2026 Full Guide: What is the Debt-to-Income Ratio for Mortgage?

When I bought my first home, I was obsessed with my credit score. I checked it daily, thinking that 750 was the golden ticket to any loan I wanted. I was wrong. I walked into a lender's office confident, only to be grilled about my car payment and student loans. That's when I learned a hard lesson: your credit score shows your history, but your Debt-to-Income Ratio (DTI) shows your ability to pay right now.

For many first-time homebuyers in 2026, DTI is the "silent deal-killer." It's the number lenders care about most to determine if you can actually afford the monthly mortgage payments. In this guide, I'll walk you through exactly what this ratio is, how to calculate yours before you house hunt, and what strategies you can use to fix it if it's too high.

People Also Read:

- 10 Tips: First-Time Home Buyer Tips and Advice for You

- Must-Read Tips: How Do I Get the Lowest Mortgage Rates?

- Step-By-Step Guide: How to Refinance a Mortgage Loan?

- First-Time Home Buyer Requirements: Everything You Need to Know

- Where and How to Compare Mortgage Loan Quotes Online?

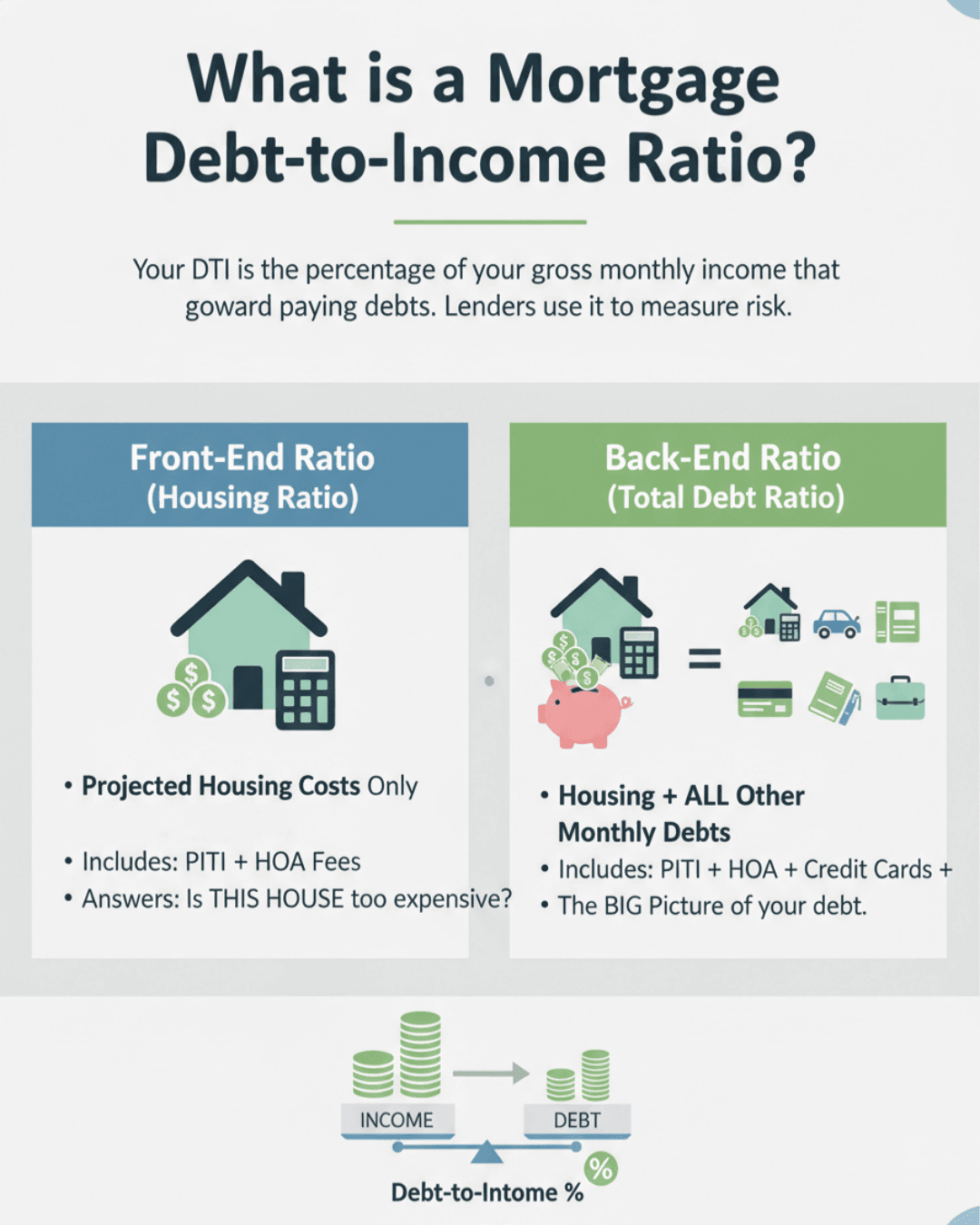

What is a Mortgage Debt-to-Income Ratio?

Simply put, your Debt-to-Income Ratio is the percentage of your gross monthly income that goes toward paying debts. Lenders use this metric to measure risk. Specifically, the risk that you won't be able to handle a new mortgage payment on top of your existing bills.

To understand this fully, you need to know that lenders look at two specific types of DTI:

-

The Front-End Ratio (Housing Ratio): This only looks at your projected housing costs. It includes the principal, interest, taxes, and insurance (PITI), plus any Homeowner Association (HOA) fees. It answers the question: Is this specific house too expensive for you?

-

The Back-End Ratio (Total Debt Ratio): This is the big one. It combines that new housing payment with all your other recurring monthly debts.

Most lenders focus heavily on the Back-End Ratio. Even if the house payment looks affordable (low front-end), having a $800 car payment could wreck your back-end ratio and disqualify you. Also, remember that we always calculate this using your Gross Monthly Income (your pay before taxes), not what actually hits your bank account.

