Full Guide 2026: How to Get a DSCR Loan? Everything Here

If you're a real estate investor in 2026, you likely know the frustration: you found the perfect rental property, but the thought of digging up two years of tax returns or explaining every deposit on your bank statement makes you want to walk away. I've been there. The good news is that the lending landscape has shifted. Today, the most efficient way to scale a portfolio, without the income verification headache, is the DSCR loan.

In this guide, I'm cutting through the noise. We aren't looking at outdated 2024 data. I'm going to walk you through exactly how to get a DSCR loan right now in 2026, from the initial application to the closing table.

Quick Glance at Getting a DSCR Loan

If you are in a rush to secure your next property, here is the condensed roadmap we will follow. This 8-step process is the industry standard for closing a deal efficiently this year:

- Find a specialized DSCR lender (Do not rely on traditional big banks).

- Calculate your DSCR to see if your property's income covers the debt.

- Check your eligibility (Credit score, LTV, and cash reserves).

- Secure your down payment (Typically 15-25% is required).

- Gather property documents (Focus on the lease and entity docs, not tax returns).

- Submit your application online using a streamlined portal.

- Pass the underwriting process (The appraisal and rent schedule are key here).

- Close the loan (Often within 20-45 days, averaging 30 days, usually in an LLC).

Whole Process to Get a DSCR Loan

Let's dive into the step-by-step details of securing your DSCR loan, so you know exactly what to expect.

STEP 1. Find a DSCR Lender

The first thing I tell new investors is this: your regular bank probably can't help you here. Wells Fargo or Chase typically don't hold these loans. You need a "Non-QM" (Non-Qualified Mortgage) lender. In 2026, the market is flooded with lenders offering these products, but their terms vary wildly. One lender might demand a 1.25 DSCR ratio, while another down the street accepts 1.0 but charges a higher rate.

You absolutely must shop around. A difference of 0.5% in interest might not sound like much, but on a 30-year cash-flow investment, it eats directly into your profit margin. Instead of calling lenders one by one, you can compare live rates and multiple loan officers instantly using AI-driven platforms like Bluerate. It saves hours of phone tag and gives you a real-time view of the market.

STEP 2. Calculate Your DSCR

Before you even fill out an application, you should know your numbers. The Debt Service Coverage Ratio (DSCR) is the heartbeat of this loan. It's a simple formula: Rental Income divided by PITIA (Principal, Interest, Taxes, Insurance, and HOA).

If your monthly rent is $2,500 and your total monthly debt (PITIA) is $2,000, your DSCR is 1.25. Typical minimum DSCR is 1.00-1.25 for standard approval, with 1.15+ for best rates. Ratios as low as 0.75 are possible with adjustments like lower LTV. I've even seen loans close with a ratio below 1.0 (No-Ratio loans), but you'll need a larger down payment to offset the risk.

STEP 3. Meet Requirements of DSCR Loan

Since the lender isn't looking at your W2s, they are looking strictly at the asset and your reliability. Here is what you generally need for a DSCR loan to bring to the table in 2026:

- Credit Score: Credit scores range widely. Most lenders require a minimum of 620-680, with 660 common for better terms, and some accept 620 but with higher rates.

- Property Potential: The property must be "rent-ready." You generally can't use a standard DSCR loan for a gut-renovation project (you'd need a bridge loan for that).

- Cash Reserves: This is often overlooked. Reserves are often 3-6 months PITIA post-closing, but specifics vary. Some require 6+ months. This proves you won't default if the property sits vacant for a month.

STEP 4. Save for Down Payment

This is where DSCR loans differ most from the "house hacking" loans you might see on social media. You cannot get into these with 3.5% down. Because the lender is taking on more risk by ignoring your personal income, they require you to have more "skin in the game."

Down payments typically range 15-25% for purchases (up to 80-85% LTV), varying by lender, DSCR, and credit. 20-25% is standard. Remember, your funds need to be "sourced and seasoned." Expect to put down 15-25%. With excellent credit and strong DSCR, some lenders offer 15%. This means the money should be in your account for at least 60 days, or you need a clear paper trail showing where it came from (like a sale of another asset or a business profit distribution).

