Mutual of Omaha Mortgage Reviews: Pros, Cons, and Real Voices

Choosing a mortgage lender is one of the biggest financial decisions a homebuyer will make. If you're considering Mutual of Omaha Mortgage but aren't sure what to expect, this Mutual of Omaha Mortgage Review walks through what the company is, the strongest pros and the most common cons, real complaint themes from BBB and review sites, and ratings across major platforms, plus practical takeaways you can use when you shop for a loan.

What is Mutual of Omaha Mortgage?

Mutual of Omaha Mortgage is the residential mortgage arm of the Mutual of Omaha family. The parent company traces its roots to 1909. The mortgage business as a mortgage originator/servicer operates nationally and positions itself as a full-service residential lender offering purchase, refinance, construction, renovation, and reverse-mortgage solutions. The company highlights an emphasis on customer service and educational resources for borrowers, like Homebuying 101, First-Time Buyer guidance, calculators, etc.

With approximately 500 loan officers across 70 branch locations, Mutual of Omaha Mortgage funded roughly $6 billion in home loans recently, making it a top-50 national lender. The company's mission emphasizes helping customers protect their priorities and achieve financial objectives through personalized mortgage solutions. Their core values include existing for customers, acting with integrity, embracing innovation, maintaining accountability for results, and collaborating to achieve collective success.

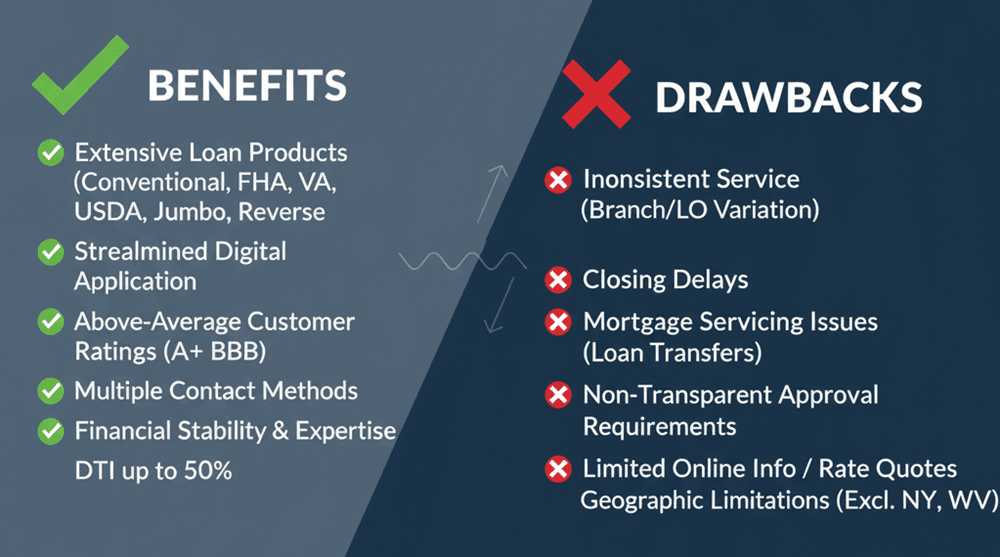

Pros and Cons of Mutual of Omaha Mortgage

Here are the main strengths and weaknesses summarized from the company's site and independent review sources.

Pros

- Wide variety of loan options: conventional, FHA, VA, USDA, jumbo, construction/renovation, reverse mortgages, and refinance options.

- Educational resources and calculators (Homebuying 101, Refinance 101, etc.) that help borrowers understand choices.

- Third-party review presence and generally positive ratings on some large review sites.

- Multiple contact/interaction methods (online application, borrower portal, phone, branch/loan-officer network) and national footprint.

- Flexibility in underwriting for some borrowers: publicly available third-party reviews note Mutual of Omaha's willingness to consider higher debt-to-income profiles in certain programs.