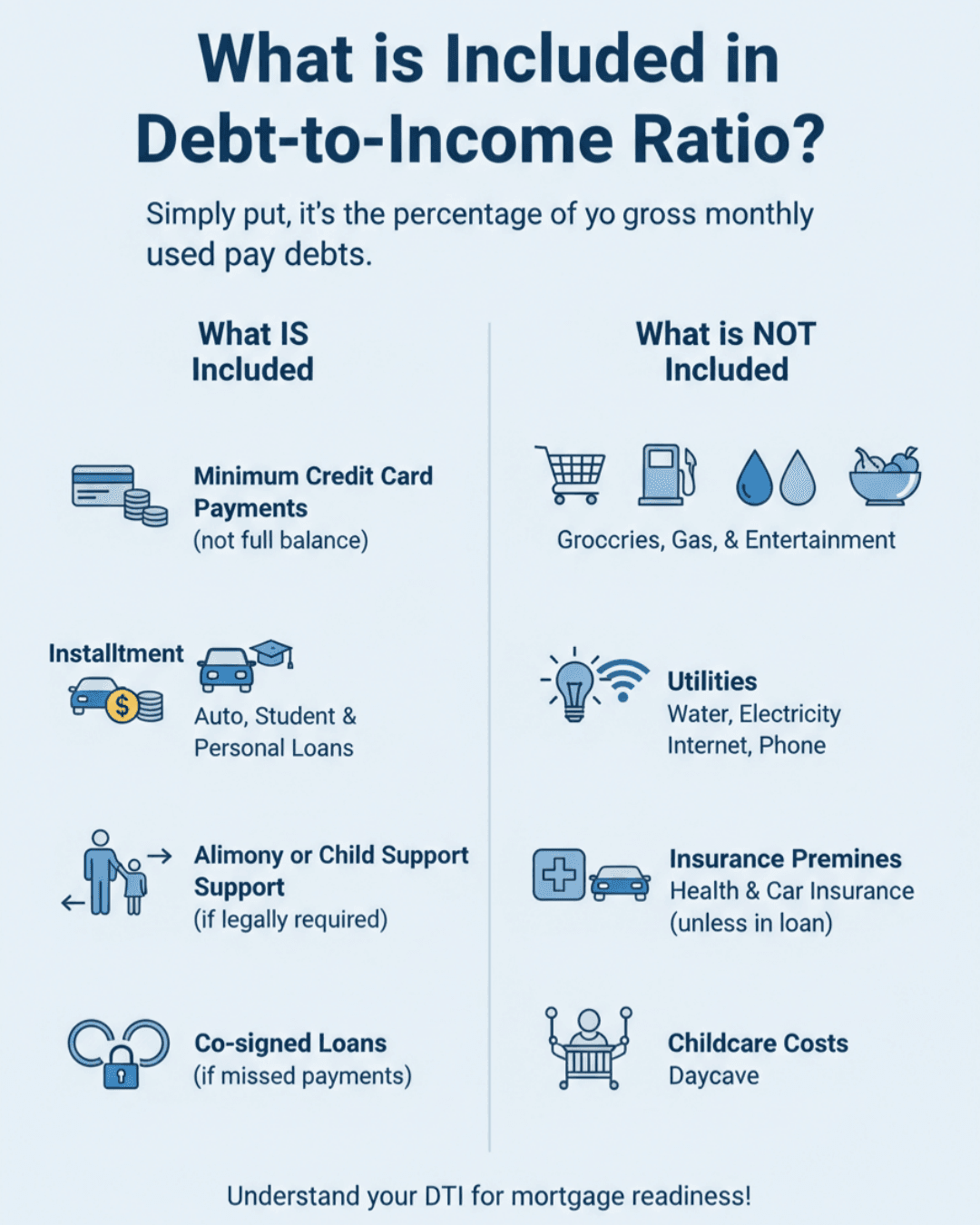

What is Included in Debt-to-Income Ratio?

I often see clients panic, thinking they need to list every single penny they spend. That isn't the case. Lenders are generally only interested in debts that appear on your credit report and significant recurring obligations.

Here is a breakdown of what counts and what doesn't:

What IS Included:

-

Minimum Credit Card Payments: Note that it's the minimum payment listed on your statement, not the full balance you might pay off monthly.

-

Installment Loans: This includes auto loans, student loans, and personal loans.

-

Alimony or Child Support: If you are legally required to pay it.

-

Co-signed Loans: If you co-signed a loan for your cousin and they miss payments, that debt counts against your DTI.

What is NOT Included:

-

Living Expenses: Groceries, gas, and entertainment.

-

Utilities: Water, electricity, internet, and phone bills.

-

Insurance Premiums: Health or car insurance (unless included in the loan).

-

Childcare Costs: Surprisingly, daycare is usually not counted in DTI, though it affects your budget reality.

For student loans in deferment, lenders, especially for FHA loans, typically estimate a payment, often 0.5% or 1% of the loan balance, even if you aren't currently paying anything.

