Read First: How Much Income Needed for 500K Mortgage?

It wasn't long ago that half a million dollars bought you a mansion in the suburbs. Today? In many parts of the U.S., $500,000 is just the starting line for a decent three-bedroom home. If that price tag makes your stomach tighten, you aren't alone. Most buyers I talk to are staring at Zillow listings wondering the exact same thing: Can I actually pull this off with my current salary?

While there's no "one-size-fits-all" paycheck that guarantees approval, the math isn't a secret. It usually comes down to your debt-to-income ratio and the current mood of the market (read: interest rates).

Below, I'll walk you through the realistic income numbers you need right now. Just keep in mind that these are estimates. For the final say, you'll want to run your specific numbers through an affordability calculator or chat with a local loan officer who knows your area's tax rates.

What Income Do I Need for a 500K Mortgage?

Let's cut to the chase. Lenders don't look at your grocery budget. They look at your Debt-to-Income (DTI) ratio.

The industry standard is the 28/36 rule. Lenders prefer your housing payment (mortgage + taxes + insurance) to stay under 28% of your gross monthly income. They also want your total debt (housing + student loans + car notes) to stay under 36%.

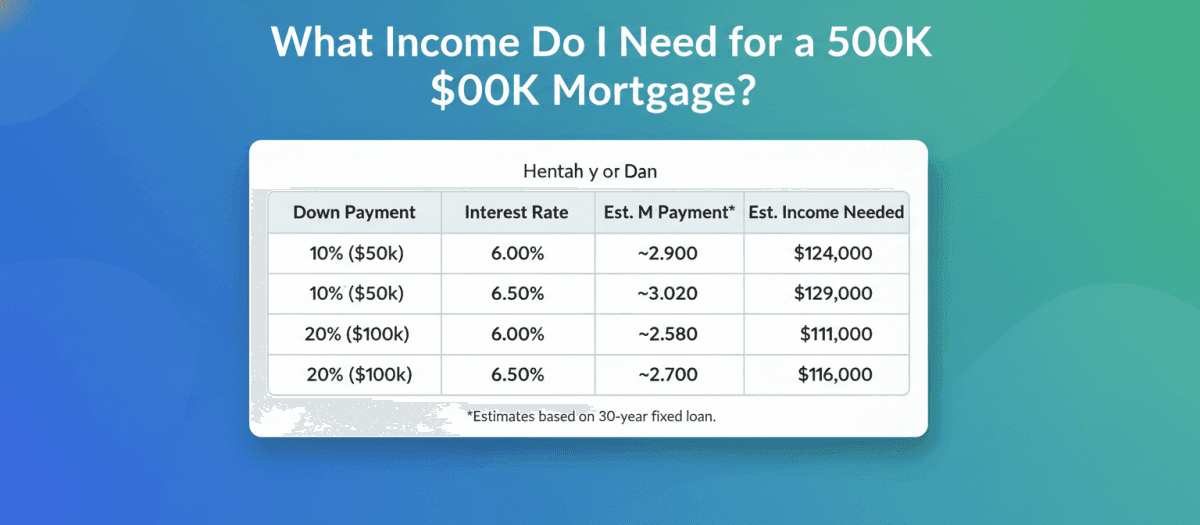

So, what does that look like in dollars and cents?

If we assume a 30-year fixed mortgage with interest rates hovering between 6.0% and 6.5%, here is the gross annual income you'd likely need to get a "Yes" from the bank.

Note: The monthly payment estimates above include Principal, Interest, Taxes, and Insurance (PITI). I've factored in roughly $150-$200/month for property taxes and insurance, though this varies wildly by state.

To comfortably afford a $500,000 home without eating ramen every night, you generally need a household income between $110,000 and $130,000, depending heavily on your down payment.

