How Much Income Needed for a 400K Mortgage? Know Your Affordability

Let's be honest: in today's market, a $400,000 home isn't exactly a mansion. In many parts of the U.S., it's the new standard for a starter home or a decent condo. But seeing that price tag often triggers a specific anxiety: "Can I actually get the bank to say yes?"

I talk to buyers all the time who think they need a massive salary to qualify, but that's not always the case. The real answer depends less on how much you make and more on how much you keep after your other debts are paid. While you can crunch the numbers yourself, understanding the "why" behind the math is crucial before you talk to a pro at Bluerate or your local bank. Let's break down what it really takes to afford this in 2026.

People Also Read:

- Expert Guide: How Much of Your Income Should Go to Mortgage?

- Solved - How Much Income Needed for 300K Mortgage?

- Read First: How Much Income Needed for 500K Mortgage?

What Income Is Needed for a 400K Mortgage?

I'll cut straight to the chase. If you are looking to buy a $400,000 home in 2026, you generally need a household income between $115,000 and $145,000.

Why such a big gap? Because your income doesn't exist in a vacuum. Lenders are obsessed with risk. If you have a pile of student loans or a small down payment, you are "riskier," so you need more income to offset that. Conversely, if you are debt-free with a fat savings account, you can qualify with less.

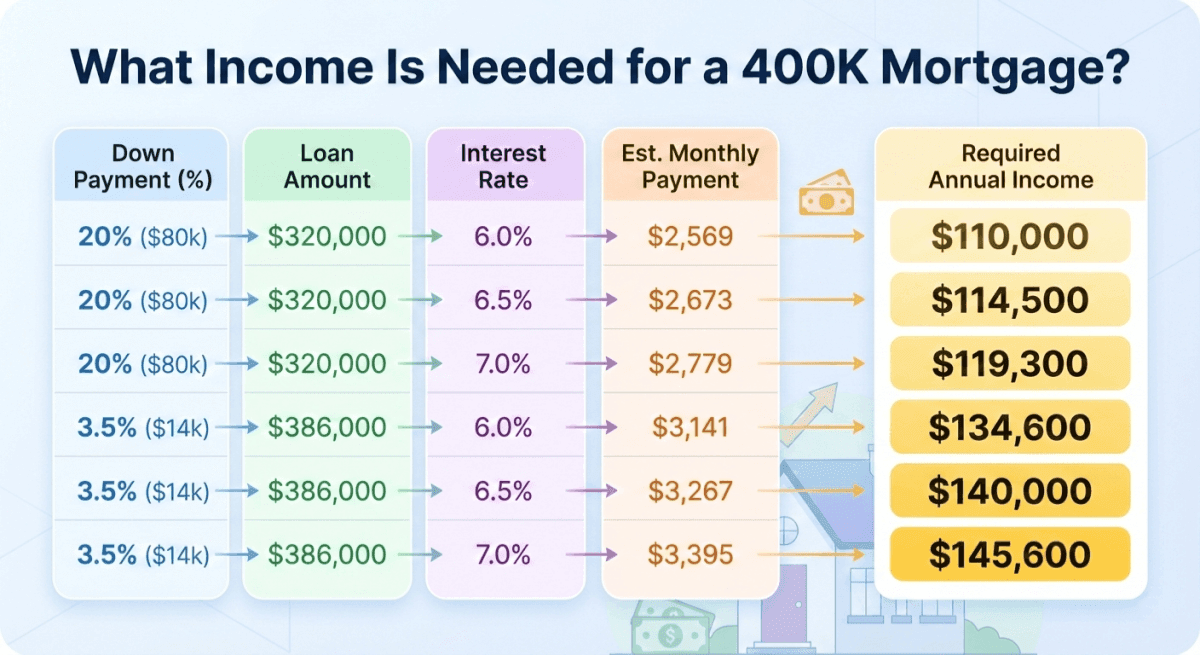

I ran the numbers below to show you exactly how interest rates and your down payment change the game. Note that these aren't just guesses. They are based on the standard 28% Front-End DTI ratio that most conservative lenders use.

Income Requirements for a $400K Home (2026 Estimates)

| Down Payment | Loan Amount | Interest Rate | Est. Monthly Payment | Required Annual Income | |---|---|---|---|---| | 20% ($80k) | $320,000 | 6.0% | $2,569 | $110,000 | | 20% ($80k) | $320,000 | 6.5% | $2,673 | $114,500 | | 20% ($80k) | $320,000 | 7.0% | $2,779 | $119,300 | | 3.5% ($14k) | $386,000 | 6.0% | $3,141 | $134,600 | | 3.5% ($14k) | $386,000 | 6.5% | $3,267 | $140,000 | | 3.5% ($14k) | $386,000 | 7.0% | $3,395 | $145,600 |

*Payment includes Principal, Interest, Taxes (~1.2%), Insurance($250/mo), and PMI(0.55%) where applicable.

*Payment includes Principal, Interest, Taxes (~1.2%), Insurance($250/mo), and PMI(0.55%) where applicable.