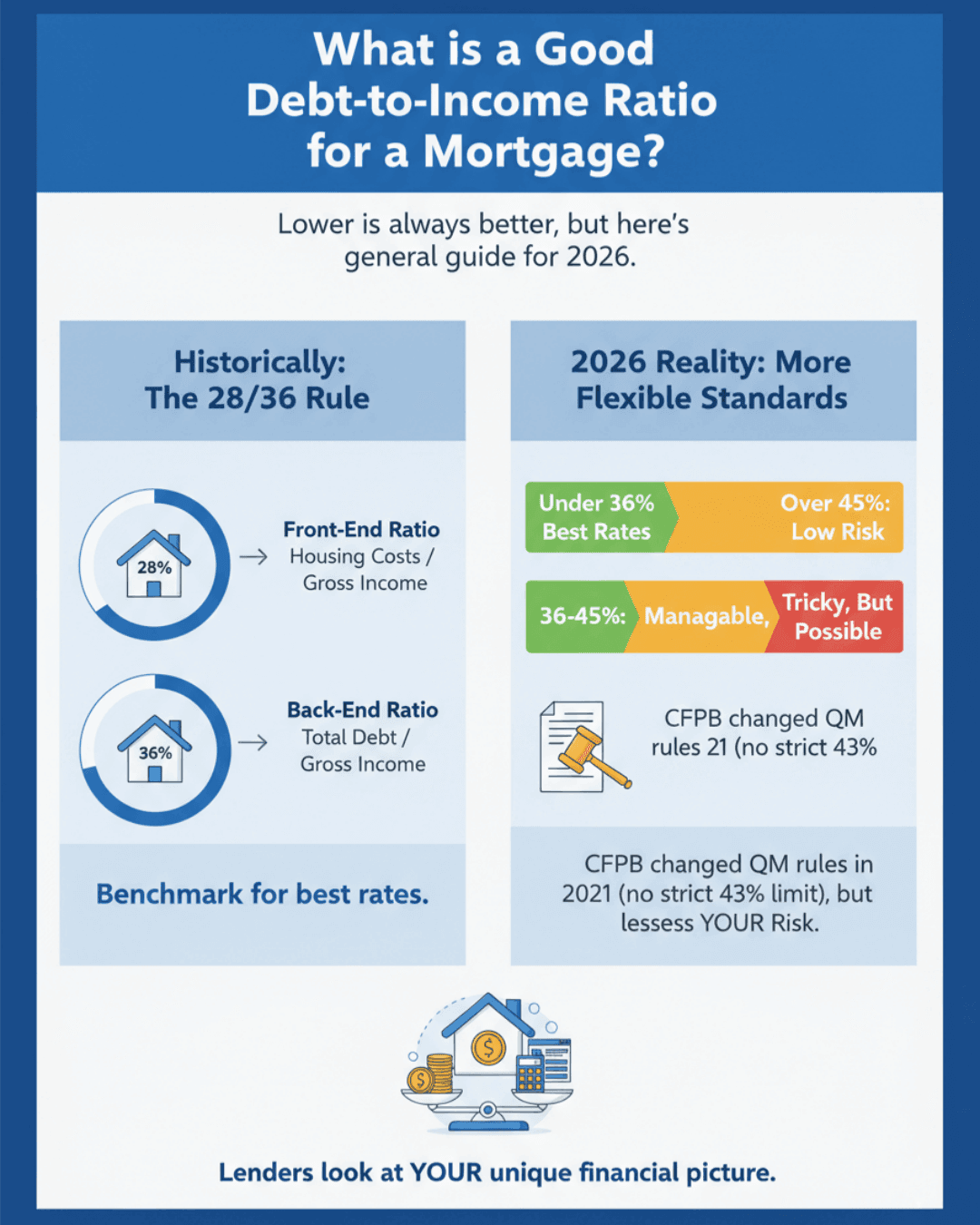

What is a Good Debt-to-Income Ratio for a Mortgage?

Is there a magic number? Historically, yes. You might hear about the 28/36 rule. What is the 28-36 rule for mortgages? This traditional standard suggests your housing costs shouldn't exceed 28% of your income, and your total debt shouldn't exceed 36%.

However, in 2026, with home prices where they are, lenders have become more flexible. The Consumer Financial Protection Bureau (CFPB) replaced the 43% DTI limit for Qualified Mortgages (QM) in 2021 with a price-based approach (APR spread over the Average Prime Offer Rate), while still requiring lenders to consider DTI or residual income.

That said, lower is always better. A DTI under 36% usually unlocks the best interest rates because lenders see you as low-risk. A DTI over 45% makes things tricky, though not impossible.

What is the Debt-to-Income Ratio Requirement for a Mortgage?

Different loan programs have different risk appetites. Here are the current general DTI caps for the major loan types in the U.S.:

-

Conventional Loans: Typically allow up to 45% via manual underwriting with compensating factors, but Fannie Mae and Freddie Mac's Desktop Underwriter (DU) automated systems approve up to 50%.

-

FHA Loans: These are the most generous. The standard cap is 43%, but FHA frequently approves ratios up to 57% if the rest of your application is strong.

-

VA Loans: There is no hard maximum, but 41% is the benchmark. VA loans focus heavily on "residual income" (money left over for living expenses) rather than just the ratio.

-

USDA Loans: These typically allow a back-end ratio up to 41% for automatic approval (front-end around 29-34%), but manual underwriting permits up to 44% or higher with strong compensating factors like credit score or reserves.

How to Calculate Debt-to-Income for Mortgage?

If you don't need a fancy financial degree to figure this out, you just need a calculator and your recent pay stubs to calculate DTI for mortgage.

