NEXA Mortgage Reviews: What People Are Saying About?

Shopping for a mortgage can feel hesitant, especially when you're trying to decide between different lenders and brokers. If you're considering NEXA Mortgage but wondering whether they're the right fit for your home financing needs, you're not alone.

Many homebuyers search forums like Reddit for real experiences before committing to a lender or broker. This review pulls together those firsthand accounts, public review sites, and company disclosures so you — a homebuyer, loan officer, or partner — can make a clearer decision.

What is NEXA Mortgage?

NEXA Mortgage is a full-service mortgage brokerage headquartered in Chandler, Arizona. The company markets itself as a national broker platform licensed in most U.S. states and positions its business model around providing loan officers and borrowers access to a broad network of wholesale lenders and products. NEXA was founded in 2017 by Mike Kortas and Mat Grella and grew quickly by recruiting experienced loan officers under a broker model that emphasizes choice of lender and pricing control for loan officers.

Because NEXA functions primarily as a broker, it typically does not fund loans from its own balance sheet. Instead, individual loan officers place borrower files with wholesale lenders with whom the brokerage has relationships. That broker model explains why experiences can vary by individual loan officer and branch: loan officers operate with some autonomy and choose which wholesale partners to use for each file.

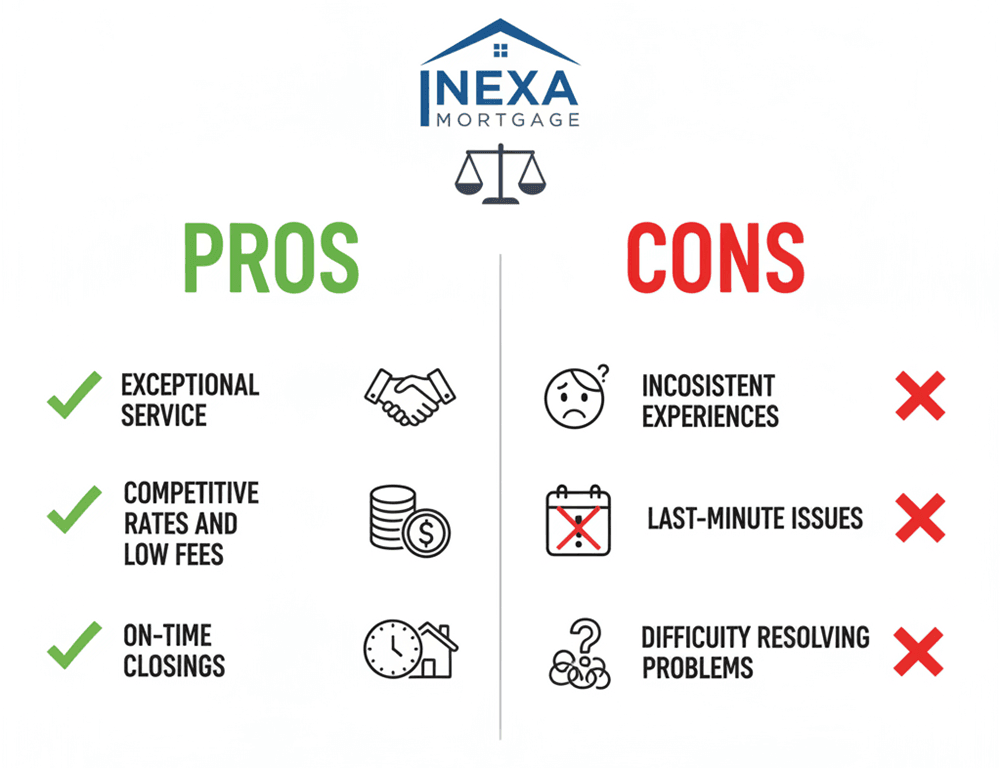

Pros and Cons: Why Choose NEXA Mortgage?

Also, let's take a look at the pros and cons of NEXA Mortgage, and see whether it's a good broker for you.

Pros

-

Exceptional service and communication: Many positive reviews describe loan officers who are proactive, communicative, and helpful, especially those who specialize in a particular loan product or borrower profile. When borrowers are paired with an experienced, responsive loan officer, the process often moves smoothly.

-

Competitive rates and expanded lender access: NEXA promotes access to a large pool of wholesale lenders and pricing engines, which can help loan officers shop rates across vendors. For borrowers, that can translate into competitive pricing and more product choices than a single retail bank might offer.

