3 Methods: How to Calculate Debt-to-Income Ratio for Mortgage?

When I first started thinking about buying a home, I spent hours obsessing over my credit score. While that number is important, I quickly learned that lenders care just as much about another metric: your Debt-to-Income (DTI) ratio. It is the key number that tells a bank if you can actually afford the monthly payments without drowning in debt.

In this guide, I'll walk you through three easy ways to calculate this yourself: the accurate "pen and paper" method, the quick Bankrate tool, and the detailed Zillow calculator. While running these numbers on your own is a great starting point, I always suggest chatting with a professional to get the full picture. You can easily find and consult a local loan officer for free to get a precise look at your approval odds.

People Also Read:

- 10 Tips: First-Time Home Buyer Tips and Advice for You

- Where and How to Compare Mortgage Loan Quotes Online?

- Must-Read Guide: How to Apply for a Mortgage Loan Online?

- Mortgage Prequalification vs Preapproval: All Differences

- Must-Read: How Long is a Mortgage Preapproval Good for?

What is the Debt-to-Income Ratio for a Mortgage?

Simply put, your DTI compares how much you owe every month to how much you earn. Lenders use this ratio to measure risk. Basically, do you have enough cash flow to handle a mortgage?

To really understand this like a pro, you need to know that lenders actually look at two different ratios. I want to make this distinction clear because it affects how much you can borrow:

-

Front-end DTI (Housing Ratio): This calculates only your projected housing costs, principal, interest, taxes, and insurance (PITI), divided by your gross income.

-

Back-end DTI (Total Debt Ratio): This is the more critical number. It combines your new housing costs plus all your other monthly debt obligations, like credit cards, car loans, and student loans.

Most loan programs focus heavily on the back-end ratio. If this number is too high, you might need to pay off some debt before qualifying.