Cons

- Inconsistent borrower experiences across branches and loan officers: many negative reviews cite variation by individual originator and region. Independent review sites and BBB complaints show this pattern.

- Complaints about processing and closing delays appear repeatedly in public reviews and BBB records.

- Issues related to mortgage servicing (loan transfers to other servicers, lost checks, late-fee disputes) show up in complaint threads.

- Limited public details on some approval/price features on the website.

- Marketing/contact issues: some borrowers report persistent direct-mail or solicitations even after asking to opt out.

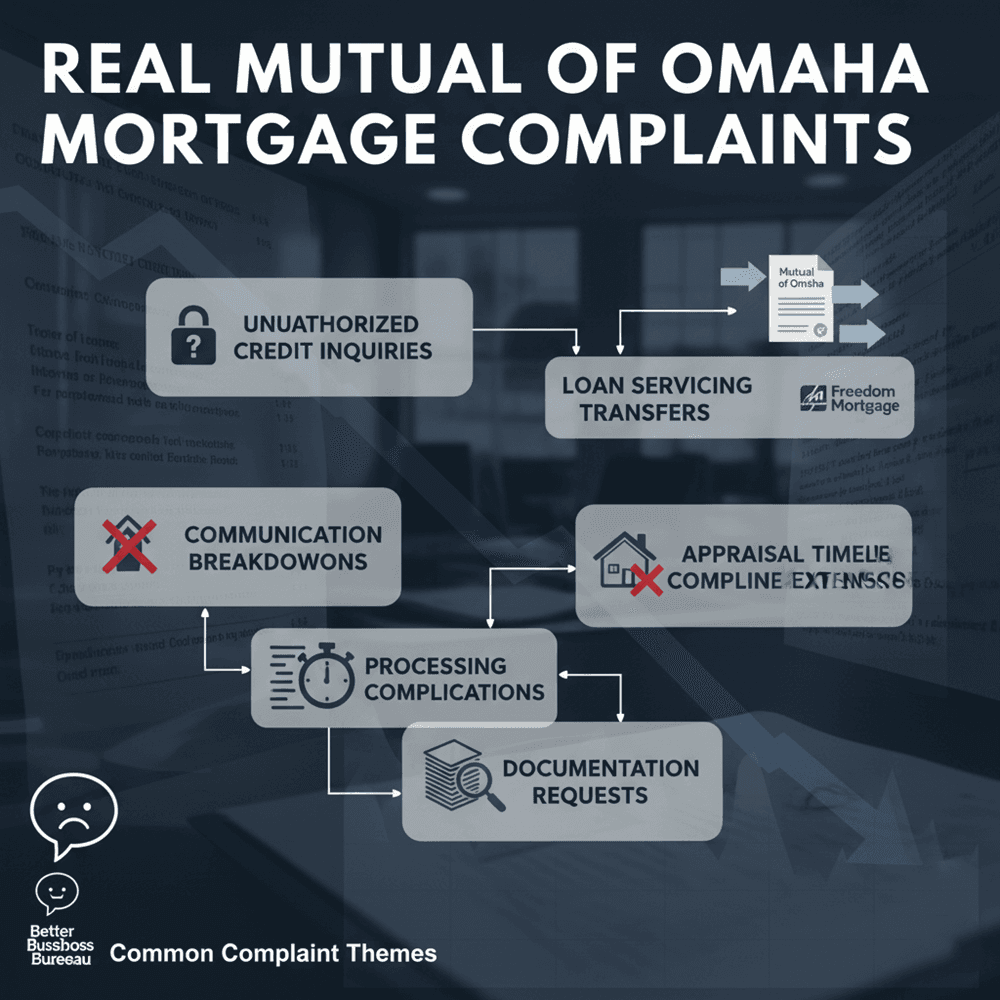

Real Mutual of Omaha Mortgage Complaints

Across BBB complaint threads, there are some public reviews that show several recurring themes:

- Communication breakdowns: unanswered emails/phone messages and slow responses during the underwriting or closing stages are commonly reported.

