United Wholesale Mortgage Reviews: What People Are Saying About?

What is United Wholesale Mortgage? Is it a good choice for a first-time homebuyer or someone who wants a refinance? To help you get the ins and outs of the company, here's the full review for you. You may walk through its history, pros & cons, complaints, and real ratings here, so you'll be able to make an incisive decision.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2026: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

[Introduction] What is United Wholesale Mortgage?

United Wholesale Mortgage (UWM) is a wholesale mortgage lender founded in 1986, originally Shore Mortgage, that does not take retail applications directly from consumers. It works through independent mortgage brokers and loan officers. Under CEO Mat Ishbia, UWM grew rapidly and became the largest mortgage originator in the U.S. by full-year 2024 volume: the company reported $139.4 billion in loan originations for 2024 and, according to HMDA-based reporting, originated 366,078 loans in 2024, narrowly edging Rocket Mortgage by count. UWM also claims it controls roughly 43% of the wholesale channel.

UWM positions the company as technology-driven and broker-focused. Its product set spans conventional, FHA, VA, USDA, jumbo, and HELOC options available through its broker network. For borrowers, that means you can only access UWM's prices and products by working with a participating broker.

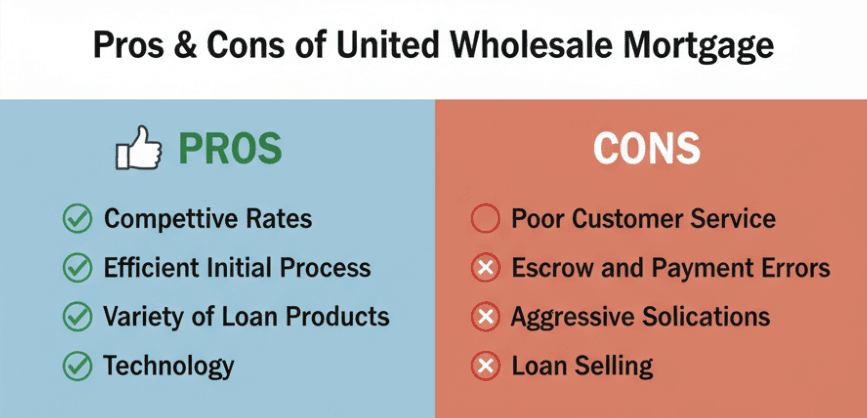

[Pros & Cons] Things to Consider Before Choosing United Wholesale Mortgage

Now, let's learn about the benefits and drawbacks of United Wholesale Mortgage.

Pros

-

Competitive rates: Because UWM is wholesale-only, brokers can shop its programs for borrowers. Many borrowers report low rates and attractive promotions. UWM's scale also allows a broad product menu and frequent program updates.

-

Efficient initial processing: UWM highlights fast turn times and tech tools for brokers. Some brokers and borrowers report quick initial underwriting and fast clear-to-close times when files are complete.

-

Wide product range: UWM offers conventional, FHA, VA, USDA, jumbo, construction/one-time-close, and HELOC products. Useful for borrowers with diverse needs and for brokers who place many loan types.

Cons

-

Customer-service and servicing complaints: A pattern in public reviews and regulatory complaints shows issues with post-closing servicing: escrow errors, insurance tracking problems, payment posting errors and long hold times when borrowers call. These are the most frequent complaint categories on BBB and other review sites.

-

Escrow/payment mistakes: Multiple complaints allege wrong parcel numbers, misapplied tax payments and delays/refused refunds for escrow mistakes. Problems that create real borrower stress and possible late fees.

-

Communication/transparency gaps: Because borrowers apply through brokers, the borrower experience depends on broker competence and on UWM's servicing systems. Consumers sometimes report last-minute document requests, repeated re-requests, and confusing messaging.

-

Aggressive/unsolicited outreach: Some consumers report aggressive telemarketing from third parties or UWM-affiliated broker channels, like multiple calls, and spoofed numbers. UWM's responses in public complaint forums often note that third parties sometimes falsely claim affiliation. Still, the volume of these complaints is notable.

-

Loan transfers/selling: Borrowers report unexpected transfers of servicing, for example, a loan sold to another servicer, which complicates statements, tax documents, and customer service continuity. This is a common industry practice, but it's a frequent source of borrower frustration with UWM.

[Complaints] What Are Dissatisfactions?

BBB shows hundreds of complaints against UWM in recent years, with the largest categories being service issues, billing/escrow errors and customer service problems. The BBB profile lists 223 total complaints in the last 3 years, and many complaint entries include detailed borrower accounts. Below are three representative, verbatim complaint excerpts from the BBB:

"Company offered a disaster forbearance back in june 2024 allowing me to postpone my july and august payments. They told me I would have options to restructure my loan and add the skipped payments on to the end of the loan. After them giving me the runaround for several months on this, I have started getting letters saying my loan is in default and theyre going to take action if I didnt pay the balance in full by 1 December. They kept telling me to wait longer and wait longer. That this process could take up to 30 days. Its been 3 months at this point and theyre still not pushing any progress on this. *** has put me in a position that I had to take a loan out to repay this balance to avoid getting my house foreclosed on."

