Tomo Mortgage Reviews: Learn Pros, Cons, Complaints Here

Shopping for a mortgage lender can feel overwhelming. Advertising, rate tables, and "limited-time" offers make it hard to tell what borrowers actually experience. If you're considering Tomo Mortgage and want a clear, evidence-based look at how the lender performs in practice, this review will introduce the company background, Pros & Cons, complaints, real customer feedback, and loan services. You might as well read on for more information.

What is Tomo Mortgage?

Tomo Mortgage is a digital-first, non-bank direct lender founded in late 2020 by former Zillow executives, including Greg Schwartz. The company positions itself as a technology-driven mortgage originator that uses automation and data to reduce fees and speed the purchase mortgage experience. Tomo emphasizes transparent online pricing, a "no lender-fees" model, and tools such as TrueRate and an affordability calculator on its site. Tomo reports operations across many U.S. states and lists an NMLS registration for consumer lookup.

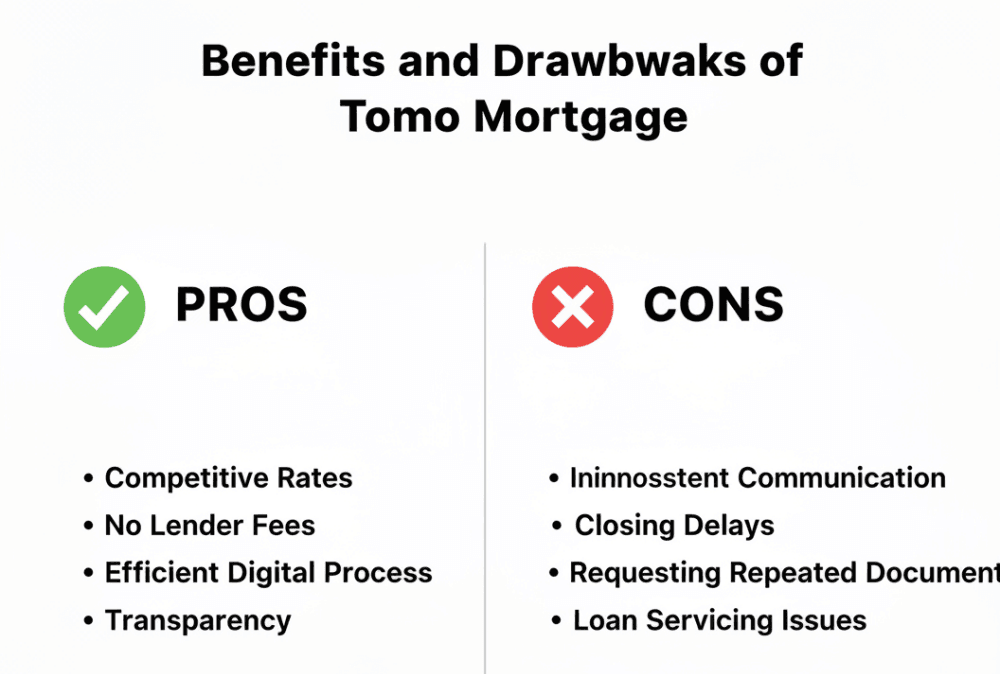

Benefits and Drawbacks of Tomo Mortgage

Now, let's starts with the pros and cons of Tomo Mortgage.

Pros

-

Competitive Rates — Tomo advertises lower-than-industry rates and uses TrueRate to show where quoted rates sit versus market data. Multiple customer reviews praise Tomo for offering very competitive rates versus other lenders. If a low nominal rate is your top criterion, Tomo often appears near or at the top in public comparisons.

-

No Lender Fees — Tomo emphasizes "no origination/processing" lender fees and claims to pass savings to borrowers rather than charging typical origination fees. That said, borrowers still pay standard third-party closing costs (appraisal, title, escrow), so "no lender fees" reduces, but does not eliminate, closing cash requirements. Confirm what's included on the Loan Estimate.

-

Efficient Digital Process — The application flow is online and streamlined; Tomo highlights fast pre-approval paths and automation that shifts verification earlier. For straightforward W-2 borrowers with standard documentation, the digital workflow can shorten time-to-decision and reduce back-and-forth.

