Guild Mortgage Reviews: Pros, Cons, Complaints, and Rating

Thinking about working with Guild Mortgage, but unsure if they're the right fit? You're not alone on Reddit. Many homebuyers search for firsthand experiences before committing to a lender.

This review synthesizes Guild's business background, product lineup, common complaints, and ratings across major consumer platforms so you can decide whether Guild suits your needs. It also draws on real search discussions and customer feedback to reflect typical buyer concerns and expectations.

Who is Guild Mortgage?

First, let's learn what Guild Mortgage is. It was founded in San Diego in 1960 and has grown into a national residential mortgage lender that emphasizes a relationship-based origination model. As of the end of 2023, the company reported more than 4,200 employees and over 350 retail branches, and it originates and services loans in 49 states and the District of Columbia. Guild provides a full range of mortgage products, including government-backed loans and specialized programs for various borrower types.

Guild has expanded both organically and through acquisitions (for example, the Academy Mortgage acquisition added meaningful scale), builds local branch presence, and highlights programs intended for first-time buyers and underserved markets. The company operates through origination and servicing channels and markets programs and guarantees designed to accelerate closings and protect buyers during purchase transactions.

Benefits and Drawbacks of Guild Mortgage

Also, don't miss the pros and cons of Guild Mortgage. There are factors that you should take into consideration.

Pros

-

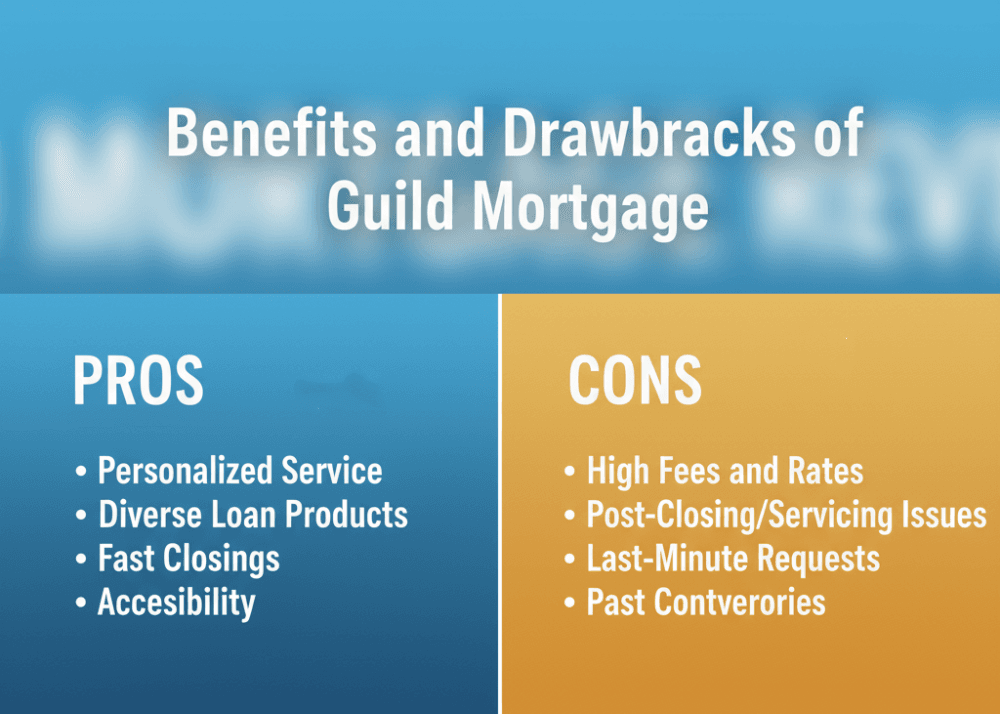

Personalized Service: Guild's branch and loan-officer model emphasizes local, relationship-driven service. Many customers praise loan officers who provide guidance and explain loan options during origination.

-

Diverse Loan Products: Guild offers a wide range of products (conventional, FHA, VA, USDA, HELOCs, reverse mortgages, and specialized programs such as doctor and ITIN offerings), which helps borrowers with varied credit and income profiles find options without necessarily switching lenders.

-

Fast Closings / Closing Guarantees: Guild markets the Homebuyer Express (HBE) 17-day closing guarantee, which promises reimbursement (up to $500) for qualifying delays caused by the company. This program is intended to help buyers in competitive markets.

