Explained: What are the 3 Types of Reverse Mortgages?

How many types of reverse mortgages are there? It's usually the first thing homeowners ask me when they start looking into their options.

Here is the short answer: There are three.

But knowing the number isn't enough. While they all do the same basic thing, turn your home equity into cash without a monthly mortgage bill, they work in completely different ways. I've seen people almost sign up for the wrong one, which would have cost them thousands in fees or locked them out of cash they really needed.

In this breakdown, I'm going to cut through the jargon and explain exactly how each type works, so you can figure out which one, if any, makes sense for your retirement.

What are the 3 Types of Reverse Mortgages?

To pick the right lane, you need to know who is driving the car. The three categories of reverse mortgages in the U.S. generally break down by who insures them and what you can do with the money:

- Home Equity Conversion Mortgage (HECM)

- Proprietary Reverse Mortgage (Jumbo)

- Single-Purpose Reverse Mortgage

Let's look at what actually sets them apart.

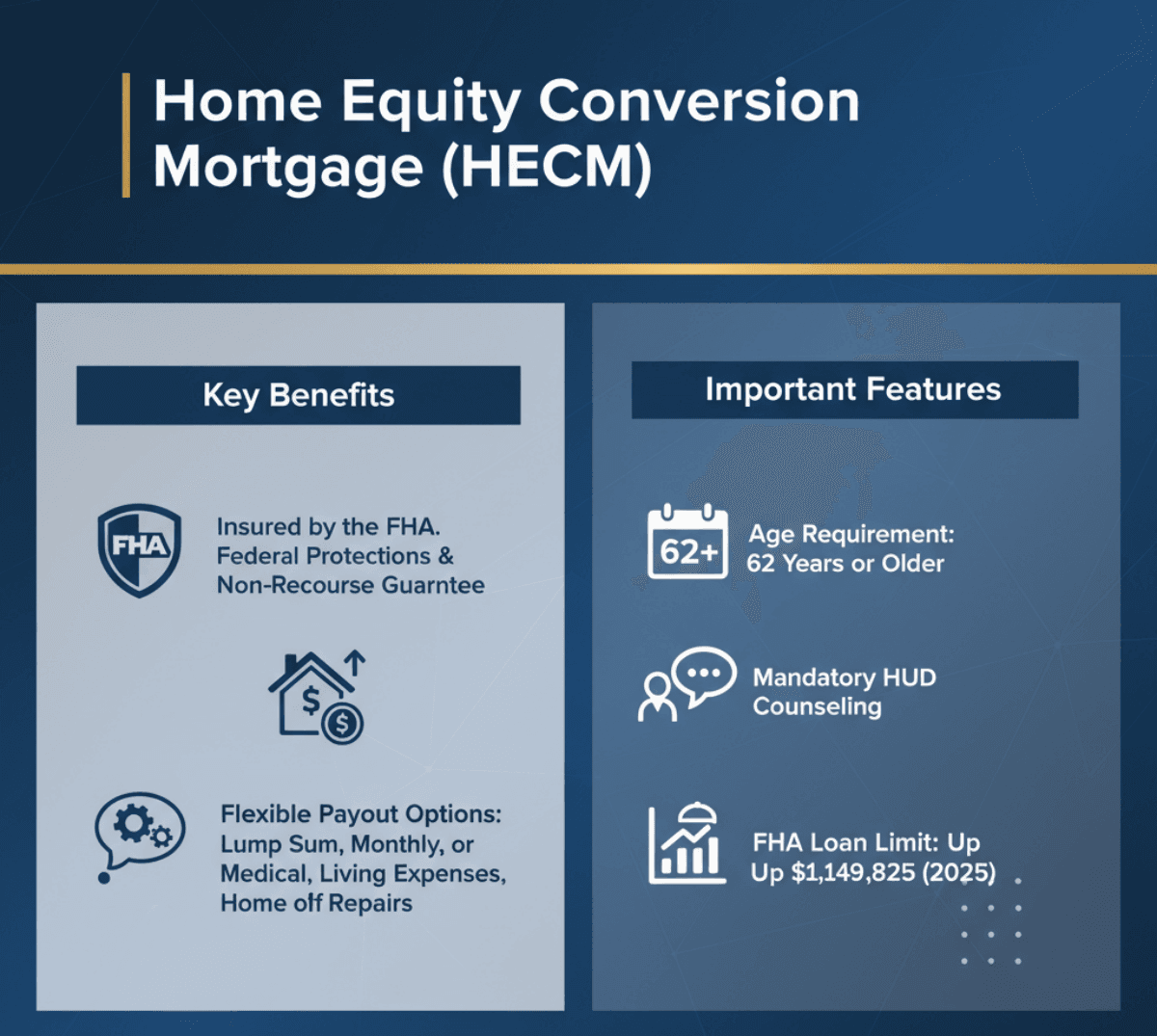

Home Equity Conversion Mortgage (HECM)

Best for: The vast majority of homeowners who want flexibility and federal protections.

