Expert Guide: How Much of Your Income Should Go to Mortgage?

What percentage of income should go to mortgage is the question that keeps most first-time buyers awake at night. I was reading a thread on Reddit recently where people were debating if spending half their paycheck on a house is the new normal or just financial suicide. It highlighted a scary truth: what a bank says you can borrow and what you actually should spend are two very different things.

While the rules below are great starting points, your budget is personal. For a sanity check on your specific numbers, I always suggest chatting with professional loan officers online. It's free and way more accurate than a generic calculator.

People Also Read:

- How Much Do Mortgage Points Cost? Take a Look Here

- 3 Methods: How to Calculate Debt-to-Income Ratio for Mortgage?

- How to Calculate Early Payoff of Mortgage? Formula and Penalty

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- Must-Read Guide: How to Apply for a Mortgage Loan Online?

What Percentage of Income Should Go to Mortgage?

The truth? There isn't one perfect number. A single guy in Ohio has a totally different budget reality than a family of four in San Francisco. However, over the years, financial experts have developed a few "golden rules" to keep you safe.

Think of these not as strict laws, but as stress tests for your wallet. Read through them and see which one actually fits your life.

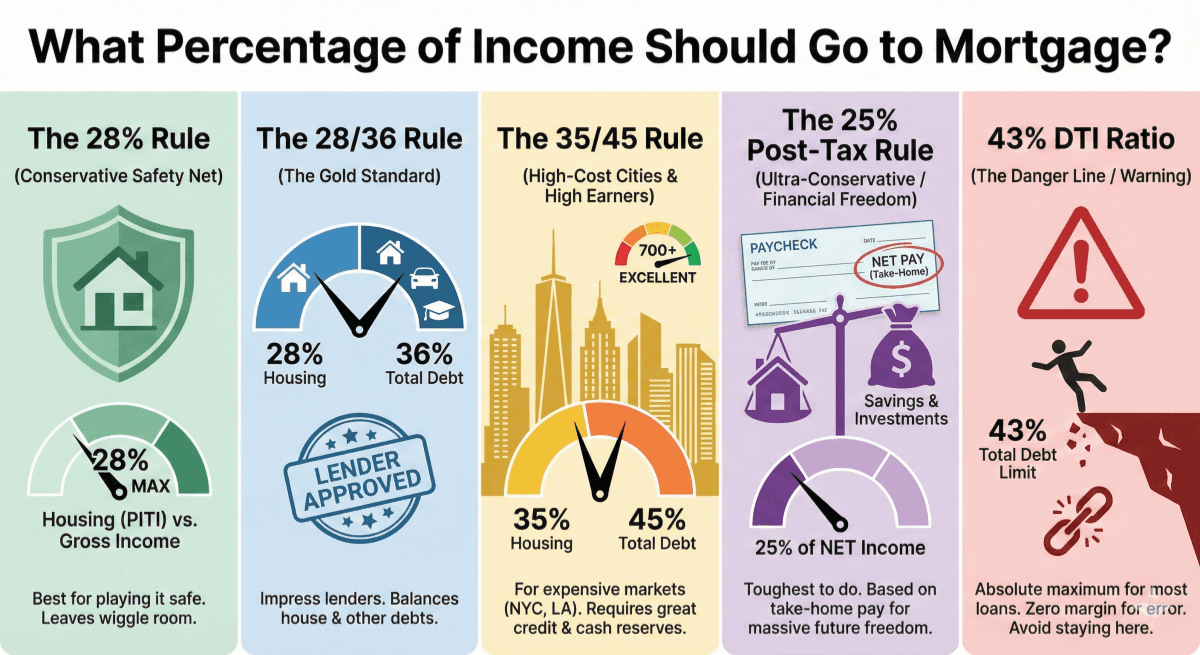

The 28% Rule

Best for: Conservative borrowers who like playing it safe with standard loans.

This is what I call the "old school" safety net. Lenders often refer to this as the Front-End Ratio. The idea is simple: your total housing bill, that's Principal, Interest, Taxes, and Insurance (PITI), should never eat up more than 28% of your gross monthly income (that's before the IRS takes their cut). If you stick to this, you're generally safe from becoming "house poor." It leaves you enough wiggle room for groceries, gas, and the occasional vacation without sweating every time the mortgage is due.

Example: If your household brings in $10,000 a month gross, your hard limit for a mortgage payment is $2,800. Keep in mind, if you buy in a town with high property taxes, that eats into the $2,800, meaning you'll have to look for a cheaper house price-wise to stay on budget.

The 28/36 Rule

Best for: The "Gold Standard" for financial health and getting approved for a Conventional Loan.