-

Accessibility: With a large retail footprint and online application tools, Guild can serve borrowers who prefer face-to-face assistance or a hybrid digital experience.

Cons

-

Fees and Rates Can Be Higher Than Some Competitors: Guild does not display a universal "one-size-fits-all" rate. borrower quotes depend on credit profile, product, and market conditions. Third-party reviewers and some consumers note that, depending on the offer, Guild's rates and fees may be less competitive than certain direct online or local credit-union options.

-

Post-Closing Servicing Issues: Many of the public complaints are service/servicing related (account access, payment posting, transfers to other servicers, and communication breakdowns). These issues tend to appear in post-closing reviews and complaint filings.

-

Last-Minute Document Requests: A recurring theme in customer threads and reviews is stressful, last-minute documentation requests that can delay closings or create extra coordination work for buyers and real estate agents.

-

Past Regulatory Matter: Guild settled a False Claims Act matter with the U.S. government in 2020 related to FHA underwriting, paying $24.9 million to resolve the allegations. That legal episode is part of the company's public record and worth noting when assessing compliance history.

Complaints on Guild Mortgage

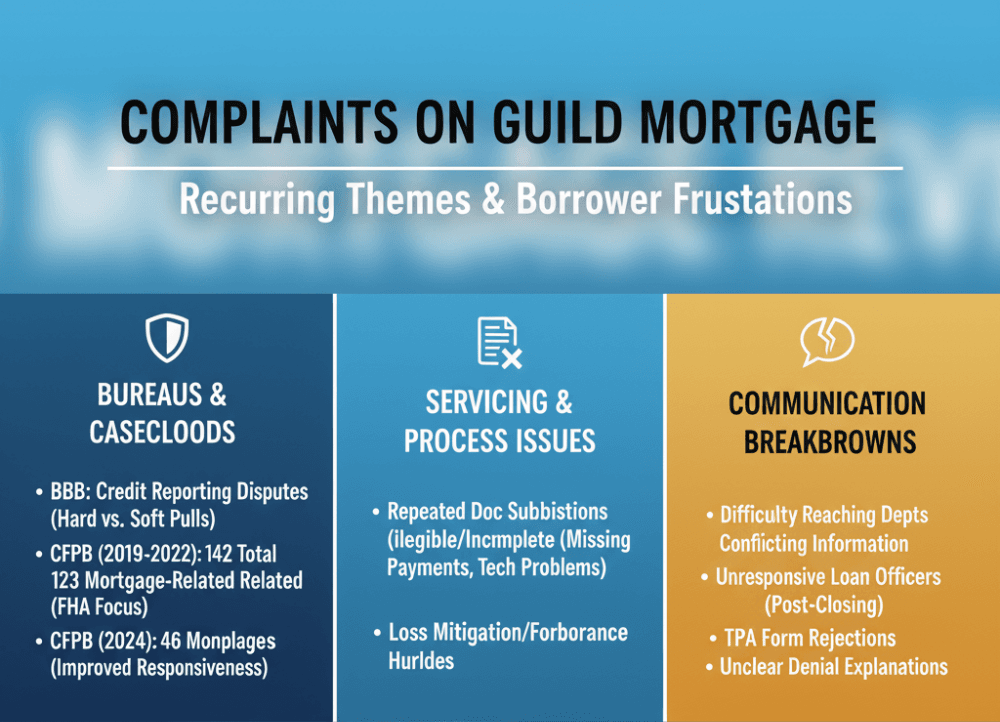

Better Business Bureau records show recurring complaint themes, including credit reporting disputes where borrowers claim Guild performed hard credit inquiries without proper authorization, despite being told soft pulls would occur. Loan servicing complaints involve repeated submission of required documentation that Guild deems inadmissible for various reasons, including illegibility or incompleteness, creating frustrating cycles for borrowers attempting loss mitigation or forbearance arrangements.

From 2019 to 2022, the Consumer Financial Protection Bureau received 142 complaints against Guild Mortgage, with 123 relating specifically to mortgage products, particularly FHA loans. Payment process issues dominate these complaints, encompassing missing payments, unresponsive customer service, and technical problems with online account platforms. In 2024, CFPB received 46 mortgage-related complaints for Guild Holdings Company, providing timely responses to all but one complaint, suggesting improved responsiveness compared to earlier years.