Insured by: The Federal Housing Administration (FHA).

If you've seen those TV commercials featuring celebrity spokespeople, they are talking about the HECM. This is the "standard" reverse mortgage, making up the vast majority (over 90% in key segments) of the market. Because it's backed by the FHA and regulated by HUD, I generally consider it the safest route for most people.

The big trade-off here is the cost. To get that federal backing, you have to pay Mortgage Insurance Premiums (MIP), both upfront and annually. It can be expensive. But in exchange, you get a "non-recourse" guarantee. This means no matter what happens to the housing market, you or your heirs will never owe the bank more than the house is worth when it's sold.

Features

- Age Check: You need to be 62 or older.

- Mandatory Chat: You must have a session with a HUD-approved counselor. It's not just a formality. It's there to make sure you aren't being scammed.

- The Cap: The FHA limits the home value it will cover. The current 2026 limit is $1,249,125.

- Your Money, Your Choice: You can take the cash however you want, lump sum, monthly checks, or my favorite, the Line of Credit, which actually grows over time if you don't use it.

- Freedom: Use the funds for anything. Medical bills, groceries, or fixing the roof.

Example

I remember working with a client, Robert. At 74, he was "house rich" with a $600,000 home, but he was stressing over a $40,000 balance left on his old mortgage. His social security check was barely covering his bills. We set up a HECM. It immediately paid off that $40,000 balance (stopping his monthly payments), and we put the rest of his available equity into a Line of Credit. He didn't take all the cash at once. he just let it sit there as a safety net for future healthcare costs.

