Best DSCR Lenders Near Me 2026: Highlights, Pros & Cons

If you've been scrolling through threads on Reddit communities like r/loanoriginators or r/realestateinvesting lately, you've probably noticed a common frustration. Investors are tired of their local bank manager staring blankly at them when they mention "rental income" or "Airbnb projection." You're not alone. The biggest headache in 2026 isn't finding a property. It's finding a lender who actually understands the asset-based model.

When I started my investment journey, I used to type "DSCR lenders near me" into Google, hoping for a branch I could walk into. But here is the reality I learned the hard way: the best "local" lender is rarely down the street. In the DSCR world, specific national lenders often know your local market better than the community bank next door. This guide cuts through the noise to bring you the top players who can actually close your deal this year.

People Also Read

- DSCR Loan Requirements 2026: Ratio, Credit Score, Down Payment, Type

- DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

- DSCR Formula: How to Calculate DSCR in Real Estate?

- 8 Best Non-QM Mortgage Lenders 2026: Get Your Best Pick Here

6 Best DSCR Loan Lenders In 2026

Finding the "perfect" lender is subjective, but after analyzing rate sheets, closing timelines, and borrower feedback from across the US, I've narrowed it down. These six companies stand out in 2026 because they balance competitive rates with the one thing investors value most: reliability. While they are national direct lenders, their digital reach effectively makes them the best option "near you," wherever your property is located.

#1 theLender

If there is one company that has really embraced the mantra of "Make Non-QM Great Again," it's theLender. Based on my observation of the market, they distinguish themselves by focusing on the human element of lending. They don't just run an algorithm.

They seem to look at the story behind the deal. They are particularly strong for investors who might have a complex financial history that scares off rigid banks. They treat real estate investment with a "common sense" underwriting approach, making them a go-to for borrowers who need flexibility without sacrificing professionalism.

Highlights

- Loan Amounts: Up to $3.5 Million

- Max LTV: Up to 80% on purchases

- Credit Score: Accepts scores as low as 620 (program dependent)

- Property Types: SFR, Condos, 2-4 Units

- Income Doc: No tax returns required (Asset-based)

Pros

- Extremely flexible "Common Sense" underwriting

- Great options for self-employed borrowers

- Offers interest-only payment options to improve cash flow

Cons

- Rates can be slightly higher for borrowers with credit scores under 660

- Their most aggressive programs may require higher reserves

#2 Visio Lending

Visio Lending feels like the "OG" in this space. They have positioned themselves not just as a lender, but as a specialized partner for landlord investors. What I appreciate about Visio is their laser focus, they don't dabble in everything. They specialize in rental properties.

Their "Bank 19" program is well-known in the industry for streamlining the documentation process. If you are building a massive portfolio of single-family rentals or vacation homes, Visio's infrastructure is built to handle volume and scale with you.

Highlights

- Experience: Over a decade of specializing strictly in landlord loans

- Structure: entity-friendly (LLCs, Corps)

- STR Friendly: Specifically underwrites vacation rentals (Airbnb/VRBO)

- Loan Terms: 30-year fixed options available

- Cash-Out: Aggressive cash-out refinance options

Pros

- Very standardized process, and you know exactly what to expect

- Excellent for Short-Term Rental (STR) investors

- No DTI (Debt-to-Income) calculations are used

Cons

- They can be stricter on property condition than some competitors

- Prepayment penalties are standard though common in DSCR

#3 Kiavi

Formerly known as LendingHome, Kiavi is a powerhouse for the modern investor who loves technology. If you hate printing, scanning, and faxing documents, Kiavi is your best friend. They utilize AI and machine learning to speed up the appraisal and underwriting process significantly.

In my experience, Kiavi is often the fastest route to the closing table. They appeal heavily to flippers who are transitioning into holding rentals, offering a seamless bridge between their bridge loans and long-term DSCR products.

Highlights

- Speed: Closing times can be as fast as 10-15 business days

- Tech Platform: 24/7 online portal for real-time tracking

- LTV: Up to 80% LTV for DSCR loans

- Rate Structure: Competitive tiered pricing based on experience

- Portfolio: Scalable options for investors with multiple properties

Pros

- Incredibly fast and transparent online process

- High transparency on fees before you apply

- Reward repeat borrowers with lower rates/fees

Cons

- Less flexibility for unique/rural properties that don't fit their data box

- Customer service is efficient but can feel less "personal"

#4 RCN Capital

RCN Capital brings a level of institutional gravity to the table. When you deal with RCN, you feel like you are working with a commercial bank that happens to do residential loans. They are a national direct lender with deep pockets, meaning they don't run out of funds when the market gets tight.