-

On-time closings: Numerous reviews praise timely closings and an efficient process when the originator and processing team are well coordinated. The broker model can enable faster turns when the chosen wholesale lender is efficient and the borrower's documentation is complete.

Cons

-

Inconsistent experiences: Because NEXA is a broker network with individual loan officers who run their own production, service quality and attention to detail vary considerably. Many complaints and low-rated reviews are associated with individual loan officers rather than the brand in the abstract.

-

Last-minute issues: Several borrowers reported unexpected issues near closing — missing paperwork, late requests for documents, or surprise changes to fees. These eleventh-hour problems are stressful and can reflect process gaps at the loan officer or processing level.

-

Difficulty resolving problems for some customers: Formal complaints and low-scoring reviews commonly cite frustration with follow-up and escalation when problems arise. Borrowers and some former loan officers describe challenges getting speedy resolutions from management.

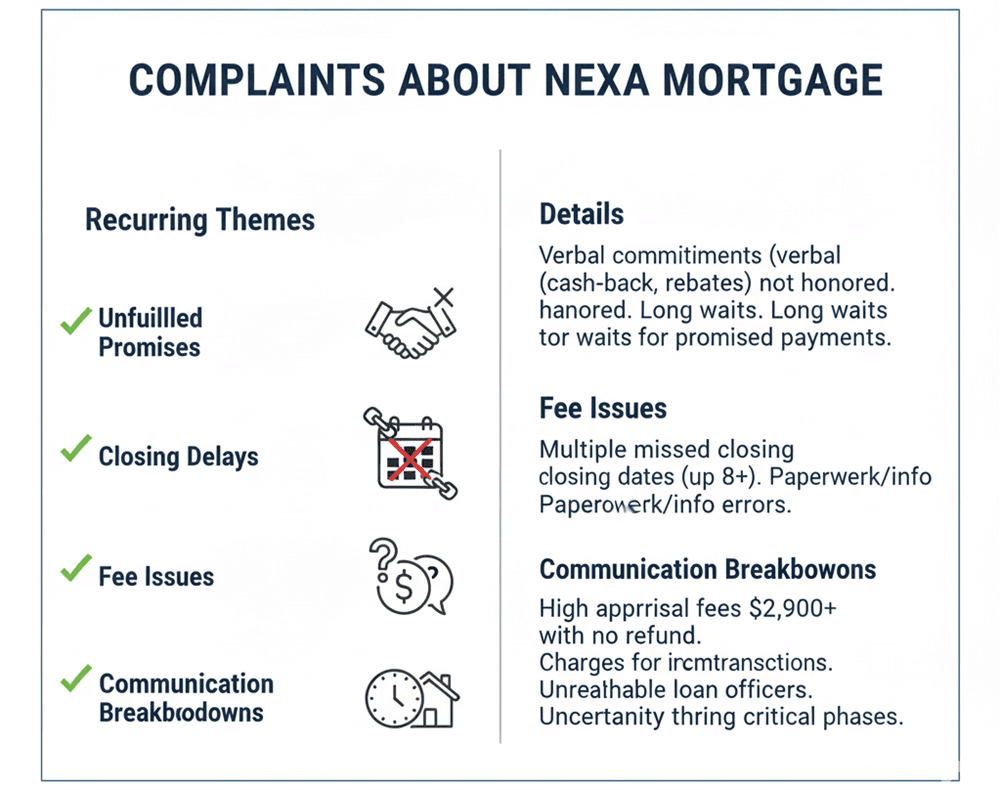

Complaints About NEXA Mortgage

There are several topics that people mainly complain about NEXA Mortgage on the Better Business Bureau, such as:

-

Unfulfilled verbal promises or cash-back/rebate disputes. Several complaints allege that loan officers verbally promised cash-back at closing or rebates that were not reflected in closing documents.

-

Closing delays and documentation errors. Customers have reported repeated postponements of closing dates attributed to paperwork errors, missing disclosures, or underwriting problems.

-

Fee disputes. Appraisal charges, technology or onboarding fees, and one-off costs are common sources of friction when borrowers feel they were surprised by items added to their closing statements.

-

Communication breakdowns. A dominant complaint pattern is an inability to reach the loan officer or branch support at critical moments during the transaction.

