Best Asset Depletion Lenders in 2026: Top Rank Here

I have sat across from countless clients, retired executives, crypto investors, and business owners, who have millions in the bank but still got rejected by traditional banks. It is a frustrating reality: you are wealthy, but your tax returns do not show a steady W-2 salary. That is where Asset Depletion Loans come in.

In 2026, these loans are no longer just a "loophole". They are a mainstream solution for high-net-worth individuals. Instead of looking at your monthly pay stub, lenders calculate a "virtual income" based on your liquid assets to satisfy the Debt-to-Income (DTI) ratio. If you have the capital but lack the pay stub, this is your path to homeownership.

People Also Read

- Non-QM Loan Requirements: Everything to Know At First

- 8 Best Non-QM Mortgage Lenders: Get Your Best Pick Here

- Self-Employed Mortgage Guide: How to Get, Requirements

- ITIN Mortgage Loan Guide: Definition, Requirements, Process

- Top Picks: Best Asset-Based Mortgage Lenders

6 Top-Rated Asset Depletion Lenders in 2026

The Non-QM (Non-Qualified Mortgage) market has evolved significantly this year. I have analyzed dozens of lenders based on their asset calculation formulas, interest rates, and underwriting speeds to bring you this list.

While the "headline rates" matter, the calculation method is actually more important. Some lenders verify 100% of your cash, while others might only count 70% of your stock portfolio. Here are the 6 lenders that are leading the pack in 2026.

(Note: Loan terms change daily. Always compare current quotes.)

#1 CrossCountry Mortgage -- Best for Tech-Driven Experience & Speed

- Website: https://crosscountrymortgage.com/

- NMLS Number: 3029

- States Available: Licensed in most states. Verify specific licensing as restrictions may apply (e.g., past cease-and-desist in some states like Massachusetts).

CrossCountry Mortgage (CCM) has cemented its position as a giant in the lending space. From my experience, they are one of the few large lenders that have successfully built a dedicated "Non-QM" division that actually moves fast. They don't treat asset depletion clients as "difficult cases". They treat them as VIPs. Their process is streamlined, blending a massive branch network with a tech-heavy underwriting system.

Features

- Fast Track Processing: Offers tech-enabled processing for Non-QM loans, including asset qualifier products, though closing times vary by case.

- Flexible Asset Types: Accepts various liquid assets in Non-QM products like Signature Asset Qualifier Loan. RSU/stock options may qualify if vested and liquid, per general guidelines

- High Loan Limits: In 2026, they continue to offer jumbo loan amounts well above the conforming limits, essential for luxury buyers.

- Hybrid Qualification: You can sometimes combine asset depletion with other income streams (like rental income) to boost your borrowing power.

Why Choose: Choose CrossCountry if you want the security of a big national brand but need the speed of a digital-first lender to close your deal on time.

#2 Angel Oak Mortgage Solutions -- Best for Non-QM Variety & Flexibility

- Website: https://angeloakms.com/

- NMLS Number: 1160240

- States Available: Primarily wholesale lender, available through approved brokers in licensed states.

If there is a "King of Non-QM," it is Angel Oak. They were pioneering these loans when everyone else was scared of them. I frequently recommend Angel Oak to clients who have a complex financial picture, perhaps a past credit event or a very unique asset mix. They write their own rules (Portfolio Lending), meaning they don't have to sell your loan to Fannie Mae, giving them immense flexibility.

Features

- Generous Calculation Methods: Historically, they use asset qualifier program to calculate required assets (e.g., loan amount + debts x 60 months + reserves). No employment/DTI needed, with a min FICO 700 and max LTV 75%.

- Credit Flexibility: They are often willing to work with borrowers who have a minimum FICO 700 for asset qualifier program, provided the assets are strong.

- Diverse Asset Inclusion: They look at checking, savings, money markets, and publicly traded stocks with a high degree of acceptance.

- Bank Statement Combo: You can often switch between a Bank Statement loan and Asset Depletion depending on which yields a lower rate.

Why Choose: Angel Oak is the "problem solver." If other lenders have said "no" because your scenario is too weird, Angel Oak is usually the one to say "yes."

#3 North American Savings Bank (NASB) -- Best for Retirees & IRA/401k Assets

- Website: https://www.nasb.com/

- NMLS Number: 400039

- States Available: Primarily serves Greater Kansas City area for some products. Nationwide digital for select Non-QM, like asset depletion (min $175k loan, exceptions by zip).

