Detailed Guide: How Does a Reverse Mortgage Work in 2026?

What is a Reverse Mortgage? Simply put, it is a financial tool that allows homeowners aged 62 and older to convert part of their home equity into cash without having to sell their home or make monthly mortgage payments.

I have sat across the table from hundreds of families who are "house rich but cash poor." In 2026, with the cost of living rising and the FHA increasing the lending limit to $1,249,125, understanding this tool is more critical than ever. Unlike a traditional mortgage where you pay the bank every month, a reverse mortgage is just that—the reverse. The bank pays you. But it is not "free money," and it is certainly not for everyone.

In this guide, I will walk you through exactly How Does a Reverse Mortgage Work, stripping away the jargon so you can decide if it is the right move for your retirement.

How Do Reverse Mortgages Work?

A reverse mortgage allows you to borrow against the value of your home. However, instead of writing a check to the lender every month, the interest and fees are added to your loan balance. This means your loan balance grows over time, while your home equity (the part you own free and clear) decreases.

Most reverse mortgages today are Home Equity Conversion Mortgages (HECMs), which are insured by the Federal Government. The devil is in the details, so let's look under the hood at how the mechanics actually function.

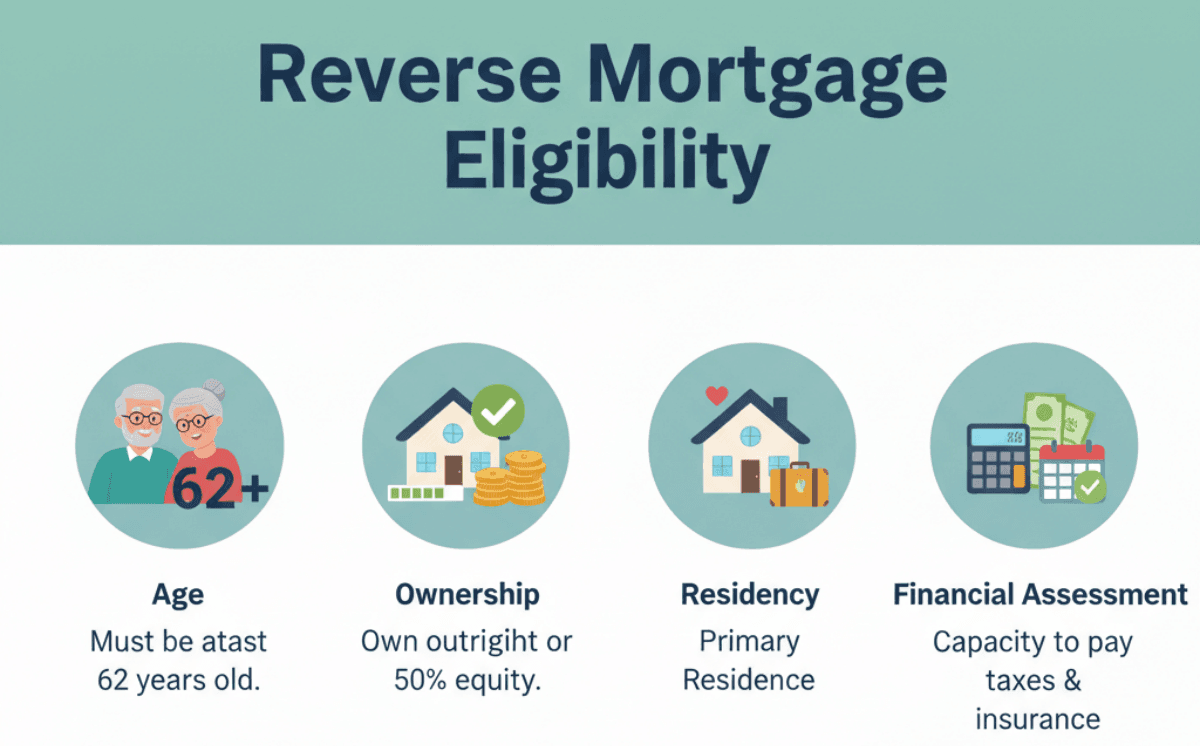

Eligibility

Before we talk about money, we have to see if you can even get in the door. The requirements are strict for a reason to protect you.

