Society Mortgage Reviews: Pros, Cons, Complaints to Learn

Are you considering using Society Mortgage but feeling uncertain about whether it's the right choice for your home purchase? Many homebuyers face this dilemma when exploring mortgage lenders. With countless options available and stakes running high, selecting a trustworthy lender deserves careful research.

This comprehensive guide examines Society Mortgage's strengths, shortcomings, and real customer feedback across multiple platforms. Whether you're a first-time buyer, real estate professional, or seasoned investor, understanding the true landscape of this lender helps you make an informed decision about your mortgage journey.

What is Society Mortgage?

Society Mortgage is a U.S. mortgage banker that offers a broad set of home-loan products (FHA, VA, USDA, conventional, jumbo, 203(k), and Non-QM options) and operates both online and through regional offices. The company's own "About" page states it traces its roots to a firm founded by Chad Turner in 1996 and that the business later evolved from a mortgage brokerage model (CREFCO) into an FHA/VA/USDA-approved mortgage banker.

Society Mortgage positions itself as a lender that handles a wide range of borrower profiles, from first-time buyers to self-employed and investor borrowers, and publishes educational content and product pages for each loan type on its site. The company lists an NMLS/company ID and shows multiple office locations, like Fort Lauderdale, FL, and a presence in Portland, ME, among others.

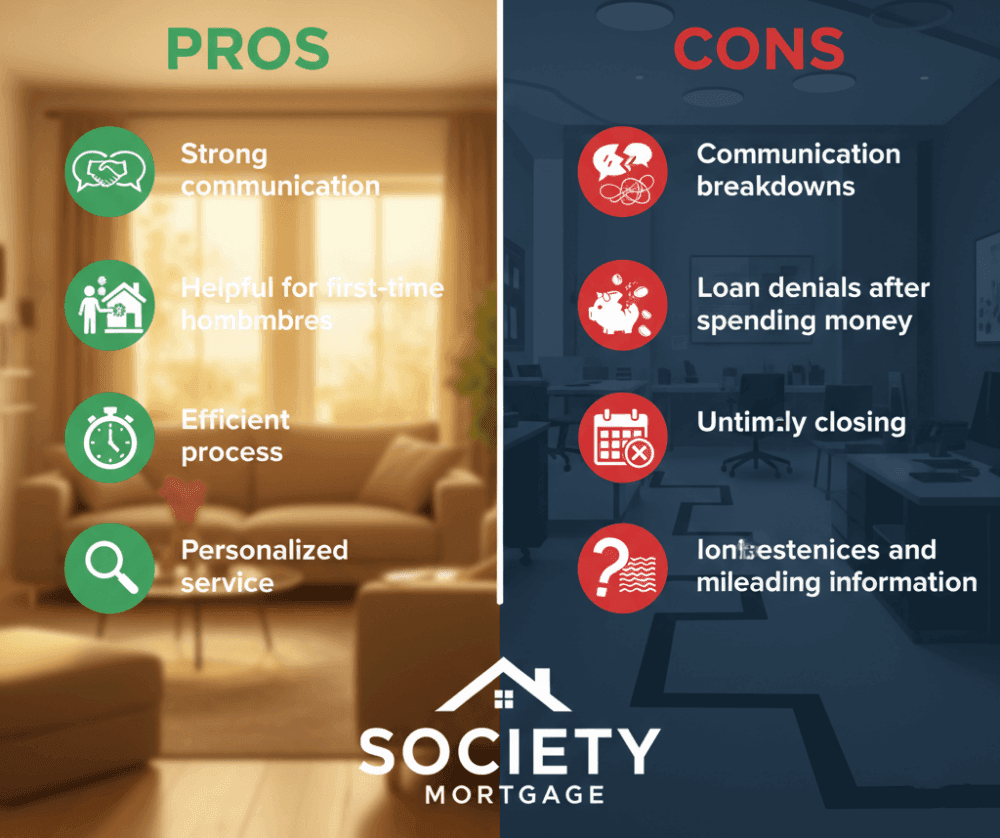

Pros and Cons of Society Mortgage

Society Mortgage presents strengths that appeal to particular borrower segments and recurring issues that prospective customers should weigh.

Pros

- Strong communication: many reviewers single out individual loan officers who were highly communicative and responsive during the process.

- Helpful for first-time homebuyers: reviewers on multiple platforms note clear explanations and educational support for first-time buyers.

- Efficient process: several customers report streamlined document upload tools and relatively fast processing/closings compared with traditional banks. Society Mortgage also promotes digital tools aimed at speeding workflows.

- Personalized service: loan officers able to structure solutions for VA, USDA, Non-QM, and other niche programs receive frequent praise.

