No-Income Verification Mortgage: What Is It and Who Is It for?

I see this scenario in my office all the time: You run a successful business, your cash flow is strong, but your accountant did too good a job writing off your expenses. Now, your tax returns show almost no net income, and the traditional bank just denied your mortgage application. It's frustrating to have the money but not the "paperwork" to prove it.

But here is the truth: A low "taxable" income doesn't mean you can't buy a home. Enter the No-Income Verification Mortgage. This is a legitimate solution that looks at your real cash flow rather than your tax forms. And the best part? You don't have to figure this out alone. You can simply connect with a local loan officer for a free consultation to see what options are actually available to you.

What is a No-Income Verification Mortgage?

First, let's clear up a massive misconception. The term "No-Income Verification" is a bit of a misnomer. In the industry, we technically call these Non-QM (Non-Qualified Mortgage) loans.

It does not mean you get a loan with zero income. It simply means we verify your ability to pay without looking at your W-2s or standard 1040 tax returns.

People often remember the risky "NINA" (No Income, No Assets) loans that helped fuel problems before the 2008 crisis. Today, however, federal Ability-to-Repay (ATR) rules require lenders to consider and verify the income or assets they rely on, even for Non-QM loans. Instead of using W‑2s and full tax returns, many Non-QM lenders document repayment ability with third‑party records like bank statements or verified assets, which still must be specific to the individual borrower. These products are more regulated and documentation‑heavy than pre‑crisis "no doc" loans, even though they offer more flexibility to self‑employed and non‑traditional earners.

People Also Read:

- Non-QM Loan Requirements: Everything to Know At First

- Self-Employed Mortgage Guide: How to Get, Requirements

- Best Mortgage Lenders for Self-Employed: Top-Rated Picks

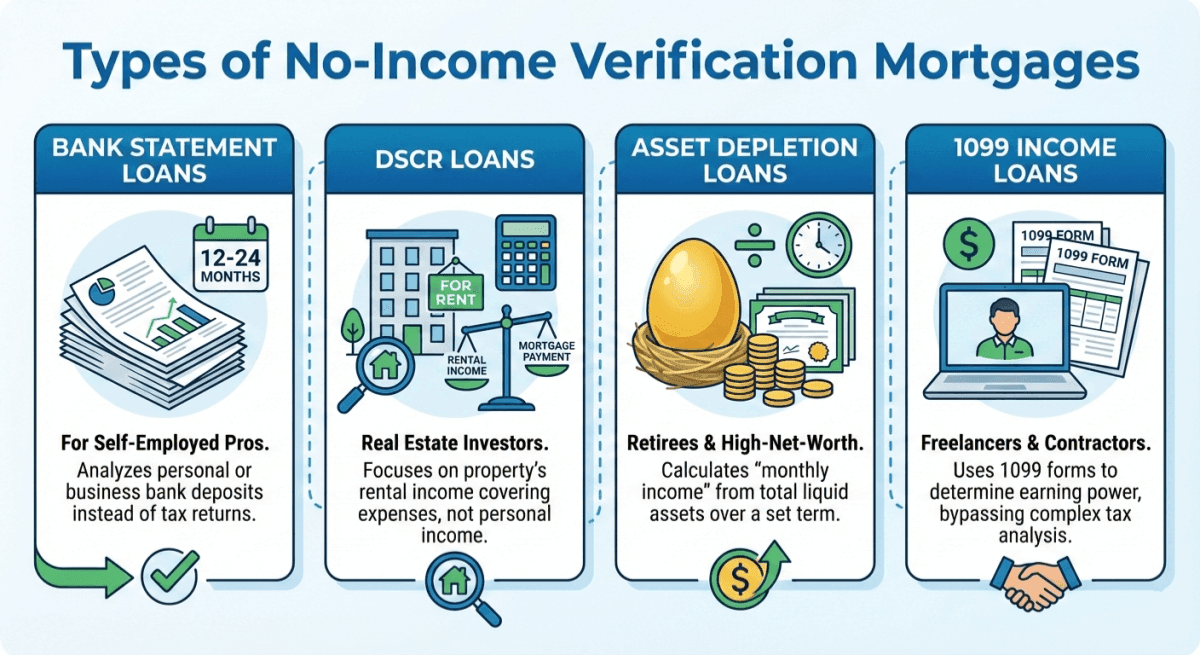

Types of No-Income Verification Mortgages

These loans aren't one-size-fits-all. Depending on how you earn your money, there are a few different "buckets" you might fall into. Here are the most common types available in the US market right now:

-

Bank Statement Loans: This is the most popular option for self-employed pros. Instead of tax returns, the lender analyzes 12 to 24 months of your personal or business bank statements. If the deposits are there, you qualify.

