Reverse Mortgage Explained: Definition, Types, Example, FAQs

If you are like most people, you've probably seen those TV commercials featuring famous actors talking about "tax-free cash" from your home. But if you are anything like me, your first instinct is likely skepticism. Is it a scam? Is it too good to be true?

I want to clear the air. I am not here to sell you a loan. I am here to explain what this actually is. Think of a traditional mortgage as you paying the bank in installments to buy your house. A reverse mortgage is essentially the opposite: the bank pays you in installments to "buy" a portion of your home equity, while you continue to live there. It is not free money. It is a loan, but for many "house-rich, cash-poor" seniors, it is a lifeline. Let's break down exactly how it works without the sales pitch.

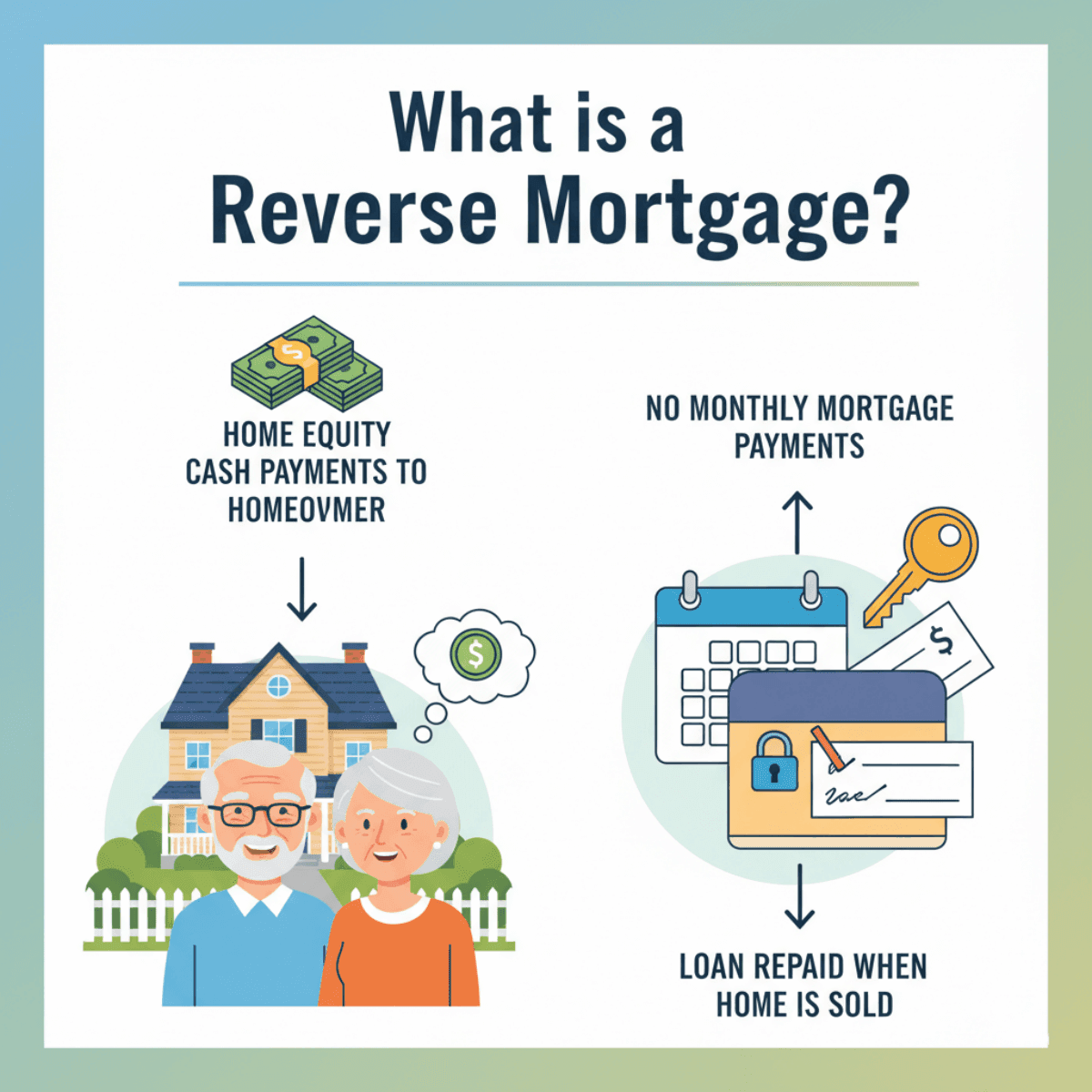

What is a Reverse Mortgage? Meaning and Example

A reverse mortgage is a loan available to homeowners aged 62 or older that allows them to convert part of the equity in their homes into cash. The biggest difference between this and a regular home equity loan is that you do not make monthly mortgage payments. Instead, the loan is repaid when you move out, sell the home, or pass away.

