Solved - How Much Income Needed for 300K Mortgage?

Buying a home priced at $300,000 feels like the "sweet spot" for many of the homebuyers I talk to. It's often the entry point for a solid starter home in many U.S. suburbs. But let's be real: with interest rates bouncing around and inflation impacting our grocery bills, the old rules of thumb don't always apply. You are likely asking, "Can I actually afford this?" rather than just "Do I qualify?"

In this guide, I'll break down exactly what salary allows you to comfortably sign those papers. We won't just look at the sticker price. We'll dig into the monthly reality. While I'll give you the math, remember that your financial fingerprint is unique. You can also freely chat with a loan officer nearby, but for now, let's solve this math together.

People Also Read:

- Read First: How Much Income Needed for 500K Mortgage?

- How Much Income Needed for a 400K Mortgage? Know Your Affordability

How Much Income Do I Need for a 300K Mortgage?

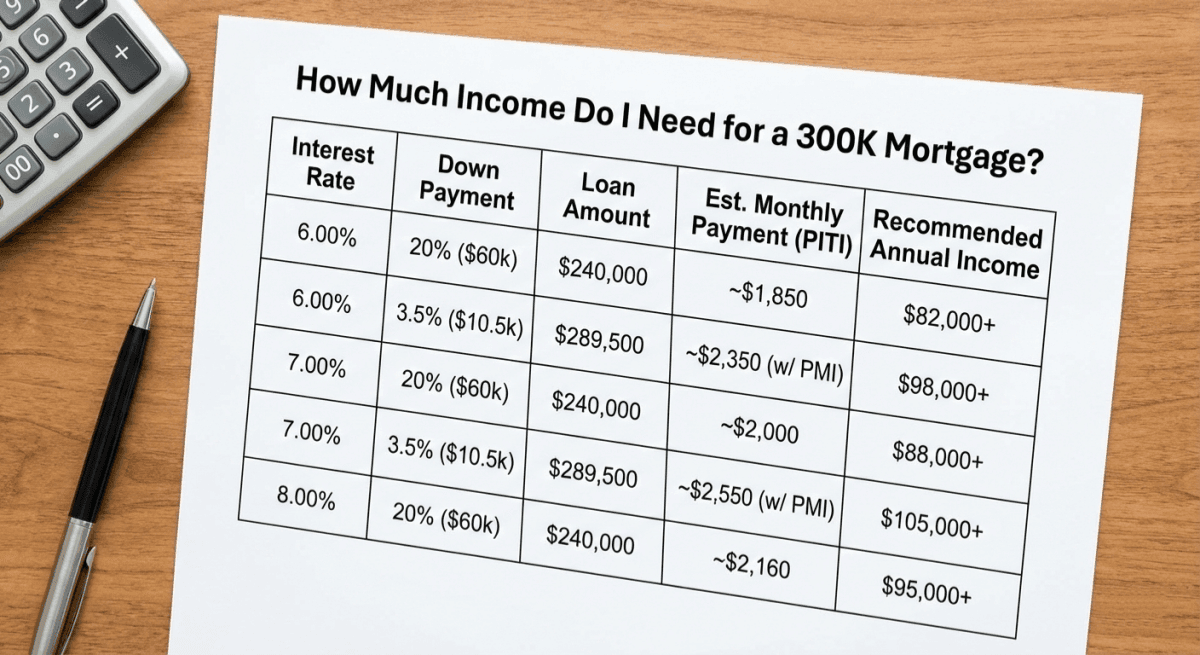

Let's cut straight to the chase. To buy a $300,000 house in today's market, assuming an interest rate around 6.5%, your income needed is around $85,000 and $105,000.

Why the wide range? Because your income doesn't just pay the mortgage. It has to cover property taxes, homeowners' insurance, and your existing debts, like that car payment or student loan.

Lenders typically use the 28/36 rule:

-

No more than 28% of your gross income should go to housing costs (PITI: Principal, Interest, Taxes, Insurance).

-

No more than 36% of your gross income should go to total debt (Housing + Credit Cards + Loans).

Here is a realistic breakdown of the income you'd need based on different down payments and interest rates. Please note that these figures estimate a monthly debt load of $500 (car/cards) and include estimated taxes/insurance.

