pay their taxes faithfully, and they have saved up significant cash. Yet, they believe the door to the American Dream is locked simply because they don't possess a Social Security Number (SSN).

If this sounds like your situation, I have some excellent news: Yes, you can buy a house in the U.S.

The key is an ITIN Mortgage Loan. It is a specific financing path designed exactly for people in your shoes. While it requires a bit more paperwork than a standard loan, it is completely legal and attainable. In this guide, I'm going to walk you through exactly how these loans work, the updated requirements for 2026, and the actionable steps you need to take to get the keys to your new home.

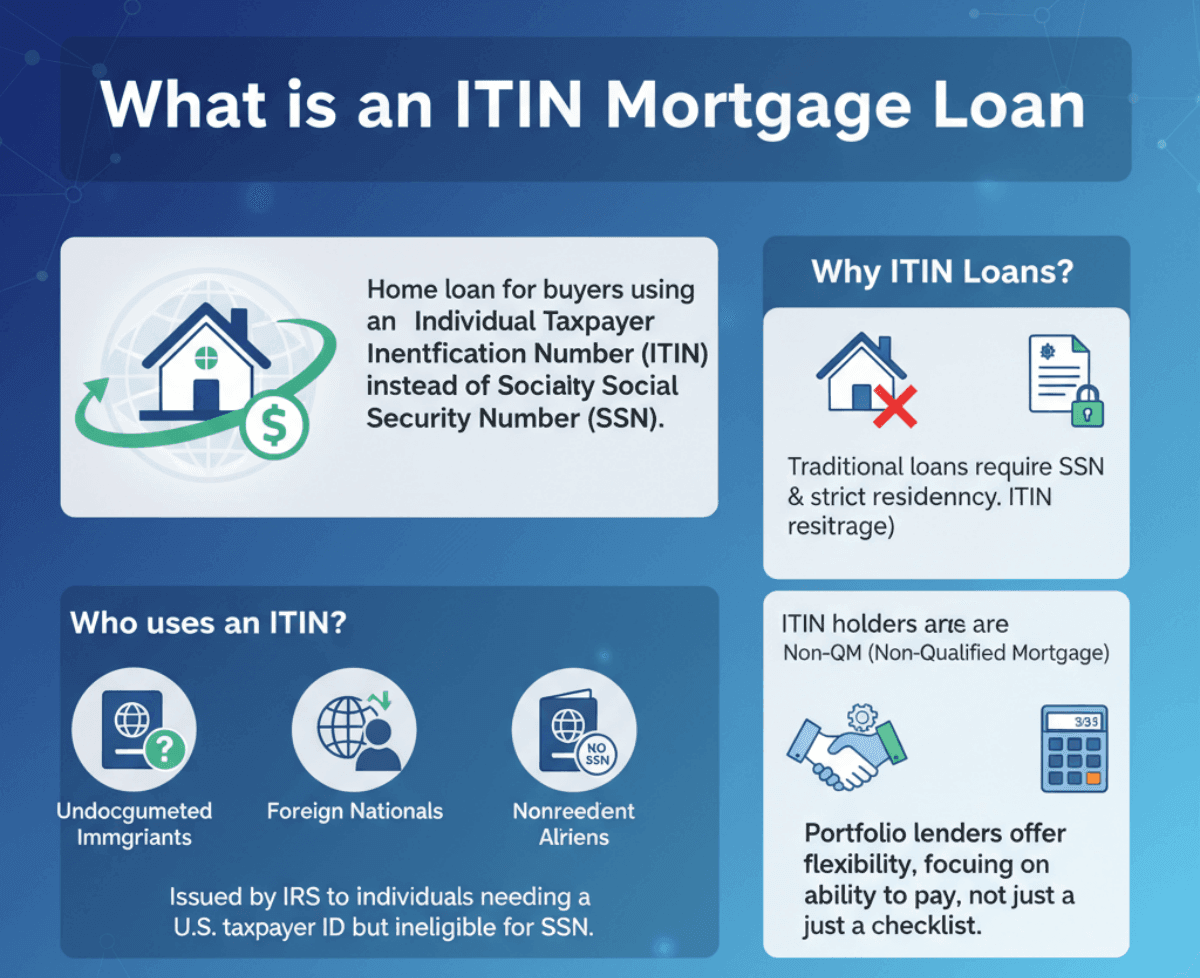

What is an ITIN Mortgage Loan?

An ITIN Mortgage Loan is a type of home loan created for buyers who use an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number.

The IRS issues these numbers to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, an SSN. This includes undocumented immigrants, foreign nationals, and nonresident aliens.