The concept is called "Equity Conversion." You built up savings in the form of your house, bricks and mortar, over decades. Now, you are turning those bricks back into spendable cash.

Let's look at a real-life example to make this concrete.

Meet Sarah, a 68-year-old retired teacher living in Florida.

-

Her situation: She owns her home outright, and it is currently valued at $500,000. However, with inflation, her small pension and Social Security checks barely cover her groceries and utilities. She is stressed every month.

-

The Solution: Sarah takes out a Home Equity Conversion Mortgage (HECM). Based on her age and interest rates, the lender grants her access to about $200,000 of her equity.

-

The Outcome: She chooses to receive $1,000 a month to supplement her income and keeps a remaining "line of credit" for emergencies.

-

The Catch: She doesn't pay the bank back monthly. The interest just adds up on the loan balance in the background. She stays in her home, plants her garden, and lives comfortably. She only pays the loan back when she eventually decides to sell the house or passes away.

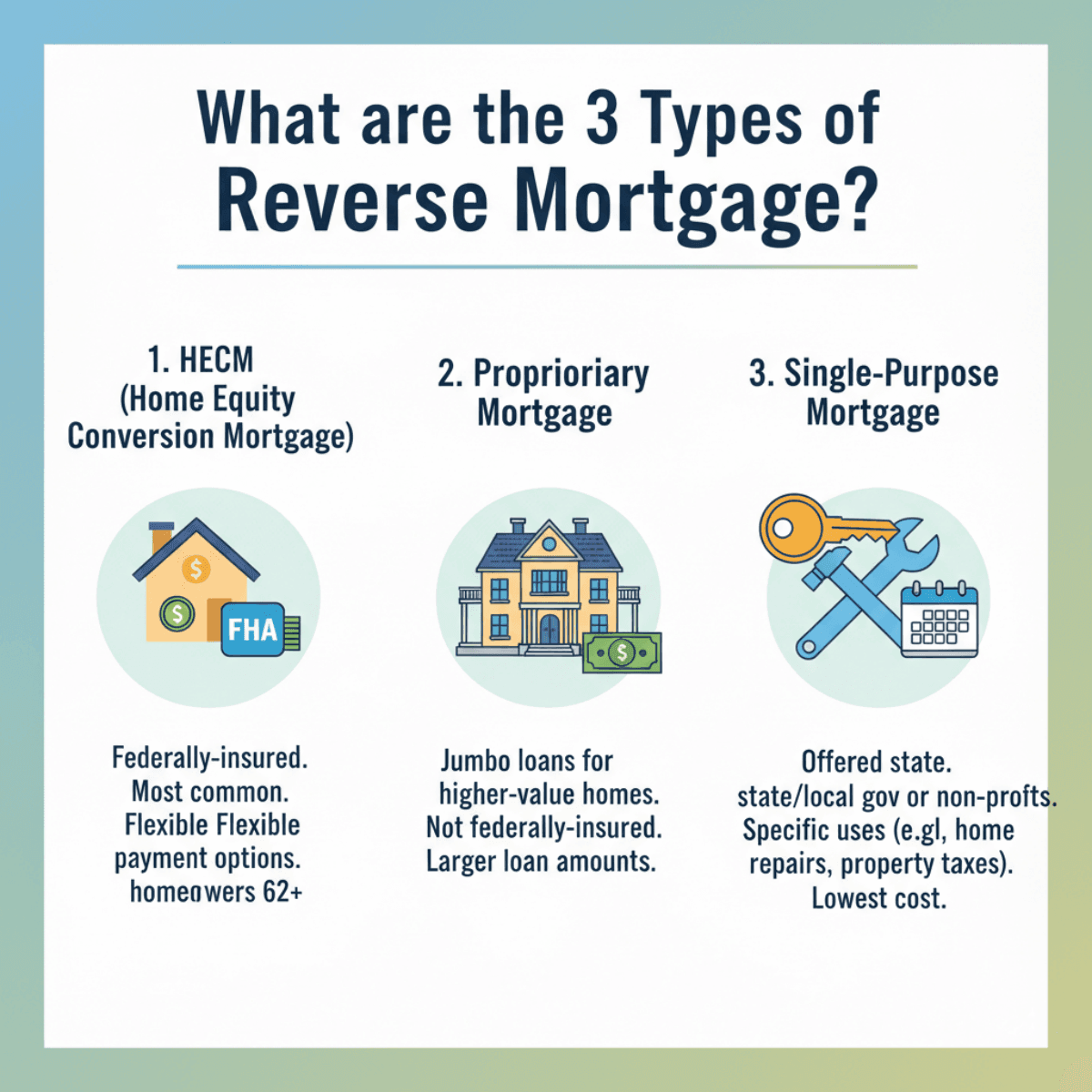

What are the 3 Types of Reverse Mortgages?

Not all reverse mortgages are created equal. Depending on your house value and what you need the money for, you will generally encounter three specific types.

Home Equity Conversion Mortgage (HECM):

This is the big one. It is federally insured by the Federal Housing Administration (FHA) and is the most common type you will see. If your home is valued under the federal limit, which increased to $1,209,750 in 2025, this is likely the loan you will get. It offers the most consumer protections and flexible payout options.

Proprietary Reverse Mortgages (Jumbo Loans):

These are private loans not insured by the government. Who are these for? They are for people with high-value homes (e.g., a $3 million mansion) that exceed the FHA's lending limits. They often have higher interest rates, but allow you to access a massive amount of cash upfront. Some proprietary programs in certain states also allow borrowers as young as 55, unlike the strict 62+ rule for HECMs.