Cons

- Communication breakdowns: while many praise individual officers, numerous complaints point to times when loan officers became hard to reach or when follow-through lagged. BBB complaint records and multiple negative reviews reflect this pattern.

- Loan denials after spending money: some consumers reported paying appraisal/processing fees or completing underwriting steps before learning their loan would not be approved, a recurring theme in complaint threads.

- Untimely closings/processing delays: delays pushing closing dates and causing logistical stress are mentioned in several negative reviews.

- Inconsistencies or unclear disclosures: a subset of complaints describes confusing or changing explanations about fees, program eligibility, and final loan terms.

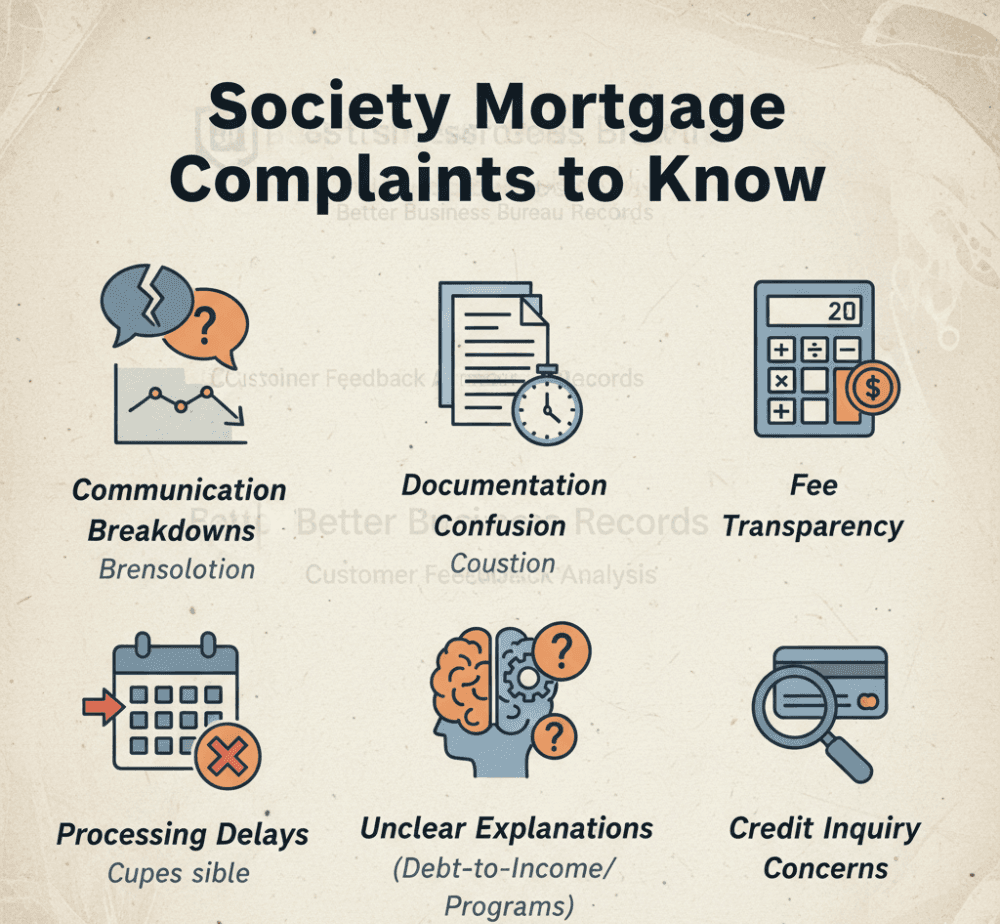

Society Mortgage Complaints to Know

A review of Better Business Bureau (BBB) complaint listings shows a clustering around a few themes:

- Communication issues: unreturned calls/emails, poor follow-up.

- Unexpected denials or underwriting reversals after application steps and costs were incurred.

- Documentation and processing errors, like requests to re-submit forms, and confusion about required paperwork.

- Fee/closing cost transparency: customers reported that final costs differed from initial estimates.

- with working with this mortgage company I feel they fumbled mine and my husbands file from the get go. They would say one thing then do the other, never responded when asking for an update, and the the fact that i had to pay for an appraisal thru them before final approval on the loan keeping me from essentially swapping lenders since i felt like they were playing with my time. The kicker was when we were told to come up with ****** to pay for my husbands irs tax that was owed and it wasn't even that much but i understood the extra to cushion just in case, but was told that i would get the extra back from it at the closing table and was told this multiple times. now they are stating that i get nothing back and the extra from it was baked into my loan giving me lower interest. i was not told this when it was happening

- Getting texts and phone calls, Saying the credit bureau or whatever is gonna sell my information that I need to contact them or do something to opt out of it. I dont even know who these people are. I dont have a mortgage through these people. I have no clue why they keep contacting me this is bull c*** and they wont stop.