NASB is a Federal Savings Bank, which adds a layer of trust and stability. However, unlike most stiff banks, they are incredibly nimble with Portfolio Loans. I have found them to be particularly excellent for retirees. Many lenders heavily discount retirement accounts (sometimes only counting 60% of value), but NASB understands that for a retiree, that IRA is the income.

Features

- Retirement Friendly: They have specific guidelines designed for utilizing 401(k)s and IRAs as the primary income source for DTI calculations. Uses depletion calculation (assets divided by months) for retirement accounts like 401(k)/IRA.

- No Employment Required: For their asset-based products, they truly mean it when they say you don't need a job if the math works.

- Competitive Rates: Because they are a bank holding the loans, their rates are often slightly sharper than broker-only shops.

- Dedicated Officers: They assign experienced loan officers who specialize in complex self-employed and retiree tax structures.

Why Choose: If you are retired and your wealth is locked in 401(k) or IRA accounts, NASB's underwriting guidelines are likely the most favorable for your situation.

#4 New American Funding -- Best for Manual Underwriting

- Website: https://www.newamericanfunding.com/

- NMLS Number: 6606

- States Available: Nationwide (All 50 States)

New American Funding (NAF) has built a reputation on inclusivity and manual underwriting. In an age where computers automatically reject applications that don't fit a perfect box, NAF uses human underwriters to look at the "whole story." This is crucial for asset depletion because automated systems often misread large, irregular deposits as "risk" rather than "wealth."

Features

- Manual Underwriting: A real person reviews your file. If your assets are in multiple complex trusts or international accounts, a human can understand that better than an algorithm.

- Broad Asset Acceptance: They are known to consider various liquid assets that others might ignore.

- Custom Terms: They offer a variety of terms (Fixed, ARM, Interest-Only) that can help lower the monthly payment to fit the DTI requirements.

- Fast Closing Times: Despite the manual review, their operations team is highly efficient.

Why Choose: Choose New American Funding if you have a messy paper trail that requires a human being to understand and approve, rather than a computer checklist.

#5 Truss Financial Group -- Best for Real Estate Investors

- Website: https://trussfinancialgroup.com/

- NMLS Number: 1665620

- States Available: Check specific coverage (Strong in CA, FL, TX, etc.)

Truss Financial Group operates differently. They cater heavily to real estate investors and business owners. When I deal with clients looking to buy an investment property using their liquid capital, Truss is a go-to. They are less of a "retail bank" and more of a "deal maker" firm. They understand that investors care about Cash on Cash return and speed.

Features

- Investor Focus: They specialize in DSCR (Debt Service Coverage Ratio) loan and Asset Depletion loan, often blending the two concepts.

- No Tax Returns: Their primary selling point is the ability to bypass the 1040s entirely.

- High Leverage: They are often willing to lend at higher LTVs (Loan-to-Value) for strong borrowers.

- Crypto Consideration: In 2026, they are among the more forward-thinking lenders regarding cryptocurrency liquidity (subject to current volatility guidelines).

Why Choose: If you are a real estate investor or entrepreneur looking to scale your portfolio without showing tax returns, Truss speaks your language.

#6 LendFriend Mortgage -- Best for Personalized Service

- Website: https://www.lendfriendmtg.com/

- NMLS Number: 1397086

- States Available: Select States (Strong presence in TX, FL, and others)

LendFriend operates with a boutique philosophy. In the Non-QM world, things can get stressful. Documents get asked for repeatedly, and guidelines get confusing. LendFriend's reputation is built on "holding your hand" through the process. They provide a concierge-level service that is rare in the mortgage industry today.

Features

- Dedicated Support: You aren't just a number. You get direct access to senior loan officers.

- Transparent Updates: They are known for over-communicating status updates so you are never left guessing.

- Custom Rate Locks: Flexible options to lock in your rate while you sort out asset transfers.

- Efficiency: Despite being smaller than the giants, their turn-times are incredibly competitive because they don't have administrative bloat.

Why Choose: Choose LendFriend if you are a first-time Non-QM buyer and want a stress-free, personalized experience where the lender guides you through every step.

How to Choose the Best Asset Depletion Loan Lender?