-

DSCR Loans (Debt Service Coverage Ratio): Real estate investors love this one. The underwriting focus is primarily on whether the property's actual or projected rental income covers the mortgage payment and expenses, rather than on your personal tax returns or W‑2 income. Some lenders may still review your credit profile and basic financials, but the qualifying decision is driven mainly by the property's DSCR.

-

Asset Depletion Loans: Ideal for retirees or high-net-worth individuals who don't have a job but have a large nest egg. We take your total liquid assets (stocks, savings) and divide them by a set term to calculate a "monthly income."

-

1099 Income Loans: Designed specifically for freelancers and contractors. We use your 1099 forms to determine earning power, skipping the complex tax return analysis.

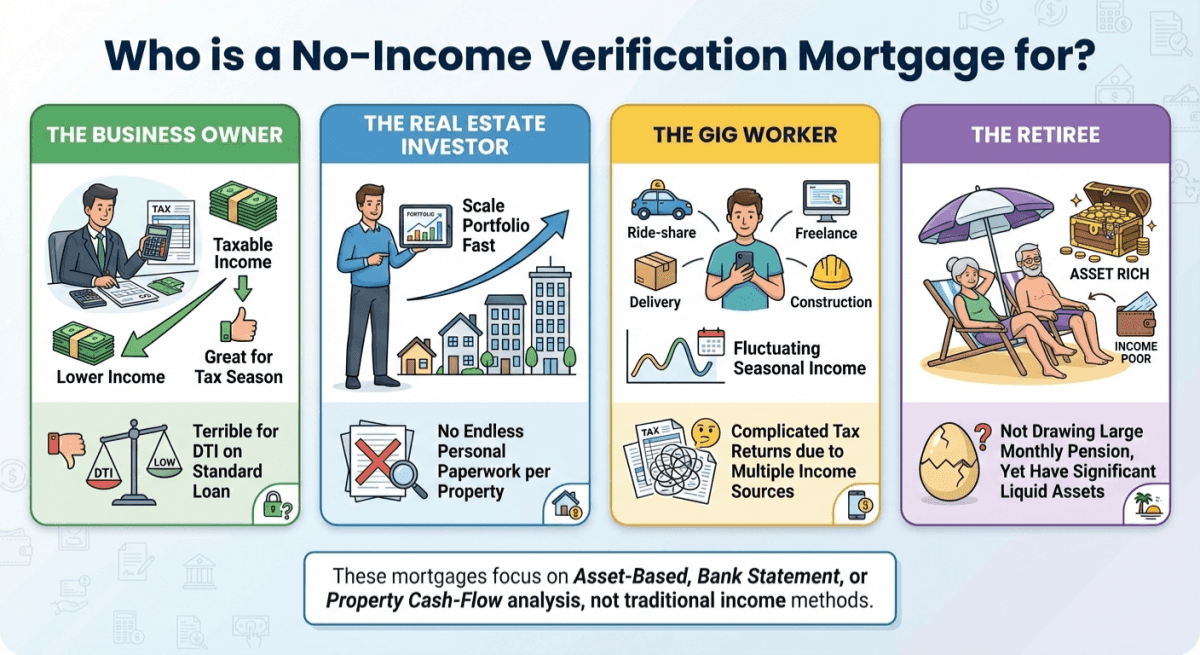

Who is a No-Income Verification Mortgage for?

I always tell my clients: if you have a 9-to-5 job with a W-2 and simple taxes, stick to a conventional loan—it's cheaper. However, a No-Income Verification Mortgage is a lifesaver if you fall into these specific categories:

-

The Business Owner: You legally utilize tax deductions to lower your taxable income. Great for tax season, but terrible for your Debt-to-Income (DTI) ratio on a standard loan application.

