How to Calculate Reverse Mortgage Without Personal Information?

Let's be real: the moment you type your phone number into an online mortgage form, your phone starts ringing, and it doesn't stop. I've been there. You're just curious about the numbers. You aren't ready to talk to a high-pressure salesperson yet. You just want a ballpark figure to see if a reverse mortgage is even worth considering.

The good news is that you don't have to trade your privacy for information. While getting a penny-perfect quote eventually requires a credit check, you can get a very accurate estimate on your own. In this guide, I'll show you exactly how the math works so you can do it by hand, and I'll point you toward two specific calculators that I've verified do not require your email or phone number.

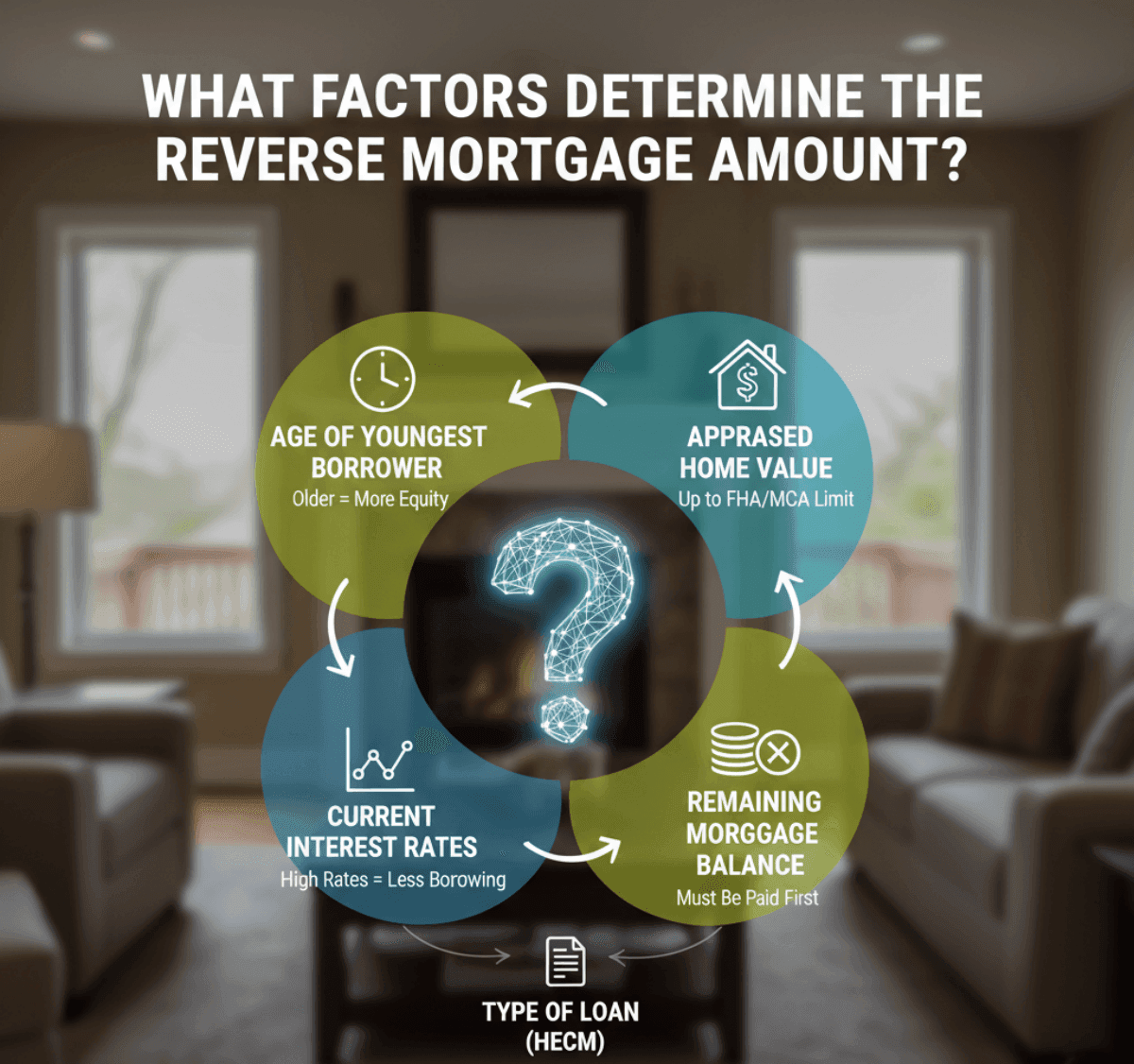

What Factors Determine the Reverse Mortgage Amount?