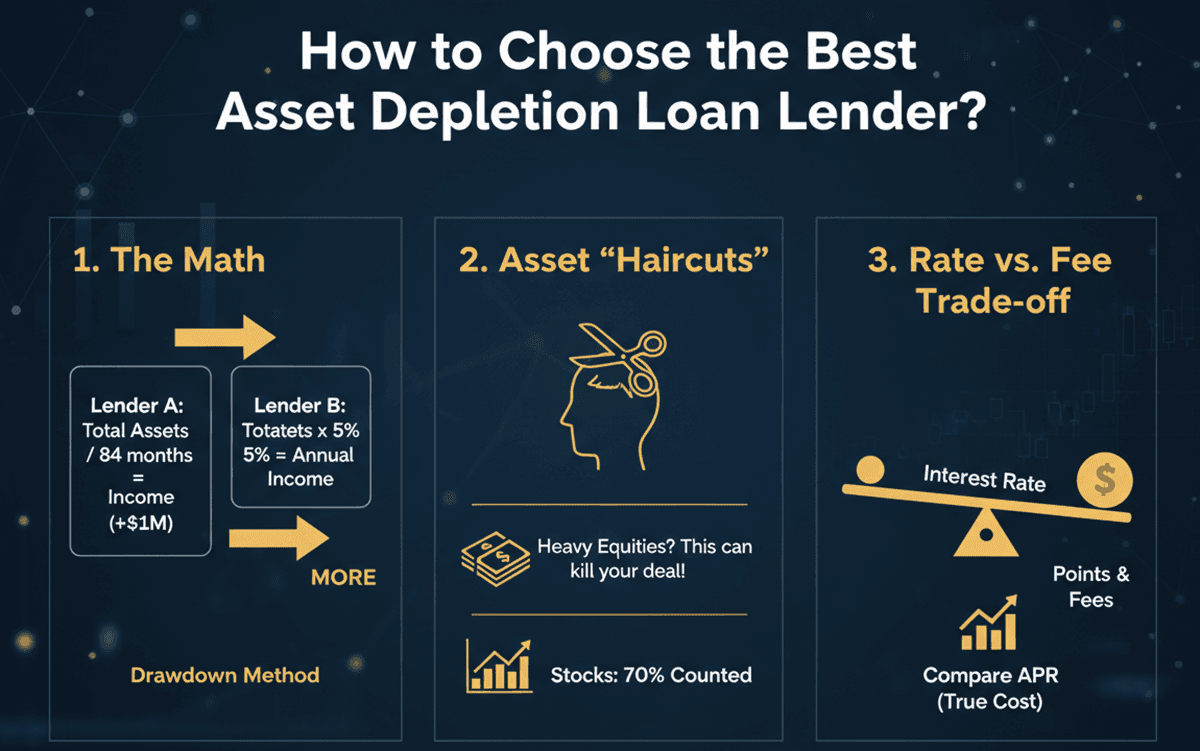

Choosing the right lender is not just about who has the lowest interest rate banner on their homepage. In the world of asset depletion, the "Calculation Method" is the most critical factor.

Here is what you need to watch out for:

-

The Math: Lender A might use a "Drawdown Method" (Total Assets / 84 months = Income). Lender B might use a "Rate of Return Method" (Total Assets x 5% = Annual Income). Lender A could qualify you for $1M more than Lender B with the exact same money in the bank.

-

Asset "Haircuts": Some lenders count 100% of your cash but only 70% of your stocks. If you are heavy in equities, this "haircut" can kill your deal.

-

The Rate vs. Fee Trade-off: Non-QM loans often come with higher rates. You need to compare the APR, not just the interest rate, to see the true cost including points and fees.

This comparison process used to take weeks of phone calls. Now, it's much easier.

Instead of calling 10 different banks and explaining your finances 10 times, you can verify your eligibility online. I recommend using Bluerate. It is an AI-driven search engine specifically for mortgages. You can compare asset depletion rates and guidelines from multiple lenders side-by-side to see who gives you the most buying power.

Conclusion

The lending landscape in 2026 is more inclusive than ever for high-net-worth individuals. Having significant assets without a W-2 job is no longer a barrier to buying your dream home. It's just a different paperwork process.

Whether you need the flexibility of Angel Oak, the speed of CrossCountry, or the investor focus of Truss, there is a solution out there for you. The key is to match your specific asset mix (Cash vs. Stocks vs. Retirement) with the lender's specific calculator.

Don't leave money on the table or risk a rejection. To get a clear picture of what you qualify for right now, I highly suggest visiting Bluerate.ai. It's the smartest way to shop for a Non-QM loan, ensuring you get the best rate and the right terms for your unique financial situation.