Real Customer Reviews on NEXA Mortgage

What do reviewers say across commonly used platforms? Here I collect customer reviews from 3 popular sites. Each of these platforms attracts different audiences and therefore different types of feedback.

Zillow: 4.9/5

Zillow profiles for NEXA loan officers and the company show a large number of high-rated reviews. The platform's reviewer base tends to include many borrowers who successfully closed loans. That skews the sample toward completed, positive outcomes. Positive Zillow reviews mention helpful loan officers, competitive rates, and quick closings. Even so, a few Zillow reviewers mention initial communication hiccups that improved as the file progressed.

Heather was great to deal with and all the people in her office were great. The entire process was great. The communication between all parties was awesome and Heather kept me in the loop the whole time.

Michael went above and beyond our expectations right up to our recording date! I highly recommend him and his team to help you with all of your real estate financing!

We greatly enjoyed working with Garrett, he made the whole process easy . Answered any and all questions he could. Highly recommend. Would definitely work with him again in the process of buying a home.

TrustPilot: 3.2/5

TrustPilot captures a broader mixture of feedback, including more critical and longer-form complaints. Positive TrustPilot reviews highlight helpful leadership and loan officers who work hard to close files. Negative reviews often focus on fee transparency, internal fee collections affecting loan officers, and company policies that reviewers (often loan officers) view as unfavorable.

The involvement of Amanda, as a party to the buyer's lender, has led to our closing date being rescheduled multiple times, causing significant distress for both our family and the buyer's family. We have been without homes and personal property, missed important work events, and incurred substantial expenses for food and lodging over the past 7 days. Our children and animals have been displaced, and our daily routines and continuing education programs have been negatively impacted. Amanda's actions have not only caused hardship for two families, but have also inconvenienced several professionals, including our lender, realtors, the sellers of our new property, and the title company. Despite not being our lender, Amanda has had a significant impact on our lives and the lives of many others. As of now, both the buyer and our family are without a place to live, 6 days after our original closing date. Amanda's unprofessionalism, lack of dependability, and failure to be held accountable for the hardship she has caused are unacceptable

If I could rate this company with a negative amount of stars, I would. What an absolute disaster of a company. Stay away from Nexamortgage, Axenmortgage (same company) and Michael Tracy. Roped us around for 3 weeks, gave us nonsense information that actually made my credit score decrease, then wanted us to pay another $300 to pull my scores again. All in all, I've spent THOUSANDS of dollars per Michael Tracy and have nothing to show for it. I do have ALL of the screenshots and would be more than happy to provide them to everyone who wants to see them.

BBB: 1.8/5.0

BBB's customer reviews pull more of the formal complaint volume, including disputes about unfulfilled promises, closing delays, and difficulty obtaining refunds for services when loans do not close. These formal complaints tend to emphasize the resolution process (or lack thereof) and can be more detailed than casual review-site comments.

There are over [NUMBER] loan officers at NEXA Mortgage and the company culture is cooperation and not competition. I've met so many NEXAns and can't get over what a wonderful company they are.

If I could give them zero stars I would. [LOAN OFFICER NAME] gave me nothing but the run around for two months. Then bashed me and my wife's financial status personal information on [PLATFORM]. Luckily I found a lender that was not a scumbag thru a different company and closed on my home in 3 weeks don't use this company and DO NOT use [LOAN OFFICER NAME].

Loan Options Offered by NEXA Mortgage

NEXA offers the standard roster of residential mortgage products through its wholesale lender network. Because loan officer teams choose lenders and product partners, NEXA can support a broad mix of programs — from conventional fixed-rate mortgages to government-insured products and specialty offerings.

-

Adjustable Rate Mortgage: ARMs begin with a fixed-rate period (commonly 5/1, 7/1, or 10/1) and then adjust periodically. They typically offer lower initial rates than long-term fixed loans but carry interest-rate and payment risk when adjustments begin.

-

Fixed Rate Mortgage: Fixed-rate loans (15- and 30-year are the most common) provide predictability and are popular with borrowers who plan to own long-term or who prioritize stable monthly payments.

-

FHA Loans: FHA loans are government-insured and typically allow lower credit scores and smaller down payments, making them an important option for first-time buyers and borrowers with limited cash.

-

VA Loans: VA loans offer eligible veterans and service members strong benefits: potential zero down payment, no private mortgage insurance, and flexible credit criteria.