- Age: You must be at least 62 years old.

- Ownership: You must own the home free and clear or have sufficient equity to pay off any existing mortgage at closing. There is no fixed percentage like 50%, which is assessed case-by-case via appraisal and financial review.

- Residency: The home must be your primary residence. You cannot use this for a vacation home or rental property.

- Financial Assessment: This is a big one. Even though there are no mortgage payments, lenders must verify that you have the financial capacity to pay your ongoing property taxes and homeowners' insurance.

You are required to complete a counseling session with a HUD-approved counselor. I always tell my clients: treat this session not as a hurdle, but as a safety net. They are there to make sure you aren't being sold something you don't understand.

Loan Funds

So, how much money can you actually get? In 2026, the maximum claim amount (the highest home value the FHA will insure) has risen to $1,249,125.

However, you don't get 100% of your home's value. The amount you get, known as the Principal Limit, depends on three things:

- Age: The older you are, the more you can borrow.

- Interest Rate: Lower rates usually mean higher borrowing power.

- Home Value: Up to the FHA limit.

The funds you receive are generally income tax-free. They are considered loan proceeds, not income. This means they typically won't affect your Social Security or Medicare benefits, though you should check with a specialist regarding Medicaid.

No Monthly Payments

This is the feature that makes people's ears perk up. As long as you live in the home, you do not have to make a monthly principal or interest payment to the lender.

However, I need to clear up a common misconception. "No monthly mortgage payments" does not mean "no cost." You are still accumulating interest every single month. You just aren't paying it out of pocket right now. The bill is essentially being deferred until the end of the loan. This frees up your monthly cash flow significantly, which is why this product is a lifeline for many retirees on a fixed income.

Growing Debt

Here is the hard truth that some gloss over: Negative Amortization.

Because you aren't paying the interest monthly, that interest is added to your loan balance. Then, next month, you are charged interest on the new, higher balance. This is compound interest working against you.

- Year 1: You might owe $100,000.

- Year 10: You could owe $150,000 or more, depending on rates.

This means your equity, the wealth you leave to your children, shrinks over time. If your goal is to leave a debt-free home to your heirs, a reverse mortgage might conflict with that goal unless your home value appreciates faster than the interest rate which is rare.

Repayment Trigger

You can live in your home for the rest of your life without paying back a dime. But eventually, the piper must be paid. The loan becomes "Due and Payable" when a Maturity Event occurs:

- The borrower passes away.

- The home is sold.

- The borrower moves out for more than 12 consecutive months (e.g., moving into a nursing home).

- Default: If you fail to pay property taxes or insurance, the lender can call the loan due.

Once one of these triggers happens, the clock starts ticking for repayment.

Repayment Process

When the loan is due, how do you pay it back? In 99% of the cases I see, the loan is repaid by selling the home.

- If the house sells for more than the loan: The lender gets paid, and you (or your heirs) keep the remaining profit.

- Non-Recourse Protection: This is critical. A HECM is a "non-recourse" loan. This means you can never owe more than the home is worth. If the market crashes and your loan balance is $400,000, but the house is only worth $300,000, the FHA insurance covers the difference. Neither you nor your heirs is personally liable for the shortfall.

Your Responsibilities

I cannot stress this enough: You still own the home. The bank does not own it. They just have a lien on it. Because you are the owner, you have responsibilities.

You must continue to pay:

- Property Taxes

- Homeowners Insurance

- HOA Fees (if applicable)

- Basic Maintenance

If you let the roof cave in or stop paying taxes, the lender considers this a default. They can and will foreclose to protect their collateral. This is the number one reason reverse mortgages fail, so ensure your budget includes these ongoing costs.