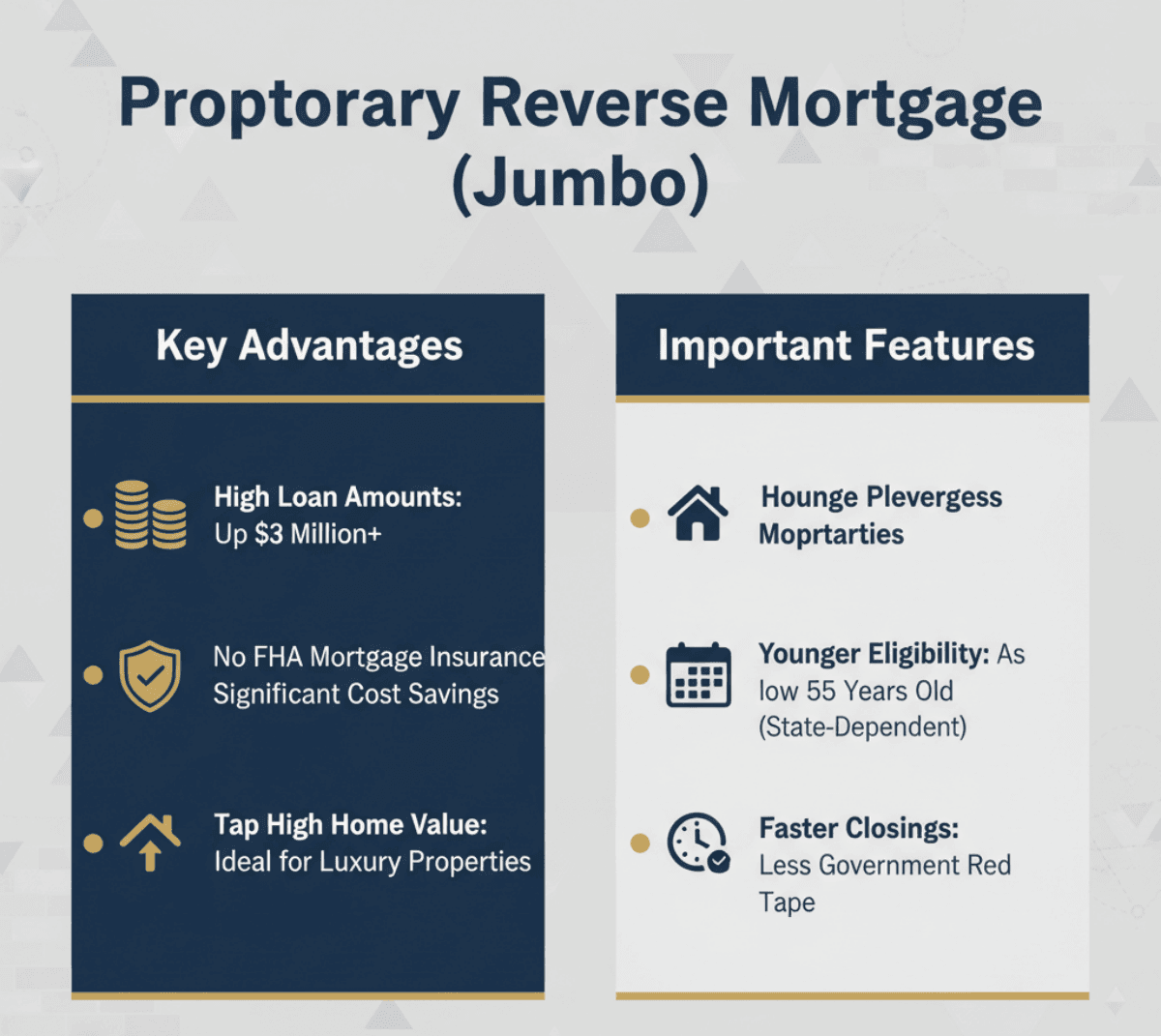

Proprietary Reverse Mortgage (Jumbo)

Best for: People with high-value homes who need more cash than the government allows.

Insured by: Private Lenders (No government backing).

Think of this as the "luxury" version of a reverse mortgage. We often call them "Jumbo" loans. Since these are private loans not insured by the federal government, they don't have to play by all of HUD's strict rules.

I usually steer clients toward this option if their home is worth significantly more than the FHA limit ($1.15 million+). With a HECM, that extra value in your luxury home is basically ignored. With a Proprietary loan, you can tap into it. Plus, you avoid that expensive mortgage insurance premium I mentioned earlier.

Features

- Big Numbers: Loan amounts can climb to $4 million or more.

- Younger Borrowers: Minimum age often starts at 55 (varies by state and lender, e.g., 55-62), younger than HECM's fixed 62.

- Save on Insurance: You skip the heavy FHA Mortgage Insurance costs, which can save you a bundle at closing.

- Property Mix: These lenders are often more willing to approve high-end condos that the FHA might reject.

- Speed: Less red tape means you can often close these deals faster than a government loan.

Example

Take Sarah, a 60-year-old widow in Los Angeles. She was sitting on a property worth $2.2 million but needed about $800,000 to help her daughter and handle some estate planning. A HECM wouldn't work, she was too young (under 62), and the FHA limit would have capped her available cash way below what she needed. A Proprietary Reverse Mortgage looked at her full $2.2 million value and gave her the large lump sum she needed, without the FHA restrictions.