Examples of Income Needed for 500K Mortgage

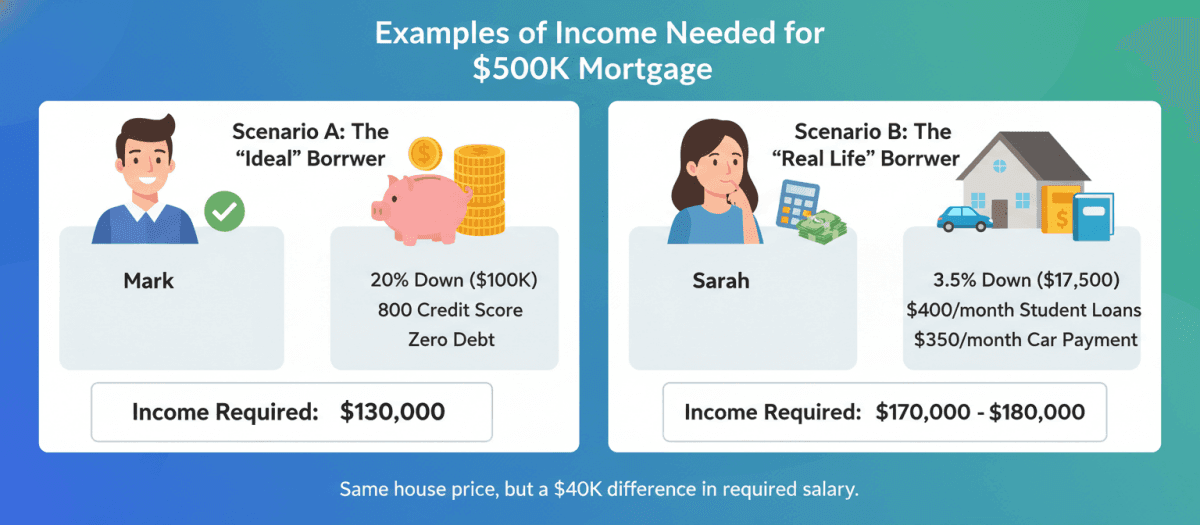

Spreadsheets are sterile. Let's look at how this plays out for actual people, because your other debts change the equation dramatically.

Scenario A: The "Ideal" Borrower

Imagine a buyer named Mark. He's been saving for years and puts 20% down (100k). He has an 800 credit score and zero debt—no car payment, no student loans. Because he put 20% down (100k), his monthly housing payment is around $3,030.

- Income Required: Since he has no other debts dragging him down, a lender might approve him with an income as low as $130,000.

Scenario B: The "Real Life" Borrower

Now look at Sarah. She's getting an FHA loan with just 3.5% down ($17,500). She also pays $400/month for her student loans and $350 for her car. Her loan is bigger, her rate is likely slightly higher, and she has to pay for mortgage insurance. Her monthly housing bill jumps to nearly $4,000.

- Income Required: To cover that higher payment plus her $750 in other monthly debts, Sarah typically needs to earn closer to $170,000 - $180,000 to qualify.

Same house price, but a $40k difference in required salary.