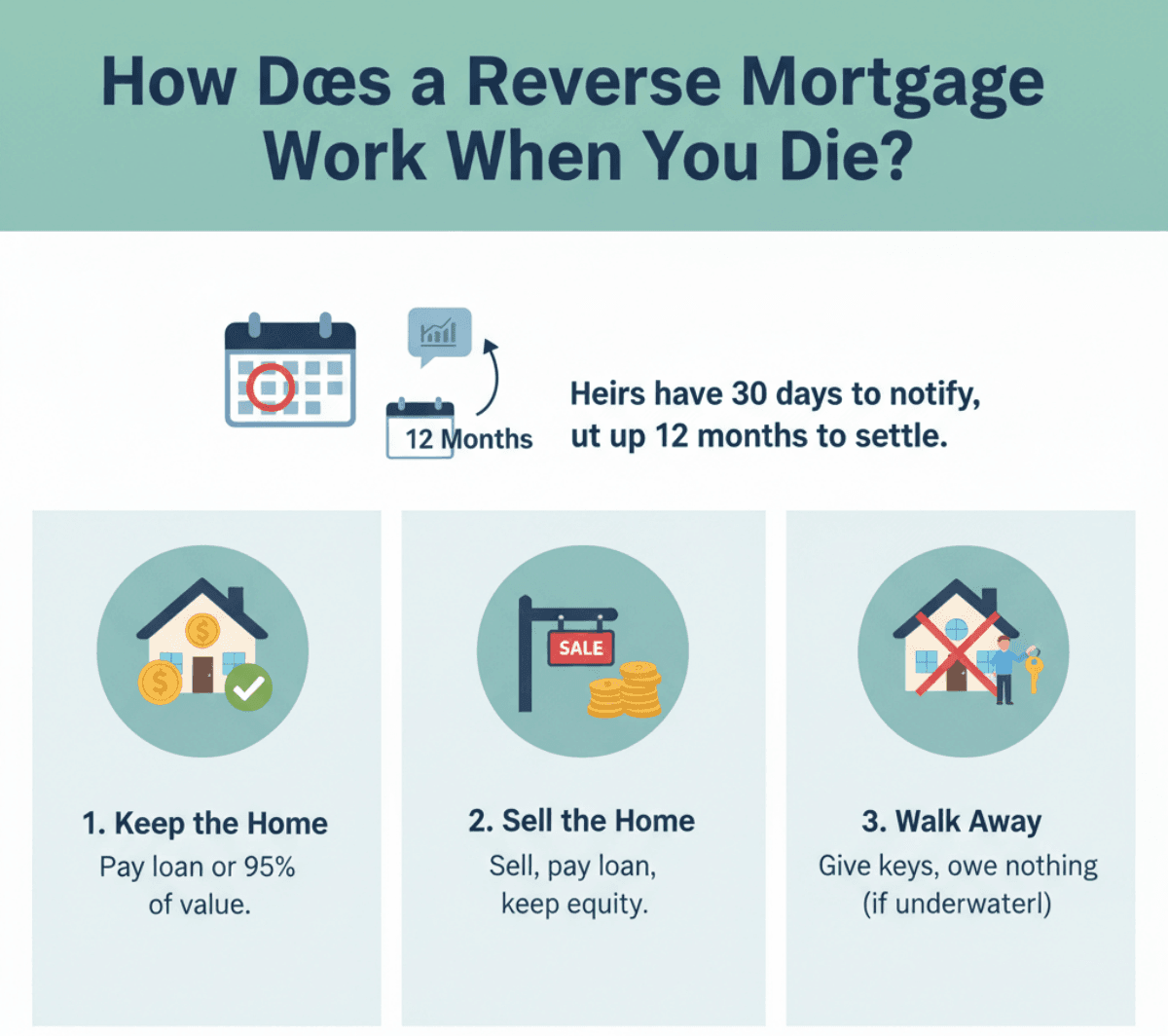

How Does a Reverse Mortgage Work When You Die?