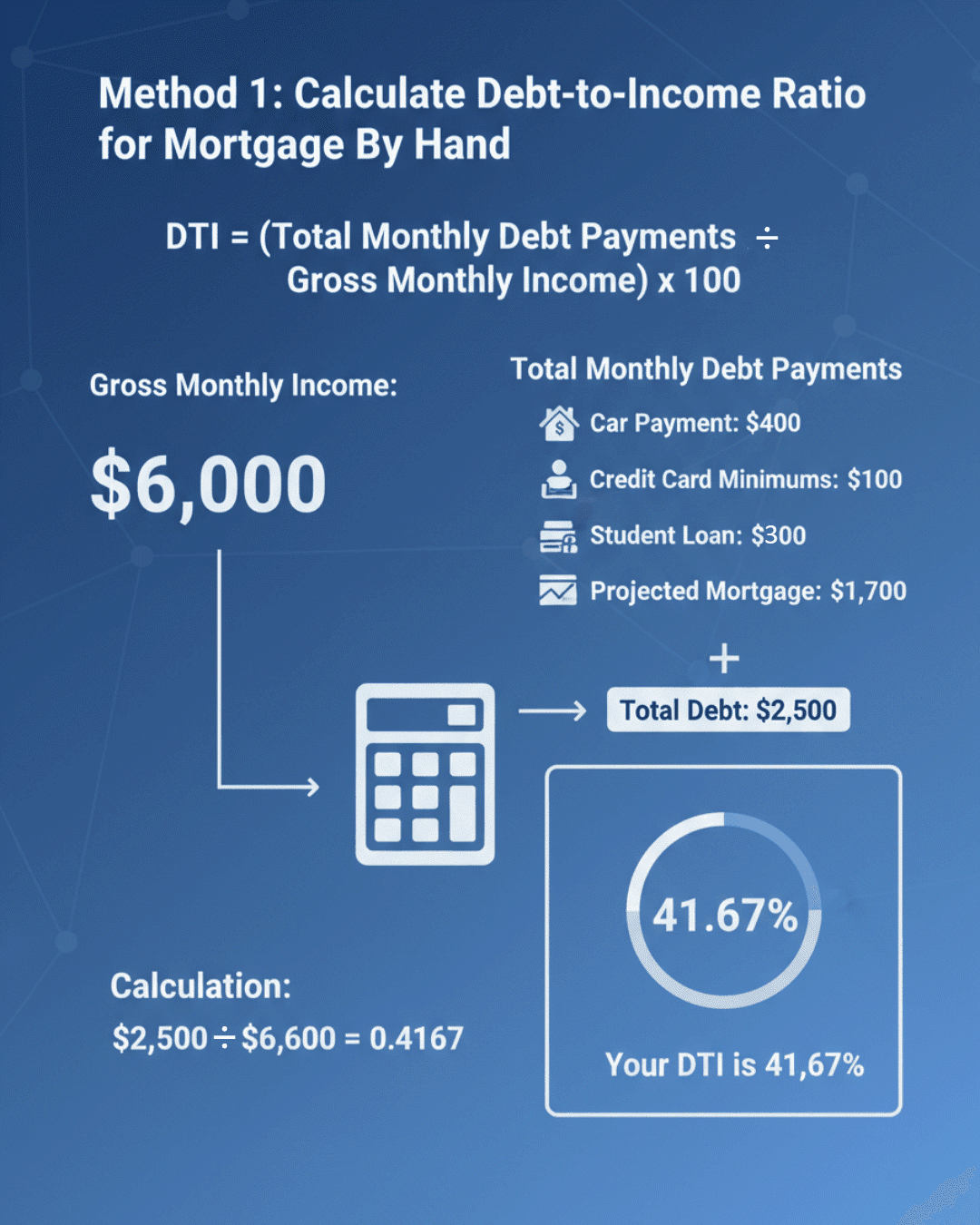

Method 1: Calculate Debt-to-Income Ratio for Mortgage By Hand

I personally love this method because it forces you to look at your finances honestly. Calculators are great, but doing the math by hand ensures you don't miss anything specific to your situation.

Here is the formula lenders use: DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) x 100

-

Gross Income: This is your income before taxes, health insurance, or 401(k) contributions are taken out.

-

Monthly Debt: Only include debts that show up on a credit report (loans, credit cards). Do not include groceries or utilities.

Let's look at a real-life example:

Imagine you earn $6,000 a month (gross).

You have a $400 car payment, $100 in credit card minimums, and a $300 student loan. You are looking at a house with a projected mortgage payment of $1,700.

-

Total Debt: $400 + $100 + $300 + $1,700 = $2,500.

-

Calculation: 2,500 divided by 6,000 equals 0.416.

-

Result: Your DTI is 41.67%.

By doing this manually, you get the most accurate "back-of-the-napkin" estimate.