Single-Purpose Reverse Mortgages:

These are rare and usually offered by non-profit organizations or local state agencies. They are the cheapest option but also the least flexible. You can only use the money for one specific thing approved by the lender, like paying property taxes or fixing a leaking roof.

How Does a Reverse Mortgage Work?

So, how does the mechanics of this actually play out? It can be confusing, so I will break it down into the key operational points.

-

Borrowing Against Equity: The amount you can borrow isn't random. Reverse mortgage amount is calculated based on the age of the youngest borrower, current interest rates, and the lesser of your home's appraised value or the FHA limit ($1,209,750). Generally, the older you are, the more you can borrow.

-

No Monthly Payments: This is the main draw. You receive money, but you do not send a check to the bank every month. However, you must still pay your property taxes, homeowners insurance, and HOA fees. If you fail to pay these, the lender can foreclose.

-

Keep Ownership: A common myth is that the bank takes your house. This is false. You retain the title. The bank just puts a lien on the property, similar to a standard mortgage.

-

Loan Repayment: The loan becomes due when the "maturity event" happens, usually when the last surviving borrower dies or moves out. The house is typically sold to pay off the debt.

-

Non-Recourse Protection: This is critical for your peace of mind. HECMs are "non-recourse" loans. This means you or your heirs will never owe more than the home's fair market value at the time of sale. Even if the loan balance grows to $600,000, but the house is only worth $500,000, FHA insurance covers the shortfall, so that the most your estate or heirs would ever have to pay is the home's fair market value, which is typically up to 95% of that value. Your heirs are not personally liable for any remaining debt.