Before we dive into the math, you need to understand how a reverse mortgage works and the levers that move the numbers. The amount you can borrow, known as the Principal Limit, isn't random. It's driven by a specific set of variables.

-

Age of the youngest borrower: This is the biggest driver. The program is designed so that older borrowers get access to more equity. If you are 75 but your spouse is 62, the bank must use the 62-year-old's age for the calculation, which significantly lowers your loan amount.

-

Appraised value of your home: This seems obvious, but there's a catch called the Maximum Claim Amount (MCA). The FHA caps the value they will recognize. Even if your home is worth $2 million, the calculation stops at the 2026 lending limit (more on that below).

-

Current interest rates: This has an inverse relationship. When interest rates are high, your borrowing power goes down. When rates drop, you can borrow more.

-

Remaining mortgage balance: A reverse mortgage must be a "first lien." That means if you still owe $100,000 on your current mortgage, the reverse mortgage proceeds must pay that off first. You only get what's left over.

-

Type of Reverse Mortgage loan: Most people choose the HECM (Home Equity Conversion Mortgage). Within this, you can choose a fixed rate (lump sum only) or an adjustable rate (which allows for a line of credit). The adjustable rate usually offers more flexible access to cash.

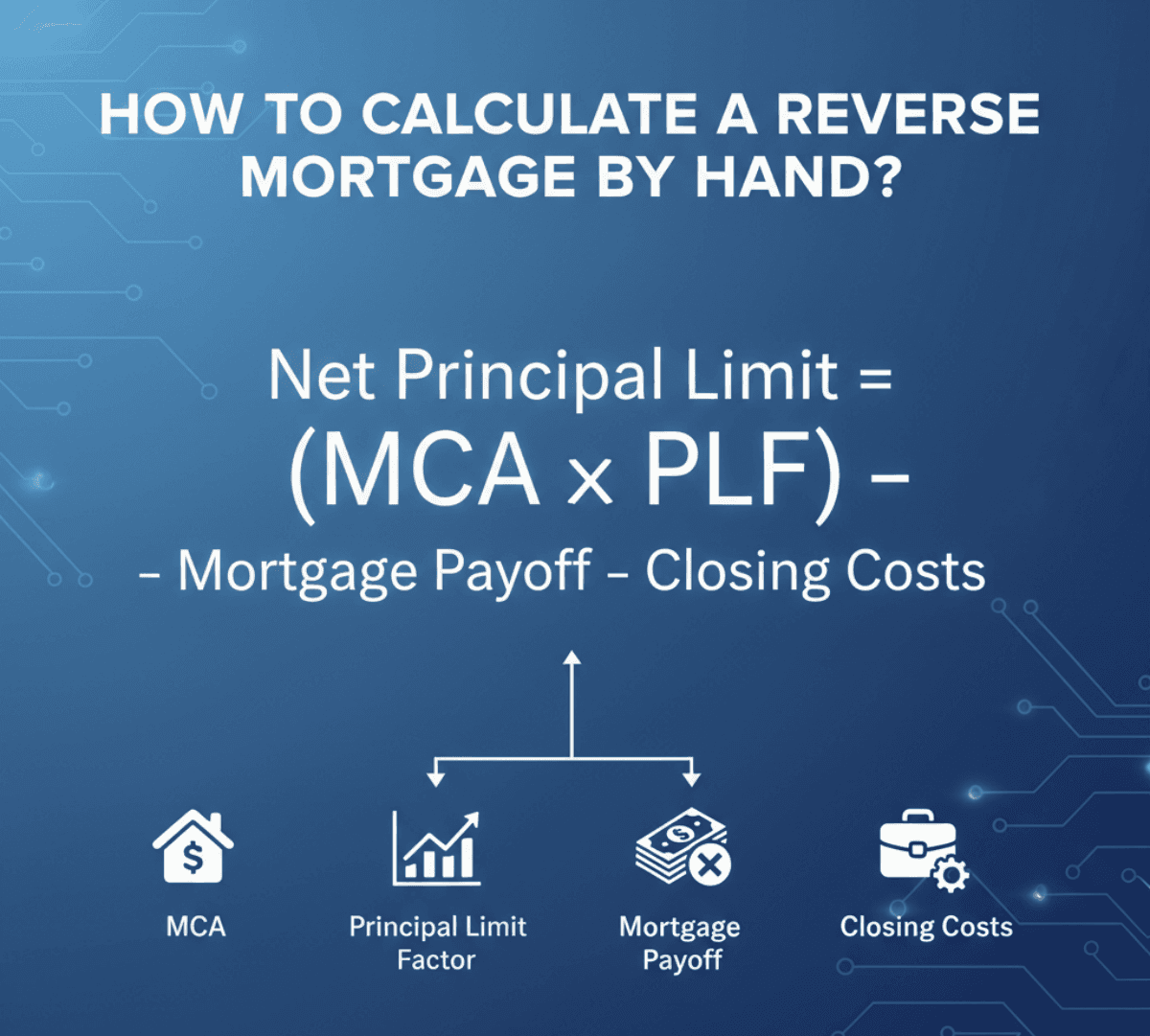

How to Calculate a Reverse Mortgage By Hand?