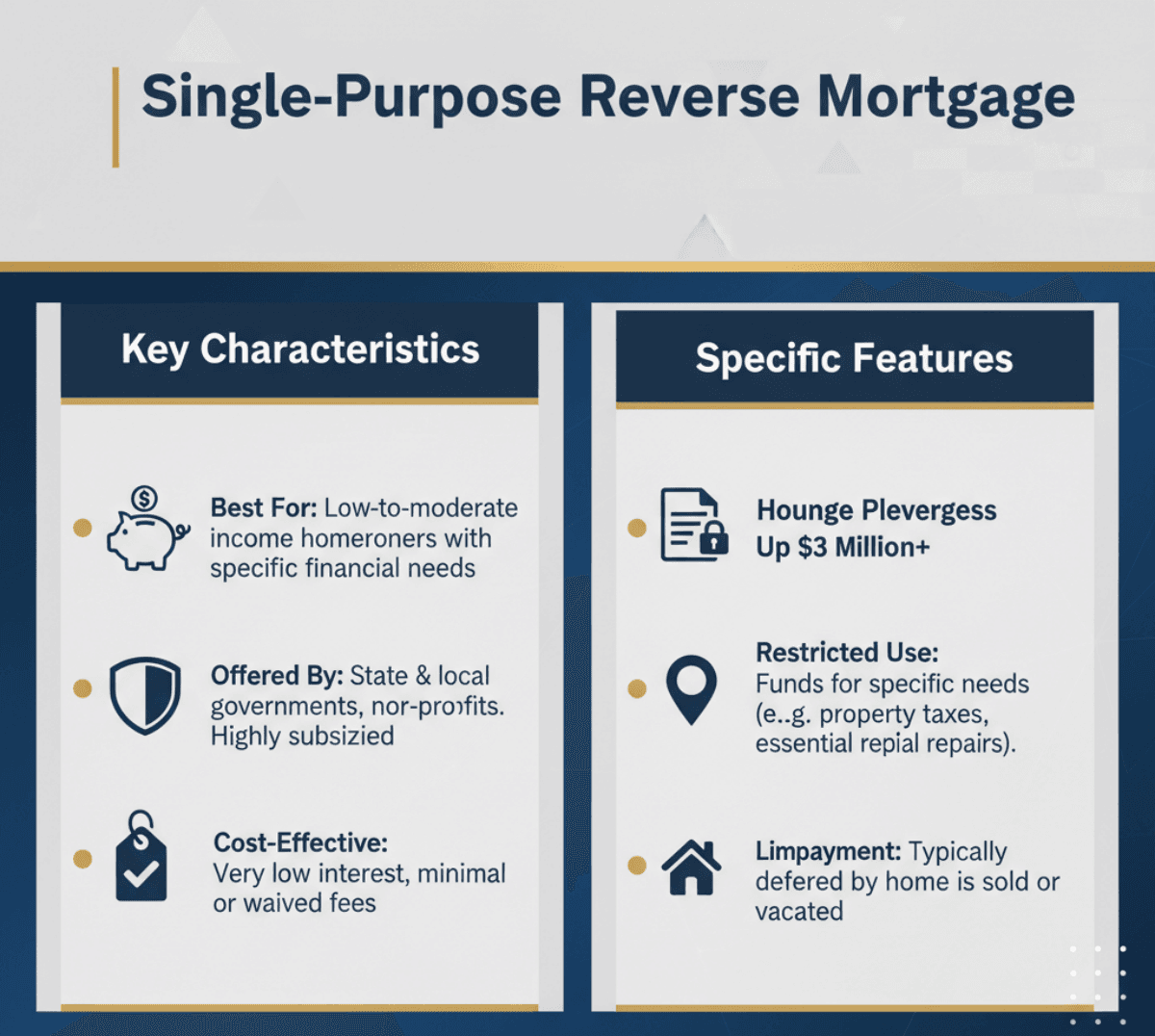

Single-Purpose Reverse Mortgage

Best for: Homeowners with lower incomes who have one specific bill to pay.

Insured by: State agencies, local governments, or non-profits.

This is the "unicorn" of the group. These loans are incredibly helpful, but they can be very hard to find. They aren't offered by big national banks. Instead, you'll find them through state housing agencies or local non-profits.

They are designed for one thing: keeping seniors in their homes. Because they are often subsidized, they are the cheapest way to borrow against your home, with very low interest and barely any fees. The catch? You don't get a pile of cash to spend on whatever you want.

Features

- Strictly Business: The lender usually restricts the funds to one specific purpose, usually property taxes or essential repairs like a new furnace.

- Budget Friendly: Closing costs are often waived, and interest rates are rock bottom.

- Income Limits: These are generally meant for folks with low-to-moderate income.

- Location Matters: Availability is spotty. You have to check if your specific county or state offers one.

- Safety: Like the others, you typically don't repay it until you move out or pass away.

Example

Martha, 78, was doing okay on Social Security until her property tax assessment spiked. She couldn't pay the tax bill and was terrified of the county placing a lien on her house. She didn't need a huge loan. She just needed to pay the tax man. We found a Single-Purpose program in her state. The lender paid the overdue taxes directly to the county. Martha didn't see a dime of cash personally, but the problem was solved for almost zero cost, and she got to stay in her home.