-

The Real Estate Investor: You want to scale your portfolio fast and don't want to submit endless personal paperwork for every single rental property you buy.

-

The Gig Worker: Your income fluctuates seasonally, or you have multiple side hustles that make your tax returns look complicated.

-

The Retiree: You are "asset rich" but "income poor" because you aren't drawing a large monthly pension.

How Does a No-Income Verification Mortgage Work?

The mechanics are surprisingly straightforward, though the underwriting is more manual than a standard loan.

In a traditional mortgage, a computer algorithm checks your W-2 data. With a No-Income Verification loan, a human underwriter reviews your alternative data. For instance, if you apply for a Bank Statement Loan, they will comb through your deposits, subtract a standard expense factor (like 50% for overhead), and determine your "usable" income.

Because the lender is doing more manual underwriting and taking on more perceived risk by not relying on traditional income documentation, there is a trade‑off. In practice, Non‑QM rates are often higher than standard conforming 30‑year fixed rates, and a spread in the range of about 0.50% to 1.50% or more is common depending on credit, down payment, and loan type. Think of this premium as the "convenience fee" for the flexibility of not showing your tax returns.

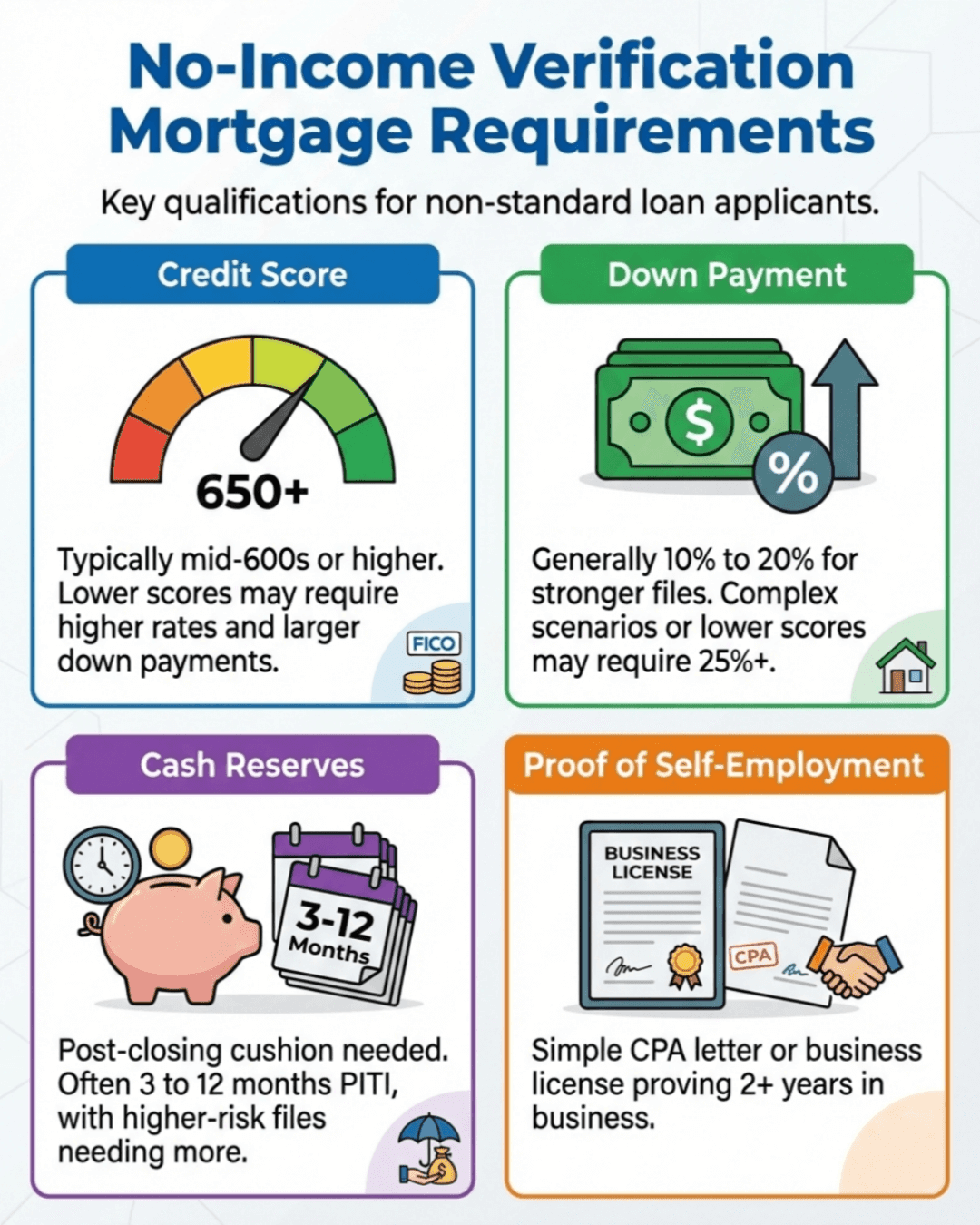

No-Income Verification Mortgage Requirements

While these loans are flexible, they aren't "easy money." Lenders in 2026 still have strict standards to ensure you don't default. Here is what you typically need to bring to the table:

-

Credit Score: Your credit history carries a lot of weight here. Many Non‑QM lenders look for FICO scores in the mid‑600s or higher, but some programs allow lower scores at the cost of higher rates and larger down payments.

-

Down Payment: You generally cannot put 3% down like on certain agency loans. Typical minimums range from about 10% to 20% for stronger files, while lower credit scores or more complex scenarios may require 25% or more.

-

Cash Reserves: Lenders also want to see a post‑closing cushion. Depending on your credit, loan size, and occupancy, reserve requirements often fall in the 3 to 12 month PITI range, with higher‑risk files needing more.

-

Proof of Self-Employment: A simple letter from your CPA or a business license proving you've been in business for two years usually does the trick.

Pros and Cons of No-Income Verification Mortgage

Before you sign on the dotted line, it is vital to be realistic about the trade-offs.