If you really want to avoid digital tracking, you can do the math on the back of a napkin. It won't be perfect because the government updates the actuarial tables regularly, but it will give you a solid estimate.

The Formula: Net Principal Limit = (MCA x PLF) - Mortgage Payoff - Closing Costs

Let's break down the variables for 2026:

-

MCA (Maximum Claim Amount): Use your home's value or the 2026 HECM Limit of $1,249,125, whichever is lower.

- If your home is worth $500,000, use $500,000. If it's worth $1.5 million, you must use $1,249,125.

-

PLF (Principal Limit Factor): This is the tricky part. This is a percentage determined by HUD based on the age of the youngest borrower and the current expected interest rate.

- Rule of Thumb: In the current rate environment (as of early 2026), this factor typically ranges from 0.30 to 0.75.

- Example: If you are 62, your factor might be around 0.34. If you are 85, it might be closer to 0.65.

-

The Calculation:

- Let's say you are 75 years old and own a home worth $600,000. You have no existing mortgage.

- Assume a PLF of 0.42 (hypothetical for this example).

- $600,000 x 0.42 = $252,000 (This is your Gross Principal Limit).

- From this $252,000, you must subtract the hefty closing costs (discussed later) to find your "Net" cash.

How to Estimate a Reverse Mortgage Using Calculators?

Manual calculation is great for understanding the theory, but looking up the exact PLF for the current week's interest rate is a headache.

If you want a computer to do the heavy lifting without demanding your Social Security Number or email address, I recommend the following two tools. I've tested them personally to ensure they don't force a signup.

