4 Real Use Cases: How Bluerate AI Agent Transforms Mortgages

Am I actually getting the best rate, or just a teaser? Will my side-hustle income get my application rejected at the last minute? Why does finding a responsive loan officer feel harder than finding the house itself?

If you've ever lost sleep over these questions, you aren't alone. I've been there. Stuck in the endless loop of "phone tag," leaving voicemails, and waiting days for a simple pre-qualification letter while my dream home sits on the market. The traditional mortgage process is opaque, slow, and frankly, outdated.

But what if you could have a mortgage expert in your pocket, available 24/7, who doesn't just "chat" but actually crunches the numbers? Enter Bluerate AI Agent. It's not just a tool. It's a total shift in how we finance homes. By replacing weeks of uncertainty with instant, data-driven clarity, Bluerate is bringing a long-overdue revolution to the mortgage industry.

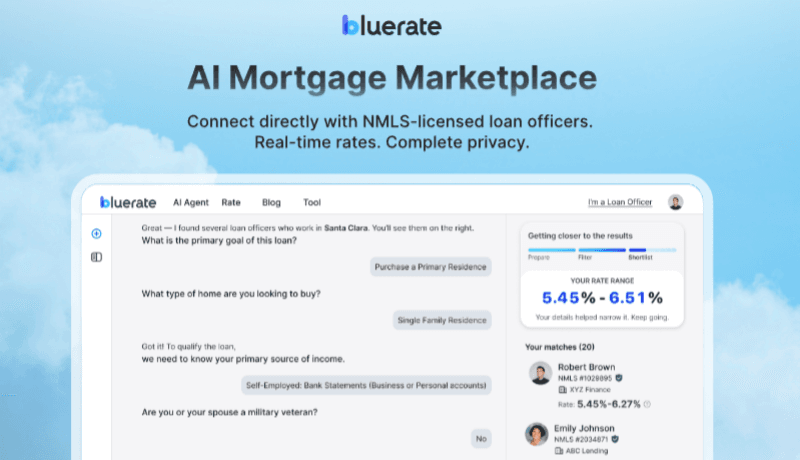

What is Bluerate AI Agent?

Let's be clear: Bluerate is not a basic customer service chatbot that recites generic FAQs. It is Your 24/7 AI Loan Officer Assistant.

Think of it as a bridge between you and the complex world of lending. Powered by advanced Natural Language Processing (NLP) and deeply integrated with a real-time Loan Origination System (LOS), Bluerate understands the nuance of your finances. It doesn't guess. It calculates.

-

First-Time Homebuyers: Ask questions without judgment and shop for real rates privately with no spam calls attached.

-

Self-Employed: Bypass traditional bank rejections by matching with experts who understand 1099s and business income.

-

Refinance Seekers: Compare live rates anonymously and explore cash-out or HELOC options with full transparency.

-

Investors: Quickly secure funding by connecting with Loan Officers who specialize in investment portfolios and rental properties.

Real-World Scenarios: Old Way vs. Bluerate Way

The best way to understand the impact of Bluerate is to see it in action. Let's look at 5 specific situations where this AI technology completely transforms the borrowing experience.