This is the question that keeps parents awake at night: "Will I burden my kids?"

When you pass away, your heirs have rights. They generally have 30 days to notify the lender and up to 6 months with potential extensions up to 12 months to settle the loan.

They have three choices:

- Keep the Home: Pay off the loan balance or 95% of the home value, whichever is less.

- Sell the Home: Sell it, pay off the reverse mortgage, and pocket any remaining equity.

- Walk Away: If the house is underwater (debt > value), they can sign a "Deed in Lieu of Foreclosure," give the keys to the lender, and walk away owing nothing.

How Do You Get Paid from a Reverse Mortgage?

One size does not fit all. Depending on whether you choose a fixed or adjustable rate, you have options:

- Lump Sum: You take all the available cash at closing. Only available with a Fixed Rate.

- Monthly Payments (Tenure): The lender pays you a steady check every month for as long as you live in the home. It's like a pension.

- Line of Credit: This is my personal favorite for many clients. You leave the money in the account and only draw what you need. Crucially, the unused portion of your line of credit grows larger over time, giving you more borrowing power as you age.

- Combination: You can take some cash now and leave the rest in a line of credit.

How Do You Pay Back a Reverse Mortgage?

While you aren't required to make payments, you can.

Most people simply wait until they sell the home to pay it back. However, there is no prepayment penalty. I have clients who take a reverse mortgage to eliminate a mandatory payment, but still send the bank $500 a month voluntarily just to keep the interest from snowballing too fast. This preserves more equity for their heirs.