I view them as a solid choice for the serious investor who wants stability. They are particularly adept at handling mixed-use properties, which many other residential DSCR lenders shy away from.

Highlights

- Property Types: SFR, 2-4 Units, Condo, Mixed-Use, Multi-family (5+)

- Terms: 30-Year Fixed, ARM options

- Minimum Loan: Typically $55k+, accommodating lower-value assets

- Credit Requirement: Generally prefers 660+

- Foreign Nationals: Robust programs for non-US citizens

Pros

- Very stable capital source and reliable closings

- Strong support for commercial/mixed-use assets

- Professional process suitable for seasoned pros

Cons

- Can be paperwork-heavy compared to fintech startups

- Turn times can vary during peak market volume

#5 Angel Oak Mortgage Solutions

Angel Oak is often synonymous with Non-QM lending. They are a market leader for a reason: they practically invented many of the loan products used today after the 2008 crash reforms. For 2026, they remain a top contender because of their "Credit Box" width.

If you have a credit event in your past, like a bankruptcy or foreclosure that has just aged out, Angel Oak is often the first lender to offer a viable solution. They are the safety net for investors who have the cash flow but lack the perfect FICO score.

Highlights

- Credit Flexibility: Solutions for scores down to 600 (case-by-case)

- Loan Amounts: Jumbo loan amounts available (up to $3M)

- Doc Types: Full Doc, Bank Statement, and Investor Cash Flow (DSCR)

- Vesting: Closes in LLC or personal name

- Refinance: Offers Delayed Financing options

Pros

- Extremely forgiving regarding credit history

- Wide variety of program options beyond just DSCR

- Strong brand reputation and reliability

Cons

- Processing times can be slower due to high volume

- Rates might include a premium for lower credit tiers

#6 Easy Street Capital

As the name suggests, Easy Street Capital aims to remove the friction from lending. They have carved out a massive niche in the Short-Term Rental (Airbnb/VRBO) space. While other lenders struggle to underwrite Airbnb income, Easy Street embraces it. They use AirDNA and other data to project income, rather than relying solely on long-term lease market rents.

If you are looking to buy a vacation rental in a high-demand tourist area, they are arguably the most "forward-thinking" lender on this list for that specific strategy.

Highlights

- STR Specialist: Specifically designed for Airbnb/VRBO investors

- No DTI: strictly asset-based

- Prepayment: Flexible penalty structures available

- Closing: Can close in as little as 48 hours (for hard money) or fast for DSCR

- Down Payment: Competitive LTV options

Pros

- Best-in-class for Short-Term Rental underwriting

- Minimal documentation required

- Focus on the asset's cash flow potential, not your tax returns

Cons

- Interest rates reflect the higher risk/speed convenience

- Primarily focused on investment properties only (no owner-occupied)