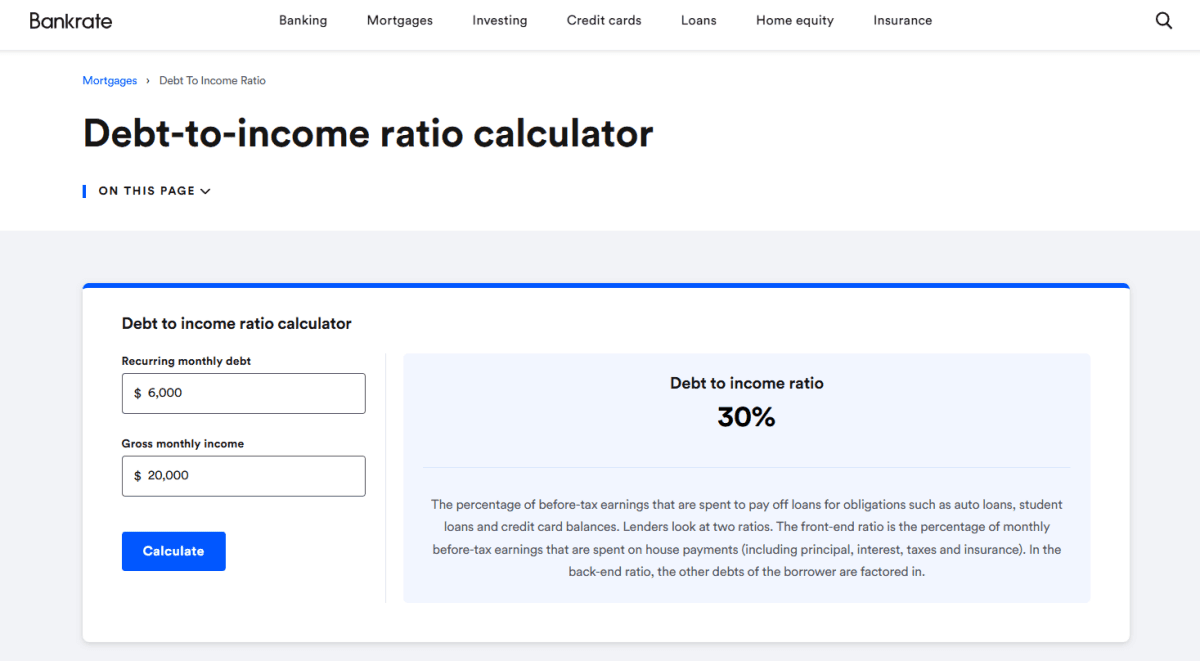

Method 2: How Do You Calculate DTI for Mortgage via Bankrate

If you are in a rush and just want a quick "temperature check," the Bankrate DTI Calculator is my go-to tool. Its main advantage is simplicity, and you don't need to get lost in the weeds of complex data entry.

However, its simplicity is also its downside. It treats all debt the same and doesn't offer a breakdown of housing vs. non-housing debt.

-

Navigate to the calculator page.

-

Enter your Recurring monthly debt (sum up your car, student loans, and credit cards first).

-

Enter your Gross monthly income.

-

Instantly view your ratio percentage.

It is a fantastic tool for a quick estimate while you are browsing homes on your phone, but remember, it is just a rough guide.

