MortgagePros Reviews 2026: Is It a Scam or Not?

On forums like Reddit, people ask bluntly: "Is Mortgage Pros a scam?", usually after receiving unexpected calls, texts, or direct-mail offers that look too good to be true. That exact thread and similar posts show the public's main worry: aggressive outreach can look fraudulent even when a company is legitimately licensed.

This review pulls together company materials, regulator and licensing records, Better Business Bureau complaints, platform reviews, and employee feedback so you can judge risk vs. reward for yourself. Read on for a fact-checked, source-backed view and concrete examples you can cite when advising borrowers, loan officers, or partners.

** People Also Read**

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

Learn What MortgagePros is

MortgagePros, LLC is a privately held mortgage company headquartered in Troy, Michigan (880 W. Long Lake Rd). The firm states it was founded November 11, 2019 and presents itself as a full-service mortgage lender/broker offering refinance, purchase loans, FHA, VA, jumbo loans, and HELOC options.

The company publishes an NMLS company ID (1925352/MB - 102132) and lists licensing or registrations across many states. It claims activity in 38 states and counting. Those licensing pages and its NMLS ID make it straightforward for consumers or partners to confirm the company's registration status via NMLS/DIFS lookup.

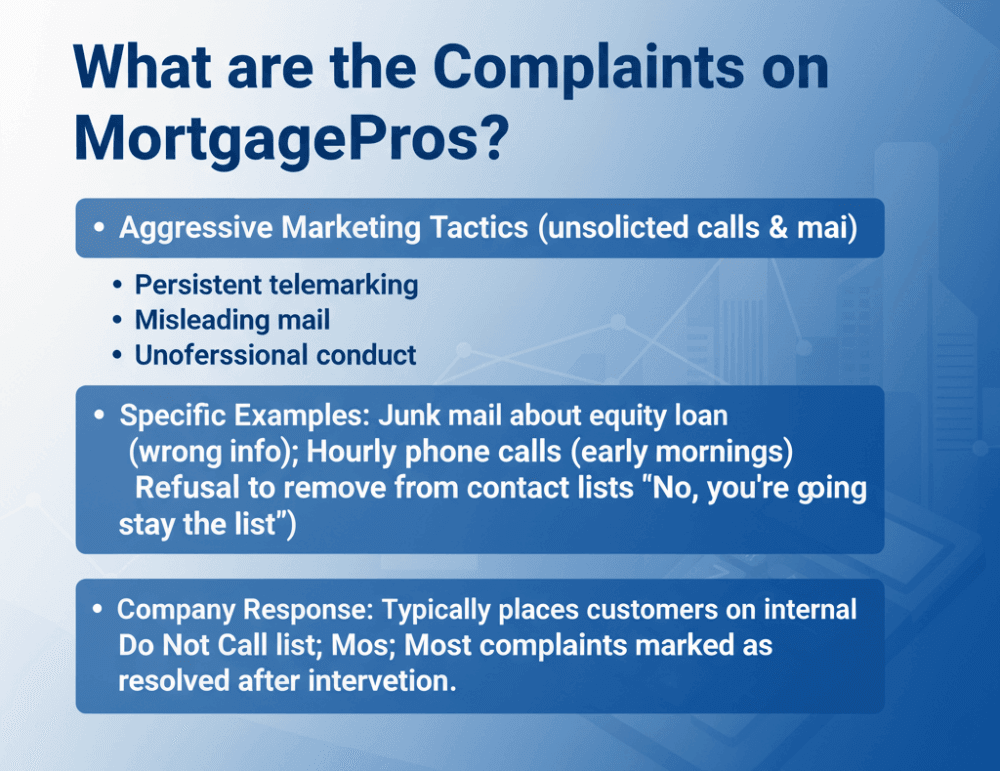

What are the Complaints on MortgagePros?

The bulk of consumer complaints visible on the BBB profile center on marketing/sales practices (unsolicited calls, repeated texts, and direct mail), difficulties with refunds and promises around appraisal fees, and occasional service (communication) breakdowns during loan processes.

A recurring theme: customers ask to be removed from contact lists but claim they keep receiving calls or mail. The BBB profile is extensive and shows multiple recent complaints with business responses and many marked resolved after company's follow-up.

All of a sudden this place started calling me nonstop 20+ times a day and texted me and I told them to stop and they dont stop! Thankfully I have setup my phone to block unknown calls and use an app to filter out unwanted calls or else my phone would be ringing all day!