Communication failures represent another significant complaint category. Borrowers report difficulty reaching appropriate departments, receiving conflicting information from different representatives, and experiencing long hold times without resolution. Some customers describe loan officers becoming unresponsive after closing, leaving servicing questions unanswered. Third-party authorization form rejections and unclear explanations for application denials further contribute to customer frustration documented across complaint platforms.

What People Are Saying About Guild Mortgage?

Ratings and sentiment vary widely depending on the platform and whether reviews reflect origination or post-closing servicing.

Zillow (4.97/5.0)

Guild has earned a very large volume of highly positive origination reviews on Zillow. Guild and press releases highlight that the company achieved one of the largest volumes of five-star ratings among lenders in recent years, with high marks for loan-officer responsiveness and closings. These ratings tend to reflect borrowers' origination experiences immediately after closing.

Jason and his entire team at Guild Mortgage were amazing, and guided us through every step of the loan process. They were all readily available for any questions we had, and provided frequent updates, which helped put us at ease that everything was on-track for the closing date. We would recommend them to anyone in the home buying process!

Matt and his team at Guild were very professional and helpful throughout the whole process. My wife and I could not be happier with the results. I would highly recommend this company. They walked us through step by step and always responded quickly to our questions and concerns.

Tara was amazing! She was always prompt and I was always able to reach her with any and all questions and concerns I had. She was a great resource to have as a first time homebuyer!

ConsumerAffairs (2.4/5.0)

ConsumerAffairs presents a mixed picture. Many positive stories about helpful loan officers and smooth purchases, but numerous negative accounts focusing on servicing failures, payment posting issues, and transfers to other servicers that created confusion. This platform tends to aggregate longer-term and servicing complaints more visibly than the origination-focused sites.

Working with Chandler in Lawton Oklahoma was awesome.... He understood my needs, communicated with me regularly giving me updates and making sure I understood what was needed and he was always available if I had any questions. I feel I made a friend along the way.... Thank you Chandler for all your hard work!

I have bought and sold several homes in my life and Guild Mortgage is the worst lender I've ever dealt with. The loan officer was incompetent when I got my loan. She made a few mistakes costing me several thousand dollars that it shouldn't have in taxes. Now they say I'm behind on my mortgage, took about an hour to find pout they misapplied the check and it was on time (3 days early). After they called several times and sent an email saying I was late they won't confirm in writing that the payment was made on time, like I'm suppose to trust that they took care of their mistake. Terrible company, don't do business with them.

Avoid this company at all costs. They wrongly reported late payments despite receiving them on time. They never notified me of any issues; instead, they falsely claimed a late payment after I received a text confirming that my payment was received on time.

BBB (1.53/5.0)

BBB for Guild displays low customer-review averages (for example, the BBB customer reviews page shows an average of 1.53/5 on the profile used in complaint summaries), even while other BBB listings show an A+ rating in the BBB system for certain local profiles. In short, the BBB data reflect mixed signals: Guild's file and responsiveness can earn favorable formal ratings in some local BBB records, but the customer review panels and complaint records show many dissatisfied customers who experienced servicing or communication problems. Read the specific local BBB profile carefully for the most relevant picture in your state.

It's 2025, why does their website feel like a high school kid's tech project that sends you into a never-ending loop where nothing can be accomplished? Why is it impossible to make a one-time payment just because you set up future automatic payments? This makes no sense and this mortgage company shits.

Waits till last minute to get things done. Horrible service. Would not use again

Guild mortgage is not a company I would recommend to anyone. All I've been asking for is my July 1st mortgage statement which I've been requesting by email and phone calls and every person gives a different lie each time. What's so hard about giving someone access to their statement either online or by email. I thought they were required to give you a statement each month. And yes I've been trying for the last two weeks and it's July 3rd 2025 now. Seems like it's everyone's first day on the job. Horrible is all I can say

What Loan Types Does Guild Mortgage Support?

Guild offers the standard set of residential mortgage products plus specialty options. Below are the product headings and the company pages that describe each.

-

Conventional: Guild offers fixed-rate and adjustable conventional loans, including conforming and high-balance options, with typical underwriting standards that favor higher credit scores for best pricing.

-

FHA: Guild originates FHA purchase and refinance products, including FHA 203(k) renovation loans in applicable markets.

-

USDA: Guild processes USDA loans in eligible rural and suburban areas, following USDA income and property guidelines.

-

VA: Guild supports VA purchase and refinance loans, assisting service members, veterans, and eligible spouses through VA-specific documentation and entitlement processes.