- Wasted a month of my time after running my credit. Did not contact me after a week of me calling and leaving voicemails nonstop. I was told I would be contacted the next day multiple times, never happened. Ended up having to change to a different mortgage company which had to pull credit again and close on the house for me with no trouble. Terrible communication, told me multiple things that were not true. Need this credit inquiry erased, complete waste of time, had me thinking Society Mortgage was a scam!

Listen to the Real Voices for Society Mortgage

To avoid relying on a single source, I synthesized customer feedback from three independent platforms below. Each platform has different sampling characteristics, so reading them together gives a fuller picture. BBB tends to show complaint/resolution threads. TrustIndex aggregates site reviews. Zillow often lists reviews from borrowers who used the lender during property searches.

BBB: 4.09 out of 5.0

The BBB profile lists Society Mortgage's customer review average at 4.09/5. Society Mortgage is BBB-accredited, and the profile shows years in business and accreditation dates. Positive BBB reviews highlight helpful loan officers and successful closings. Negative entries emphasize the communication and documentation issues summarized above.

- So far everything has been great a few surprise questions but nothing **** has not been awesome helping with. His team seems also great as well. Waiting for clear to close and have every confidence right now it will happen. I am sometimes impatient and texted or emailed questions all received well and replied to. Will update later. Oh he also helped me deal with a real estate that was unresponsive very instrumental in me getting the home I want. And my apologizes to that agent for my rash texts.

- Alfredo has been amazing. Very insightful, explaining every step of the process along the way. Fast, courteous, and knowledgeable. Would definitely recommend this company!

- My experience with Society Mortgage was very refreshing. My officer was listening to what I wanted and gave very helpful advice. It was good to work with someone that wanted to make a pleasant positive outcome.

Trustindex: 4.6 out of 5.0

Trustindex aggregates reviews and, at the time of checking, shows Society Mortgage with an overall rating of around 4.6/5 from over 2,000 reviewers. Many Trustindex entries praise named loan officers and the company's responsiveness. Negative Trustindex posts echo issues about program explanations or misunderstandings in a minority of cases.

- Worked with Michael Posso through this first time experience. With him and everyone else they made it fairly easy and simple. Several things was confusing for me but he was there for my questions. If I could give the man a fist bump, I would. He deserves it.

- I have been trying to contact my loan officer assistant and cannot get through. I have emailed, I called and her mailbox is full so I can't even leave a message. She has emailed me saying that she has not heard from me and has tried to contact me. I do not know what is going on, but I would like help with trying to buy my fathers house please.

- Amazing ,helpful,respectful and very professional Johnathan was a great help taking us through this process and everything work out more than I aspected God bless him and his family his respectfulness was unbelievable

Zillow: 4.89 out of 5.0

Zillow lists Society Mortgage with a high rating of around 4.89/5. Zillow reviews frequently come from borrowers who completed transactions and, therefore, tend to skew positive. Common positive themes are competitive rates and helpful loan officers, while the less common negatives mirror communication or closing-timing complaints found elsewhere.

- He was on top of everything. He told me where I needed to be credit wise and how much I could expect for closing and made my payments within my ballpark on the lower side. He helped me to line up all of the needed resources. I am honestly impressed.

- I couldn't ask for an easier person to work with, Jonathan made the process of buying a house easy, less stressful, positive energy, great communication, answers all questions you have, he will follow up with you to make sure everything is going ok and if you have any questions, I bought 2 houses and I had Jonathan both times so it was nice to know things will get done.

- Working with John has been such a seamless process. He's very attentive and answered all of my questions. The process was quick and easy. I highly recommend working with him. 10/10!! Thanks again John!!

Home-buying Loans Offered by Society Mortgage

Society Mortgage publishes product pages for a full suite of purchase products. The introduction below summarizes the company's publicly stated offerings and usual program characteristics.

- USDA Purchase Loans: Society Mortgage is USDA-approved and publishes a USDA purchase loan guide explaining eligibility (rural area maps, income limits, primary-residence requirement, and zero-down structure). These loans can be attractive for buyers in eligible rural/suburban areas.

- FHA Purchase Loans: Society Mortgage's FHA purchase pages cover FHA eligibility, minimum down payment (3.5%), mortgage insurance implications, and appraisal/underwriting processes, useful for buyers with lower credit scores or small down payments.

- VA Purchase Loans: The lender offers VA purchase loan support for eligible service members, veterans, and certain family members. Society Mortgage materials describe COE verification, entitlement usage, and the lack of monthly mortgage insurance for VA loans.

- Conventional Purchase Loans: Society Mortgage's conventional loan pages explain conforming loan mechanics, PMI considerations, and profile guidance for borrowers with stronger credit and larger down payments.