- Servicing transfers & post-closing issues: some borrowers report their mortgages being sold/transferred to third-party servicers, sometimes accompanied by payment or payoff processing problems.

- Processing delays and rate lock disputes: borrowers report long timelines and disputes around when/if a rate was locked.

- Appraisal and title problems: lower-than-expected appraisals, disputes over appraisal accuracy, or title/closing company errors that lengthen closings.

Real Mutual of Omaha Mortgage Reviews

Examining feedback across independent platforms provides a balanced perspective on actual customer experiences. These reviews reflect diverse borrower situations and help identify patterns beyond individual incidents.

TrustPilot: 3.9/5.0

Trustpilot lists 886 reviews and a TrustScore of around 3.9/5. Positive reviews praise helpful, knowledgeable loan officers, especially on reverse mortgages and complex cases. Negative reviews typically cite communication failures, appraisal problems, long closing times, and aggressive marketing/solicitation. The company appears to respond to a substantial share of negative reviews.

I was very satisfied with the diligence and perseverance shown by our loan officer John Briggs. He communicated every step of the process in coordinating the reverse mortgage application through to a successful completion. We understood each step of the process which was fully explained by John throughout the approval process. I rate his knowledge very high and his sincerity outstanding.

Jim Scheffler and his team were instrumental during the prequalification and application process. He informed us of all the available programs that were out there and answered any question we had right away. We had wanted to make an offer on a property over a weekend and he was able to get us the information that we needed that same day. This is service at it's finest!

Horrible company. I've requested them to stop sending me mortgage offers and take me off their mailing list for over two years and they always say they do and then another one the next week. They also don't show it is Mutual of Ohama, it comes as VA Loan Program and in the tiny fine print shows their real name and states they have no affiliation with VA. False advertising.

ConsumerAffairs: 3.6/5.0

ConsumerAffairs shows a mixed picture. Positive posts tend to come from reverse mortgage customers who mention patient explanations. Negative posts focus on refinance delays, rate-lock surprises, and customer-service frustrations.

Dave G was very responsive and assisted me to file a requested for a new mortgage. He assured me that I would hear back, but to date I have not received any new information. This mortgage is very important to me and my business. A reply would be appreciated. Thank you for your reply in advance.

After a harrowing month of back and forth between loan officer and whoever is above him, I don't have the reverse mortgage I had hoped for. So now having to go through the whole process with some other company who may be just as lame. I was very forthright about my income and even sent them 3 years of tax returns rather than two so that they could see my home business was making a profit on some years. With that said they kept harping about my 1040, line 12, saying they weren't seeing a Schedule A. That is the line where you either have itemized deductions or you just take the Standard. I always take the Standard. Any accountant would realize this, duh! I could not make them understand this. A whole week wasted over ignorance. Guess I should have read the reviews first. Enough said.

They were nice and friendly and helpful upfront. Got my mortgage closed super fast. Communication was awesome! Felt like I had made new friends and they even sent a welcome letter and said they would be servicing the mortgage and all was great! Then I got a letter in the mail before my first payment was even due saying they sold it to another company. This company is rude and said I had to mail in payments or pay over the phone. I googled and found a payment website but it directed to another site that says it's not owned or operated by them and they needed my SSN. I called the customer service number and the lady was super rude saying, "Well that's your only option and basically to just suck it up." MOA talks a good game but doesn't follow through on what they say. I do not recommend.

Experience: 4.86/5.0

Mutual of Omaha's website highlights an Experience.com score of 4.86/5 with a very large number of reviews displayed on the corporate homepage. This is one of the highest third-party scores shown publicly and is prominently quoted on the company site. However, platform methodologies and the mix/timing of review solicitation can vary between sites, which helps explain score differences across platforms.