STEP 5. Gather Property and Financial Docs

This is the fun part, or at least, the "relief" part. You can shred your tax returns for this application. The documentation load is significantly lighter than a conventional mortgage.

Here is what you generally need to organize:

- Purchase Agreement: If buying new.

- Lease Agreements: If refinancing an existing rental.

- Bank Statements: usually the last 2 months to prove your down payment and reserves.

- Entity Documents: If you are closing in an LLC (which I highly recommend for liability protection), you'll need your Articles of Organization and Operating Agreement.

- Identification: Driver's license or passport.

STEP 6. Apply for DSCR Loan Online

Gone are the days of faxing paperwork. In 2026, almost every reputable DSCR lender uses a digital portal. You will fill out a standard Form 1003 (Uniform Residential Loan Application). It looks just like a regular mortgage application, but borrowers complete Form 1003 while the list properties and income sections are not verified due to asset-based underwriting.

STEP 7. Get Approved for DSCR Loan

Once you apply, the file goes to Underwriting. The most critical piece of this puzzle is the Appraisal.

The appraiser won't just look at the property value. they will complete a Form 1007 Rent Schedule. This document tells the lender what the "fair market rent" is for your area. If the appraiser says the market rent is only $2,000, but you need $2,200 to qualify, your loan might hit a snag. I always recommend being present at the appraisal if possible, or providing the appraiser with a list of comparable rentals in the area to justify your numbers.

STEP 8. Close DSCR Loan

Once underwriting gives the "Clear to Close," you are at the finish line. You will sign your Closing Disclosure (CD) and wire your down payment.

One specific detail to note: Many investors prefer to close these loans in the name of an LLC rather than their personal name. DSCR lenders are very LLC-friendly. This provides a layer of asset protection. Just ensure your title company knows this in advance so the deed is prepared correctly.