The Formula: (Total Monthly Debt Payments ÷ Gross Monthly Income) x 100 = DTI %

Step-by-Step Guide:

-

Add up your monthly debts: Combine your future estimated mortgage payment (including taxes/insurance) + credit card minimums + car loans + student loans.

-

Determine your Gross Income: This is your pre-tax income. If you are salaried, take your annual salary and divide by 12. If you are hourly, multiply your hourly rate by the average hours worked per month.

-

Divide and Multiply: Divide the debt number by the income number, then multiply by 100 to get your percentage.

Debt-to-Income Ratio Example

Let's make this real. Imagine a homebuyer named Alex.

-

Alex's Gross Income: $6,000 per month.

-

Proposed Housing Cost: $1,800 (Mortgage + Tax + Insurance).

-

Other Debts:

- Car Loan: $400

- Student Loan: $250

- Credit Card Minimums: $150

-

Total Monthly Debt: $1,800 + $400 + $250 + $150 = $2,600.

The Calculation: $2,600 (Debt) ÷ $6,000 (Income) = 0.4333

Result: Alex has a 43% DTI.

This places Alex right at the limit for many conventional loans, meaning he might get approved, but he shouldn't take on any more debt before closing.

Why is the Debt-to-Income Ratio Important?

You might wonder, "If I pay my bills on time, why does this ratio matter?"

From a lender's perspective, DTI is the best predictor of future default. Life is unpredictable. If you are spending 50% of your income on debt and your car breaks down or you have a medical emergency, you have very little "wiggle room" in your budget.

A high DTI signals that you are "house poor" or over-leveraged. It impacts two main things:

-

Approval: It is a pass/fail gatekeeper. If your ratio is too high, the loan is denied, regardless of your 800 credit score.

-

Borrowing Power: A high DTI might force you to buy a cheaper house because the lender won't approve a loan amount that pushes your ratio over the limit.