Most traditional loans, like those backed by Fannie Mae or FHA, have strict requirements regarding residency status and SSN. Because ITIN holders don't fit these "qualified mortgage" (QM) boxes, ITIN loans fall under a category called Non-QM loans.

This implies that the banks or lenders keeping these loans on their own books (portfolio lenders) have more flexibility. They are looking at your ability to pay rather than just a government checklist. By 2026, the market for these loans will have matured significantly. Fintech companies and specialized lenders have streamlined the process, making it faster and less "clunky" than it was just a few years ago.

Also Read: Full Comparison: Difference Between QM and Non-QM Mortgage

How Does an ITIN Mortgage Loan Work?

You might be wondering, "If I don't have a standard credit score history linked to an SSN, how will the bank trust me?"

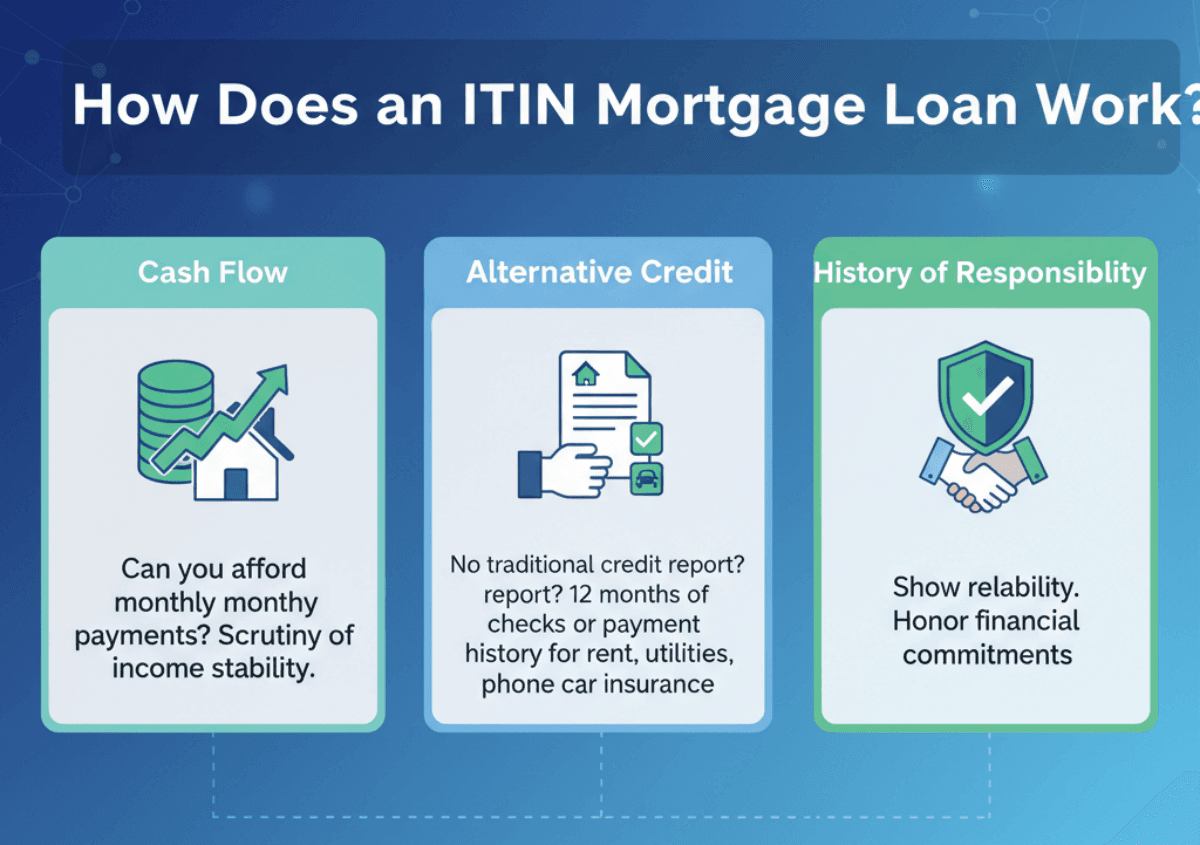

This is where ITIN loans get interesting. ITIN lenders use a manual underwriting process. Instead of just pulling a FICO score from a computer, a human underwriter looks at your full financial picture to assess risk.

They typically look for:

-

Cash Flow: Can you afford the monthly payments? They will scrutinize your income stability.

-

Alternative Credit: Since you might lack a traditional credit report, lenders often accept "alternative tradelines." This means providing 12 months of cancelled checks or payment history for rent, electricity, mobile phone bills, or car insurance.

