Detailed Guide on Asset Depletion Loan: Definition, Pros & Cons

I was scrolling through a Reddit thread recently that perfectly captured a frustration I hear all the time. The user asked, "Should I do an asset depletion mortgage?" They were sitting on a healthy pile of assets but were terrified of rocking the boat with their employer to get a specific "remote work letter" for a traditional loan.

It's a classic dilemma: you have the wealth to buy the house three times over, but because you don't have a standard W-2 pay stub, or your tax returns show too many deductions, the bank treats you like you're broke.

This is where an Asset Depletion Loan comes in. It was designed exactly for this scenario. It isn't about selling your stocks or draining your retirement. It's about making the math work so lenders can see your true purchasing power. In this guide, I'm going to walk you through exactly how this works, the math behind it, and whether it's the right move for your financial portfolio.

Also Read: Best Asset Depletion Lenders in 2026: Top Rank Here

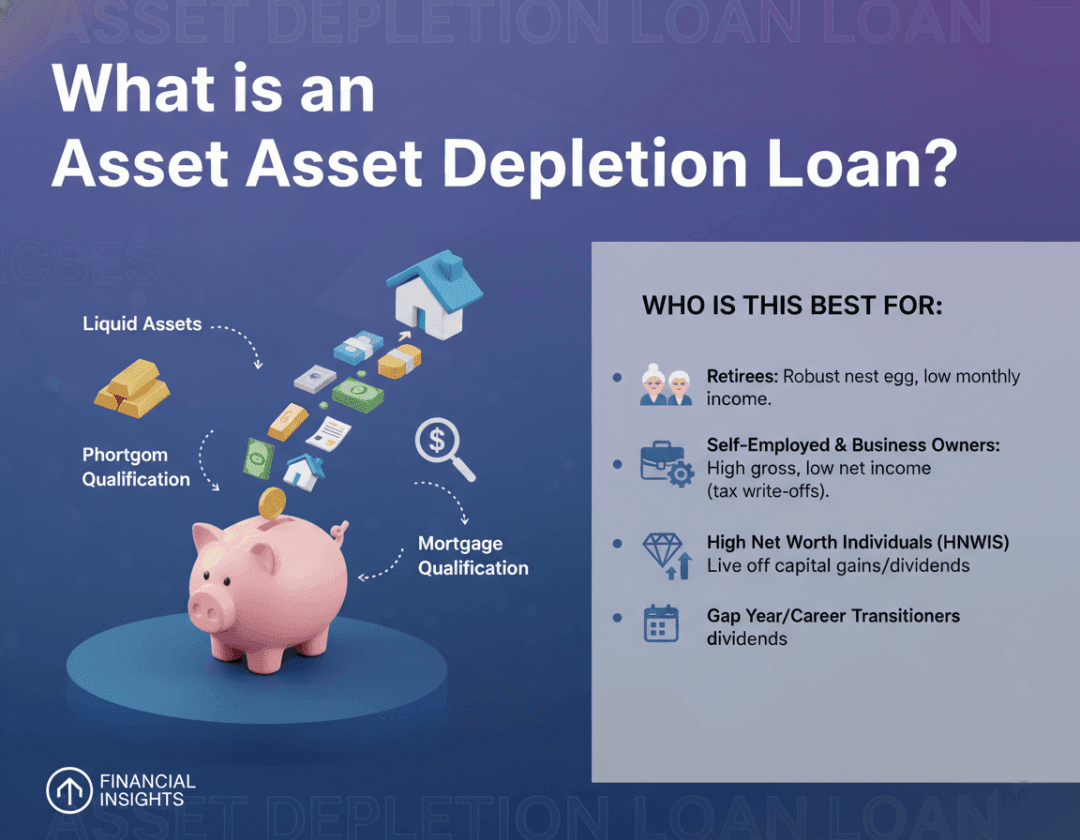

What is an Asset Depletion Loan?

An Asset Depletion Loan is a type of mortgage that allows you to qualify based on your total liquid assets rather than your monthly employment income. In the mortgage world, asset depletion calculations are available under Non-QM products from specialized lenders.

Fannie Mae offers a specific QM-eligible version called 'Employment-Related Assets as Qualifying Income,' with restrictive guidelines such as a maximum LTV of 70% or 80% if the asset owner is 62+ years old, limited to purchase or limited cash-out refinances on principal residences or second homes.

Think of it as a "common sense" loan. Instead of looking at your debt-to-income (DTI) ratio based on a salary, the lender looks at your net worth. They calculate a "phantom income", a theoretical monthly income stream you could generate if you slowly withdrew from your assets over time.

Who is this best for?

-

Retirees: You have a robust nest egg but a low monthly pension or Social Security check.