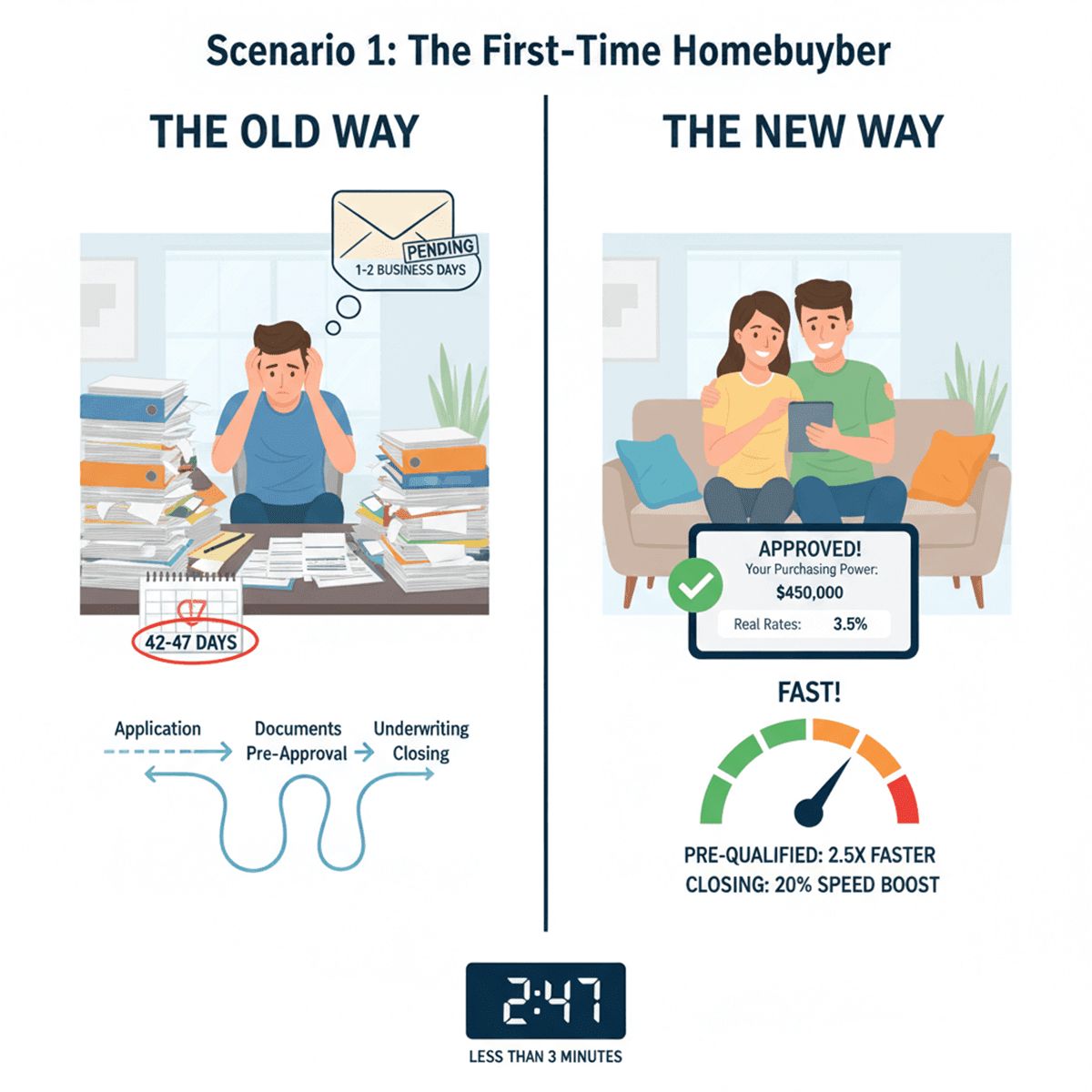

Scenario 1: The First-Time Homebuyer -- From "Can I Buy?" to Pre-Qualified in Minutes

Imagine Sarah. She's a first-time buyer with a credit score of 620. She's terrified of rejection and confused by online ads promising rates that seem too good to be true and usually are.

The Old Way:

Sarah spends her evening Googling "lenders near me." She fills out three different forms and waits. Many lenders provide a formal pre-approval letter the same day or within 1-2 business days if all documents are submitted promptly. During that wait, she has no idea if she can actually afford the house she viewed on Sunday. Even worse, once she starts the full application process, the average time to close a purchase loan is about 42-47 days. That is nearly two months of biting her nails, wondering if the deal will fall through.

The Bluerate Way:

Sarah opens the Bluerate chat and simply asks, "My credit score is 620, what can I afford?"

Because Bluerate connects directly to the LOS, it doesn't give a generic range. It runs her scenario against live lending guidelines. In less than 3 minutes, Sarah knows her purchasing power and sees real rates, not "bait-and-switch" teasers. The AI instantly matches her with a Loan Officer who specializes in FHA or lower-credit profiles.