- 203K Purchase Loans: Society Mortgage provides FHA 203(k) financing for purchase+rehab scenarios (detailed contractor estimates, renovation scopes, and disbursement mechanics are covered on the 203(k) pages). This suits buyers purchasing homes that require substantial repairs.

- Jumbo Purchase Loans: Society Mortgage offers jumbo financing for high-balance purchases. The site outlines typical higher credit/down payment expectations and refinance parallels for jumbo balances.

- NON-QM LOANS: The lender's Non-QM product pages list multiple alternative documentation programs (bank-statement, P&L, 1099, DSCR, ITIN, asset-based solutions). These target self-employed or non-W-2 borrowers who don't fit conventional underwriting. Non-QM pricing and terms usually reflect higher perceived risk.

Refinance Programs Offered by Society Mortgage

Society Mortgage also documents multiple refinance pathways (USDA, FHA, VA streamlines and full refinances, conventional, 203(k) refinance for rehab, and jumbo refi options). Each refinance page explains the program's intended benefit (rate-term reduction, streamline ease, or cash-out flexibility). Borrowers should evaluate closing costs vs. projected savings and consult a loan officer for eligibility.

- USDA Refinance Program: Society Mortgage documents USDA-specific refinance options (including streamline types where available) and the primary-residence/area/income limits applicable to USDA refinance eligibility.

- FHA Refinance Program: FHA streamline and full refinance options (including rate-term and cash-out where permitted) are explained on the FHA refinance page. These can reduce borrower documentation in certain qualified scenarios.

- VA Refinance Program: VA IRRRL (Interest Rate Reduction Refinance Loan) and other VA refinance options are described, focusing on simplified documentation and entitlement considerations for veterans.

- Conventional Refinance Program: Society Mortgage's conventional refinance page outlines rate-term and cash-out options for conventional loan holders.

- 203K Refinance Program: FHA 203(k) refinance is available for homeowners seeking to refinance and fund renovations in one loan. Site guidance lists eligibility and underwriting expectations.

- Jumbo Refinance Program: High-balance refinances are supported with jumbo refinance offerings. The page covers typical jumbo requirements and considerations.

FAQs About Society Mortgage

Q1. Is Society Mortgage trustworthy?

Yes, with caveats. Society Mortgage is a licensed mortgage banker approved for FHA/VA/USDA programs and publicly lists NMLS/company IDs and office locations. The company is BBB-accredited and presents thousands of public reviews across aggregator sites, which supports institutional legitimacy.

Q2. Is Society Mortgage legit?

Yes. Society Mortgage operates as a real mortgage bank (NMLS/company ID visible on its site), advertises approvals for FHA/VA/USDA, and maintains a consumer-facing web presence with product pages and a contact workflow. There are no public indications in the major regulatory or industry pages consulted that the company is a sham. However, as with any lender, individual service experiences vary, and customers should confirm licensing and current status in their state via the NMLS Consumer Access tool and state regulator pages.

Conclusion

Society Mortgage is a legitimate, multi-product mortgage banker with documented experience across government and conventional programs and a public footprint of thousands of reviews and ~21,000+ loans closed. The majority of public feedback is positive, with many borrowers single out talented loan officers, strong support for first-time buyers, and useful digital tools that make document handling simpler. At the same time, a meaningful minority of complaints cluster around communication failures, unexpected underwriting reversals, and timeline/closing delays.

Practical takeaways for borrowers considering Society Mortgage

- Ask for the loan officer's NMLS and direct contact info, and confirm prior experience with your loan program (USDA, VA, Non-QM, etc.).

- Get written estimates and a "clear-to-close" checklist, document what the lender expects and what fees are non-refundable before you pay them. This reduces the risk of surprise denials after costs are incurred.

- Rate-shop and compare underwriting overlays, Non-QM, jumbo, and government program overlays can differ materially between lenders. Compare at least two offers.

- If you need a quick close or tight timeline, confirm lead times (appraisal, title, seller windows) in writing and consider a local lender with a strong, proven track record for on-time closings in your market.

Society Mortgage is a viable option, especially for borrowers who need specialized programs (USDA, VA, Non-QM, 203(k)), but your outcome will depend heavily on the specific loan officer/team assigned and how clearly expectations and fees are documented at the outset. Combine the company's published credentials (NMLS, FHA/VA/USDA participation, loans-closed claims) with up-to-date review checks and direct due diligence to decide whether Society Mortgage fits your needs.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

- MortgagePros Reviews 2026: Is It a Scam or Not?

- Tomo Mortgage Reviews: Learn Pros, Cons, Complaints Here

- E Mortgage Capital Reviews: Everything You Want to Know Here

- Guild Mortgage Reviews: Pros, Cons, Complaints, and Rating

- NEXA Mortgage Reviews: What People Are Saying About?