In the past week since I've done a hard credit pull, mortgage pros has called me 200 + times from different junk numbers in my area. Which is deceptive in itself because obviously I am more likely to pick up from a local number. I cannot block the numbers because they generate unlimited omega numbers to call you on. They are harassing me and will often not take no for an answer when you tell them you're not interested. The agents are often rude when they don't get what they want and act entitled to your time. I would like them to never contact me again and also provide an explanation of why they think it's acceptable to harass people after sneakily buying their information from credit agencies.

This company calls me almost every hour. Today they called at 5:30am. I keep asking to be removed from their list but sure enough I get another call from one of their minions less than an hour later. No idea how a company like this can stay in business.

What People Are Saying About MortgagePros?

To form a balanced picture we combined feedback from multiple platforms: TrustIndex (aggregates Google/Yelp/etc.), Zillow's lender profile, WalletHub, and employee review sites. Below are high-level summaries and short real review excerpts.

Zillow (4.69/5.0)

MortgagePros maintains a Zillow lender profile and shows activity there, but much of the detailed user feedback is aggregated through Google/Yelp feeds (and is visible on third-party aggregators). The company highlights its refinance and purchase services on Zillow and elsewhere, but Zillow's public lender page is often a redirect/aggregated listing rather than a long, independently moderated review corpus.

The Mortgage Pros Team knows what they're doing!! They made my refinance quick and painless, making sure I understood every step along the way. I couldn't be happier with the team and will definitely refer them to my friends and family going forward.

George went above and beyond from day 1 of working with him. He never gave up when we ran into some issues and was able to get the loan closed. He was professional, understanding and extremely knowledgable. Very responsive with calls and messages regardless of the time. Would work with George any time!

Paul took all the time with me, and was very patient with me. Paul also kept me me informed about everything going on and also was very inspirational when I was getting discouraged!

TrustIndex (4.9/5.0)

TrustIndex shows a strong positive score for MortgagePros (4.9 with thousands of reviews at the time of checking). Many reviewers praise specific loan officers by name for responsiveness, clarity, and a smooth closing process. Interspersed with praise are a number of complaints about texting/calling after an opt-out, echoing BBB themes.

MortgagePros got me where I needed to be, they showed me options I wasn't even thinking about. Androu and Dylan were extremely helpful, going above and beyond to get me closed on this loan. I will go through them again in the future.

MortgagePros got me where I needed to be, they showed me options I wasn't even thinking about. Androu and Dylan were extremely helpful, going above and beyond to get me closed on this loan. I will go through them again in the future.

I have been working with Savon and Aya for some time now and they have guided me throughout the entire process. They were always available if I had a question and they are very professional at what they do. The process was smooth thanks to both Savon and Aya. Communication was key

WalletHub (≈4.8/5.0)

WalletHub lists MortgagePros' profile and aggregates user ratings. Many customers who completed loans report high satisfaction (speed of closing, professional loan officers). WalletHub also contains negative user comments that mirror BBB/TrustIndex problems about marketing materials, unwanted mail, or calls.

Cayden did a good job on my refinance process. Thank you, Cayden; may God bless you for everything you do for people. I may give your information to anyone who needs help.

Yousef Tomas has handled both my refi and my HELOC loan. He is very committed to his profession. He is thorough, patient, stays in contact throughout the entire process and beyond. He makes it seem so easy. I would work with him again for any future loans. I would recommend him to friends and family. Thank you Yousef for your services.

BEWARE! THEY ARE A SCAM! They keep sending me junk marketing letters, telling me that "after careful review of my mortgage, I qualify for a home equity loan," which is false as they don't have access to my mortgage information.