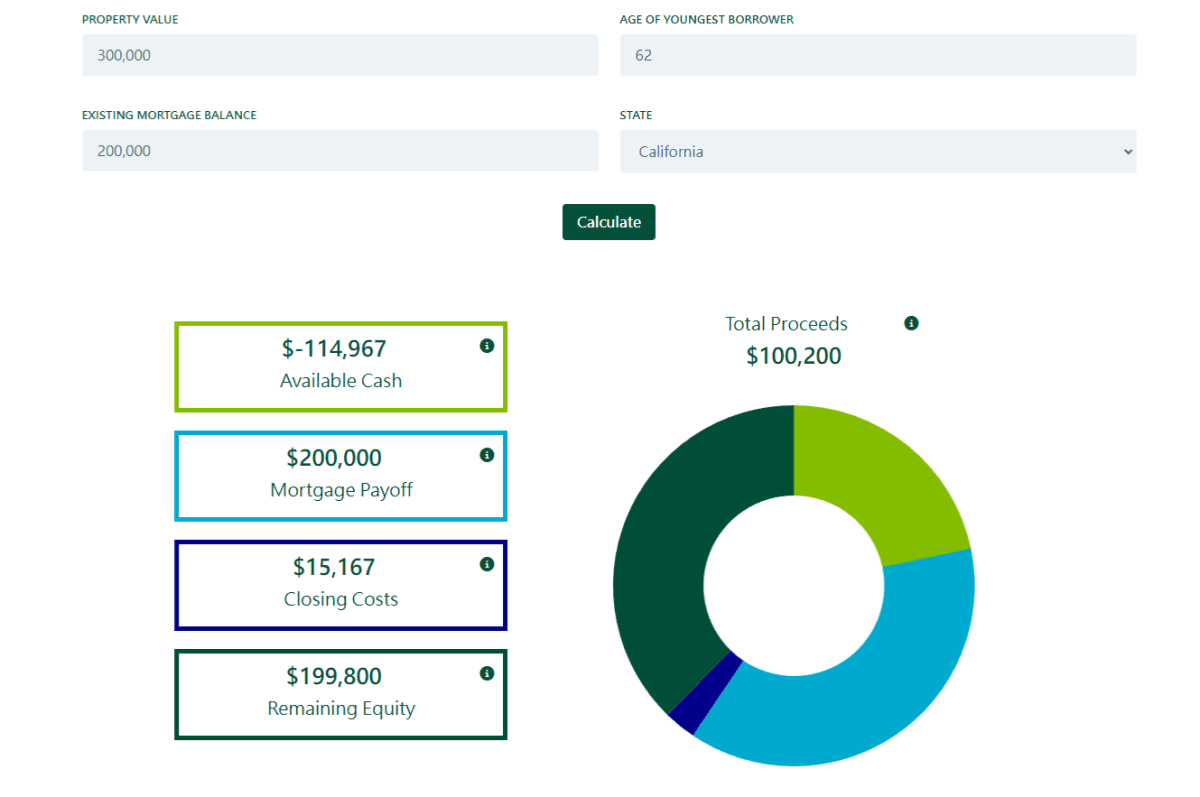

Fairway Reverse Mortgage Calculator

Fairway Independent Mortgage Corporation is a major lender, and its Reverse Mortgage Calculator is one of the few that is genuinely "privacy-first."

You simply enter your Property Value, the Age of the Youngest Borrower, your Existing Mortgage Balance, and your State/Zip Code. You do not need to enter your name or contact info.

The tool is excellent for seeing the "Cash Flow" side of things. It breaks down the Available Cash (Net Principal Limit) and shows you exactly how much money goes toward paying off your existing mortgage versus closing costs. It also provides a helpful pie chart that visualizes where the equity goes.

The biggest pro is the anonymity. However, be patient. The calculator can sometimes be a bit slow to load as it pulls real-time rate data. Also, keep in mind that the default settings often assume an adjustable-rate HECM, which is the most common choice, but you might need to toggle settings if you want a fixed-rate estimate.