-

Transparency Tools — TrueRate and the affordability calculator are intended to help borrowers compare offers and estimate practical affordability, which is helpful when shopping for enders. These tools are part of Tomo's core pitch.

Cons

-

Inconsistent Communication — Across review sites, some borrowers report poor or sporadic communication from assigned loan officers or underwriting teams, especially when loans become complex. Multiple one-star reviews cite being left to chase updates. This appears to be the most commonly mentioned service complaint.

-

Closing Delays — While Tomo publishes a high on-time close statistic, a minority of borrowers report last-minute underwriting requests or files being pulled back for re-review near closing, producing delays. Those delayed cases tend to generate the strongest negative reviews because of the high stress around closing dates.

-

Repeated Document Requests — Several customers describe having to submit the same documents multiple times or dealing with document-handling errors; this is frequently mentioned in 1- and 2-star complaints.

-

Loan Servicing / Transfer Communications — Like many loan originators, Tomo may sell or transfer servicing after closing. Some borrowers said communication around transfers could be clearer, which can cause confusion for new borrowers receiving notices from a servicer they didn't expect.

-

Automated Process Limitations — The automation that speeds standard loans can feel impersonal for edge cases (self-employed income, complicated assets, atypical properties). Borrowers with complex profiles sometimes say they needed more human underwriting support than the automated system provided.

Complaints About Tomo Mortgage

Tomo is not currently listed with a Better Business Bureau accreditation in the same way some legacy lenders do. Therefore, I dive into Reddit and dig out some complaints about Tomo Mortgage.

-

Poor or inconsistent communication — Reported on Reddit, many people say they had to initiate updates.

-

Staff professionalism can vary — Some reviews call out individual team members by name (positive and negative), implying that borrower experience depends heavily on who handles their file.

-

Service variability — Some borrowers describe "horrible" experiences, which is often tied to last-minute underwriting issues. Others report "exceptional" service and deep cost savings. This polarity suggests operational inconsistency rather than a single, universal failure mode.

Tomo Mortgage Reviews: Real Voices

Also, here we can see the rating of Tomo Mortgage on ConsumerAffair, Trustpilot, and Zillow to get an overall idea.

ConsumerAffairs: 2.3 out of 5.0

ConsumerAffairs includes both detailed complaints and some positive notes. Common negative threads there: advertised rates that some borrowers say didn't match their Loan Estimate, repeated document requests, and privacy/employer-contact concerns reported in individual complaints. Positive comments mention an easy online application flow when things go smoothly.

Tomo went above and beyond in matching a low rate from a competitor. That low rate combined with a super low origination fee made a big difference as to why I choose them. The icing on the cake was the great working relationship that followed. They were understanding and patient when my closing date got pushed back twice. I had a good experience working with Tomo and would definitely recommend them.

They messed up the underwriting. They failed to file an appraisal. They messed up in the HOA doc reviews. They pulled the approval because of an issue on their end the day before signing. Absolute clown show. Then when we went to a different lender they refused to send over any docs that we paid for.

Company denied my application due to they can't verify my information... I provided them social security number and my bank documents and my information and my pay stubs. It's weird that they can't verify you but you have my personal information. If I don't exist then I wouldn't be able to open up a bank account in my name... this company needs to be shut down.

Trustpilot: 4.4 out of 5.0

Trustpilot trends positive overall, with many 5-star reviews praising low rates and helpful loan advisors, while a smaller share of 1–2 star reviews focus on communication breakdowns and delayed closings. Many positive reviews mention specific loan officers by name.

We got the lowest rate we could find. We were particularly happy in the way the loan officer handled all our questions. The experience with closing could have been better as our questions experienced a lot of latency in answers during important last few days in closing. But overall everything was done on time and we are glad we worked with Tomo.

We were assured that a potential property concern wouldn't be an issue with Tomo underwriting, so we went ahead with the application (and paid the inspection fee) only to be denied two weeks into closing for the very issue we discussed---leaving us scrambling to find a new lender and out almost $600.

The entire team was a wonderful experience and they made the process easy to understand, especially as a first time home buyer. I would definitely recommend Tomo to anyone who is looking for a lender.