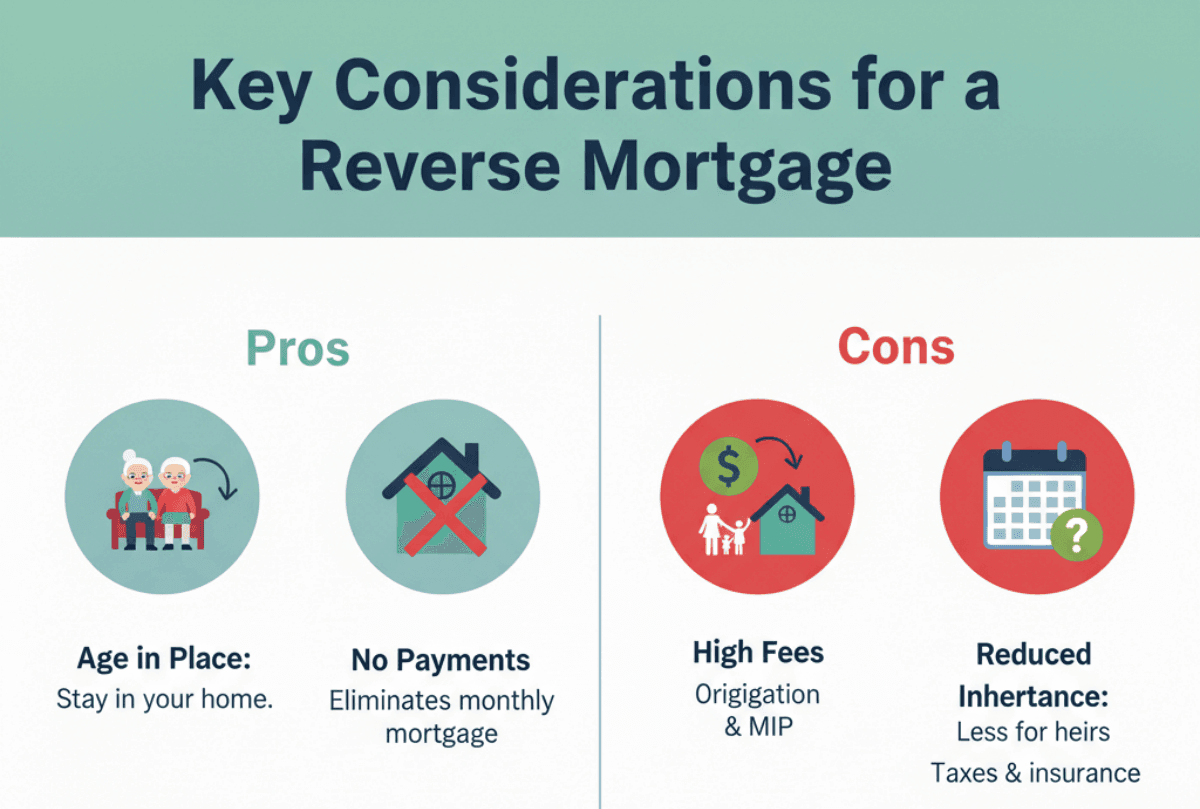

Key Considerations for a Reverse Mortgage

Before you sign on the dotted line, let's weigh the reality.

Pros:

- Allows you to "age in place" in your own home.

- Eliminates monthly mortgage payments, improving cash flow.

- The funds are tax-free and can be used for anything (healthcare, debt, lifestyle).

Cons:

- The Origination Fee and Mortgage Insurance Premium (MIP) can be expensive compared to regular loans.

- You are spending your children's inheritance.

- It requires careful planning to ensure you don't run out of money to pay taxes later in life.

FAQs About How Reverse Mortgage Works

Q1. What is the 95% rule on a reverse mortgage?

This is a safety net for your heirs. If your loan balance grows to be higher than your home's value, your heirs can satisfy the debt and keep the house by paying 95% of the current appraised value, rather than the full loan balance. The FHA insurance covers the rest.

Q2. What is the 60% rule in reverse mortgage?

This is a borrower protection rule. In the first year of the loan, you typically cannot withdraw more than 60% of your approved Principal Limit. This prevents borrowers from spending all their equity too quickly, ensuring there is money left for later years.

Q3. What is the biggest problem with reverse mortgage?

In my experience, the biggest problem is default due to taxes and insurance. Some seniors spend their loan proceeds too fast and then lack the cash to pay their annual property taxes. If this happens, they risk foreclosure and losing their home.

Q4. How much money do you actually get from a reverse mortgage?

It depends on the "Principal Limit Factor" set by HUD. Generally, a 62-year-old might get access to roughly 35-40% of their home's value, while an 85-year-old might get access to 60% or more. High interest rates reduce the amount you can get. Low rates increase it.

Q5. What is the best age to get a reverse mortgage?

Mathematically, the older you are, the more money you get. However, the "best" age is when you genuinely need the cash flow. Taking it at 62 purely for lifestyle spending can be risky, but taking it at 75 to cover in-home care is often a strategic financial move.

Q6. Who is responsible for home repairs on a reverse mortgage?

You are. The bank will not come to fix your leaky faucet. In fact, if the home falls into serious disrepair, the lender can technically call the loan due. You must maintain the property to FHA standards.

Conclusion

A reverse mortgage is not good or bad. It is simply a tool. As a power saw, it can build a house or cut off your hand depending on how you use it.

In 2026, with the lending limit now over $1.2 million, it is a powerful option for retirees with high-value homes who need cash flow. But it requires you to understand the trade-offs: you are trading future equity for current cash.

Do not do this alone. Talk to your adult children, so there are no surprises. And please, use your mandatory counseling session to ask hard questions. If you are responsible for the funds and understand the mechanics, a reverse mortgage can be the key to a comfortable, dignified retirement in your own home.

People Also Read

- [2026] What is a Mortgage? Everything You Need to Know Here

- Formula: How to Calculate Mortgage Payment? Learn Here

- Must-Read Guide: How to Apply for a Mortgage Loan Online?

- How to Calculate Early Payoff of Mortgage? Formula and Penalty

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- How to Calculate Reverse Mortgage Without Personal Information?

- 8 Best Reverse Mortgage Companies: 2026's Top-Rated Picks

- Explained: What are the 3 Types of Reverse Mortgages?