-

History of Responsibility: They want to see that you are a reliable person who honors financial commitments.

Essentially, the lender is taking a slightly higher risk because the loan isn't government-backed. To offset this, the terms, like the interest rate and down payment, are adjusted, which I will cover in the next section.

Pros and Cons of ITIN Mortgage Loans

As someone who believes in financial transparency, I need to be honest with you. While these loans are a fantastic tool, they aren't perfect. It is crucial to weigh the benefits against the costs before signing any papers.

The Pros:

-

Access to Homeownership: The biggest benefit is obvious. You stop renting and start building equity in your own asset.

-

Flexibility: Lenders are often more understanding of unique income situations, such as self-employment or cash income, provided it is documented.

-

Building Credit: Many ITIN lenders now report to credit bureaus, helping you build a U.S. credit history over time.

The Cons:

-

Higher Interest Rates: Because these are considered "higher risk" by the industry, you can expect an interest rate that is roughly 1% to 3% higher than the standard market rate for conventional loans.

-

Larger Down Payment: You typically cannot buy a house with 3% down. Most ITIN programs require 15% to 20% down payment, sometimes more depending on your credit profile.

-

Fewer Lender Options: You can't just walk into any big bank, like Chase or Wells Fargo, and expect them to offer this. You need specialized lenders.

ITIN Mortgage Requirements (2026 Update)