By streamlining this initial intake, Bluerate helps borrowers get pre-qualified 2.5x faster than traditional methods. Furthermore, by collecting clean, verified data upfront, the entire loan closing process can speed up by 20%. Sarah goes from "confused" to "confident" before her coffee gets cold.

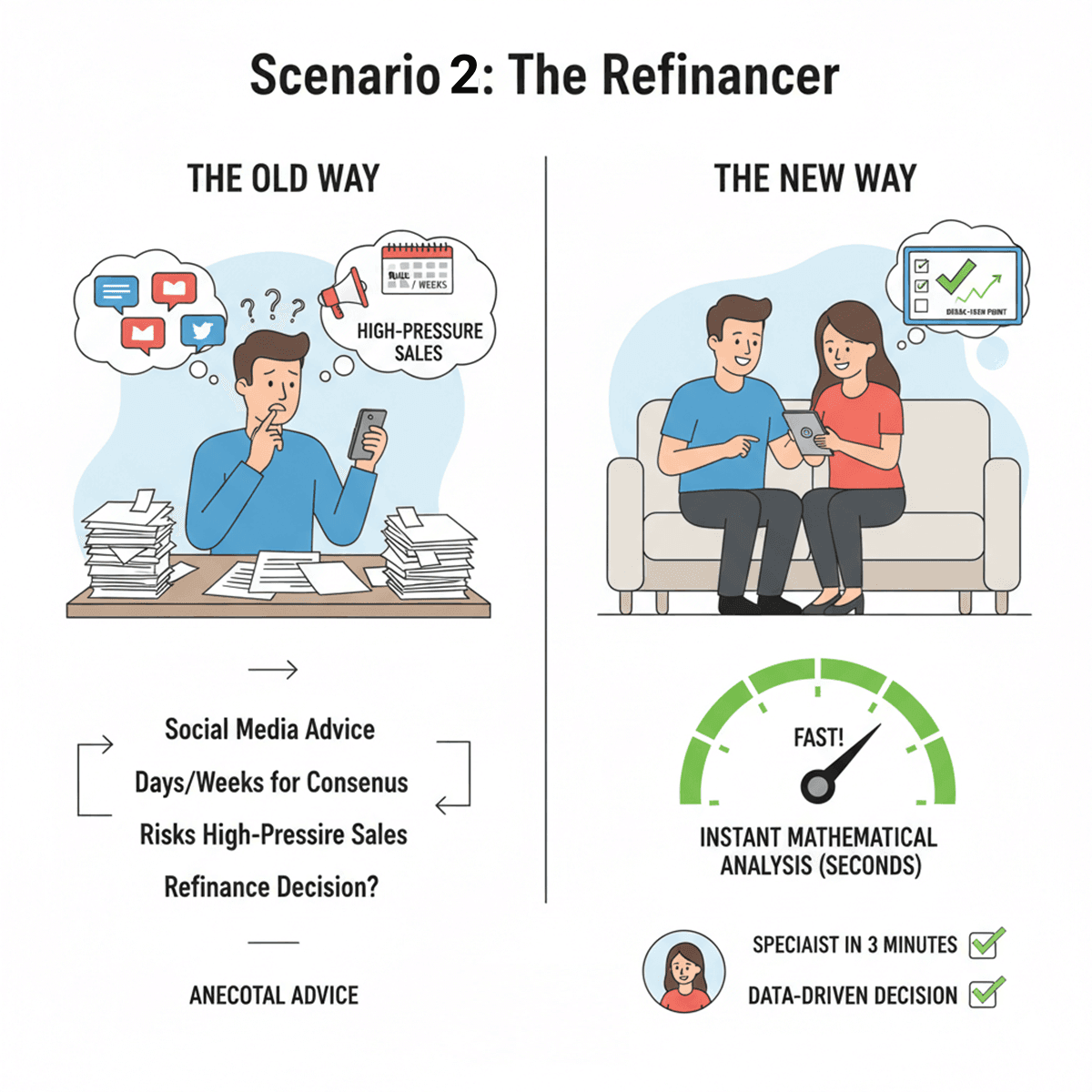

Scenario 2: The Refinancer -- Instant Break-Even Analysis

Finally, there's Tom. He already owns a home, but sees that interest rates have dropped. He's wondering if refinancing is worth the hassle and the closing costs.