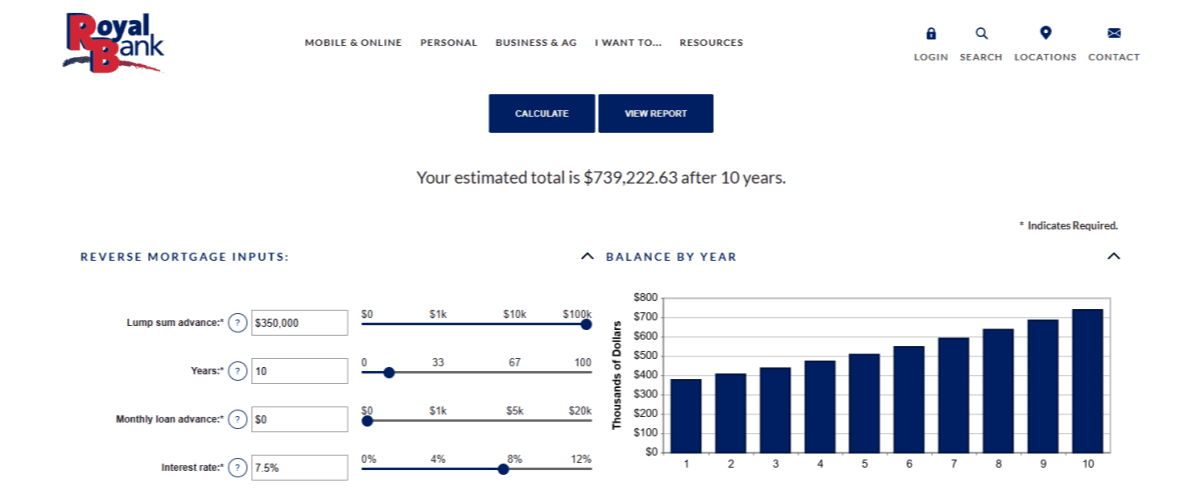

RoyalBank Reverse Mortgage Calculator

While Fairway is great for seeing how much money you can get, the Royal Bank Reverse Mortgage calculator is excellent for understanding what you will owe.

This tool asks for different inputs: the Lump sum you want to take, the number of Years you plan to live there, and the Interest rate.

This calculator focuses on the debt trajectory. It generates a line graph and a table showing the Outstanding Balance year over year. This is crucial for answering the question: "If I take this loan, how much equity will be left for my kids in 10 years?" It visually demonstrates how the loan balance grows as interest compounds.

It's fantastic for long-term planning and seeing the impact of compound interest. However, it is a "simple" calculator. It doesn't automatically pull in the complex HUD lending limits or specific origination fees as the Fairway tool does, so it's better used as a "Debt Growth" estimator rather than a "Loan Qualification" tool.

Understanding Fees and Costs

When you run these numbers, you might be shocked that the "Net Cash" is significantly lower than the "Gross Amount." That's due to the closing costs, which are generally higher for reverse mortgages than standard loans.

Here is what is being subtracted from your total:

-

Origination Fees: Lenders charge this to process the loan. The FHA regulates this: they can charge 2% of the first $200,000 of home value, plus 1% of the remaining amount. However, there is a hard cap of $6,000.

-

Mortgage Insurance Premium (MIP): This is usually the biggest hit. You must pay an upfront MIP of 2% of your home's value (up to the $1.249M limit). On a $600,000 home, that is $12,000 gone immediately. This insurance is mandatory because it guarantees you will never owe more than the home is worth (non-recourse protection).

-

Other Closing Costs: Just like buying a house, you have to pay for an appraisal (~$600+), title insurance, recording fees, and counseling fees ($125–$200).

Conclusion

Calculating a reverse mortgage without giving up your personal information is completely possible if you know where to look. By using the formula I shared, or the anonymous tools from Fairway and Royal Bank, you can get a realistic "ballpark figure" completely privately.

Remember, these numbers are estimates. The PLF changes weekly with interest rates, and your actual home appraisal could come in lower than you think.

You can run these numbers yourself first. Sleep on them. Discuss them with your family. Only when you are truly serious about moving forward should you contact a professional Loan Officer to get an official quote. That way, you're in the driver's seat, armed with data, rather than being sold a product you don't understand.

People Also Read

- What is Break Even Point in Mortgage? Learn Here

- Where and How to Compare Mortgage Loan Quotes Online?

- Must-Read Guide: How to Apply for a Mortgage Loan Online?

- Formula: How to Calculate Mortgage Payment? Learn Here

- [Solved] How to Calculate HELOC Payment? Easy-to-Understand

- 8 Best Reverse Mortgage Companies: 2026's Top-Rated Picks