-

HELOC/HELOAN: Guild offers home equity lines and home equity loans in markets where those products are available. program availability and LTV limits vary by state and product terms.

-

Reverse Mortgage: Guild's Flex Payment Mortgage and related resources describe options for older homeowners exploring reverse mortgage alternatives. these products have specific eligibility and counseling requirements.

Loan Programs Supported by Guild Mortgage

Guild also markets targeted programs that are designed to address down-payment barriers, certain professions, or tax ID borrowers. Examples include:

1% Down

The 1% Down program combines a minimal 1% borrower contribution with Guild's 2% grant, effectively creating 3% total down payment for conventional loans. This program helps buyers who have saved some funds but lack the traditional 5-20% down payment, bridging the gap between renting and homeownership for financially stable families with limited savings.

3-2-1 Home Plus

This first-time buyer program requires just 3% down payment (acceptable as gift funds), demands only a 620 minimum credit score, and provides eligible borrowers $2,000 Home Depot gift cards plus $1,000-$2,500 grant money for closing costs. Properties must be located within 100% area median income for borrower family size unless in underserved areas, targeting workforce housing affordability.

Down Payment Assistance Programs

Guild connects borrowers with various state, county, and city down payment assistance initiatives offering grants, forgivable loans, or deferred-payment second mortgages. These programs frequently target first-time buyers, specific professions like teachers or public safety workers, or designated neighborhood revitalization zones. Guild loan officers help navigate application processes and coordinate multiple funding sources.

Homebuyer Protection

Guild's Homebuyer Protection includes two guarantees: Credit Approval Protection pays up to $1,000 for inspections, appraisals, and relocation expenses (plus up to $5,000 lost earnest money) if Guild cannot close after issuing preliminary approval. Homebuyer Express promises 17-day closing or $500 closing cost reimbursement. These protections provide financial recourse when Guild fails to meet commitments.

MyPath2Own

MyPath2Own represents Guild's homebuyer education and preparation program, providing resources helping prospective buyers understand credit requirements, budgeting, saving strategies, and loan application processes. This initiative serves buyers who aren't quite ready to apply but want guidance preparing financially for eventual homeownership within 6-24 months.

Zero Down

Beyond VA and USDA loans requiring no down payment, Guild offers additional zero-down options for qualified borrowers in certain markets or meeting specific criteria. These programs address the primary barrier preventing renters from transitioning to ownership---lack of substantial savings for down payments and closing costs.

Doctor Program

Medical professionals receive specialized financing acknowledging their unique financial situations. The Doctor Program excludes student loan debt from debt-to-income calculations, recognizes future earning potential despite current residency or fellowship salaries, and offers no-money-down options. This program serves physicians, dentists, and other healthcare professionals whose high debt loads and delayed peak earnings typically complicate traditional mortgage qualification.

ITIN Mortgage Program

Individual Taxpayer Identification Number mortgages serve borrowers who file taxes using ITINs rather than Social Security numbers. This program expands homeownership opportunities for immigrants and others lacking Social Security numbers but maintaining steady employment and tax compliance, demonstrating Guild's commitment to serving diverse communities.

Mortgage Calculators on Guild Mortgage

Guild provides online calculators that help buyers estimate monthly payments, affordability, income requirements, closing costs, refinance benefits, and temporary buydowns. The calculators are useful early planning tools but are not for loan approvals. Treat results as estimates and confirm numbers with a loan officer for your specific profile.

Mortgage Payment Calculator

This calculator estimates total monthly housing expenses, including principal, interest, property taxes, homeowners' insurance, and mortgage insurance when applicable. Users input loan amount, interest rate, term, and property details to understand complete payment obligations beyond just principal and interest.

Mortgage Affordability Calculator

The affordability calculator determines the maximum purchase price based on income, debts, down payment, and estimated interest rates. This tool helps buyers establish realistic home shopping budgets aligned with lender qualification standards, preventing wasted time viewing properties beyond financial reach.

Mortgage Income Calculator

This calculator reverses the equation, showing the minimum income required to qualify for the desired loan amounts. Borrowers uncertain whether their earnings support specific purchase prices can quickly determine feasibility before investing time in property searches or applications.

Closing Cost Calculator

Estimating closing expenses helps buyers understand the total cash needed at closing beyond the down payment. This calculator factors in loan amount, property location, and purchase price to approximate title fees, escrow charges, prepaid items, and lender costs, enabling adequate savings planning.