Chris was very knowledgable and professional . He responded promptly and took time for phone calls when needed. He explained the process thoroughly and provided best options. Overall, super easy and efficient experience .

Kayla made things very plain and simple. When I had questions about needed documents, I got answers quick. The process was made very easy and relatively quick.

Justin walked me through the whole process and answered any question I had quickly. Justin also gave me sound advice to help raise and maintain my credit Justin is very honest and I would recommend having him work with anyone to purchase a home

Loan Programs that Mutual of Omaha Mortgage Provides

Mutual of Omaha offers a broad product set. Here are the program categories the company documents on its site.

Homebuying 101

The Homebuying 101 program provides foundational education for those new to real estate transactions. This resource explains the entire purchase process from initial planning through closing, demystifying potentially overwhelming procedures. Topics covered include budgeting for homeownership, understanding credit requirements, determining affordable price ranges, and navigating the application journey.

First-time buyers benefit from guidance on saving for down payments, choosing between loan types, and preparing required documentation. The program emphasizes realistic expectations about timelines, costs beyond purchase price, and ongoing homeownership responsibilities. Interactive tools help estimate monthly payments under different scenarios, enabling informed decisions before committing to specific properties or loan amounts.

First-Time Homebuyer

First-time homebuyer programs specifically address unique challenges facing those entering homeownership. Mutual of Omaha offers low down payment options, including 3% conventional loans and 3.5% FHA financing, reducing upfront cash requirements that often present barriers. Flexible credit score standards accommodate borrowers still building credit histories, though higher scores unlock better rates.

Educational counseling helps first-timers understand long-term financial implications and avoid common pitfalls. Down payment assistance program information connects buyers with potential grants or subsidized second mortgages where available. The company's patient approach recognizes that first-time buyers need extra support navigating unfamiliar terminology and processes. Loan officers work to match borrowers with appropriate products rather than pushing maximum loan amounts that might create future financial strain.

Second Home

Second home financing enables purchasing vacation properties or getaway residences while maintaining primary residences. These loans require higher down payments than primary residence mortgages, typically 10-20% depending on credit and loan type. Interest rates may run slightly above primary residence rates due to perceived higher risk. Qualification considers both existing mortgage obligations and proposed second home payments, requiring sufficient income to support dual housing expenses.

Property must be situated reasonable distance from the primary residence and intended for personal use rather than rental income. Vacation home purchases represent significant financial commitments requiring careful analysis of carrying costs, including maintenance, insurance, property taxes, and utilities. Mutual of Omaha's advisors help evaluate whether second home ownership aligns with overall financial plans before proceeding with applications.

Investment Property

Investment property loans facilitate purchasing rental properties or houses intended to generate income. These mortgages carry stricter qualification requirements, including higher credit scores, larger down payments (typically 15-25%), and lower debt-to-income ratio limits. Lenders analyze projected rental income alongside borrower employment earnings, though rental income calculations often use conservative percentages to account for vacancy periods and maintenance costs.

Interest rates exceed primary residence rates due to higher default risk when properties don't generate expected returns. Investment property financing requires demonstrating adequate reserves covering several months of mortgage payments plus anticipated repairs. Mutual of Omaha evaluates borrower experience with rental properties, offering more favorable terms to seasoned landlords versus first-time investors. Understanding local rental markets and realistic income projections proves essential before committing to investment property loans.

Fixer Upper

Fixer upper loans combine purchase financing with renovation funding in single mortgages, eliminating need for separate construction loans. FHA 203(k) and conventional renovation products enable buying properties needing significant repairs that traditional financing wouldn't approve. Loan amounts incorporate purchase price plus estimated renovation costs, with funds disbursed as work completes according to approved contractor schedules.

Properties can be uninhabitable at purchase, allowing buyers to transform distressed houses into desirable homes. Required inspections ensure renovation plans address code violations and safety issues. Working with approved contractors and detailed renovation budgets becomes mandatory. These complex transactions take longer than standard purchases, requiring patience and realistic timelines. Fixer-upper financing appeals to buyers willing to manage renovation projects in exchange for potential equity gains and customized living spaces.