If you want to impress a lender, this is the metric to hit. It's a two-part test. First, keep your housing costs under 28%. But the second part is the kicker: your total debt load, house plus car notes, student loans, and credit cards, shouldn't cross 36% of your gross income. This is the Back-End Ratio. It's a reality check that ensures your beautiful new home doesn't become a burden because you're already drowning in student debt or car payments.

Example: Sticking with that $10,000 gross income, your mortgage cap is still $2,800. But let's say you have a $500 car lease and $400 in student loans. That's $900 in other debt. Since your total debt cap is $3,600 (36%), and you already have spoken for, your mortgage budget actually shrinks $900-$2,700. You lose buying power because of those other debts.

The 35/45 Rule

Best for: Buyers in expensive cities (HCOL) or those with stellar credit scores.

Let's be real: if you live in NYC, Los Angeles, or London, the 28% rule is practically a fantasy. In these high-cost markets, you often have to spend more just to get a foot in the door. In high-cost-of-living (HCOL) areas like NYC or LA, the 35/45 rule allows up to 35% of gross income on housing and 45% total DTI (potentially post-tax in some guidelines), but only with excellent credit (typically 700+) and ample reserves. Lenders approve this cautiously for high earners who retain cash for essentials.

The catch? Lenders usually only sign off on this if you look great on paper, meaning a credit score over 700 and plenty of cash reserves in the bank. The assumption is that high earners have more leftover cash for essentials even after a big mortgage payment.

Example: If you earn 15,000 a month gross, this rule lets you push your mortgage payment up to $5,250. It's a huge number, but as long as your total debts don't crush that 45% back-end limit, you can likely get approved.

The 25% Post-Tax Rule

Best for: Dave Ramsey fans and ultra-conservative budgeters.

This is the toughest rule to follow, but it helps you sleep best at night. Unlike the others, this looks at your net income, the actual cash that hits your checking account after taxes and 401k deductions. This toughest rule recommends spending no more than 25% of your net (take-home) income on total housing costs (PITI) for a mortgage, rooted in historical FHA underwriting standards. It's especially challenging today with high rates, but ideal for conservative budgeters like Dave Ramsey followers aiming for financial freedom. I'll be honest: in today's market with high rates, this is incredibly hard to do. But if you can pull it off, you'll have massive freedom to invest, save for college, and retire early.

Example: Say you earn $10,000 gross, but after taxes and benefits, you only bring home $7,000. This rule caps your mortgage at just $1,750. In many cities, that might mean renting a bit longer or buying a much smaller starter home than you initially wanted.

43% DTI Ratio

Best for: Knowing your absolute "do not cross" danger line.

I'm listing this not as a goal, but as a warning. The 43% back-end Debt-to-Income (DTI) ratio is the standard maximum for most Qualified Mortgages (QM) under federal Ability-to-Repay rules, ensuring borrowers aren't overextended. FHA-backed QM loans typically cap at 43% but allow up to 50% with strong compensating factors like high credit scores or reserves. Conventional loans often go to 45-50% in similar cases.

Think of it as the cliff's edge. If your total monthly debts exceed 43% of your gross income, traditional banks usually have to say no. Even if you find a lender willing to go higher, you should hesitate. Borrowing up to this limit leaves you with zero margin for error. If your car breaks down or you have a medical emergency, you could be in serious trouble.

Example: On a $10,000 monthly income, your absolute debt ceiling $4,300. If you have zero other debts, you could technically get a $4,300 mortgage, but living that close to the edge is risky business.