Zillow: 4.86 out of 5.0

Zillow lender profile reviews skew positive in aggregate, with many customers and some real estate professionals reporting fast closings and strong rates when the files proceed smoothly. As with other sites, the negative reviews---although smaller in number---are vocal and focus on time-sensitive failures around closing.

I made offers on multiple homes before getting the one we wanted, and Tomo was there each time with the best rate. I shopped around quite a bit and they were by far the best. James was also wonderful to work with at each step of the way. Thank you, Tomo!

Please use caution before allowing any mortgage seller to pull a hard credit report as the credit bureaus sell the information regarding the inquiry to mortgage brokers who are obviously the bottom feeders of the industry. After telling the screener from Tomo Mortgage I HAD to have a bridge loan he LIED and said he checked with the loan officer who said they could completely do it, talked me into the approval process when I was only asking rates. Would have been okay with it but today I have received over 70 calls and texts from lenders. The transaction with TOMO has been the most annoying transaction of any kind I have had so far this year. 70!! 70 calls! OMFG. Update, 2nd day 5 calls by 945 AM.

I compared over 20 diff lenders and Tomo offered the best rate with zero fee. If you are lucky to see my review comment, you just saved yourself so much time shopping and comparing the lenders. I have been recommending tomo to everyone i know ever i since they helped me with my loan last month.

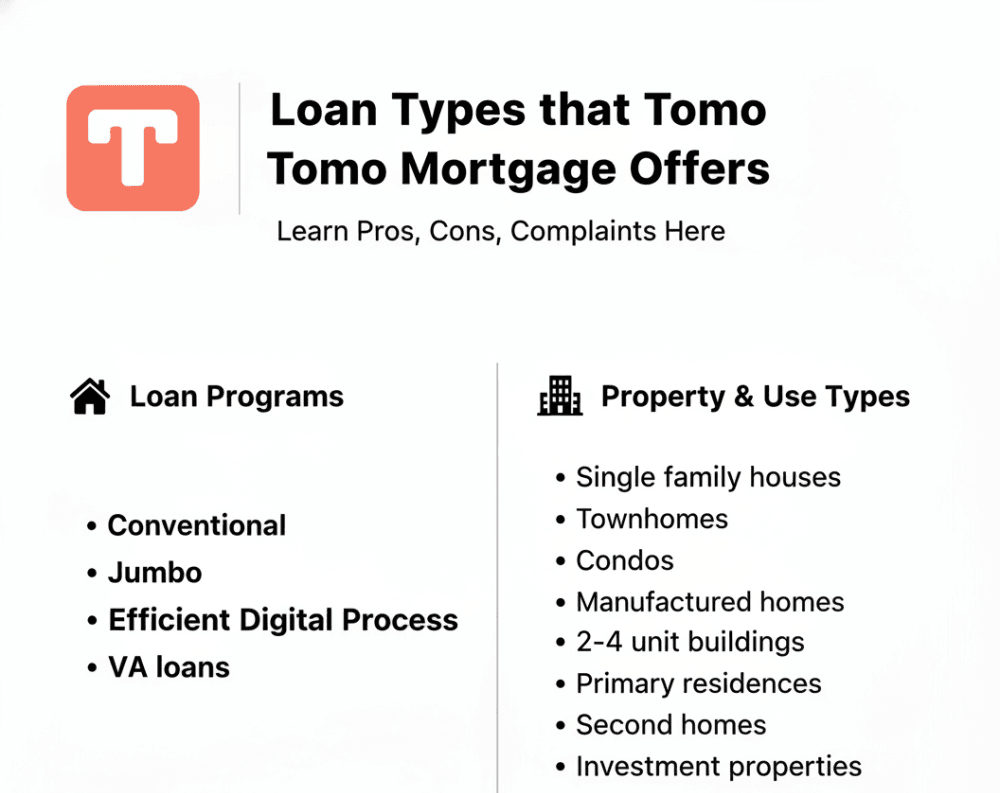

Loan Types that Tomo Mortgage Offers

Tomo Mortgage supports a variety of purchase loans: Conventional, Jumbo, FHA, and VA. Term options include 15- and 30-year fixed rates and common ARMs such as 5/1, 7/1, and 10/1. Tomo lists a minimum loan amount (for many products) of around $75,000 and advertises Jumbo capabilities up into the high-six/low-seven figures, depending on product and market.