Key Factors Influencing Income Needed for a 500K House

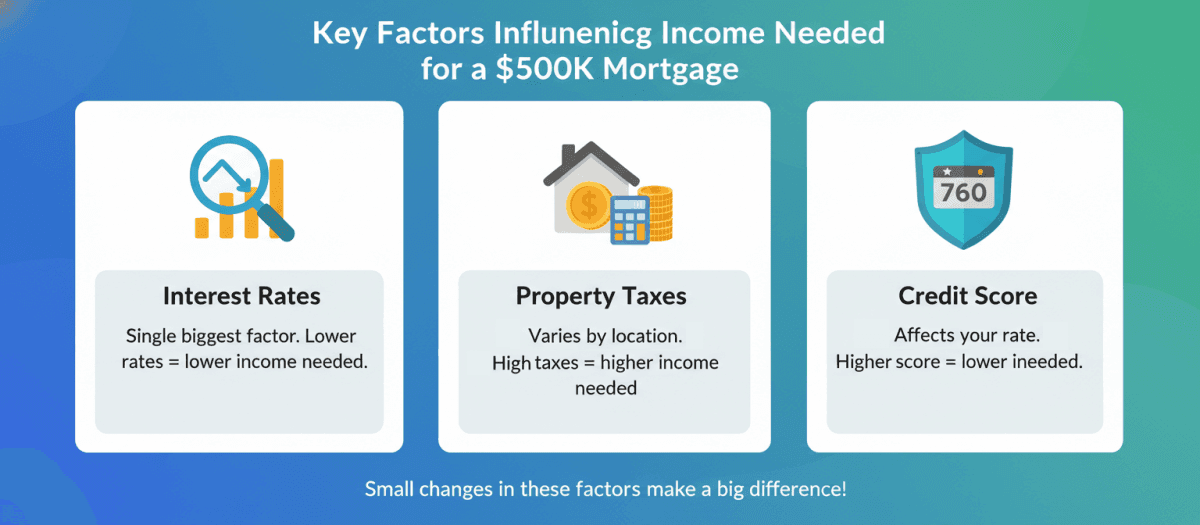

If you are on the borderline of qualifying, a few specific levers can make or break your application.

-

Interest Rates: This is the elephant in the room. A 1% drop in rates can lower your required income by over $10,000/year. It's the single biggest factor you can't control.

-

Property Taxes: People forget this one. A $500k house in New Jersey might have a $10,000-$12,000 tax bill (2.0-2.4% effective rate), while the same house in Colorado might be $3,000-$5,000 (0.6-1.0%). That tax bill gets divided by 12 and added to your DTI. High taxes = higher income needed.

-

Credit Score: It's not just about approval. It's about the rate. A 760 score gets you the cheapest money. A 640 score gets you a higher rate, which inflates your monthly payment and forces you to show more income to qualify.

FAQs About Income Needed for 500K Mortgage

Q1. Can I afford a 500K house on a 70k salary?

No. I won't sugarcoat it. On a $70k salary, your take-home pay is likely around $4,500 a month. The mortgage payment alone on a $500k home (even with good terms) would be around $2,900 (PITI with good terms). Lenders won't approve it, and honestly, you wouldn't want to live with that little wiggle room anyway.

Q2. Can I afford a 500k house on 100k salary?

It's very tight. If you have a massive down payment (think 25-30%) and zero other debt, maybe. But for a standard buyer putting 5-10% down, $100k usually isn't enough in today's interest rate environment. You would likely be "house poor."

Q3. Can I afford a 500K house on 150k salary?

Yes, likely. This is the sweet spot. At $150k, a standard $3,500 mortgage payment eats up about 28% of your gross pay, which is exactly where banks like you to be. Assuming you don't have a luxury car payment or massive credit card bills, you should be fine.

Q4. What credit score do I need for a $500k loan?

Technically, you can get an FHA loan with a score as low as 580, or a conventional loan at 620. But if you want a monthly payment that doesn't hurt, aim for 740+. The better the score, the lower the rate, and the less income you need to show.

Q5. What other costs should I consider for a $500K mortgage loan?

Don't just save for the down payment. You'll need closing costs (usually 2-5% of the home price), plus a "reserve" fund. Lenders often want to see that you have 2 to 6 months of mortgage payments sitting in your bank account after you close, just in case.

Conclusion

Buying a home of $500,000 is a massive financial commitment, but don't let the big numbers paralyze you. While earning between $110k and $130k is the general benchmark, your personal situation—specifically your credit score and down payment—can change the math entirely.

The best move? Stop guessing and get clear on your actual numbers.

If you want to see what rates you specifically qualify for without the headache, check out Bluerate.ai. It helps you find competitive mortgage rates tailored to your profile, so you can walk into that open house knowing exactly what you can afford.