Construction Financing

Construction financing funds building new homes from ground up, providing funds throughout building phases rather than single lump sums. Construction-to-permanent loans transition from construction financing to permanent mortgages upon completion, avoiding dual closing costs. Initial down payments typically reach 20% or higher, with interest-only payments during construction periods. Detailed construction plans, licensed contractor agreements, and realistic budgets prove essential for approval.

Lenders disburse funds in draws as construction milestones complete, with inspections verifying work quality before releasing subsequent payments. Construction periods usually span 6-12 months depending on home complexity and weather factors. Building costs can exceed estimates, requiring contingency funds to cover overruns. Mutual of Omaha's construction specialists guide borrowers through these intricate transactions, ensuring proper documentation and realistic planning.

Relocation

Relocation mortgage assistance helps employees transferring to new geographic areas for work. Corporate relocation packages sometimes include employer assistance with closing costs or temporary housing during transitions. Quick processing becomes critical when job start dates loom, requiring efficient documentation gathering and underwriting. Relocation buyers may lack familiarity with new markets, making local expertise valuable for neighborhood selection and pricing evaluation.

Distance complicates property viewing and inspections, potentially requiring video tours or trusted representative involvement. Selling existing homes while purchasing new properties creates timing challenges that bridge loans or contingent offers might address. Mutual of Omaha's national footprint enables coordinating with loan officers in destination cities, providing local market insights alongside financing. Streamlined processes help transferring families establish housing quickly, minimizing disruption to work and personal lives.

Refinance 101

Refinance 101 education explains reasons to replace existing mortgages with new loans offering improved terms. Rate-and-term refinancing secures lower interest rates or changes the loan duration without extracting cash, potentially saving thousands in interest over loan's life. Refinancing from adjustable-rate to fixed-rate mortgages provides payment stability and protection against future rate increases.

Removing private mortgage insurance becomes possible once equity reaches 20%, eliminating this monthly expense. Consolidating debt through refinancing taps home equity to pay high-interest credit cards or other obligations, though extending repayment over the mortgage terms increases total interest paid. Timing refinancing requires weighing closing costs against monthly savings, calculating break-even points where accumulated savings exceed upfront expenses. Market conditions and personal financial changes both influence optimal refinancing timing.

Cash Out Refinance

Cash out refinance replaces existing mortgages with larger loans, providing a lump sum cash equal to the difference. Homeowners leverage accumulated equity for major expenses, including home improvements, college tuition, medical bills, or business investments. New loan amounts can reach 80% of current property values, though exact limits vary by loan type and credit profile. Interest rates typically exceed rate-and-term refinancing since lenders assume increased risk with larger loan balances.

Qualification requires demonstrating the ability to afford higher payments alongside sufficient equity cushions protecting lender interests. Cash-out proceeds get taxed differently than loan proceeds, creating potential tax implications requiring professional advice. Using home equity for non-essential spending risks losing homes if financial circumstances deteriorate. Mutual of Omaha advisors help evaluate whether cash-out refinancing serves long-term financial interests or creates unnecessary risk exposure.

Lower My Payment

Lowering monthly payments motivates many refinancing decisions when financial circumstances change or better rates become available. Extending loan terms from 15 to 30 years reduces monthly obligations, though it increases total interest paid over the loan life. Securing lower interest rates decreases payments while maintaining original payoff schedules, potentially saving substantial sums. Removing FHA mortgage insurance by refinancing to conventional loans once reaching 20% equity eliminates this monthly charge.

Adjustable-rate mortgages resetting to higher rates prompt refinancing to fixed rates, stabilizing future payments. Income reductions from job changes, medical issues, or retirement make payment relief essential for maintaining homeownership. Qualification for payment-reducing refinancing still requires meeting credit and income standards, though debt-to-income ratios obviously improve with lower housing payments. Strategic refinancing prevents financial distress while preserving homeownership through temporary or permanent income adjustments.