Eligible property types include single-family homes, townhomes, condos, manufactured homes, and 2–4 unit buildings. Loan uses include primary residences, second homes, and investment properties. Tomo does not emphasize construction-only loans or co-ops. As always, exact eligibility, maximum loan limits, and mortgage insurance/down payment requirements depend on the specific program and underwriting.

Please note that minimums vary by program (for example, FHA programs generally have lower credit score thresholds such as 580 for maximum-case scenarios), so check Tomo's product pages and the issued Loan Estimate for program-specific requirements.

What Else Services Does Tomo Mortgage Provide

Let's see what other services Tomo Mortgage can offer to you.

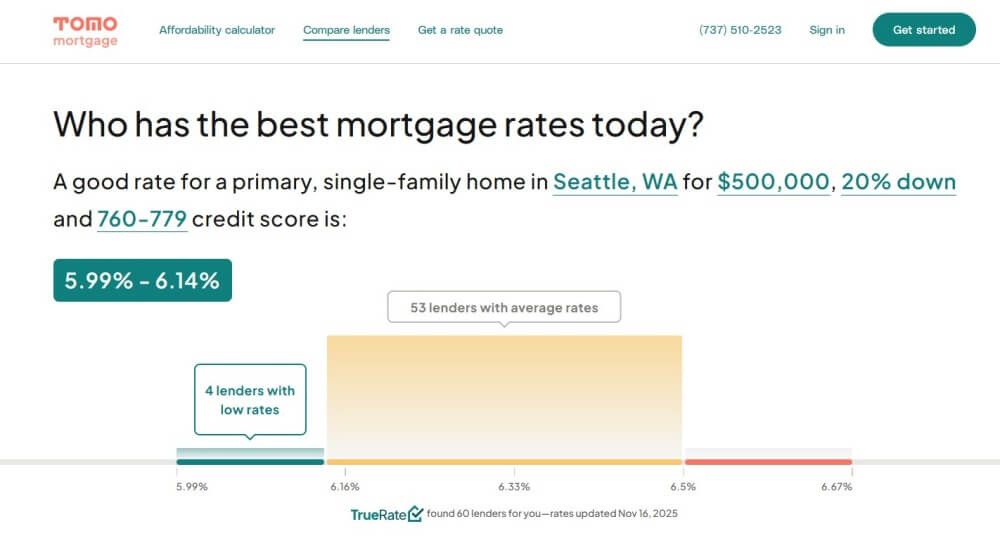

Compare Lenders

Tomo's TrueRate tool is designed to compare a borrower's likely market rate versus advertised rates across lenders, using a dataset Tomo says is drawn from a large sample of loan records. TrueRate is central to Tomo's transparency argument: it shows where a quoted rate sits relative to market distribution (e.g., "high/average/low" categories). Use this as a sanity check when you shop, but verify assumptions in your own Loan Estimate.