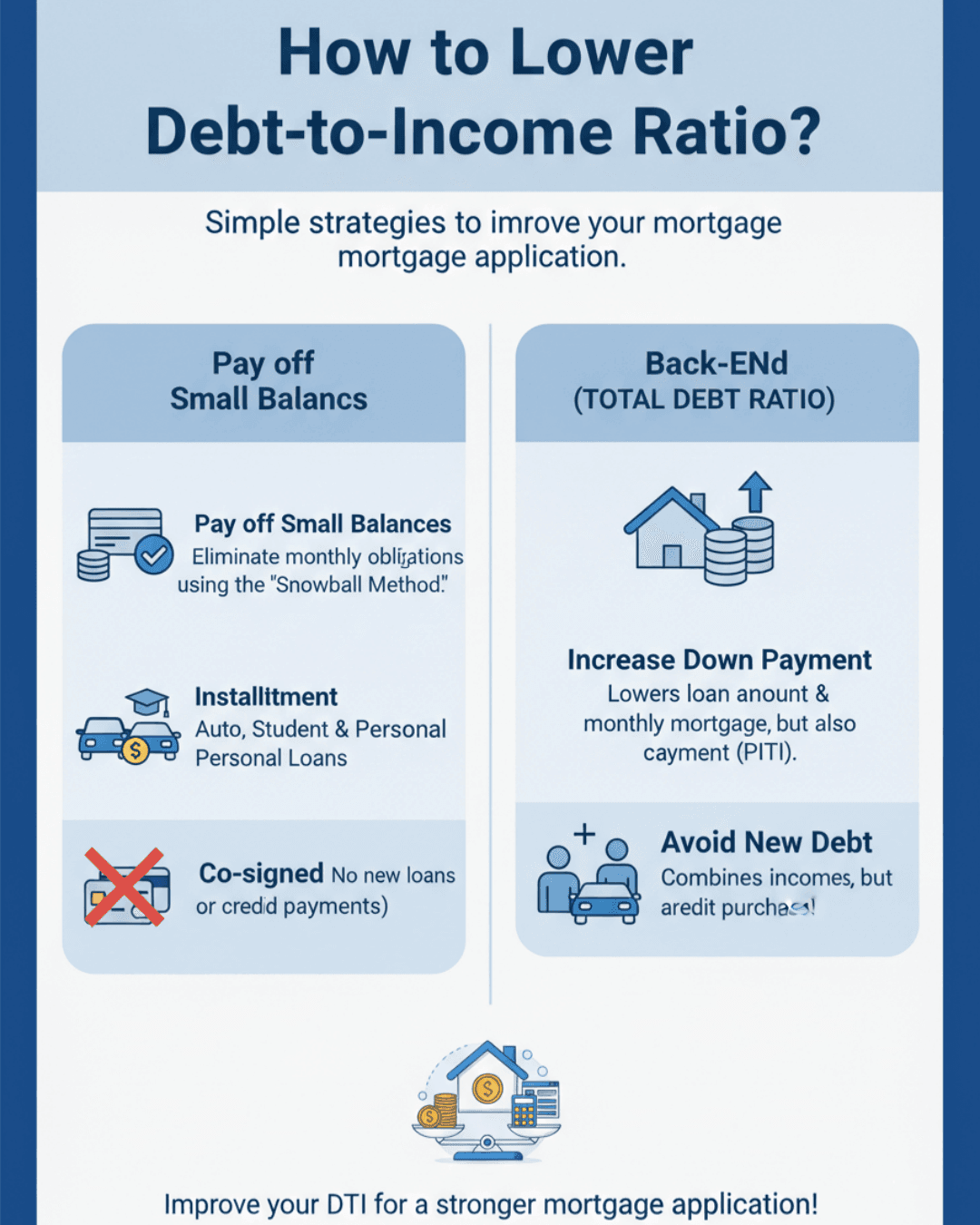

How to Lower Debt-to-Income Ratio?

If you crunched the numbers and your DTI is sitting at 55%, don't panic. You can fix this. You need to either decrease the numerator (debt) or increase the denominator (income).

-

Pay off small balances: Use the "Snowball Method." Clearing a credit card with a $50 monthly minimum payment helps your ratio more than paying down a large chunk of a car loan but keeping the monthly payment the same. We need to eliminate the monthly obligation.

-

Increase your Down Payment: A larger down payment reduces your loan amount, which lowers your monthly mortgage payment (PITI), instantly dropping your DTI.

-

Add a Co-Borrower: Adding a partner or spouse to the loan adds their income to the calculation, which can drastically lower the ratio. Just remember, it adds their debt too!

-

Avoid New Debt: This is the golden rule. Do not buy furniture on credit or lease a new car while applying for a mortgage.

FAQs About Debt-to-Income Ratio for Mortgage

Q1. How quickly can I improve my DTI?

It can happen almost instantly in the eyes of a lender. Once you pay off a debt and have proof, like a "paid in full" letter or a zero-balance statement, your loan officer can often update your file immediately via a "rapid rescore," without waiting 30 days for credit bureaus to update.

Q2. Is all debt treated the same in my debt-to-income ratio?

Mostly, yes. However, there is an exception for "installment debt", like a car loan, with fewer than 10 months of payments remaining. In many cases, lenders can exclude this debt from your DTI calculation since it will be gone soon.

Q3. Does my DTI influence my credit score?

No. This surprises many people. Credit bureaus (Equifax, Experian, TransUnion) do not know your income, so they cannot calculate DTI. DTI is calculated manually by the lender. However, high credit card balances (high utilization) do hurt your score.

Q4. Can I get a mortgage with a 50% DTI?

Yes, but it is harder to get a mortgage. You will likely need an FHA loan or a Conventional loan with "compensating factors," such as a high credit score (720+) or significant cash savings (reserves) left over after closing.

Final Word

Understanding your Debt-to-Income Ratio is the difference between a stressful loan application and a smooth closing. Before you fall in love with a house, take ten minutes to calculate your DTI.

If you are on the borderline, don't get discouraged. I've seen many buyers tweak their finances, paying off one specific credit card or adjusting their down payment, to get into the safe zone.

You might as well talk to a mortgage professional for a pre-approval early in the process. They can run the official numbers and tell you exactly how much "house" your DTI allows you to buy. Being prepared is the best way to win in this market.