The takeaway? If you can scrape together 20% down, you effectively give yourself a "raise" in the eyes of the bank. But if you are coming in with 3.5% down, which is totally fine, by the way, be prepared to show a higher salary to cover that Mortgage Insurance (PMI).

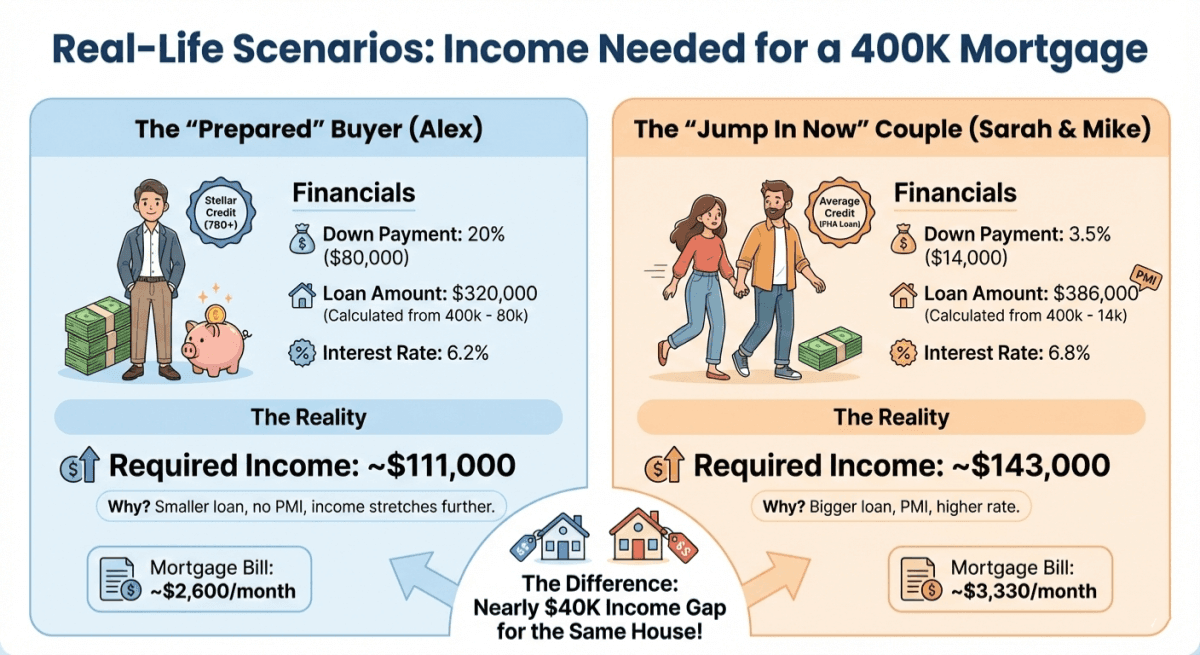

Real-Life Scenarios: Income Needed for a 400K Mortgage

Spreadsheets are useful, but real life is messier. To help you visualize this, let's look at two specific situations I see frequently.

The "Prepared" Buyer (Alex)

Alex has been renting cheap and saving hard. He's putting 20% down ($80,000) on a $400k townhouse. Because his credit is stellar (780+), he snagged a 6.2% rate.

-

The Payment: His mortgage bill is around $2,600/month.

-

The Reality: He only needs to earn about $111,000 to qualify. Since he has no PMI and a smaller loan, his income stretches further.

The "Jump in Now" Couple (Sarah & Mike)

Sarah and Mike are tired of renting and want to buy now. They have a combined income, but only 3.5% down ($14,000) for an FHA loan. Their credit is average, landing them a 6.8% rate.

-

The Payment: Because of the bigger loan and PMI, their bill is around $3,330/month.

-

The Reality: To get approved for the exact same house as Alex, they need to earn roughly $143,000. That is nearly a $40k difference in required income, just because of the down payment and rate.