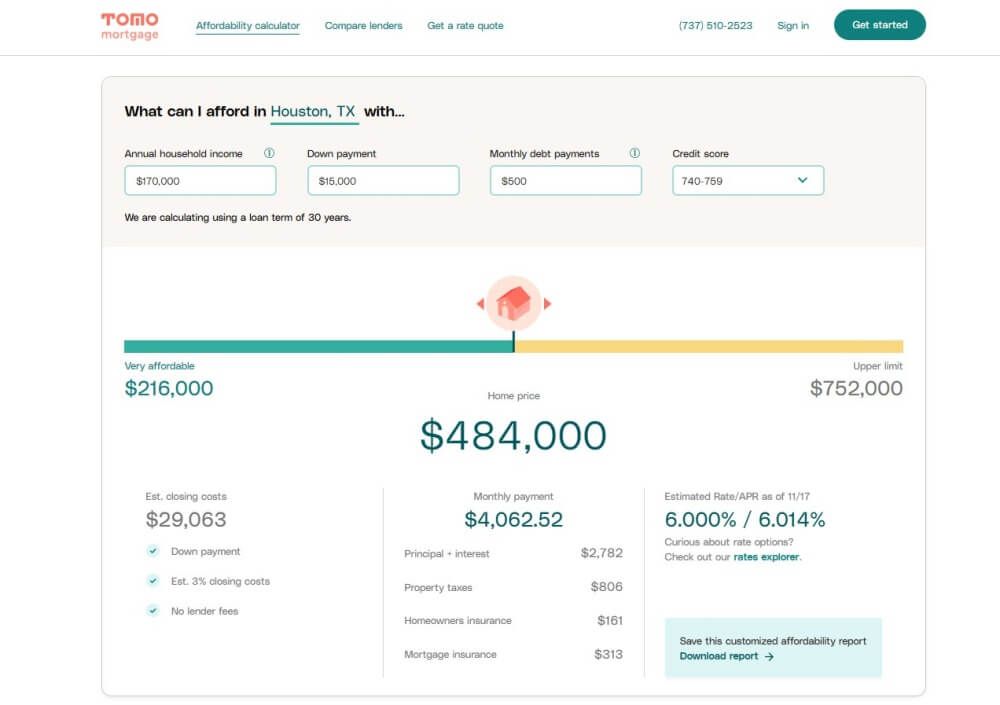

Affordability Calculator

Tomo's affordability calculator asks for income, debts, down payment, and location to estimate realistic purchase price ranges and monthly payments---factoring in taxes, insurance, and HOA where applicable. It's a practical planning tool, but not a lender decision---final underwriting can and will change numbers based on documentation and compensating factors.

FAQs About Tomo Mortgage Reviews

Q1. Is Tomo loans legit?

Yes, Tomo Mortgage is a licensed non-bank lender operating in many U.S. states (NMLS information is available for consumer lookups). It is a venture-backed fintech that has been covered by mainstream industry press and has publicly reported funding rounds. That said, "legit" does not mean flawless; verify licensing for your state and always compare the issued Loan Estimate to advertised numbers.

Q2. Is Tomo Mortgage safe?

Tomo uses standard online security and follows federal mortgage regulations as a licensed lender, but borrowers should read the privacy policy and the Loan Estimate carefully. Personal data sharing (employer verification, credit pulls, third-party vendor checks) is part of mortgage processing---ask which checks are soft vs. hard pulls during preapproval.

Q3. Who owns Tomo Mortgage?

Tomo is a privately held company co-founded by ex-Zillow executives and backed by VC and strategic investors, like Ribbit Capital, NFX, DST Global, Progressive, among others, in various rounds. Public reporting covers a large seed round and a $40M Series A that increased valuation significantly.

Q4. Is Tomo Mortgage a broker or a lender?

Tomo is a direct, non-bank lender (not a broker). That means they originate and fund certain loans themselves rather than only brokering to other lenders---this is central to their ability to advertise "no lender fees" and standardized pricing. Confirm from your Loan Estimate whether Tomo or a correspondent is funding the loan.

Q5. What are the benefits of Tomo Mortgage?

Lower advertised rates, no lender fees, a fast/digital application experience, and rate/comparison tools (TrueRate). These strengths are repeatedly mentioned in positive reviews. The main tradeoffs are variability in human communication and occasional reported last-minute underwriting that can delay closings.

Conclusion

Tomo Mortgage offers a modern, technology-first path to purchase mortgages that can produce meaningful savings for borrowers with straightforward financial profiles. Their selling points: competitive rates, transparent online pricing, and convenience tools like TrueRate, are real and have won praise and investor support. Industry coverage and funding rounds back the company's scale ambitions.

However, public review data shows operational variability: when the automation and staffing align with a borrower's needs, the result is fast closings and low costs; when a file becomes complex, some borrowers report poor communication and stressful, last-minute underwriting actions. If you're advising a homebuyer or working as a loan officer/agent, treat Tomo like any other lender: (1) verify advertised rates against the Loan Estimate, (2) get explicit contact/communication expectations in writing, and (3) confirm contingency plan timing, what happens if a closing slips.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

- MortgagePros Reviews 2026: Is It a Scam or Not?