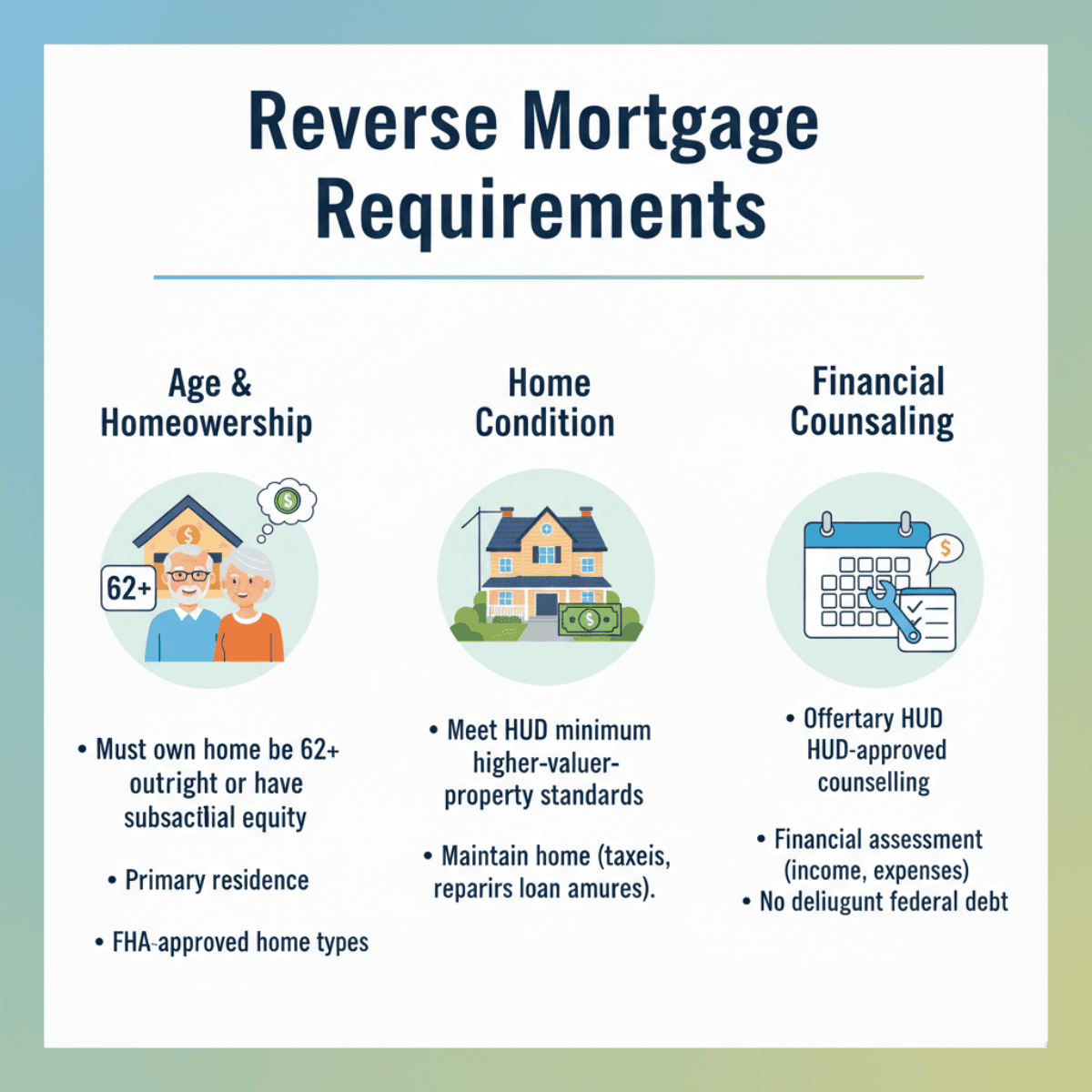

Reverse Mortgage Requirements

Getting a reverse mortgage isn't as simple as just signing a paper. The government wants to ensure you aren't making a rash decision. Here are the strict requirements you must meet for a standard HECM in 2026:

-

Age: You must be at least 62 years old. If your spouse is younger, they can be a "Non-Borrowing Spouse," but this complicates the math.

-

Ownership: You must own your home outright or have a low enough mortgage balance that can be paid off at closing with the reverse mortgage proceeds.

-

Residency: The home must be your primary residence. You cannot do this on a vacation home or rental property.

-

Financial Assessment: Lenders will check your credit and income. They need to ensure you have enough cash flow to keep paying your property taxes and insurance.

-

Mandatory Counseling: Before you can even apply, you must complete a counseling session with a HUD-approved counselor. This isn't a test. It's a safeguard to ensure you understand the costs and aren't being pressured by a salesperson.

Pros and Cons of Reverse Mortgage

Like any financial tool, a reverse mortgage is a double-edged sword. It can save your retirement, or it can drain your legacy. You need to weigh these carefully.

Benefits

-

Cash Flow: You get funds that are generally not treated as taxable income to cover medical bills, home repairs, or daily living expenses without selling your home.