"They sold my mortgage to a company, with a 1-star rating as per BBB only because you had no lower rating. I don't trust this company, with my mortgage. Can't find one good thing about this company. United Wholesale Mortgage sold my mortgage only after 6 months without any notification and gave me no choice in this sale. I would have stopped this sale to a company as bad as this. This should not be legal."

"This company keeps calling me nonstop soliciting a mortgage application. Theyve called 27 times in 24 hours. They do not take no for an answer, they talk over you, they will not put you down as not being interested, and if you hang up the same person will call back immediately. I never contacted this business for any type of service. I was told they saw I had my credit pulled for a home loan, and that gives them the right to contact me this type of harassment and boiler room calling techniques needs to stop. They use spoofed phone numbers to continually call you and disguise their number."

[Rating] Real United Wholesale Mortgage Reviews

Below, we summarize ratings from three commonly referenced review sources and sample real, published review excerpts.

Google Reviews (4.1 out of 5.0)

Google Reviews generally show many positive origination experiences, especially borrowers pleased with their broker + UWM combination and low rates, alongside negative servicing reports. Aggregators that pull Google reviews and Birdeye's index of Google/other platforms show a mixed picture: fast, low-cost originations but recurring servicing/escrow problems after closing.

"From start to finish, the experience was smooth, transparent, and efficient. The team was incredibly responsive, knowledgeable, and truly had my best interests in mind. I got a great rate, clear communication every step of the way, and felt supported throughout the entire process. Highly recommend to anyone looking for a lender that delivers top-tier service and results."

"This company is non-responsive and demonstrates a lack of care/understanding when it comes to their customers' needs. I can't fathom how a customer is trying to be proactive and communicate with a lender for assistance, but the company rather you default, conduct negative credit reporting, etc BEFORE they offer help. Then at the beginning of the shutdown, they said they enrolled me into the go T shutdown program and it turns out, they never applied it to my account! The wait times are always long, no one returns messages posted on the customer portal, and I've had enough."

"UWM sold my loan to Cenlar which has been nothing but hell (Currently they sit at 1 star with 719 reviews which are nearly all 1 star as well) and because they locked my account, due to a system error on Cenlar's end, to only use money orders or bank checks, both options which Im currently unable to do, I am now being told they will soon have to call in the collection agency. It seems 100s have also been going through same if not similar issues like mine. I was doing great with the payments before all this happened with next to no issues."

ConsumerAffairs (1.5 out of 5.0)

ConsumerAffairs reviews trend negatively, with many verified complaints about document delays, last-minute audit requests at closing, insurance tracking failures, and poor customer service. The platform's review pages contain long first-person accounts of delayed closings and unhelpful phone interactions. Many reviewers explicitly mention filing complaints with BBB or CFPB.

"I cannot say enough about this firm. From start to finish and waiting in between, the Professionalism and guidance I was met with at each step showed me that I chose the right broker. Any issues were addressed immediately which calmed my nerves during this process. I will say I almost gave up buying a home until I worked with my broker and realtor to perform a miracle.... Yes, I am very happy with the business I did with this firm."

"Worst Mortgage company I have ever had to deal with. Rude/unhelpful managers/staff. Hard to pay mortgage online. They transferred my mortgage between depts, couldn't pay mortgage because they were not setup to take my mortgage due to their internal transfer. Highly incompetent management, who is unwilling to assist. They try to force you to send a certified check even after a successful payment through their portal. RUN do not use this company! I wish I would have NEVER used this mess of a company. Do your research and search what they are being sued for."

"Completely mishandled our escrow account. Notified them multiple times they were not holding enough money for our taxes. Sent in updated increased taxes multiple times Eventually started adding in extra myself. One month before the new lager tax bill was due they sold the loan and new lender had to increased our payment to cover their shortfall."

Indeed (2.8 out of 5.0) - Summary (Employee Perspective)

Indeed shows mixed employee sentiment. Typical themes include good benefits for some roles, but complaints about pay, micromanagement, training quality, and production pressure. These internal reviews help explain why service breakdowns sometimes occur during high volumes: staffing, training, and process challenges are recurring employee comments.

"My days a work are fun and uplifting; team members always helping and have a listening ear, our culture is diversed, motto is you be you (which is awesome), the hardest part of my job is having to much fun, I enjoy the relax environment"

"If you work hard, learn what you can, and ace what you learn, there are multiple growth opportunities after just 6 to 9 months of working there. Monthly feedback is provided both positive and room for improvement. Multiple departments are present. In job training provided."

"Everyone was so nice and welcoming, I'll always advocate for this company when I hear someone speak bad about it. It's just really good energy there like yes it can be stressful at times but that's every job. You're better off stressed there than anywhere else."