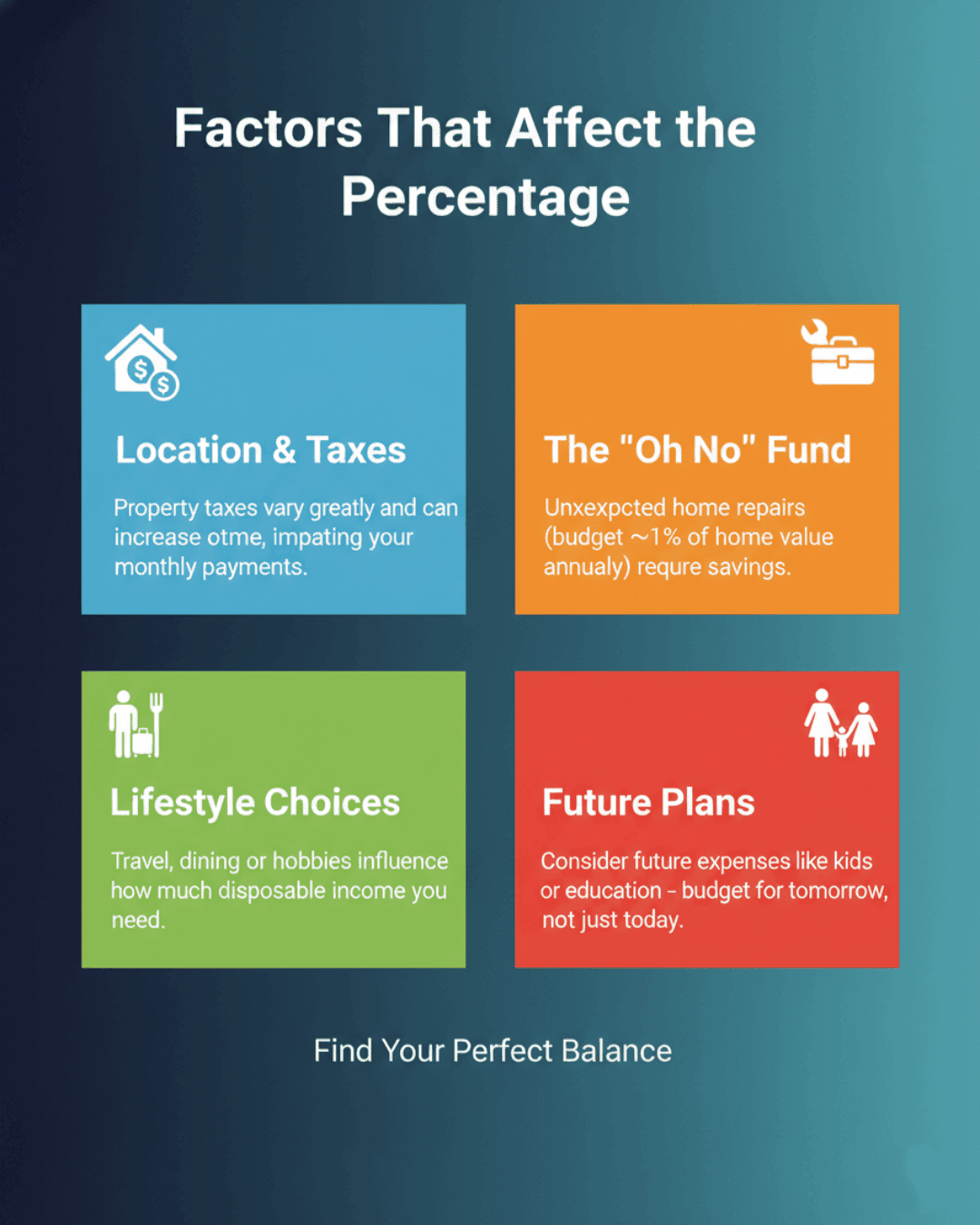

Factors That Affect the Percentage

Calculators are great, but they don't know your life. I've seen two people with the exact same salary handle the same mortgage very differently. Before you sign anything, you need to look at the "invisible" factors:

-

Location & Taxes: A $2,000 mortgage isn't the same everywhere. In states like Texas or New Jersey, property taxes can jump significantly, driving up your monthly payment years after you bought the house.

-

The "Oh No" Fund: Houses break. You should budget about 1% of the home's value every year for maintenance. If you max out your income ratio, who pays when the water heater explodes?

-

Lifestyle Choices: Do you live to travel? Do you love expensive dining? If yes, stick to the 28% rule. If you're a homebody, you might handle 35% just fine.

-

Future Plans: Are kids in the future? Daycare costs are basically a second mortgage. Don't budget for your life today. budget for your life three years from now.

Is It Okay to Spend 50% of Income on a Mortgage?

Short answer: You can, but it hurts.

We call this being "house poor." You have a gorgeous kitchen, but you can't afford to cook anything in it. Spending 50% of your income on a mortgage is generally only smart for high-income earners who still have plenty of cash left over for living expenses, or people flipping a house quickly. For the average person, it's a trap that leaves no room for retirement savings or emergencies.