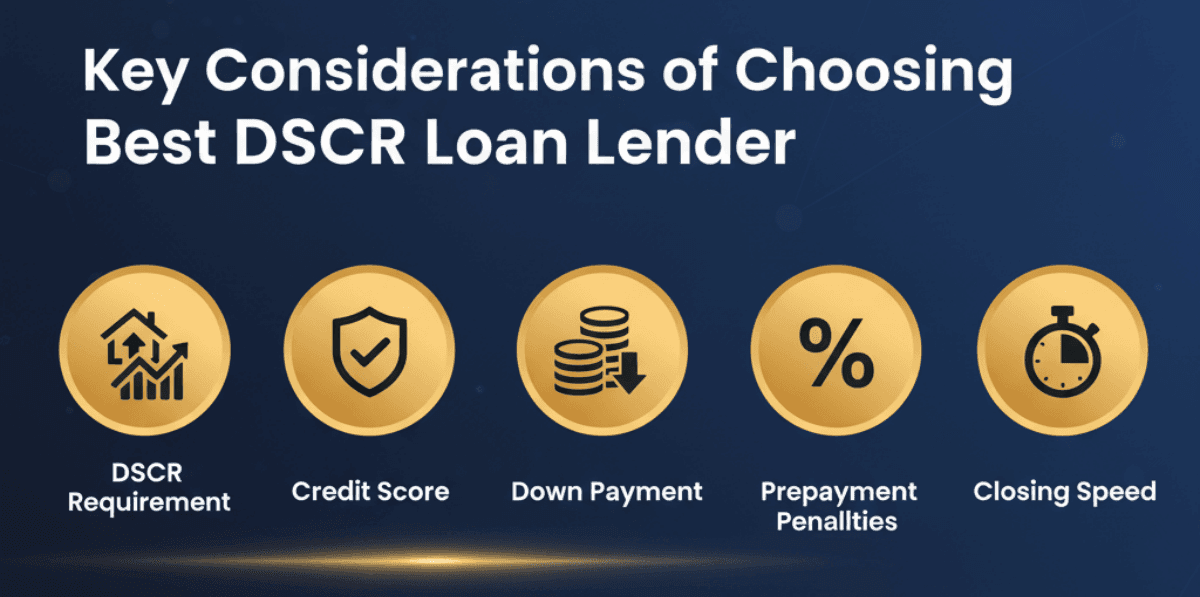

Considerations of Choosing the Best DSCR Loan Lender

Choosing a lender isn't just about clicking on the lowest mortgage rate. In my years of investing, I've learned that the "fine print" is where your profit lives or dies. When evaluating the lenders above, you need to weigh several factors heavily:

-

DSCR Ratio Requirement: Most lenders want a 1.25 ratio (Rent ÷ PITIA). However, in 2026, some offer "No Ratio" ( < 1.0) loans if you have a high down payment. This is crucial if buying in high-appreciation, low-cash-flow markets like California.

-

Prepayment Penalties (PPP): This is the biggest trap. A lower rate often comes with a 5-year hard penalty. If you plan to refinance next year when rates drop, a 5-year PPP is a deal-breaker. Always ask for the "buyout" cost of the PPP.

-

Closing Speed: In a competitive seller's market, a lender who can close in 14 days is worth paying a slightly higher rate than one who takes 45 days.

-

Seasoning Requirements: Some lenders require you to own a property for 6-12 months before you can refinance based on the new appraised value. Others allow immediate "Delayed Financing."

-

LTV & Down Payment: While 80% LTV exists, 75% is the sweet spot for better pricing. Be prepared that higher leverage always equals a higher rate.

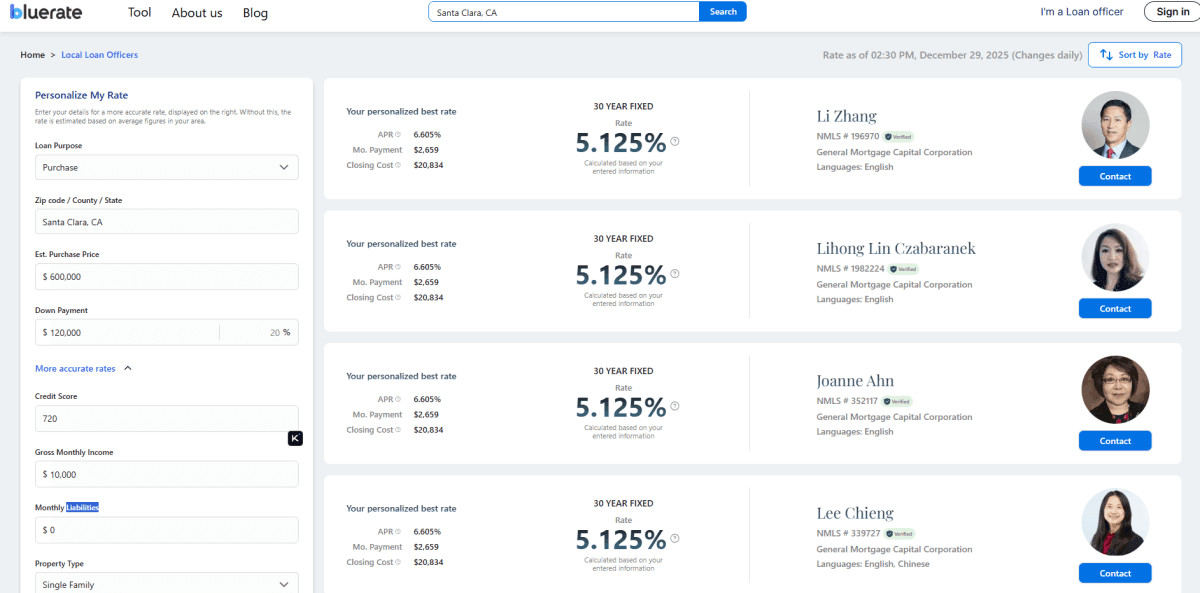

Tip: How to Find a DSCR Loan Offer Near You?