-

Jumbo Loans: Jumbo financing covers loan amounts above conforming limits and usually requires stronger credit profiles, larger down payments, and greater documentation.

-

203K Loans: The FHA 203(k) program lets borrowers finance purchase plus renovation in a single loan — helpful when buying fixer-uppers.

-

USDA Loans: USDA loans support eligible rural purchases with low- or no-down-payment options for qualifying borrowers.

-

Reverse Mortgage: Homeowners aged 62+ can access reverse mortgage options to turn home equity into cash, but these products carry long-term tradeoffs for heirs and estate planning.

Free Tools Provided by NEXA Mortgage

NEXA publishes several consumer tools on its site that help borrowers estimate affordability, calculate payments, and prepare pre-qualification materials. Tools listed on their site include:

-

Pre-Qualification Letter: A quick snapshot used for house hunting. It is an initial assessment, not a guarantee of loan approval.

-

Refinance Analysis: A calculator to help homeowners compare their current loan with potential refinance scenarios and estimate break-even points.

-

Payment Calculator: Estimates monthly mortgage payments given loan amount, rate, term, taxes, insurance, and (when relevant) mortgage insurance.

-

Search Homes for Sale: An integrated listings search that pairs property discovery with mortgage illustrations.

-

Home Value Estimate: Automated valuations to estimate property worth. useful for planning but not a substitute for an appraisal.

-

Empowering Your Home Ownership Dreams: NEXA links to insurance-quote tools so borrowers can estimate insurance costs needed for closing and budgeting.

-

PRMI Calculator: A private mortgage insurance estimator to show the impact of PMI on monthly payments when down payments are under 20%.

FAQs About NEXA Mortgage

Q1. Is NEXA Mortgage a broker or lender?

NEXA Mortgage operates primarily as a mortgage broker. That means the company connects borrowers to wholesale lenders rather than lending from its own capital. Borrowers benefit from the ability to compare multiple wholesale pricing sources, but outcomes depend on the loan officer's selection of lender and execution.

Q2. Who owns NEXA Mortgage?

NEXA was co-founded in 2017 by Mike Kortas and Mat Grella. Public reporting and company filings indicate Kortas remains the CEO and that the co-founders had closely held ownership stakes. In early 2024, the company publicly disclosed a leadership split and the termination of Mat Grella. Ownership and buyout discussions were widely reported in the mortgage trade press.

Final Word

NEXA Mortgage presents a complex picture for prospective borrowers evaluating their options. The company's extensive lender network and competitive pricing can deliver excellent results for customers, paired with experienced, attentive loan officers. Successful transactions often feature responsive communication, favorable rates, and efficient closings that meet buyers' timelines. However, the decentralized broker model creates inconsistency, where service quality depends heavily on individual loan officer competence and commitment.

The stark rating differences across platforms reveal this variability. Zillow's high scores reflect satisfied customers who successfully closed, while BBB's lower ratings capture borrowers encountering problems with communication, unfulfilled promises, or documentation errors. This disparity suggests that NEXA can deliver either exceptional or frustrating experiences depending on which loan officer handles your file.

For borrowers considering NEXA, thorough due diligence becomes critical. Research your specific loan officer's track record, read their individual reviews, and maintain detailed written documentation of all promises and commitments. Ask direct questions about timelines, fees, and processes upfront. Verify that your loan officer has sufficient experience with your loan type and scenario.

NEXA's broker model offers genuine advantages through access to multiple lenders and competitive rate shopping. However, success requires finding a quality loan officer who provides consistent communication and follows through on commitments. The company can work well for informed borrowers who carefully vet their loan officer and remain actively engaged throughout the process, but it may pose risks for those assuming all mortgage brokers deliver identical service quality.

Ultimately, NEXA Mortgage isn't inherently good or bad—it's a platform connecting borrowers with independent loan officers of varying capability. Your outcome will largely depend on choosing the right professional within their network and maintaining vigilant oversight of your transaction from application through closing.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

- MortgagePros Reviews 2026: Is It a Scam or Not?

- Tomo Mortgage Reviews: Learn Pros, Cons, Complaints Here

- E Mortgage Capital Reviews: Everything You Want to Know Here

- Guild Mortgage Reviews: Pros, Cons, Complaints, and Rating