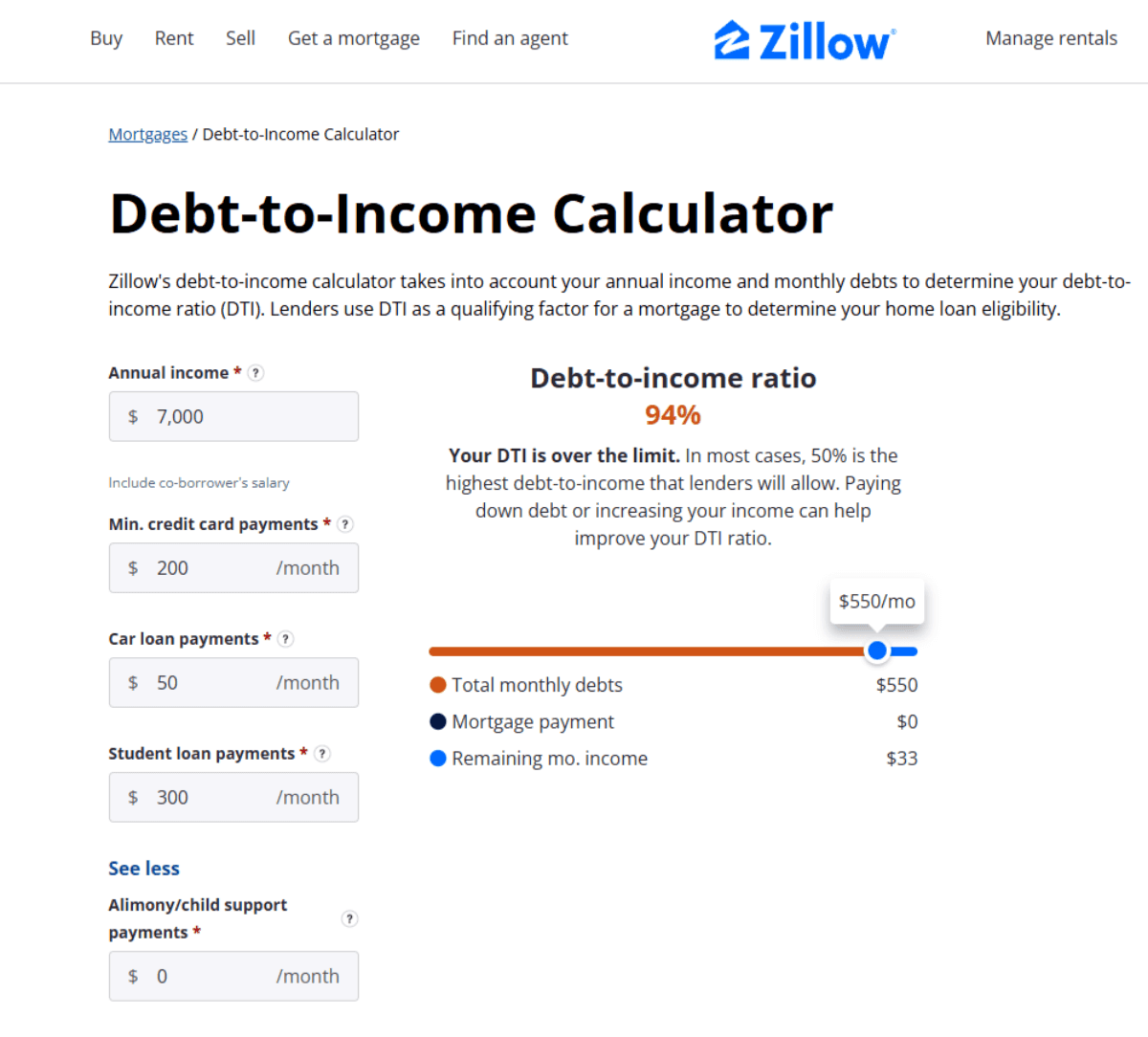

Method 3: Calculating Debt-to-Income for Mortgage Using Zillow

For a "deep dive" that mimics what an underwriter might actually look at, I prefer the Zillow DTI Calculator. This tool requires more data inputs than Bankrate, making it far more precise for serious planning.

It allows you to input specific categories like Alimony/child support, Secondary home expenses, or other specific debts. This is crucial because these obligations can make or break a loan application.

-

Input your Annual income.

-

Fill out specific fields for Min. credit card payments, Car loan payments, and Student loan payments.

-

Expand the "Advanced" section to add things like child support.

-

Review the four results: DTI ratio, Total monthly debts, Mortgage payment, and Remaining mo. income.

Zillow will even verify if your DTI is "Over the limit" based on standard guidelines. The only downside is that it takes a bit more time to fill out, but the insights are worth it.

What is a Good Debt-to-Income Ratio for a Mortgage?

So, what is the magic number? The Consumer Financial Protection Bureau (CFPB) revised the General Qualified Mortgage (QM) rule, effective October 1, 2022, removing the strict 43% DTI limit and replacing it with price-based thresholds (e.g., APR not exceeding the average prime offer rate by more than set basis points). Lenders still consider DTI but without a rigid 43% cap for QM status.

However, if you want the best interest rates and a stress-free budget, I suggest aiming for 36% or lower. The lower your ratio, the less risky you appear to banks.

Are there exceptions? Yes. Some government-backed loans, like FHA or VA loans, can sometimes approve a DTI up to 50% or even higher, provided you have "compensating factors" like a high credit score or significant cash reserves. But generally, staying under 43% keeps you safe.

FAQs About Calculating Debt-to-Income for Mortgage

Q1. Is rent included in debt-to-income ratio?

No. When you apply for a mortgage, lenders assume you will be moving out of your rental. Therefore, your current rent payment is removed from the calculation and replaced by the proposed mortgage payment (PITI) for the new house.

Q2. Are utilities included in the debt-to-income ratio?

No. Daily living expenses like electricity, water, internet, and groceries are not included in the DTI calculation. Lenders only care about debts with a legal repayment obligation (usually those found on your credit report). However, you should definitely include utilities in your own personal budget.

Q3. What's the maximum DTI for a mortgage?

For conventional loans, the maximum back-end DTI is typically 50% via automated underwriting or 43% for manual underwriting, with exceptions possible up to 45% for strong profiles. FHA loans allow up to 43%-50% back-end DTI with compensating factors via manual underwriting, or up to 55% via automated systems. However, every lender has their own "overlays" (stricter internal rules), so the maximum they allow might be lower than the federal limit.

Q4. What are common DTI mistakes?

The biggest mistake I see is using Net Income (take-home pay) instead of Gross Income. This makes your DTI look much worse than it actually is. Another common error is forgetting to include the Homeowners Association (HOA) fees of the new property in the projected debt, which can surprisingly push you over the limit.

Final Word

Calculating your DTI is the first serious step toward homeownership. Whether you used the manual formula or the Zillow tool, knowing this number gives you a baseline for what you can afford.

However, keep in mind that online calculators are just tools. They can't explain your bonus income structure to an underwriter or help you fix a credit report error. If you are unsure about your numbers, I highly recommend connecting with a pro. At Bluerate.ai, you can search for and directly contact local loan officers. They can answer your specific questions and help you get pre-approved, completely free of charge.