E Mortgage Capital Reviews: Everything You Want to Know Here

When shopping for a mortgage lender, many homebuyers encounter E Mortgage Capital and ask whether the company is trustworthy, responsive, and a good fit for their financing needs. That same curiosity shows up on community forums and search queries, for example, potential borrowers asking about real experiences on Reddit.

Therefore, this review examines E Mortgage Capital from multiple angles: who they are, what loans they offer, what customers say across major review platforms, their regulatory and complaint history, and practical tips for borrowers. Read on to get a balanced, evidence-based view so you can decide whether to include E Mortgage Capital among the lenders you compare.

Who is E Mortgage Capital?

E Mortgage Capital, Inc. (NMLS #1416824) is a privately held mortgage company headquartered in Irvine, California. The company website and corporate pages state that E Mortgage Capital was established in 2015 and that it operates through a nationwide network of loan officers, offering conventional, agency-backed (FHA, VA, USDA), jumbo, and non-QM products. The firm presents itself as a broker/lender hybrid with digital application tools and an emphasis on speed and multiple product options.

State enforcement records show E Mortgage Capital was the subject of a Washington State Department of Financial Institutions action (order dated January 2023) that included fines and a stayed revocation of its consumer loan company license, subject to conditions. This is a material item for consumers and should be considered when evaluating the company.

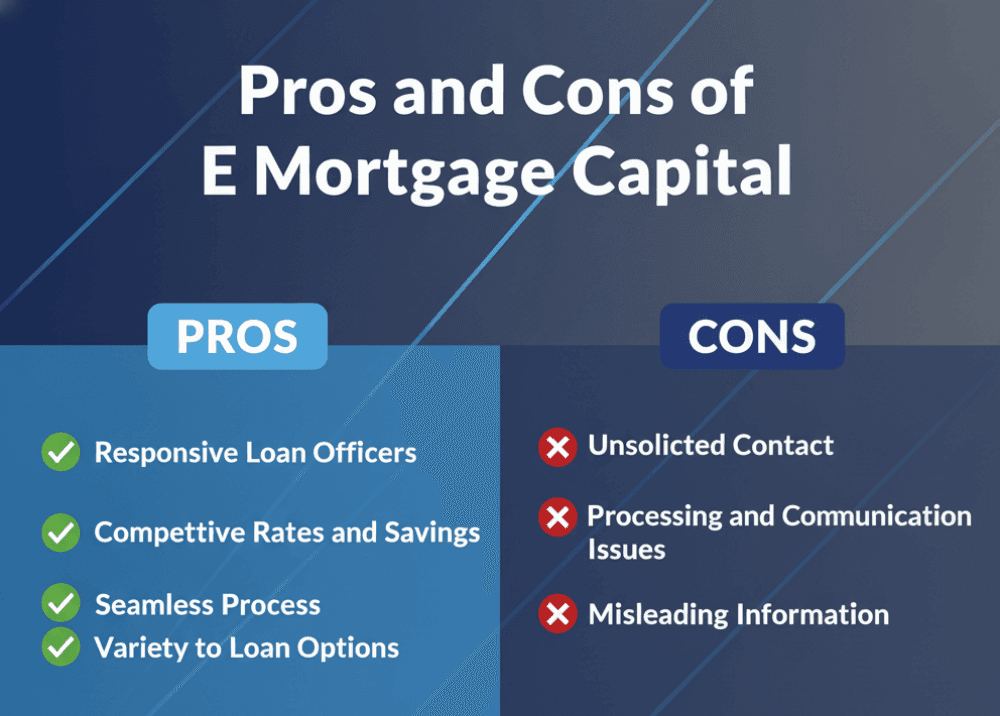

Pros and Cons of E Mortgage Capital

Before we go any further, let's check out its advantages and drawbacks first.

Pros:

-

Responsive loan officers: Many reviewers single out individual loan officers for being communicative, patient, and helpful—particularly during straightforward purchase or refinance transactions.

-

Competitive rates and options: Customers who complete loans frequently note competitive pricing and the company's ability to present multiple loan programs for comparison.

-

Digital tools and streamlined submission: E Mortgage Capital promotes an online application and calculators that many borrowers find convenient for starting the process and estimating payments.

-

Wide product mix: The company lists conventional, FHA, VA, USDA, jumbo, and non-QM products—useful for borrowers with non-standard documentation needs or high loan amounts.

Cons:

-

Unsolicited marketing contacts: A recurring complaint topic is unsolicited calls and texts from the company (or leads bought by the company), sometimes despite requests to opt out. This has driven many negative reviews and BBB complaints.