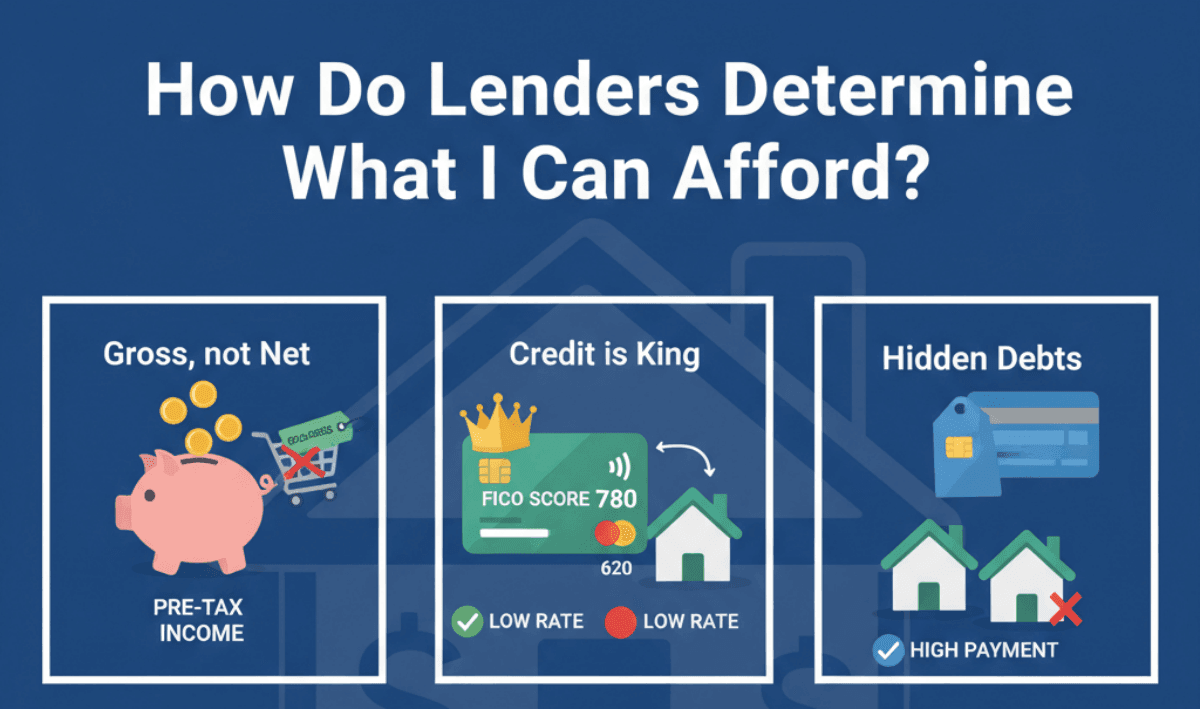

How Do Lenders Determine What I Can Afford?

It's important to remember that a lender's job is to sell you a loan, not to balance your checkbook. Here is how they look at you:

-

They look at Gross, not Net: They calculate affordability based on your pre-tax income. They don't care that you spend $800 a month on groceries. They just care about your debt obligations.

-

Credit is King: Your FICO score decides your rate. A lower score means a higher payment for the exact same house.

-

The Computer Decides: Lenders use Automated Underwriting Systems (AUS). If the computer says your DTI fits the box (usually under 43-50%), you're approved.

-

Hidden Debts: They look at minimum payments on credit cards. Even if you pay your balance in full every month, that minimum payment obligation still counts against your borrowing power.

Tips for Lowering Monthly Mortgage Payments

If the numbers above are making you sweat, don't worry. You have a few levers you can pull to get that monthly payment down to a comfortable zone:

-

Bigger Down Payment: It's the obvious one, but hitting 20% down kills Private Mortgage Insurance (PMI). That alone can save you $100-$300 a month.

-

Buy Down the Rate: Ask your lender about "mortgage points." You pay an extra fee at closing to permanently lower your interest rate. It costs cash now to save cash later.

-

Fix Your Credit First: Before you apply, pay down credit card balances. Boosting your score by even 20 points can drop your interest rate, saving you thousands over time.

-

Shop Around: Loyalty is overrated. Check with multiple lenders. A 0.5% difference in rate can change your DTI picture completely.

-

Stretch the Term: A 30-year loan costs more in total interest than a 15-year one, but the monthly payment is much lower, giving your budget room to breathe.

FAQs About the Percentage of Income Going to Mortgage

Q1. Should you spend the maximum percentage of your income on a mortgage?

Definitely no. Just because a bank approves you for a specific amount doesn't mean you should spend it. Maxing out leaves you vulnerable to life's surprises.

Q2. Do mortgage lenders use gross or net income?

They almost always use Gross Monthly Income (pre-tax). This is why their numbers often look higher than what you feel you can actually afford.

Q3. Does mortgage interest reduce taxable income?

It can. If you itemize deductions instead of taking the standard deduction, you can deduct interest on the first $750,000 of mortgage debt.

Q4. What are the risks of allocating too much income to a mortgage?

The main risks are foreclosure if you lose income, inability to save for retirement, and the stress of living paycheck to paycheck (being "house poor").

Final Word

Figuring out how much of your income should go to a mortgage isn't just a math problem. It's a lifestyle decision. While the 28/36 rule is a fantastic benchmark, only you know what you're willing to sacrifice for a home. Remember, the goal is to own the house, not let the house own you.

Online guides are helpful, but real estate is local and personal. Don't guess with your biggest asset. I highly recommend connecting with the experienced loan officers at Bluerate. They can give you a free, personalized look at what you can truly afford in today's market with no strings attached.