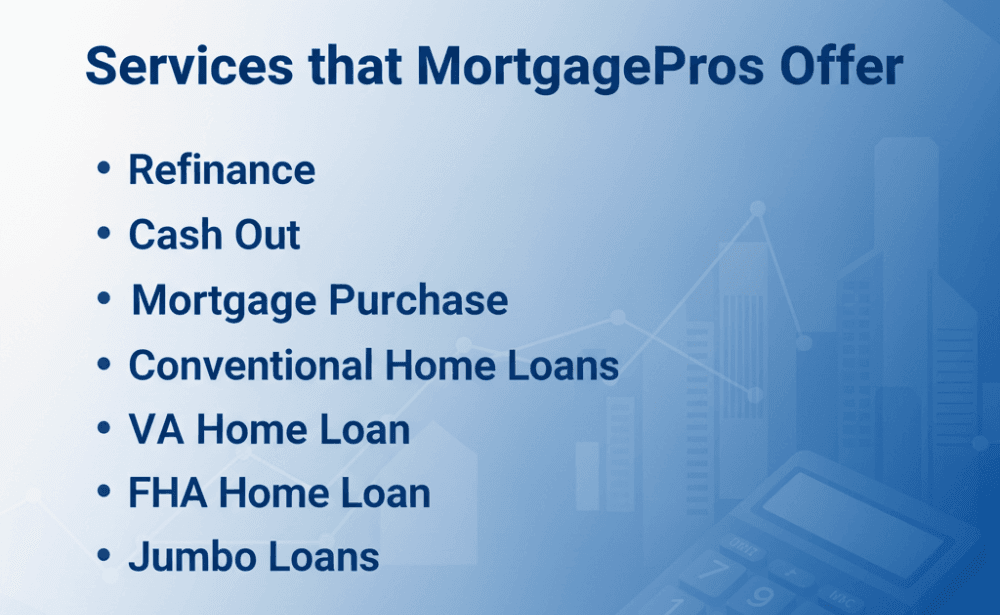

Services that MortgagePros Offer

MortgagePros' service list includes refinance, cash-out refinance, purchase mortgages, conventional loans, VA loans, FHA loans, and jumbo loans. The company emphasizes one-on-one loan officer support and claims the ability to operate across many states.

Refinance

MortgagePros describes typical refinance paths (rate/term refinance, shorter term, cash-out). Their pages recommend refinancing when rates materially improve relative to an existing loan and when borrower credit or equity positions have improved. The site also links to state-specific refinance pages (Michigan example) and lists general qualification considerations (credit score, LTV, underwriting). Always validate current market rates and underwriting rules with the loan officer. These change quickly.

Cash Out

Cash-out refinance is presented as a way to extract home equity for renovations, debt consolidation, etc. The site notes typical requirements (appraisals and maintaining sufficient equity post-refi). As with all cash-out options, borrowers should weigh closing costs, new rates, and the loss of previously favorable loan terms.

Mortgage Purchase

MortgagePros provides purchase-loan services with pre-approval assistance, and access to conventional/FHA/VA/jumbo products. Their materials emphasize pre-approval to strengthen offers and a hand-holding approach through closing. For buyers, confirm lock policies and fee disclosures early in the process.

Conventional Home Loans

Conventional loans are listed with standard guidance: 15/30-year options, PMI considerations (20% down to avoid PMI), and credit/DTI guidance. The company's pages give typical thresholds, but always confirm case-by-case.

VA Home Loan

MortgagePros markets VA loans (no down payment for eligible vets, favorable terms). Eligibility is determined by VA rules. MortgagePros can originate VA loans for qualified veterans/servicemembers via VA programs. Borrowers should confirm specifics and entitlement with a loan officer and the VA.

FHA Home Loan

FHA products are shown with the usual features (low down payment options, lower credit thresholds). The site repeats standard FHA facts (3.5% down for credit scores 580+, higher down for lower scores). FHA borrowers should consider MIP duration and refinancing options later.

Jumbo Loans

The firm lists jumbo options for loans above conforming limits and explains the tighter underwriting (higher credit, assets, and lower DTI expectations). As with any jumbo product, expect manual underwriting and stronger documentation demands.

FAQs About MortgagePros Reviews

Any questions? Take a look below.

Q1. Is MortgagePros a real company?

Short answer: Yes. MortgagePros is a registered mortgage company with an NMLS company ID and multiple state licenses. It is BBB-accredited (since 6/9/2023) and lists NMLS IDs and licensing information publicly. Those records let you confirm regulatory status and active licenses. That makes it a legitimate mortgage business rather than an obvious consumer-scam operation.

Q2. Is MortgagePros a good company to work for?

Employee review sites (Glassdoor, Indeed) show mixed but overall positive employee sentiment. Glassdoor displays strong recommendation percentages and a ~4.6 overall rating based on dozens of reviews, while some anonymous reviews allege questionable internal practices (pay adjustments, training issues). For prospective employees, that means the company can offer growth and uncapped commission, but check role-specific pay structure (hourly vs commission) and ask for current compensation details in writing.

Conclusion. Verdict & Practical Advice

Is MortgagePros a scam? No. by regulatory and licensing checks (NMLS, state licensing, BBB accreditation), MortgagePros is a legitimate mortgage company. Many borrowers who worked directly with loan officers report good outcomes and fast closings. TrustIndex and other aggregators show high average satisfaction among completed customers.

Why so many "scam" complaints then? The primary issue is lead-generation and outreach practices: unsolicited calls, persistent texting, and direct mail can read as predatory or scammy to recipients (and some complaint threads include aggressive opt-out experiences). Those outreach methods are common in high-volume mortgage lead channels. Bad execution (not honoring opt-outs, misleading mail copy) damages trust and triggers "Is it a scam?" questions. The BBB complaint stream shows exactly that pattern.