-

Processing and communication variability: While some borrowers praise individual officers, other customers report long delays, frequent requests for new documents, late in underwriting, or loan officers who become harder to reach during critical stages. These communication inconsistencies appear tied to specific loan officers or branches rather than being a uniform company-wide experience.

-

Marketing vs. actual terms complaints: A number of reviewers say promotional language or initial rate quotes did not match final loan terms, producing frustration at closing. Always get quotes and fees in writing.

BBB Complaints of E Mortgage Capital

The Better Business Bureau profile for E Mortgage Capital shows the company is BBB accredited since April 2017, and lists a significant volume of complaints: the BBB summary reports dozens of complaints in recent years. The profile noted 76 total complaints in the last 3 years at the time of review.

The most common complaint categories include service or repair issues, product issues, order issues, and a sizable number of sales and advertising or marketing-related complaints, often describing unsolicited contact and consent concerns. The BBB record also shows many complaints that the business has answered and some that were resolved after the business added consumers to its internal do-not-call lists.

"I began receiving unsolicited text messages from E Mortgage Capital earlier this week, and have received at least one/day. These messages are offers for HELOC/HELOAN loans, based on my credit score. I have not made any contact with the company, did not sign up for messages, and I am not interested in their product."

"These people call me multiple times a day and are rude and refuse to quit calling after I asked them to. I will never due business with them in the future for any needs. Stop calling!"

"Was misled and lied to. Was never told the amount of mortgage tell I closed. My credit card was also charged on appraisal when that's not the card that I authorized to use. Was even told I would get 10 grand back from my previous escrow when I only received about 300 dollars back. Was even told after 6 months at worst case scenario it would be stream lined and payments would go down. There is also more alot more"

Listen to the Real Voices

To build a fuller picture, we examined reviews across multiple platforms. Each platform attracts different audiences and volumes of reviewers, which helps explain rating differences.

Zillow (4.9 out of 5.0)

On Zillow, E Mortgage Capital loan officers and individual loan officers often receive high marks for professionalism, responsiveness, and for guiding first-time buyers. These reviews tend to come from borrowers who completed loans and are satisfied with their officer's service. That said, Zillow is an officer-centric ecosystem, meaning a strong loan officer can drive very positive feedback even if company-level issues exist elsewhere.

"Nicole was so great throughout our refinance process. She was knowledgeable, attentive, and easy to work with. She was very communicative and gave us plenty of options, taking the time to explain each one."

"I had been shopping for a lower rate and was having no luck. I finally decided to settle and was about to close on a refinance loan with a rate that was lower but not the best. Arleen called me the night before closing offering a way better deal. Putting my trust in her I backed out and ended up closing with Arleen the following week with a way better rate. Process was so smooth and straightforward. Her team is great! Thanks Arleen!"

"Would not recommend them as all they care about is profits. They buy leads and harass people with texts and calls. If you want your information to be sold and used by others, then you can use this company."

Trustpilot (2.5 out of 5.0)

Trustpilot shows a low TrustScore of around 2.5 but note the platform has very few total reviews for this company. Trustpilot listed 5 reviews at the time of checking. The complaints there emphasize unsolicited contact and Do-Not-Call concerns, while the handful of positive posts praise helpful staff. Because the review count is small, Trustpilot's low score should be interpreted cautiously, but it does corroborate the marketing/contact complaints seen on other sites.

"They constantly break marketing laws by calling people on the DNC list and texting without consent. When confronted about it, they lie and say they have permission because they are appointed by the VA. That's a very bold lie as the VA doesn't appoint lenders and certainly doesn't just give blanket permission for random mortgage lenders to contact people without their permission. I will be reporting them as soon as the gov shutdown is over."

"They just won't stop calling no matter how many times I ask them to stop."

"Joseph Shalaby was recommended to me by my realtor and was AMAZING every step of the way! We did a 21-day escrow and he was quick and efficient and made the process as easy as it could possibly be, writing letters, making calls and connections, and giving us al necessary information. I would definitely use Joseph Shalaby again."

ConsumerAffairs (1.0 out of 5.0)

ConsumerAffairs only has one review so far, but it's a really harsh comment at 1.0 rating. There are a few people who thank Michael for this comment.

"The worst communicators ever, the right hand does not know what the left hand is doing. NOTHING BUT BS FROM THESE PEOPLE. They never get back to me, they lie about following up, total confusion on their part."

Loan Options for Buying a Home

E Mortgage Capital lists a broad set of homebuying products on its site. Below is a concise, borrower-focused summary of the main types and what to expect.

Conventional Home Loan

Conventional loans at E Mortgage Capital follow standard guidelines for conforming mortgage financing (Fannie Mae/Freddie Mac). These loans generally require stronger credit and down payment standards than government programs, but offer competitive rates and purchase/refinance flexibility. Typical borrower needs: credit score generally 620+ for many conventional products, and mortgage insurance rules apply for down payments under 20%.