Refinance Calculator

The refinance calculator compares current mortgage terms against potential refinance scenarios, showing monthly payment changes, interest savings over the loan life, and break-even timelines when closing costs are factored. This analysis helps homeowners determine whether refinancing makes financial sense given their circumstances.

Home Sale Calculator

Sellers considering listing can estimate net proceeds after paying off existing mortgages, real estate commissions, closing costs, and repairs. This calculator aids decisions about whether selling produces sufficient funds for down payments on new purchases or other financial goals.

Buying Power Calculator

This tool illustrates how different down payment amounts, interest rates, or loan terms affect maximum affordable purchase prices. Borrowers can manipulate variables to understand tradeoffs---for instance, how increasing the down payment from 5% to 10% expands buying power or how rate differences impact affordability.

Temporary Buydown Calculator

For buyers considering rate buydown programs where sellers or builders pay fees, reducing interest rates during initial loan years, this calculator shows payment savings and helps evaluate whether accepting buydowns versus negotiating lower purchase prices delivers better long-term value.

FAQs About Guild Mortgage Reviews

Q1. Is Guild Mortgage a lender or broker?

Guild operates as a direct lender that originates loans through its branches and funds loans rather than acting solely as a broker that matches borrowers to third-party funders. This direct-lender model can simplify communications during origination, but servicing may be retained or transferred depending on loan sale decisions.

Q2. What is the rating of Guild Mortgage?

Ratings differ by site: Guild has strong origination ratings on Zillow/Experience (very high 4.9+ scores reflected in company press material), while ConsumerAffairs and BBB customer reviews show lower satisfaction levels for many customers, particularly around servicing. Readers should compare platform contexts (origination vs. servicing) when weighing ratings.

Q3. What credit score do you need for a guild mortgage?

Minimum credit standards depend on loan type: FHA programs accept lower scores than conventional loans (FHA underwriting can allow lower scores with higher down payments), conventional loans typically target mid-600s for competitive pricing, USDA and VA have their own underwriting overlays, and jumbo loans require stronger credit profiles. Always confirm with the underwriting guidelines for the specific program and local market.

Q4. What bank owns Guild Mortgage?

Guild Mortgage is operated by Guild Holdings Company (NYSE: GHLD) and has been publicly listed in recent years. In mid-2025, Guild announced a definitive agreement under which a fund managed by Bayview Asset Management will acquire the remaining outstanding shares in an all-cash transaction valued at roughly $1.3 billion. a transaction that would take Guild private once closed. That acquisition announcement is an important corporate development to monitor for any operational impact.

Q5. Does Guild Mortgage have good customer service?

Short answer: it depends. Many borrowers report excellent, hands-on service from their loan officers during origination. Conversely, a notable subset of borrowers reports poor experiences with servicing (payment posting, account access, transfers). If customer service is a prime decision factor for you, request references from an assigned loan officer and ask how post-closing servicing will be handled.

Q6. How long has Guild Mortgage been around?

Guild Mortgage was founded in 1960---over six decades in residential lending---giving it institutional experience across housing cycles and multiple product lines.

Conclusion

Guild Mortgage is a large, experienced national lender with an extensive product menu and a branch-driven model that many homebuyers find reassuring during origination. The company's strengths include a broad set of loan products (including specialist programs), strong origination-stage reviews on platforms such as Zillow, and promotional programs like the Homebuyer Express 17-day closing guarantee.

The caveats are clear: public complaint channels and some consumer review sites reveal recurring servicing and communication issues for a subset of borrowers. The 2020 DOJ settlement is part of Guild's regulatory history and is worth factoring into a broader due diligence review.

Practical takeaways if you're considering Guild:

-

Verify your assigned loan officer: ask for references and read branch-level reviews where possible.

-

Document everything: keep emails, texts, and a timeline of key milestones. This helps if last-minute requests or servicing changes occur.

-

Ask about servicing: confirm whether Guild will retain servicing or sell it, and what servicer transfers (if any) would mean for payments and online account access.

-

Compare costs: get multiple rate/fee quotes (including credit unions and online lenders) before deciding, because prices and overlays can vary by branch and product.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

- MortgagePros Reviews 2026: Is It a Scam or Not?

- Tomo Mortgage Reviews: Learn Pros, Cons, Complaints Here

- E Mortgage Capital Reviews: Everything You Want to Know Here