Data Source Estimates:

Data Source Estimates:

-

Average US Property Tax rate ~1.1%,

-

Homeowners Insurance ~$1,500/yr

-

PMI ~0.5-1%.

Real-Life Examples: Income Needed for a 300K House

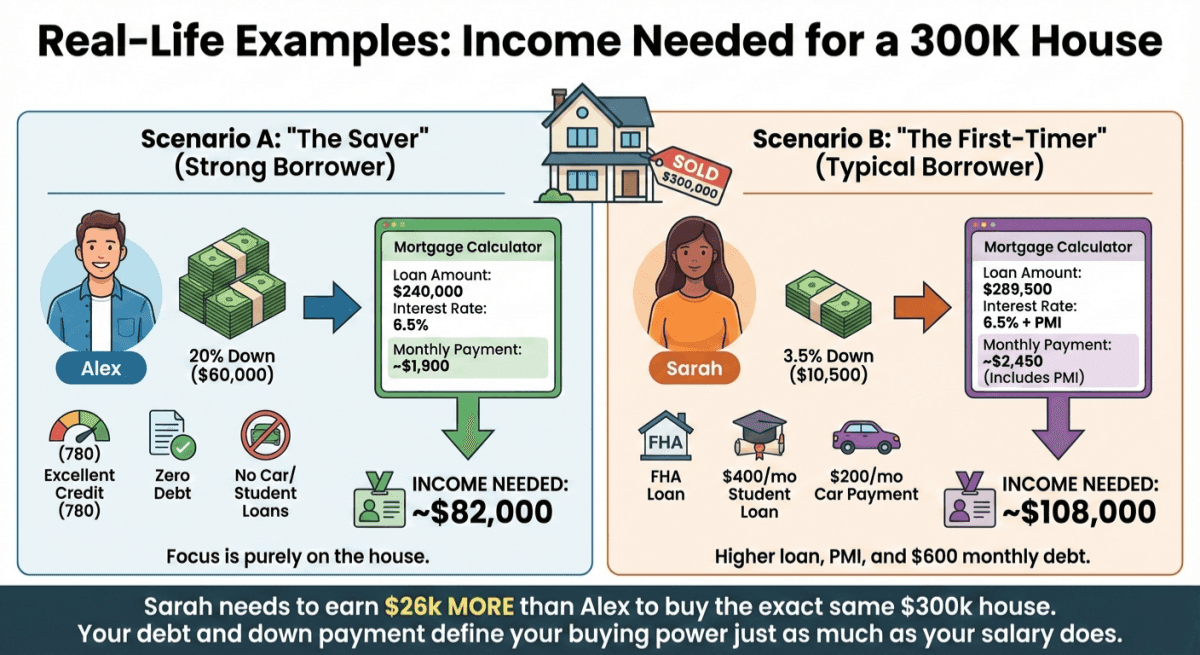

To help you visualize this, let's look at two scenarios. I've seen both of these borrower types recently, and their "affordability" looks very different even for the same house price.

Scenario A: "The Saver" (Strong Borrower)

Meet Alex. He has saved diligently and puts 20% down ($60,000). He has an excellent credit score (780) and zero other debts—no car payment, no student loans.

-

Loan Amount: $240,000

-

Interest Rate: 6.5% (Prime tier)

-

Monthly Payment: ~$1,900

-

Income Needed: Since he has no other debt, he can qualify with an income as low as $82,000. His focus is purely on the house.

Scenario B: "The First-Timer" (Typical Borrower)

Meet Sarah. She wants to stop renting but only has 3.5% down ($10,500) for an FHA loan. She also pays $400/month for her student loans and $200 for a car.

-

Loan Amount: $289,500

-

Interest Rate: 6.5% (plus Mortgage Insurance Premium)

-

Monthly Payment: ~$2,450 (Includes PMI)

-

Income Needed: Because of her higher loan amount, PMI costs, and her $600 monthly debt, she needs to earn closer to $108,000 to keep her Debt-to-Income (DTI) ratio healthy.

Sarah needs to earn $26k more than Alex to buy the exact same $300k house. Your debt and down payment define your buying power just as much as your salary does.

Key Factors That Affect Income Requirements

You might see online calculators giving you a single number, but in the real world, several levers push that number up or down. Here is what I pay attention to when structuring a loan:

-

Interest Rates: This is the big one. As shown in the table above, a 1% jump in rates can increase your required income by roughly $10,000 a year. It kills your purchasing power instantly.