We've covered the top lenders, but let's be honest: visiting six different websites, filling out six different forms, and dodging sales calls for weeks is a nightmare. I used to manage this via messy spreadsheets, but technology has finally caught up.

If you want to find the best rates without the hassle, I highly recommend Bluerate.

Bluerate.ai isn't just another lender. It's a comprehensive Marketplace developed by Zeitro that acts as your personal matchmaker. It connects borrowers with NMLS-verified, professional Loan Officers in your specific area.

Here is why I find it valuable for DSCR investors:

-

AI Loan Officer Assistant: You can literally chat with their AI agent. Tell it, "I need a DSCR loan for a duplex in Texas with 20% down," and it helps match you with the right officer and rate.

-

Personalized, Real-Time Rates: Unlike generic rate tables, Bluerate allows you to compare real-time mortgage rates from over 100 lenders tailored to your scenario, before you commit.

-

Privacy First: This is huge. You get the data without exposing your phone number to dozens of spam callers.

-

All-in-One Platform: From the initial quote to tracking your loan progress, it centralizes the chaos.

Whether you are looking for NonQM, FHA, or Conventional loans for a Single-Family or Multi-Family home, Bluerate simplifies the search. It's the smartest way to leverage the "Near Me" intent, finding the best expert for your location instantly.

FAQs About Top DSCR Lenders

Q1. Who is the number one DSCR lender?

There is no single "number one" because it depends on your strategy. Visio Lending is often top-tier for rental portfolios, while Kiavi ranks highest for speed and tech experience. Angel Oak is typically the best for borrowers with credit challenges.

Q2. What is a good DSCR loan?

A "good" DSCR loan typically features a Debt-Service Coverage Ratio of 1.25 or higher, meaning the rent covers 125% of the mortgage debt. Ideally, it also has a fixed rate (30-year) and a flexible prepayment penalty structure (e.g., 3-2-1 step down) that doesn't lock you in forever.

Q3. Are DSCR loans hard to get?

No, they are generally easier to get than conventional loans. Because they do not require personal income verification (tax returns or W2s) and focus solely on the property's cash flow and your credit score, the underwriting process is faster and less invasive.

Q4. What is the downside to a DSCR loan?

The main downsides are higher interest rates (typically 0.75% to 2% higher than conventional loans) and larger down payment requirements (usually 20-25%). They also almost always come with a Prepayment Penalty, limiting your ability to refinance quickly without a fee.

Q5. Do all DSCR loans require a down payment?

Yes. DSCR loans are investment products and carry higher risk for the lender. You generally cannot get 0% down. Most lenders require at least 20% down, though some aggressive programs might accept 15% with a very high credit score and strong reserves.

Q6. What is the minimum down payment for a DSCR loan?

The industry standard minimum is 20% (80% LTV). However, in the current 2026 market, you will find that putting down 25% usually unlocks a significantly better interest rate and easier underwriting terms.

Conclusion

As we move through 2026, the real estate market continues to favor the prepared. DSCR loans remain the most powerful tool for scaling a portfolio without being held back by personal income constraints. Whether you choose the tech-speed of Kiavi or the rental specialization of Visio, the key is to partner with a lender who understands your specific goals.

-

theLender: Offers flexible, asset-based DSCR with no tax returns, min FICO ~620, up to 80% LTV.

-

Visio Lending: Specializes in rentals/STRs, entity-friendly, no DTI, over a decade of experience.

-

Kiavi: Tech-driven, fast closings (10-15 days), up to 80% LTV for rentals.

-

RCN Capital: Handles mixed-use/multi-family, min loan ~$55k, prefers 660+ FICO, stable funding.

-

Angel Oak: Credit-flexible (down to ~600), jumbo options, DSCR cash flow focus.

-

Easy Street Capital: STR/AirDNA specialist, no DTI, fast DSCR closings.

Don't let analysis paralysis stop you. The opportunities are out there "near you" right now. I recommend starting your search on Bluerate to instantly compare your options, verify rates, and connect with a trusted professional who can close your next deal. Happy investing!