Key Considerations for a $400,000 Mortgage

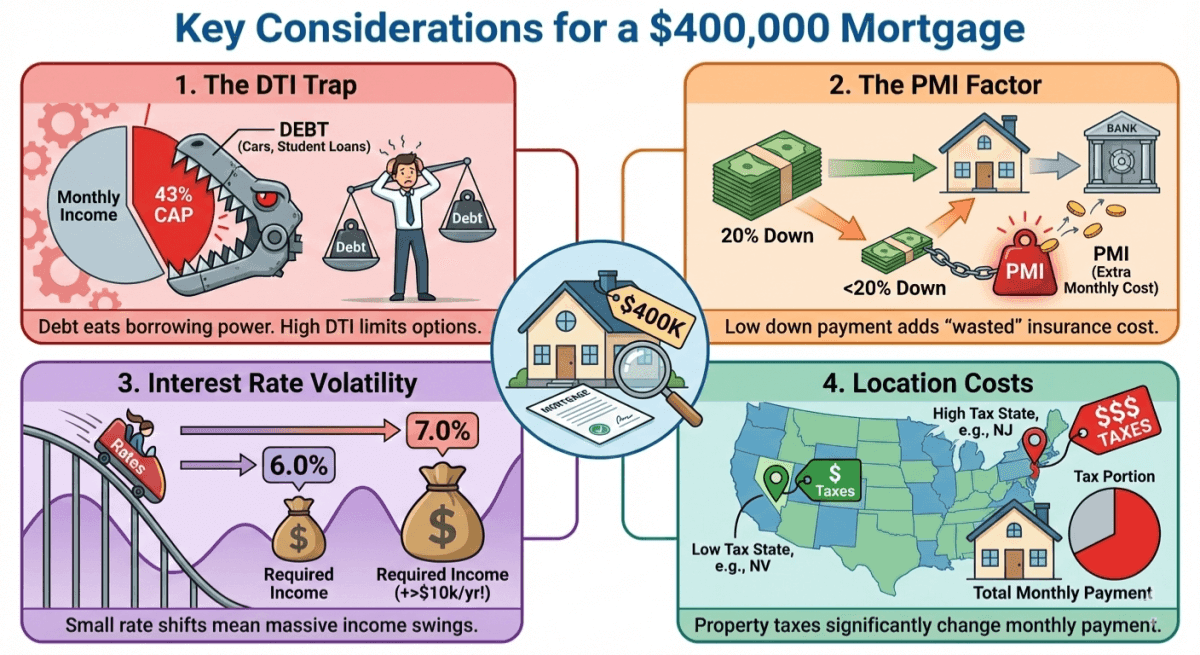

Your gross salary is just the headline. The details are in the fine print. When an underwriter looks at your file, they are hunting for red flags that could derail your ability to pay. Here is what actually matters beyond your paycheck:

-

The DTI Trap: This is the big one. Debt-to-Income ratio is simply your total monthly debt payments divided by your gross monthly income. Lenders usually cap this at 43%. If you have a $600 car payment and $400 in student loans, that eats up your borrowing power fast. I've seen high earners get denied because their DTI was maxed out by luxury car leases.

-

The PMI Factor: If you put down less than 20%, you are paying Private Mortgage Insurance. It's money that protects the lender, not you, and it counts against your monthly affordability.

-

Interest Rate Volatility: In 2026, rates are still moving. A 1% shift might not sound like much, but on a $400k loan, it can swing your required income by over $10,000 a year.

-

Location Costs: Don't forget property taxes. A $400k house in New Jersey (high tax) costs way more per month than one in Nevada (low tax).

How to Estimate Your House Affordability?

You don't need a degree in finance to get a rough idea of where you stand. I tell my clients to use the "Napkin Math" version of the 28/36 Rule.

First, take your gross monthly income and multiply it by 0.28. That is your "safe ceiling" for a mortgage payment. Next, multiply your income by 0.36. Subtract your monthly debt payments (cars, cards, loans) from that number.

Whichever number is lower is your realistic budget. If the math feels tight, you might need to pay off a credit card before applying. But honestly? The easiest way is to let technology handle it. Tools like Bluerate can run these scenarios instantly, factoring in current 2026 rates so you aren't guessing.

FAQs About Income Needed for 400K Mortgage

Q1. Can I afford a 400K house with a $70K salary?

Realistically, no. The math just doesn't work. Your take-home pay would likely be around $4,500 a month, and the mortgage alone could be $3,000+. No lender will approve that risk unless you have a massive down payment (like $200k cash).

Q2. Can I afford a 400K house with a $100K salary?

It's possible, but it's a squeeze. You would need zero other debts and a solid 20% down payment to keep the monthly costs comfortable. If you have car loans or student debt, $100k typically won't cut it for a $400k loan in this rate environment.

Q3. Can I buy a 400K house with a $150k salary?

Yes, easily. This is the sweet spot. With $150k, you're bringing in roughly $12,500 a month gross. Even with standard debts, you should have no problem qualifying for a $400k home and still having money left over for life.

Q4. How much do I need to earn to qualify for a $400,000 mortgage?

If you want a safe number to aim for in 2026, target $115,000 to $145,000 for buying a home. If you are on the lower end, focus on saving a bigger down payment. If you are on the higher end, you have more flexibility with your cash.

Q5. What is the mortgage payment on $400,000 for 30 years?

If you get a standard loan today (assuming ~6.5% rate and minimal down payment), expect to write a check for about $2,600 to $3,300 per month. That covers the loan, taxes, and insurance.

Final Word

Navigating the housing market in 2026 can feel like walking a tightrope, especially with rates where they are. But knowing your numbers is the best safety net you can have. A $400,000 mortgage is absolutely achievable for many families, provided you manage your DTI and come prepared.

Don't let the fear of rejection stop you from looking. The key is to get clarity before you fall in love with a house.

I strongly recommend checking out Bluerate. It's an AI-driven marketplace that doesn't just guess. It connects you with the right loan officers for your specific income profile. It's the smartest way to see what you can truly afford without the sales pressure.

Check your real buying power today at Bluerate.ai