FHA Loan

FHA loans are offered for buyers with lower credit scores or smaller down payments. These loans require mortgage insurance premiums (both upfront and annual) and are popular with first-time buyers. E Mortgage Capital's FHA product pages position these loans as accessible options when conventional financing is infeasible.

VA Loan

E Mortgage Capital supports VA programs for eligible veterans and service members. VA loans typically require no down payment, no private mortgage insurance, and feature favorable underwriting for qualified veterans, a strong program for the military community when the lender is an approved VA servicer/agent. Confirm current VA approval status for your loan officer.

Jumbo Loan

For loans above conforming limits (higher-cost markets), jumbo products are available. These require stronger credit, larger down payments or reserves, and closer scrutiny in underwriting. E Mortgage Capital markets jumbo financing for luxury or high-priced purchases.

Other - USDA and Non-QM

E Mortgage Capital cites USDA eligibility for qualifying rural properties and non-QM (non-qualified mortgage) products for self-employed borrowers or borrowers with alternative income documentation, useful when W-2s and standard debt ratios don't fully capture a borrower's repayment ability. Non-QM solutions vary widely by lender. Expect higher rates or different documentation standards.

Refinance

E Mortgage Capital lists standard refinance paths similar to their purchase products: conventional, FHA, VA, jumbo, and other specialty refinance options (e.g., non-QM and USDA streamline, where applicable). Below are practical takeaways about each refinance type.

Conventional Refinance Loan

Used for rate-and-term or cash-out purposes. Conventional refinances may require higher credit scores and sufficient equity to avoid mortgage insurance. E Mortgage Capital offers these options to borrowers looking to lower their rate or extract equity.

FHA Refinance Loan

Includes streamline (for existing FHA borrowers) and FHA cash-out options. FHA streamline programs often require less documentation and can be faster when the borrower already has an FHA loan.

VA Refinance Loan

VA-specific refinance options include IRRRL (Interest Rate Reduction Refinance Loan) and VA cash-out refinancing. IRRRLs are often the fastest path for borrowers already in VA loans. Confirm VA program availability with your loan officer.

Jumbo Refinance Loan

High-balance loan refinancing follows strict credit, reserve, and equity rules. Borrowers with significant home equity and strong credit profiles are the best candidates.

Other Refinance Loans

E Mortgage Capital lists USDA and non-QM refinance options for niche borrower needs. As always, product availability and terms depend on underwriting, local licensing, and investor overlays.

Other Services of E Mortgage Capital

E Mortgage Capital also provides non-lending tools and support features designed to help borrowers shop and plan.

Find a Loan Officer

E Mortgage Capital operates through a network of 674 loan officers and provides a "find a loan officer" tool so borrowers can locate local officers by geography or specialty. As reviews show, choosing the right loan officer inside the network is arguably the single most important factor in a borrower's experience. Also, Bluerate makes it easy for borrowers to search for a verified loan officer nearby.

Mortgage Calculator

E Mortgage Capital includes a mortgage calculator to estimate payments and compare scenarios. These are useful for planning, but not a substitute for a formal loan estimate from a licensed officer. Always ask for a written Loan Estimate (LE) when you proceed.

FAQs About E Mortgage Capital

Q1. Is e-mortgage capital a legit company?

Yes, E Mortgage Capital operates as a legitimate mortgage business (NMLS #1416824) and holds state licenses in many U.S. jurisdictions. It is BBB-accredited and publicly lists its corporate locations and licensing. However, legitimacy does not guarantee consistent service. Because of a past enforcement action and ongoing complaint volume on certain consumer sites, prospective borrowers should verify licensing for their state and vet specific loan officers before applying.

Q2. What is the rating of eMortgage?

Ratings vary by platform: large review aggregators and local loan-officer pages (Birdeye/Zillow/Bankrate) show very high average star ratings driven by many positive officer-level reviews (overall ~4.8–4.9 on some aggregated pages), while consumer complaint sites (BBB, ConsumerAffairs, Trustpilot) display lower scores and narratives focused on unsolicited contact or processing problems. In short, ratings are mixed and appear to reflect strong experiences with specific loan officers versus negative experiences from customers who encountered aggressive marketing or underwriting problems.

Conclusion

E Mortgage Capital is a legitimate, widely advertised mortgage company with a broad product set and many loan officers across the country. Many borrowers do report excellent experiences—especially when paired with a responsive, knowledgeable loan officer. Competitive rates, a digital application experience, and a broad suite of loan products are cited as positives.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

- MortgagePros Reviews 2026: Is It a Scam or Not?

- Tomo Mortgage Reviews: Learn Pros, Cons, Complaints Here