Debt Consolidation

Debt consolidation refinancing converts high-interest consumer debt into lower-rate mortgage debt, potentially reducing total monthly obligations. Credit card balances carrying 18-25% interest get paid through mortgage refinancing at 6-8% rates, dramatically cutting interest costs. Combining multiple debt payments into a single mortgage payment simplifies budgeting and reduces the likelihood of missed payments. Home equity enables accessing larger consolidation amounts than personal loans offer, addressing substantial debt burdens.

Lower interest rates and extended repayment periods reduce monthly cash flow requirements, though total interest paid may increase if debt gets stretched over decades. Consolidation works best when combined with spending changes, preventing debt reaccumulation. Secured debt (mortgages) carries foreclosure risk if payments fail, unlike unsecured credit card debt. Mutual of Omaha evaluates whether consolidation genuinely improves financial positions or merely delays inevitable problems requiring more fundamental solutions.

FAQs About Mutual of Omaha Mortgage Reviews

Q1. Is Mutual of Omaha a good place to get a home equity loan?

They offer home-equity options and cash-out refinances. Reviews are mixed: some borrowers are happy with the terms and guidance. Others report the company steering borrowers toward cash-out refinances rather than standalone HELOCs/home equity loans. Always compare product types (HELOC vs cash-out refinance) and ask for exact fee and rate comparisons in writing.

Q2. Does Mutual of Omaha offer mortgages?

Yes, Mutual of Omaha Mortgage provides purchase and refinance mortgages (conventional, FHA, VA, USDA, where available, jumbo, construction, renovation, and reverse mortgages). The firm publicly lists state licensing information. The company advertises operations in most U.S. states.

Q3. What credit score do you need for a Mutual of Omaha mortgage?

Exact minimums depend on product type: conventional loan programs typically target mid-600s (many lenders commonly cite ~620 as a ballpark), while FHA programs may accept lower scores under HUD rules. Third-party reviews and guides note that Mutual of Omaha offers flexibility in underwriting (and some published guides highlight acceptance of higher DTIs in certain programs). For a precise answer, request program-specific requirements from a Mutual of Omaha loan officer, and get them in writing.

Conclusion

Mutual of Omaha Mortgage is a legitimate, well-established mortgage originator with a large national footprint and a broad product menu, and it markets itself on customer education and a customer-first brand heritage. The company is BBB-accredited (A+) and appears on multiple review platforms with mixed but substantial feedback. That combination suggests a lender that can be a very good fit for many borrowers, especially those who need flexible underwriting or specialized products (e.g., reverse mortgages, renovation builds, construction), but where individual outcomes depend heavily on the assigned loan officer, the local branch, and the complexity of the transaction.

Practical next steps if you're shopping with Mutual of Omaha (or any lender):

- Get a full loan estimate in writing with itemized fees, lock status, and conditions.

- Ask how long the rate lock period is and whether extensions are available and get cost/extension policy in writing.

- Request the servicing plan: Will the loan be serviced by Mutual of Omaha or sold/transferred? and get contact names.

- Check independent reviews in your state and read recent BBB complaints for local branch patterns.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

- Raymond James Mortgage Reviews: Is It Any Good? Check Here

- United Wholesale Mortgage Reviews: What People Are Saying About?

- MortgagePros Reviews 2026: Is It a Scam or Not?

- Tomo Mortgage Reviews: Learn Pros, Cons, Complaints Here

- E Mortgage Capital Reviews: Everything You Want to Know Here

- Guild Mortgage Reviews: Pros, Cons, Complaints, and Rating

- NEXA Mortgage Reviews: What People Are Saying About?

- Society Mortgage Reviews: Pros, Cons, Complaints to Learn