-

Self-Employed & Business Owners: Your business grosses a lot, but you write off expenses to lower your taxes, making your net income look too low for a conventional loan.

-

High Net Worth Individuals (HNWIs): You live off capital gains or dividends which can be irregular.

-

Gap Year/Career Transitioners: You have savings but are currently between jobs.

Unlike "No-Doc" loans of the past, this is a fully documented loan. You just document wealth, not wages.

How Does an Asset Depletion Mortgage Work?

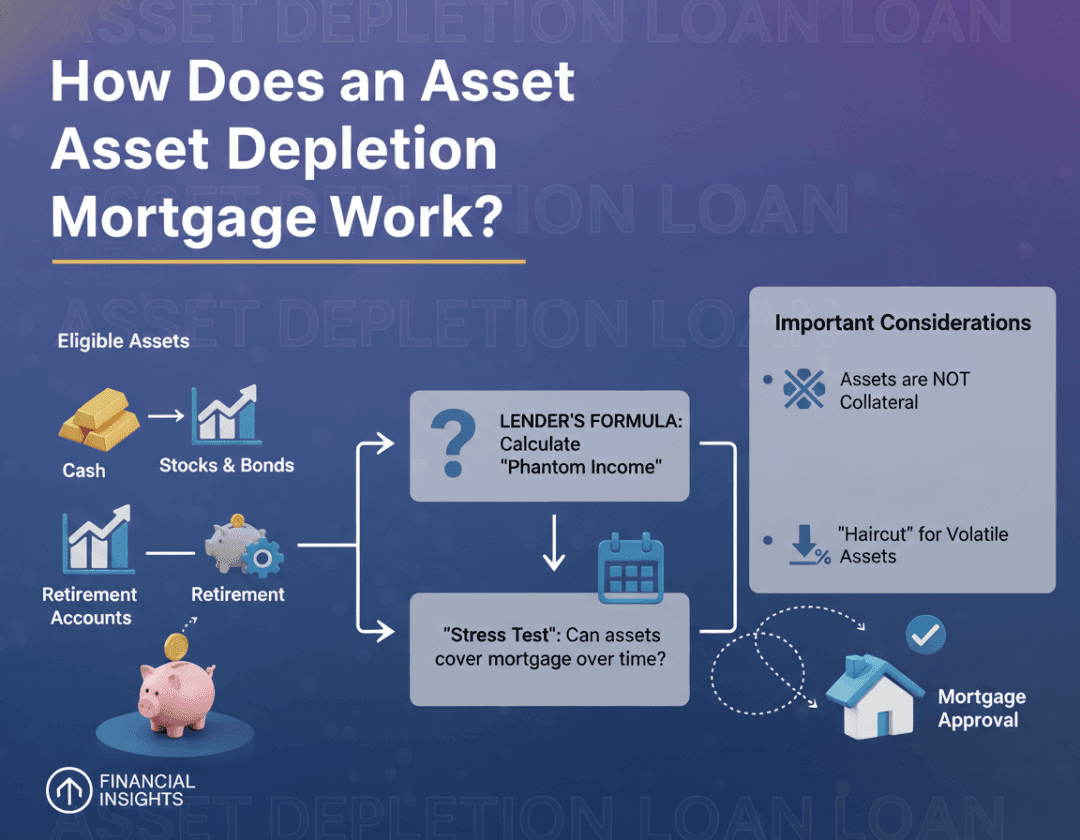

The mechanics of this loan are surprisingly simple, yet few people know they exist. The lender essentially treats your liquid assets like an annuity.

Here is the core principle: The lender takes your total eligible assets (cash, stocks, bonds, retirement accounts) and applies a formula to determine how much "income" those assets represent. They are not taking your money. You do not have to pledge your assets as collateral, and you certainly don't have to sell them to get the loan.

The "depletion" part is purely a mathematical stress test. The underwriter asks: "If this borrower stopped earning money today, how long could their assets pay the mortgage?"

However, not every dollar counts the same. Lenders typically apply a "haircut" or discount factor to volatile assets. For example, while $100,000 in a savings account counts as $100,000, $100,000 in a stock portfolio might only count as $70,000 for qualification purposes to account for market fluctuations.

Asset Depletion Mortgage Example

To make this concrete, let's look at a hypothetical borrower named Michael.

Michael is a retired consultant. He wants to buy a $500,000 home.

-

Michael's Income: $1,500/month (Social Security).

-

Michael's Assets: $1,000,000 in a mix of investment accounts and savings.

If Michael walked into a standard bank, his $1,500 income wouldn't qualify him for a $400,000 mortgage, assuming 20% down.