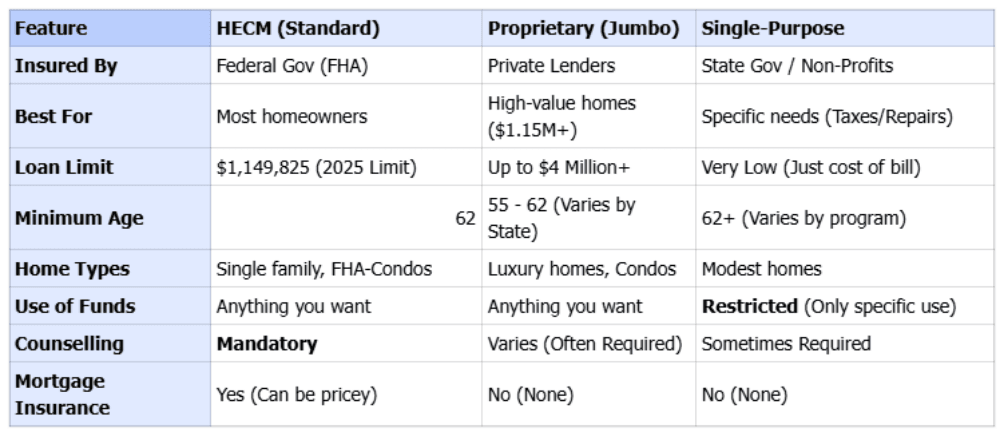

Comparison of 3 Types of Reverse Mortgages

It helps to see these side-by-side. The "Loan Limit" and "Use of Funds" are usually the deciding factors for my clients.

Reverse Mortgage Alternatives

Before you sign any paperwork, I always tell people to pause. A reverse mortgage eats into your equity, often your biggest asset. It's a powerful tool, but it's not the only tool in the shed.

Here are a few other paths you should look at first:

Borrowing Against the Home (With Monthly Payments)

- Home Equity Line of Credit (HELOC): Think of this like a credit card tied to your house. It's cheaper to set up than a reverse mortgage, but you have to make monthly payments. If you're on a tight fixed income, a variable rate hike here can be dangerous.

- Home Equity Loan: This gives you a lump sum with a fixed interest rate. It's great for a one-time expense like a kitchen remodel, provided you can handle the monthly bill.

- Home Equity Agreement (HEA): This is a newer option. An investor gives you cash now for a share of your home's future value. No monthly payments, but it can get expensive when you eventually sell.

Changing Your Lifestyle (No Debt)

- Downsizing: Honestly? Selling your house and buying something smaller is the #1 way to unlock 100% of your equity. No loans, no fees. Just cash in the bank and a lower utility bill.

- Government Aid: A lot of seniors miss out on benefits they are owed. The National Council on Aging (NCOA) has a tool called "BenefitsCheckUp" that can help you find programs to pay for heating, food, or medicine.

- Rent a Room: It's not for everyone, but renting out a spare room or basement can bring in $500-$1,000 a month without you ever touching your home equity.

FAQs About Types of Reverse Mortgages

Q1. What is the most common reverse mortgage?

The HECM is the 800-pound gorilla in the room. It accounts for about 93% of the market. Lenders prefer it because it's government-insured, and borrowers like the federal safety net it provides.

Q2. What is the best kind of reverse mortgage?

"Best" is relative. If your home is under the FHA limit ($1.15M), the HECM is usually the winner because the line of credit grows over time. If you have a multi-million dollar property, a Proprietary loan is likely better because it unlocks way more cash.

Q3. Will a reverse mortgage affect my social security?

Uncle Sam generally says no. The IRS views the money as a loan advance, not income. So, your Social Security and Medicare are usually safe. But be careful, if you put the cash in the bank and leave it there, it counts as an "asset," which could mess with Medicaid or SSI eligibility.

Q4. Why are so many people disappointed by reverse mortgages?

Sticker shock and disappearing inheritance. The upfront fees on an HECM can be surprisingly high. Plus, because you aren't paying interest monthly, the balance grows. Borrowers often realize ten years later that their equity is gone, leaving little for their kids.

Q5. Who is responsible for home repairs on a reverse mortgage?

You are. You are still the homeowner. If the roof leaks, you have to fix it. If you let the house fall apart, the lender can actually call the loan due. It's called a "technical default."

Q6. What is the downside to a reverse mortgage?

Compound interest is the silent killer here. Since you aren't paying the interest, the interest gets added to what you owe. Over time, this snowballs, and you can end up owing close to the full value of the house, leaving you with no exit strategy if you need to move later.

Conclusion

Choosing between a HECM, Proprietary, or Single-Purpose reverse mortgage really just comes down to your specific puzzle.

If you are a typical retiree, the HECM is likely your safety net. If you're sitting on a high-value estate, look at the Proprietary options. And if you just need to get a tax lien off your back, hunt for a Single-Purpose loan.

Here is my final piece of advice: Don't go it alone. Find a HUD-approved housing counselor. They don't work on commission, so they can tell you the truth about whether this is a smart move for your future.