-

Stay in Your Home: You can "age in place" comfortably. No one can force you out as long as you pay taxes and insurance.

-

Non-Recourse: You are protected if the housing market crashes. You will never owe more than the home is worth.

Drawbacks

-

High Costs: These loans are expensive. Between origination fees and FHA mortgage insurance premiums (MIP), the upfront costs are much higher than a regular mortgage.

-

Equity Erosion: Interest compounds over time. This means the amount you leave to your children (inheritance) gets smaller every year.

-

Foreclosure Risk: If you run out of money and can't pay your property taxes or insurance, the lender can ultimately foreclose after required notices and cure periods.

It is excellent for cash flow but terrible for preserving wealth for heirs. If your goal is to leave a paid-off house to your kids, this is likely not the right product for you.

Key Facts & Misconceptions

There are a few "fine print" details that most brochures glaze over, but you absolutely need to know them.

-

The "Moving Out" Trigger: If you move into a nursing home or assisted living facility for more than 12 consecutive months, the loan becomes due. This is a crucial consideration for health planning. If you leave the house, the house usually has to be sold.

-

The Line of Credit "Growth" Feature: If you choose the HECM Line of Credit option (instead of taking all the cash at once), the unused portion actually grows over time. It grows at the same rate as the interest rate plus the mortgage insurance premium. I've seen cases where a senior's available credit line grew larger than the original value of the house! This is a powerful inflation hedge.

-

Tax-Free Funds: Generally, the money you receive is considered loan proceeds rather than taxable income under current IRS rules, although individual situations can vary. This means the IRS typically doesn't tax it, and it generally does not affect your Social Security or Medicare benefits, but it can affect needs-based programs like Medicaid, so you should confirm with a qualified tax or benefits professional.

-

Payout Options are Flexible: You aren't stuck with one method. You can choose a Tenure plan (monthly payments for as long as you live in the home), a Term plan (monthly payments for a set number of years), a Lump Sum, or a Line of Credit. You can even combine them.

Is a Reverse Mortgage a Good Idea?

So, should you do it? In my opinion, the answer depends entirely on your future plans.

It is likely a GOOD idea if

You plan to stay in your current home for the rest of your life, you have high home equity but low retirement income, and you aren't concerned about leaving the home as an inheritance to your heirs. It is a tool to fund your comfort now.

It is likely a BAD idea if:

You plan to move in the next 3-5 years (the upfront costs make this too expensive for a short term), you want to leave the maximum possible assets to your children, or you are already struggling to pay your property taxes.

FAQs About Reverse Mortgage

Q1. Who owns the house in a reverse mortgage?

You do. The bank does not take the title. They simply place a lien on the property to ensure they get repaid eventually. You are still the homeowner and are responsible for maintenance.

Q2. Who benefits most from a reverse mortgage?

Seniors (62+) who are "house rich but cash poor." It benefits those who want to age in place and need supplemental income to cover medical costs or daily living expenses without the burden of monthly loan payments.

Q3. What is a better option than a reverse mortgage?

If you can manage it, downsizing (selling and buying a smaller, cheaper home) is often financially superior because it preserves more equity. A standard Home Equity Line of Credit (HELOC) is also cheaper if you can afford the monthly payments.

Q4. How do you pay back a reverse mortgage?

Repayment happens when the last borrower leaves the home. Typically, the heirs sell the house, pay off the loan balance, and keep the remaining profit. Heirs can also choose to refinance the loan into a traditional mortgage to keep the house.

Q5. How much does a reverse mortgage cost?

It is expensive. You will pay an origination fee (up to $6,000), upfront mortgage insurance (2% of home value), and closing costs. Plus, you pay ongoing annual mortgage insurance premiums.

Final Word

A reverse mortgage is not magic, and it is not a scam. It is simply a specialized financial tool designed for a specific time of life. It allows you to use the wealth you have locked up in your floorboards to enjoy your retirement years with less financial stress.

However, because it eats into your equity, it is a decision that impacts your entire family. Do not do this alone. I strongly suggest sitting down with your adult children and a neutral financial advisor to look at the numbers. Ensure you understand the impact on your estate before you sign on the dotted line. Your home is likely your biggest asset. Treat it with care.