However, with an Asset Depletion Loan:

-

Asset Valuation: The lender looks at his $1,000,000 portfolio. Because it's mostly stocks, they apply a 70% discount factor, yielding $700,000 in qualifying assets (Non-QM example).

-

Income Calculation: For a Non-QM lender using an 84-month (7-year) divisor, $700,000 ÷ 84 = $8,333 per month phantom income (added to his $1,500 Social Security).

-

Note: Fannie Mae-style calculations subtract down payment, closing costs, reserves, and penalties first, using 360 months for a more conservative figure.

The Result: The lender adds this $8,333 "phantom income" to his $1,500 Social Security. Michael now has a qualifying income of $9,833/month, easily approving him for the loan without him needing to get a job or sell a single stock.

Pros and Cons of an Asset Depletion Mortgage

Like any sophisticated financial tool, this strategy has trade-offs. It solves a specific problem, but it comes at a cost.

The Benefits

-

High Buying Power: You can qualify for luxury properties or second homes that your tax returns say you can't afford.

-

Keep Your Assets Invested: This is the biggest win. You don't have to liquidate your portfolio and trigger capital gains taxes just to buy a house. Your money keeps compounding in the market.

-

No Employment Stress: You don't need to stress about employment gaps or proving steady freelance income.

The Drawbacks

-

Higher Interest Rates: Because these are Non-QM loans, the rates are typically 0.5% to 2% higher than a standard conventional mortgage. Lenders view the lack of regular wage income as a slightly higher risk.

-

Higher Down Payment: You rarely see 3% or 5% down payments here. Expect to put down 20% to 30%.

-

Reserve Requirements: Lenders often want to see that you have 6 to 12 months of mortgage payments in liquid cash after the down payment is paid.

Asset Depletion Loan Requirements

If you decide to pursue this, you need to know what the underwriter is looking for. While every lender has its own "overlay" (specific rules), here are the industry standards I see most often in the US market:

-

Minimum Net Worth: generally, you need at least $500,000 in liquid assets, though some lenders go lower for smaller loan amounts.

-

Credit Score: A FICO score of 680-700+ is standard. Higher scores (740+) often unlock better interest rates.

-

Eligible Assets & Discount Rates:

- Cash/Savings/Money Market: Usually counted at 100%.

- Publicly Traded Stocks/Bonds: Usually counted at 70% - 90% (to buffer against market crashes).

- Retirement (401k/IRA): Often counted at 60% - 70%. Note: If you are under 59½, lenders discount this heavily because you'd pay penalties to access it.

- Ineligible Assets: Crypto (unless converted to cash), private stock, and equity in other real estate usually do not count.

-

Loan-to-Value (LTV): Most lenders cap these loans at 75% or 80% LTV.

How to Calculate Asset Depletion Income?

This is where the "Information Gain" is crucial. The denominator (the number you divide by) changes everything. There are two main ways this is calculated:

1. The "Loan Term" Method (Conservative/Fannie Mae style)

This method spreads your net assets over the entire life of the loan (usually 30 years or 360 months).

-

Formula: (Total Eligible Assets − early withdrawal penalties − down payment − closing costs − required reserves) ÷ 360.

-

Impact: This results in a much lower monthly income. It's harder to qualify.

2. The "Non-QM" Method (Aggressive)

Many specialized lenders use a shorter divisor, assuming the assets only need to supplement income for a shorter period.

-

Formula: Total Eligible Assets ÷ 60, 84, or 120 months.

-

Impact: Dividing by 84 instead of 360 increases your qualifying income by 4x.

When shopping for a loan, explicitly ask the loan officer: "What is your depletion divisor?" The difference between dividing by 60 and 360 can be the difference between a decline and an approval.