Pros:

-

You Can Actually Buy: It allows creditworthy buyers to purchase homes when traditional banks say "no."

-

Less Paperwork: Without waiting for tax transcripts from the IRS (which can take weeks), the process is often smoother.

-

Higher Limits: These programs often allow for "Jumbo" loan amounts, meaning you can buy luxury properties without standard limits.

Cons:

-

Higher Rate: You will pay a higher interest rate compared to a Fannie Mae/Freddie Mac loan.

-

Larger Down Payment: Tying up 20% cash upfront can be a hurdle for some buyers.

-

Prepayment Penalties: Be careful here. Some of these loans, especially for investors, might have a penalty if you refinance within the first 1-3 years. Always read the fine print.

FAQs About No-Income Verification Mortgage

Q1. Is it possible to get a loan without verifying income?

Not exactly. You cannot get a mortgage without documenting the income or assets the lender relies on to determine your ability to repay. You simply do not have to prove it with W‑2s or full tax returns in every case—Non‑QM lenders may instead use bank statements, 1099s, rental income, or verified assets as alternative documentation.

Q2. Can you buy a house with no source of income?

Generally, no. "No Job, No Income" loans are largely extinct. You need some source of funds—whether that's cash flow, liquid assets, or rental income.

Q3. What is the down payment for a no income verification mortgage?

Industry standard is usually 10% to 20%. If your credit score is excellent, 10% might work. If your credit is rocky, lenders may ask for 30%.

Q4. What are the risks of a no income verification mortgage?

The main risk is the higher monthly payment due to elevated rates. Also, since these are private loans, refinancing later can sometimes be trickier if your financial situation hasn't improved.

Conclusion: Is a No Income Verification Mortgage Right for Me?

If you are a W-2 employee, stick to conventional loans. But if you are an entrepreneur or investor whose tax returns don't reflect your true purchasing power, a No-Income Verification Mortgage is a powerful tool. It bridges the gap between your "taxable income" and your "actual income."

However, the market for these loans is complex. Every lender has different rules for what deposits count as income. Don't navigate this alone. Visit Bluerate today to connect with experienced loan officers for a free consultation. They can compare specific Non-QM programs for you and help you find the best rate for your unique situation.