Loan Products Provided by United Wholesale Mortgage

UWM offers the standard suite of mortgage products through brokers. You can take a look at the specific categories below.

-

Conventional: Conforming conventional loans, including high-balance/conforming-plus options. UWM supports low-down-payment conventional programs, some as low as 3% for qualified borrowers, fixed and adjustable terms, and rate/term and cash-out refinances.

-

FHA: FHA purchase and refinance products, minimum 3.5% down for scores ≥580, 500–579 with 10% down in line with FHA rules, FHA streamline refinances for eligible existing FHA borrowers, and FHA 203(k) for purchase + rehab financing. The availability depends on the broker's packaging.

-

Jumbo: Non-conforming high-balance/jumbo loans for expensive markets. UWM's jumbo product terms, maximum loan amounts, and required credit thresholds vary by program. Brokers can quote exact LTV and qualifying criteria.

-

VA: VA purchase, IRRRL (VA streamline), and VA cash-out refinance options for eligible veterans and service members. No down payment required when borrowers meet VA eligibility and UWM underwriting.

-

USDA: USDA Rural Development guaranteed loans for eligible properties and incomes. These offer up to 100% financing in qualifying rural/suburban areas. Eligibility depends on location and household income.

-

HELOC: Home Equity Lines of Credit for homeowners who need flexible, ongoing access to equity. Draw/repayment periods and qualification requirements vary by program.

Specialized Offerings on United Wholesale Mortgage

UWM lists several specialized programs that broker partners can use. These are often state-targeted or purpose-specific.

Florida Hometown Heroes: A state-aligned down-payment/closing cost assistance program for eligible frontline workers in Florida. Brokers can layer UWM loans with the program where available.

One-Time Close New Construction Loans: A "one-time close" construction → permanent financing that avoids two separate loans/closings, locking terms at the start of the build. Useful for buyers of new-build homes who prefer a single settlement.

CEMA Loans: New York-specific Consolidation, Extension, and Modification Agreement (CEMA) structures that can reduce NY mortgage recording tax when refinancing.

Temporary Rate Buydowns: Builder- or lender-funded temporary buydowns (common 2-1 or 1-0 structures) that lower payments in the first 1–3 years. These are widely used on new construction purchase transactions.

FAQs About United Wholesale Mortgage Reviews

Any questions about United Wholesale Mortgage? Check below.

Q1. Where does United Wholesale Mortgage rank?

UWM was the #1 mortgage originator in the U.S. for full-year 2024 by dollar volume: $139.4B in 2024, and by loan count (366,078 loans) per HMDA/industry summaries. Within the wholesale channel, UWM reported roughly a 43% share according to the first nine months of 2024 data. These figures come from UWM filings and industry HMDA analyses.

Q2. What credit score do you need for United Wholesale Mortgage?

There isn't a single answer. Credit minimums depend on product and borrower profile. Typical program benchmarks often cited in lender summaries: conventional programs often look for 620+ (programs can vary. Some broker-facing conventional options may require higher scores), FHA follows federal guidelines (580 minimum with 3.5% down, 500–579 with 10% down), and VA/USDA have program-specific underwriting rather than strict statutory FICO floors. Brokers will supply program-specific overlays and exact thresholds.

Q3. Who uses United Wholesale Mortgage?

Borrowers who work with mortgage brokers, especially those seeking competitive pricing, high-balance loans, or specialized programs, frequently end up with UWM loans. Brokers who want a broad product set and tech tools also use UWM heavily. Because UWM is wholesale-only, borrowers interact with it mainly through their broker.

Q4. Who is bigger, UWM or Rocket Mortgage?

By full-year 2024 origination, UWM led Rocket Mortgage in dollar volume and had a slightly higher loan count (UWM: ~366k loans/$139.4B. Rocket: ~361k loans/~$97–98B per year summaries). Context matters: Rocket operates a large retail presence. UWM is wholesale-only. Both are among the largest U.S. originators.

Conclusion

United Wholesale Mortgage is a major, broker-only mortgage originator with national reach, deep product coverage, and the scale to offer competitive pricing. Its 2024 results (top originator by volume) confirm its market leadership. For borrowers who work with a competent broker, UWM often delivers efficient closings and good pricing.

However, across BBB, ConsumerAffairs, and other public review sites, there is a persistent cluster of post-closing servicing complaints (escrow/tax errors, insurance tracking, payment posting), plus frequent notes about communication breakdowns and aggressive third-party outreach. If you or your clients are considering a UWM loan, treat the broker relationship as the key variable: choose an experienced broker who (a) documents everything, (b) confirms escrow/tax/insurance setup immediately after closing, and (c) keeps you CC'd on service communications in case you need to file complaints. Also, archive proof of submissions (insurance declarations, tax notices) and monitor statements for at least the first 12 months after closing.