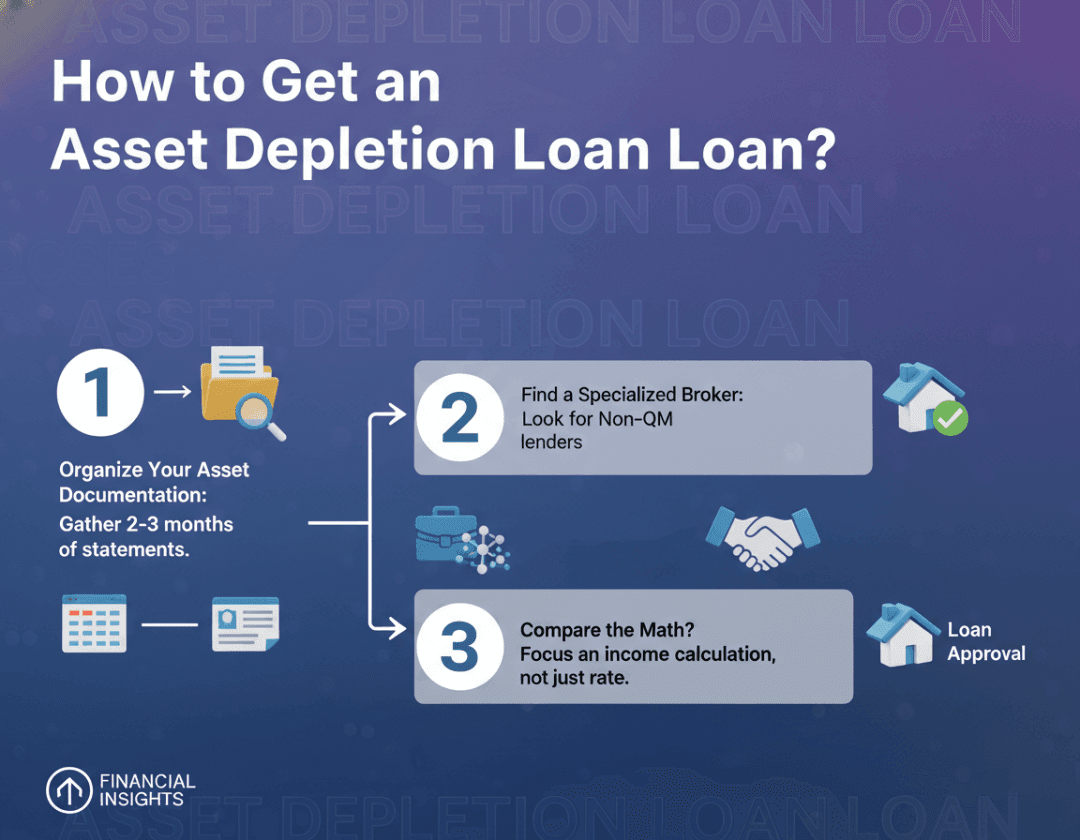

How to Get an Asset Depletion Loan?

Getting an asset depletion loan isn't as simple as walking into a Wells Fargo or Chase branch. Big banks rarely offer aggressive Non-QM portfolios.

-

Organize Your Asset Documentation: You will need the most recent 2-3 months of statements for all accounts. Ensure all large deposits are explained (sourced).

-

Find a Specialized Broker: You need a mortgage broker who has access to wholesale Non-QM lenders.

-

Compare the Math: Don't just look at the interest rate. Look at how they calculate your income. One lender might offer a lower rate but use a strict calculation that you don't pass.

This is where a little research goes a long way. Since every lender's formula for "discounting assets" varies, it's vital to shop around. I recommend using platforms like Bluerate. They allow you to consult with specialized non-QM loan officers for free. You can compare rates and, more importantly, compare how different lenders will value your specific portfolio assets.

FAQs About Asset Depletion Loans

Q1. What is the Fannie Mae asset depletion loan?

Fannie Mae allows 'employment-related assets' (e.g., 401(k)s, IRAs, Keogh plans, severance) as qualifying income under specific rules. Checking/savings are generally ineligible unless funded by these. Crypto and non-employment assets like real estate equity are excluded. They divide your net eligible assets by 360 months (the term of the loan). This results in a much lower qualifying income compared to Non-QM options.

Q2. What assets can be used for asset depletion?

Lenders prefer "Liquid" assets. This includes:

-

Checking and Savings accounts.

-

Certificates of Deposit (CDs).

-

Stocks, Bonds, and Mutual Funds.

-

Vested Restricted Stock Units (RSUs) - sometimes.

-

Retirement accounts (401k, IRA) - subject to withdrawal capability.

-

Excluded: Crypto (usually), unvested stocks, business inventory, and real estate equity.

Q3. What is the difference between asset depletion and asset utilization?

While often used interchangeably, there is a subtle difference. The terms are sometimes used interchangeably, but asset depletion typically calculates phantom income from depleting principal over a set period (e.g., 84-360 months), often for primary qualification. Asset utilization may refer to supplementing income with actual or projected interest/dividends from assets to improve DTI.

Conclusion

An Asset Depletion Loan is a powerful financial tool that bridges the gap between your "paper income" and your actual wealth. It allows you to buy the home you deserve without being forced to liquidate your portfolio or jump through hoops to generate W-2 income.

Yes, the interest rate might be slightly higher, but the flexibility of keeping your capital invested in the market often outweighs the cost.

If you think this strategy fits your profile, don't guess your buying power. The math varies wildly from lender to lender. I highly suggest visiting Bluerate to connect with experienced non-QM loan officers. You can get a free consultation to see exactly how much "phantom income" your portfolio can generate and compare personalized rates tailored to your financial situation.