The Old Way:

Tom goes to Reddit or Facebook groups. He posts: "Rates dropped 0.75%, is it worth refinancing?" Then, he waits. He gets anecdotal advice from strangers, some helpful, some wrong. It takes days or weeks to get a consensus. Alternatively, he calls a lender, but he's afraid of being pressured into a deal just so the lender can make a commission.

The Bluerate Way:

Tom chats with Bluerate. He inputs his current rate, loan balance, and the new estimated rate. The AI doesn't just say "maybe." It runs the math. It estimates the closing costs and calculates the Break-Even Point, for example, "It will take you 18 months of savings to pay off the closing costs".

This is data-driven decision-making. Tom gets an unbiased financial analysis in seconds. If the numbers make sense, Bluerate connects him with a Refinance Specialist in 3 minutes who can lock that rate. Tom saves time, avoids sales pressure, and only moves forward when the math works in his favor.

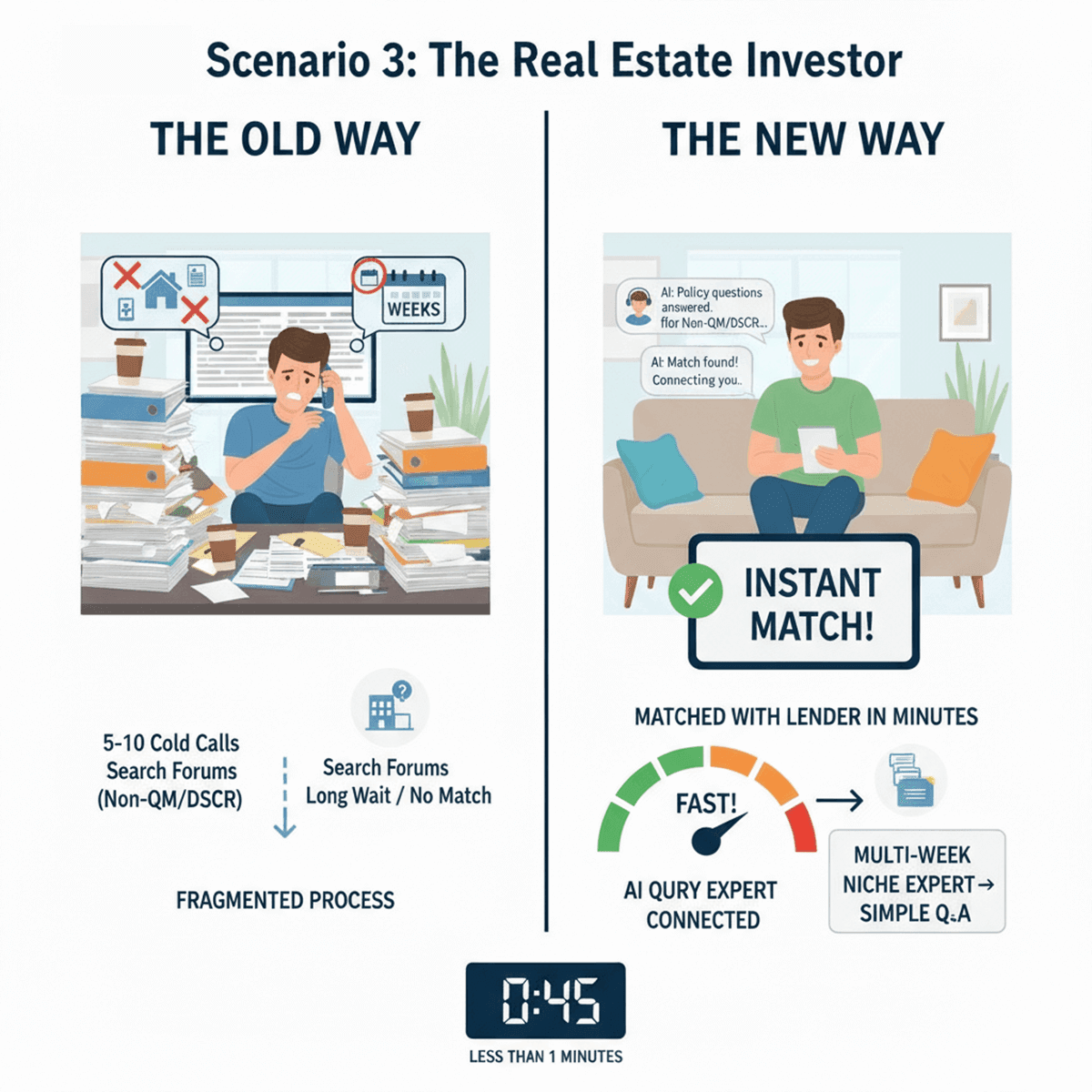

Scenario 3: The Real Estate Investor -- Unlock Non-QM Loans Without the Legwork

Meet David, an investor looking to buy a 4-unit rental property. He doesn't have a traditional W-2 job. He wants to use the rental income from the property itself to qualify for a DSCR loan.

The Old Way:

The Non-Qualified Mortgage is incredibly fragmented. Most big banks simply say "no" to these deals. David has to hunt. He scours forums, calls 5 to 10 different brokers, and explains his story over and over again. He struggles to find a true expert who understands cash-flow loans. It's a process that can take weeks just to find the right person, let alone get a mortgage quote.

The Bluerate Way:

David treats Bluerate as his 24-hour Non-QM Expert. He asks: "What's the down payment requirement for a 4-unit investment property using a DSCR loan?"

The AI creates a custom pathway. It recognizes "DSCR" and "Investment," immediately filtering out generalist lenders. It answers his policy questions instantly and matches him with Loan Officers who specialize in Non-QM products.

Instead of cold-calling random brokers, David gets a direct line to an expert who speaks his language. The AI turns a complex, niche search into a simple Q&A session, saving David hours of frustration and ensuring he finds a lender who actually wants his business.