-

Debt-to-Income Ratio (DTI): Lenders care less about how much you make and more about how much you keep. If you have high monthly debts, you need a higher income to offset them.

-

Down Payment: A larger down payment reduces the principal. But more importantly, crossing the 20% threshold removes Private Mortgage Insurance (PMI), which can save you $100−$200 a month.

-

Property Taxes & Insurance: Location matters. A $300k house in New Jersey (high tax) might cost $600/month more than a $300k house in Colorado (low tax). That difference alone requires an extra $20k in salary to qualify.

-

Credit Score: A score below 680 usually means a higher interest rate, which increases the monthly payment, which in turn demands higher income. It's a domino effect.

How to Calculate Your House Affordability?

You don't need a degree in finance to get a rough idea of where you stand. I like to use a simple "back-of-the-napkin" math trick before diving into complex spreadsheets to estimate your mortgage affordability.

The "28% Rule" Calculation:

Take your gross monthly income (before taxes) and multiply it by 0.28.

Example: $8,000/mo x 0.28 = $2,240.

This is your ideal maximum housing payment. If the mortgage calculation (Principal + Interest + Taxes + Insurance) for that $300k home is higher than this number, you might be stretching yourself too thin.

However, manual math is prone to errors, especially forgetting things like HOA fees or PMI. For accuracy, I highly recommend using a digital tool.

Tips to Qualify for a 300K Mortgage

If the numbers above look a bit daunting, don't panic. There are strategic ways to improve your application without necessarily getting a massive raise tomorrow.

-

Eliminate Small Debts: That $400/month car payment reduces your borrowing power by roughly $50,000. Paying it off is often more effective than saving a slightly larger down payment.

-

Boost Your Credit Score: Even a 20-point increase can bump you into a better rate tier. Lower rates mean lower income requirements.

-

Consider a Co-Borrower: Adding a working spouse, partner, or family member to the loan increases the total household income used for qualification.

-

Shop Your Rate: Different lenders offer different programs. A professional Loan Officer might find you "Lender Credits" to buy down your rate for the first year. Connect with a pro—don't just settle for the first bank you walk into.

FAQs About Income Needed for 300K Mortgage

Here are the most common questions I get from clients looking at this price point.

Q1. Can I afford a $300K house on a $70K salary?

Honestly? It is very tight in the current market. To make this work, you would likely need a significant down payment (20%+) to lower the loan amount, zero other consumer debt, and a low interest rate. Without those, your DTI would likely exceed lender limits.

Q2. What is the monthly payment on a $300K house?

For a standard scenario (5% down, ~7% rate), you are looking at approximately $2,400 to $2,700 per month. This includes principal, interest, taxes, insurance, and likely PMI.

Q3. What if my DTI is 43%?

DTI 43% is traditionally the limit for a "Qualified Mortgage," but it's not a hard wall. FHA loans can sometimes go up to 50% or even higher with "compensating factors" like cash reserves in the bank. You can still qualify, but expect stricter scrutiny.

Q4. How does a 5% down payment change things?

Compared to 20% down, a 5% down payment increases your loan size and adds Mortgage Insurance (PMI). This generally raises your monthly payment by $200−$300, meaning you'll need roughly 10k−12k more in annual income to qualify.

Q5. What credit score do I need for a $300k loan?

For a Conventional loan, you typically need a 620+. For an FHA loan, you can qualify with a score as low as 580 (with 3.5% down) or even 500 (with 10% down), though higher scores get much cheaper rates.

Q6. What other costs should I consider for a $300K mortgage loan?

Don't forget Closing Costs (usually 2-5% of the purchase price, or $6k- $15k) and reserves. Lenders like to see that you have a few months of mortgage payments saved up in the bank after you close.

Conclusion

Buying a 300,000 home is an achievable goal for many Americans, usually requiring a household income between $85,000 and $105,000, depending on your debt and down payment. But remember, "qualifying" for a loan and "affording" a life are two different things. You want a mortgage that fits your budget, not one that eats it.

Don't rely on guesswork. The market changes daily, and so do interest rates.

I recommend you verify your specific numbers with Bluerate. Whether you use our free AI tools or connect with one of our expert Loan Officers, getting clarity is the first step to getting the keys.