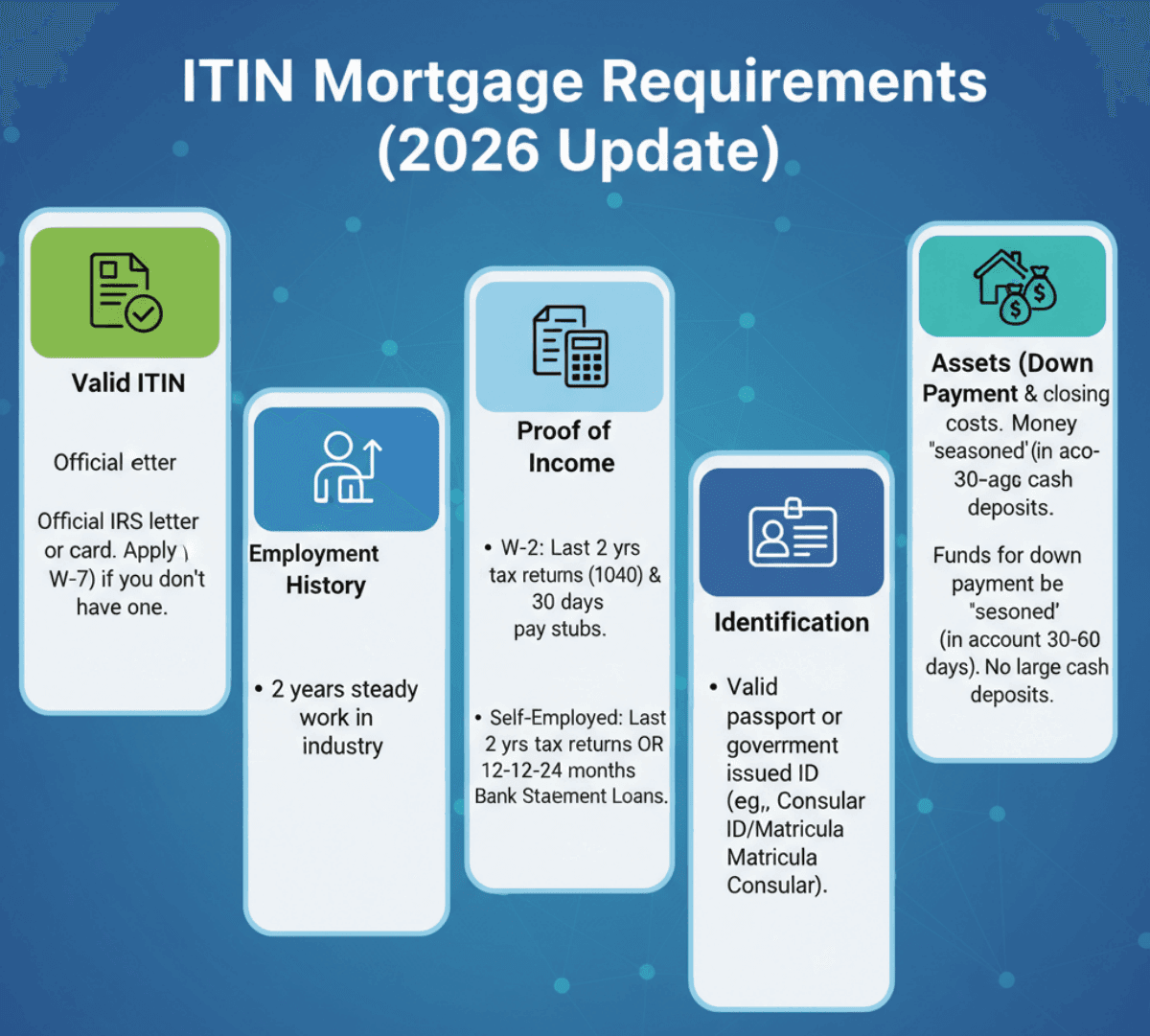

Preparation is everything. From my experience helping clients, the ones who get approved fastest are the ones who have their documents ready before they apply. Here is the checklist of what you typically need in 2026:

-

Valid ITIN: You must have the official letter or card from the IRS assigning your number. If you haven't applied for one yet (Form W-7), do that first.

-

Employment History: Lenders generally want to see 2 years of steady employment in the same line of work. If you changed jobs, it should be within the same industry.

-

Proof of Income:

- W-2 Employees: Last 2 years of tax returns (W-7/1040) and recent pay stubs (usually last 30 days).

- Self-Employed: Last 2 years of tax returns. Some lenders offer "Bank Statement Loans" where they calculate income based on 12-24 months of deposits into your business account, rather than tax returns.

-

Identification: A valid passport or a government-issued ID (like a consular ID card/Matricula Consular).

-

Assets (The Down Payment): You need to show you have the funds for the down payment and closing costs. The money usually needs to be "seasoned," meaning it has been sitting in your bank account for at least 30 to 60 days. Do not deposit a large amount of cash the day before you apply. It raises red flags.

How to Get an ITIN Mortgage Loan?

Ready to move forward? Here is the step-by-step workflow to navigate the process:

-

Check Your Status: Ensure your ITIN is active and your tax returns for the last two years are filed.

-

Save Aggressively: Aim for at least 20% of your target home price to secure the best terms. Don't forget to save extra for closing costs, which are usually 3-5% of the loan amount.

-

Find a Lender: This is often the hardest part because rates vary wildly between lenders. One lender might quote you 8% while another quotes 9.5%.

Don't do this manually. I suggest using platforms like Bluerate. They specialize in connecting borrowers with mortgage options. You can compare real-time, authentic rates for free. This transparency is vital because it prevents you from overpaying on interest. You can also consult with local loan officers through the platform who understand the specific housing market in your area. 4. Get Pre-Approved: Submit your documents to the chosen lender. They will issue a pre-approval letter, which shows real estate agents you are a serious buyer. 5. House Hunting: With your letter in hand, start looking for homes within your budget. 6. Underwriting & Closing: Once your offer is accepted, the lender will finalize the review of your file (underwriting). If all goes well, you'll sign the papers and get your keys!

FAQs About ITIN Mortgage Loan

Q1. Can I buy a house with an ITIN number?

Yes. U.S. law does not restrict property ownership to citizens. As long as you meet the lender's financial requirements regarding income and down payment, you can legally buy and own a home with an ITIN.

Q2. Who qualifies for an ITIN number?

ITINs are for individuals who need to file U.S. taxes but aren't eligible for an SSN. This includes nonresident aliens, foreign nationals, and dependents of U.S. residents/citizens who are not citizens themselves.

Q3. What loans can I get with ITIN?

You are generally limited to Non-QM (Non-Qualified Mortgage) loans. Unfortunately, you typically cannot qualify for government-backed loans like FHA, VA, or USDA loans, as these strictly require a Social Security Number and legal residency status.

Q4. How much is a down payment on an ITIN mortgage loan?

Expect to pay between 15% and 20% down. If you have a very strong credit history (even with ITIN), some lenders might go as low as 10-15%, but 20% is the standard to avoid higher fees.

Q5. How do I get an ITIN?

You must file Form W-7 (Application for IRS Individual Taxpayer Identification Number) with the IRS. You typically submit this along with your federal income tax return and original documents proving your identity (like a passport).

Final Word

Buying a home without an SSN is undeniably more challenging than the traditional route, but it is far from impossible. Thousands of families achieve this milestone every year. The most important thing is to ensure you are financially prepared and that you are not being taken advantage of with unfair interest rates.

Because rates for ITIN loans can be higher, shopping around is not just optional. It's a financial necessity. Don't settle for the first offer you receive.

I highly recommend visiting Bluerate to compare mortgage quotes for free. Seeing the real numbers from different lenders can save you thousands of dollars over the life of your loan. Take that first step today, and good luck on your journey to homeownership!