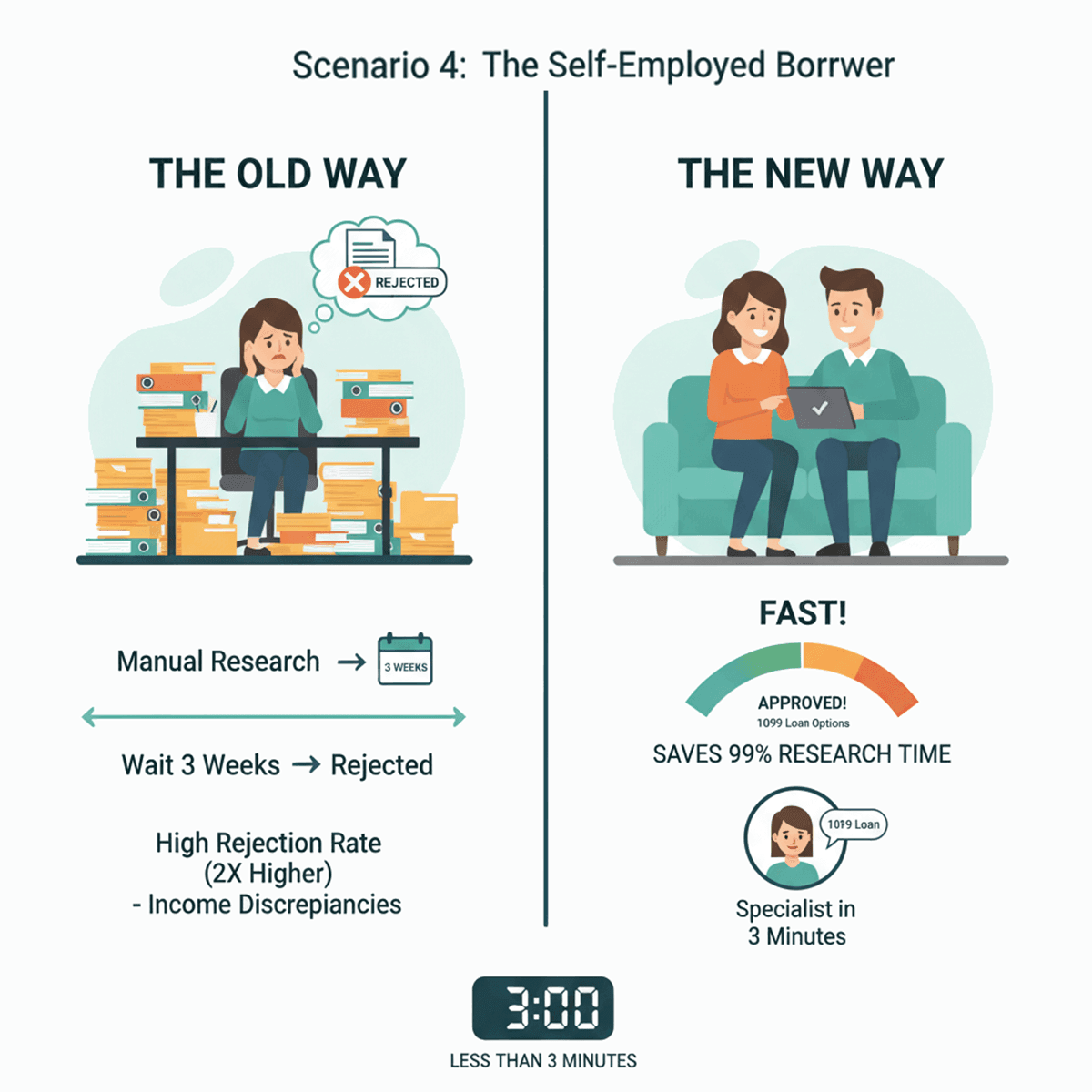

Scenario 4: The Self-Employed Borrower -- Confidence in Income Calculation

Linda runs her own graphic design LLC. She makes good money, but she writes off a lot of expenses to save on taxes. She wants to buy a home but is terrified her tax returns will show too little income.

The Old Way:

Self-employed borrowers face significantly higher mortgage rejection rates than W-2 employees, with some studies showing rates over twice as high. Linda spends nights reading conflicting blogs about "add-backs" and income calculations. She might even apply with a bank, wait three weeks, and then get rejected because the underwriter calculated her income differently than she did. This "compliance fear" keeps many qualified self-employed people on the sidelines.

The Bluerate Way:

Linda asks Bluerate: "I have 2 years of LLC income, but my net income is low. Can I apply?"

Bluerate AI Agent acts as a preliminary underwriter. It can guide Linda toward 1099 Loans---an option where lenders look at cash flow rather than tax returns.

The AI saves Linda 99% of the time she would have spent searching for answers. More importantly, it connects her with LOs who are experts in self-employed borrowers. In 3 minutes, she moves from "fear of rejection" to having a clear strategy and a specialist partner. She knows exactly where she stands before she ever fills out a formal application.

FAQs About Bluerate AI Agent

Q1. What is Bluerate?

Bluerate is an AI-powered mortgage marketplace that connects borrowers and real estate agents with the right Loan Officers. It uses advanced technology to answer mortgage questions, assess qualifications, and match users with experts based on real-time data.

Q2. Is Bluerate free to use?

Yes, for borrowers and real estate agents, using the Bluerate AI Agent to ask questions, check rates, and find Loan Officers is completely free.

Q3. Is Bluerate safe?

Absolutely. Security and privacy are our top priorities. Your data is encrypted, and we only share your information with a Loan Officer when you explicitly choose to move forward with them.

Conclusion

The days of "hurry up and wait" are over. Bluerate AI Agent isn't just speeding up the mortgage process. It's fundamentally changing the dynamic between borrowers and lenders.

By replacing opacity with transparency and delays with instant answers, we are empowering you to make smarter financial decisions. Whether you are buying your first home or managing an investment portfolio, you shouldn't have to guess. Stop guessing and start getting approved. Chat with Bluerate today and get the answers you need in 3 minutes or less.