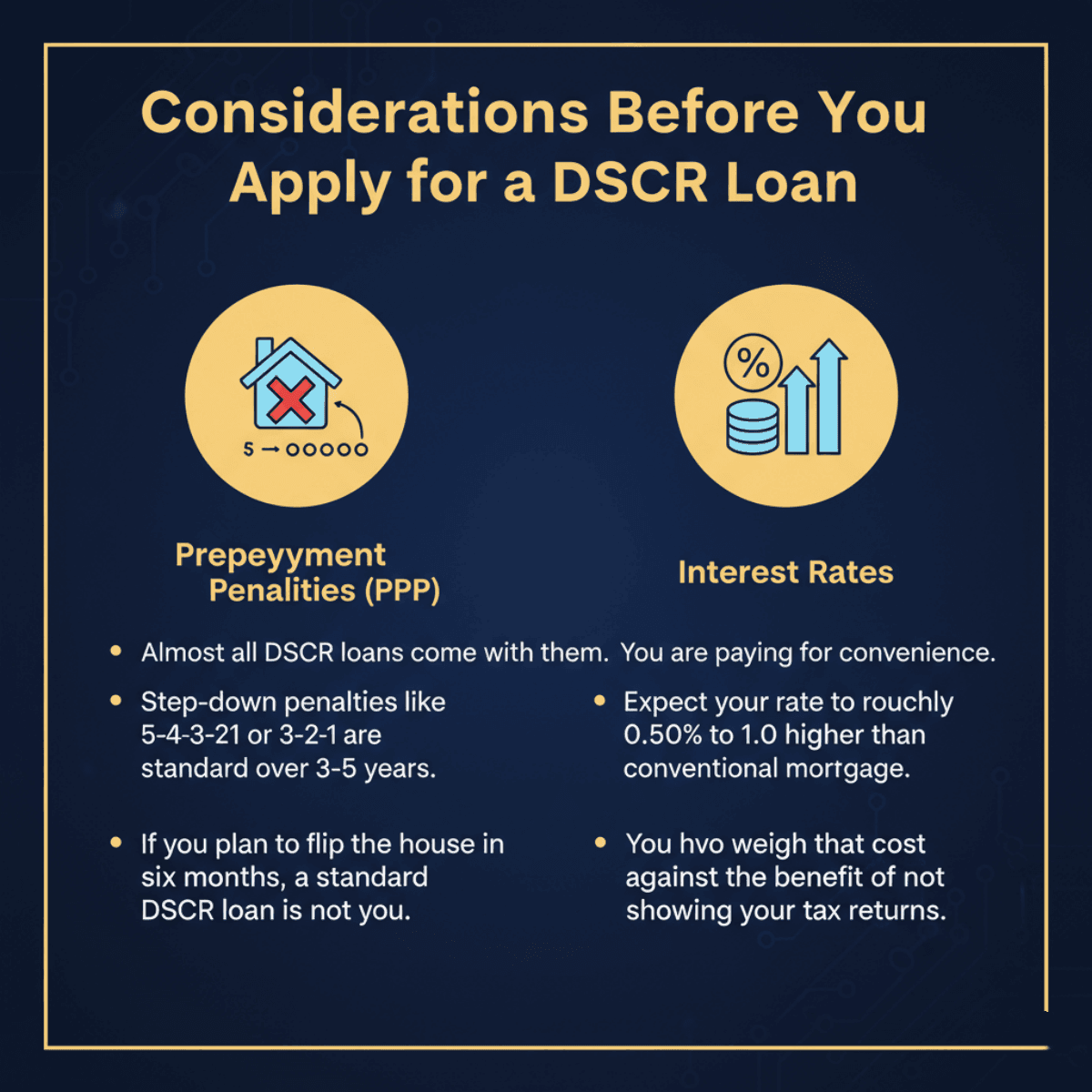

Considerations Before You Apply for a DSCR Loan

Before you jump in, I need to share a few "gotchas" that lenders might not highlight immediately.

- Prepayment Penalties (PPP). Almost all DSCR loans come with them. Step-down penalties like 5-4-3-2-1 or 3-2-1 are standard over 3-5 years. If you plan to flip the house in six months, a standard DSCR loan is not for you.

- Interest Rates. You are paying for convenience. Expect your rate to be roughly 0.50% to 1.00% higher than a conventional conventional mortgage. You have to weigh that cost against the benefit of not showing your tax returns.

FAQs About Getting a DSCR Loan

Q1. How to get a DSCR Loan with no down payment?

To be honest, you really can't. DSCR loans rely heavily on Loan-to-Value (LTV) ratios to mitigate risk. Since lenders don't verify income, they need the equity cushion. If you have zero cash, you might need to look into "Hard Money" loans or private money lenders first, fix up a property, and then refinance into a DSCR loan later (the BRRRR method).

Q2. Is it hard to get a DSCR loan?

Actually, it is easier than a conventional loan. The underwriting is "binary", either the property makes money, or it doesn't. You don't have to explain why you changed jobs or why your freelance income fluctuated last year. The paperwork is about 50% less than a standard mortgage.

Q3. Do DSCR loans require 20% down?

Yes, that is the standard in 2026. While you might find a lender offering 15% down, they will likely charge a much higher interest rate or require a higher credit score (740+). If you want the best terms, aim for 25% down.

Q4. How much are closing costs on a DSCR loan?

Budget for roughly 2% to 6% of the loan amount. This includes origination points (often 1-2 points), appraisal fees (which are higher for investment properties), title insurance, and prepaid taxes/insurance.

Q5. What are the pros and cons of DSCR loan?

Let's take a quick look at the benefits and drawbacks of DSCR loan.

- Pros: No income verification, unlimited number of loans (you can buy 10 rentals if you have the down payments), and you can close in an LLC.

- Cons: Higher interest rates, larger down payments, and prepayment penalties that lock you in for a few years.

Conclusion

Getting a DSCR loan in 2026 is one of the most powerful moves you can make to expand your real estate portfolio. It decouples your investment potential from your personal salary, allowing you to scale based on the quality of your deals, not your W2.

Don't let the technical terms scare you. If the numbers work on the property, the loan will likely work too. The most important step is simply finding the right partner. I highly recommend using Bluerate to look for a non-QM loan officer nearby, check your eligibility, and compare rates instantly. It's the smartest way to ensure you aren't leaving money on the table. Good luck with your investment!