Mortgage Loans for Foreign Nationals: 9 Best Options & Requirements

I still remember the first time I tried to help a friend from overseas buy a property here in the States. We walked into a major bank, full of hope, only to be told that without a Social Security Number or a U.S. credit score, the door was firmly shut. It was frustrating. If you are reading this in 2026, you might feel that same frustration. But here is the good news: the "impossible" is actually quite possible.

The U.S. mortgage market has evolved significantly. You don't need a Green Card, and you certainly don't need perfect American credit to build your real estate portfolio. Whether you are an investor looking for cash flow or a newcomer wanting a place to call home, specialized Non-QM (Non-Qualified Mortgage) loans are designed exactly for your situation. Let me walk you through how to navigate this landscape.

What Mortgage Loans Can Foreign Nationals Apply for?

In the past, foreign buyers were limited to "all-cash" deals or predatory hard money lenders. Today, the market is flush with options. Because you likely won't fit the strict "cookie-cutter" box of government-backed loans (like Fannie Mae), you will be looking at Non-QM loans. These are flexible mortgage products where lenders look at your assets or the property's income rather than your W-2s.

However, finding these lenders isn't as simple as walking into a Wells Fargo. Every lender has different rules for foreign nationals. Some require 30% down, others 20%. Some need a visa, others don't. This is where I often recommend using a tool like Bluerate.

Instead of calling twenty different banks and explaining your story repeatedly, you can use Bluerate to connect directly with specialized Non-QM loan officers. It allows you to compare rates specifically for foreign national programs and get expert guidance through loan origination. It's a free resource that cuts through the noise and helps you find a lender who actually wants your business.

Foreign National Mortgage

Best for: Buyers who can provide "full documentation" (income/employment) from their home country to secure a standard loan.

When we talk about a "Foreign National Mortgage," we are usually referring to a loan that mimics a traditional U.S. mortgage but accepts international documents. This is ideal if you have a strong employment history in your home country and can prove it. Unlike investment-only loans, some lenders allow this program for second homes (vacation properties) where you plan to stay part of the year. It's a solid middle-ground option that often comes with competitive rates if you are willing to provide the paperwork.

Requirements

-

Valid Passport & Visa: While a valid passport is always required, a U.S. visa is not always mandatory for foreign national mortgages. Many lenders accept applicants without a visa if legally present or for remote closings, though legal U.S. entry (e.g., visa waiver) is often needed at purchase. Some programs explicitly state "US Visa is not required normally."

-

Income Verification: A letter from your employer or an accountant (CPA) in your home country stating your income.

-

Credit Reference: Since you likely lack a U.S. credit score, lenders will ask for an international credit report or reference letters from your bank/landlord back home.

-

Down Payment: Down payments typically range from 20-50%, varying widely by lender, property type, and program. 30-40% is common but not the minimum floor.

Also Read: Best Foreign National Mortgage Lenders: How to Choose?

DSCR Loans for Foreign Nationals

Best for: Real estate investors who want to qualify based only on the property's rental income, not personal income.

In my experience, this is the #1 choice for foreign investors in 2026. DSCR (Debt Service Coverage Ratio) loans are brilliant because the lender doesn't care about your job, your taxes in your home country, or your personal debt. They only care about one thing: Will the rent cover the mortgage? If the property generates enough cash flow, you get the loan. It is fast, scalable, and requires the least amount of invasive personal documentation.

Requirements

-

DSCR Ratio ≥ 1.0: The monthly rent must equal or exceed the monthly mortgage payment (Principal, Interest, Taxes, Insurance).

-

Down Payment: Typically 20-25% minimum.

-

Reserves: You usually need 6 months of mortgage payments saved in a bank account (liquid cash) to show you can handle vacancies.

-

Loan Purpose: Strictly for investment properties, and you cannot live there full-time.

Also Read:

- DSCR Loan Requirements: Ratio, Credit Score, Down Payment, Type

- DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

- DSCR Formula: How to Calculate DSCR in Real Estate?

- Best DSCR Lenders Near Me 2026: Highlights, Pros & Cons

Asset-Based Mortgage

Best for: High-Net-Worth Individuals (HNWI) with significant cash or liquid assets but low (or hard to prove) monthly income.

If you are sitting on a large amount of capital, stocks, crypto, or savings, but you don't have a steady "salary" to show a bank, an Asset-Based Mortgage or Asset Depletion Loan is your solution. The lender takes your total liquid assets and divides them by a set term, which is usually 60 or 84 months, to create a "phantom income." They use this calculated income to approve your loan. It's perfect for wealthy retirees or entrepreneurs whose money is in the market, not a paycheck.

Requirements

-

Significant Assets: No universal minimum like $500k-$1M. Requirements vary by lender, often focusing on sufficient assets to generate qualifying "phantom income" via depletion (e.g., divided over 60-84 months), potentially lower depending on loan size.

-

Asset verification: Assets must be in a recognized financial institution (US-based or major international bank) and seasoned (held) for at least 2 months.

-

Verification: All foreign documents must be translated into English.

-

LTV: Loan-to-Value ratios are often capped at 70-75%.

Also Read:

Bank Statement Loans

Best for: Self-employed business owners who have high revenue but take many tax deductions.

If you own a business in your home country (or in the U.S.), your tax returns might not reflect how much money you actually make because of write-offs. A Bank Statement Loan allows you to use 12 to 24 months of bank deposits to calculate your income. Lenders look at the "cash flow" entering your business account rather than the "net profit" on your tax forms. This is a lifesaver for entrepreneurs who look "poor" on paper but are "rich" in cash flow.

Requirements

-

Statements: 12 or 24 months of business or personal bank statements, which must be translated if foreign.

-

Business Ownership: You typically need to own at least 50% of the business.

-

Expense Factor: Lenders will assume a certain percentage (e.g., 50%) of your deposits are expenses, unless a CPA letter states otherwise.

-

Down Payment: Varies 20-40% or more for foreign nationals. Consistent with general Non-QM but not fixed.

Hard Money Loans for Foreign Nationals

Best for: Investors needing speed (closing in <2 weeks) or funding for "Fix and Flip" renovation projects.

Sometimes, you find a deal that is too good to pass up, but you need to close in 10 days. Or perhaps you are buying a distressed property that a normal bank won't touch. Hard Money Loans are short-term, asset-based loans provided by private lenders. They are expensive (higher interest rates) and short-term (12-24 months), but they are incredibly fast and focus almost entirely on the property's value (or After-Repair Value), not the borrower.

Requirements

-

High Equity: Often 30-40%+ for safety, but ranges based on property/ARV. Accurate but lender-specific.

-

Exit Strategy: You must explain how you will pay them back (e.g., "I will sell the house in 6 months" or "I will refinance into a DSCR loan").

-

Liquidity: You need cash to pay for the renovation costs upfront (draws are reimbursed later).

-

Experience: Previous flipping experience helps get better rates but isn't always mandatory.

ITIN Mortgage Loans

Best for: Foreign nationals living in the U.S. who do not have a Social Security Number but do have an ITIN.

It is crucial to distinguish this from the others. While most loans above are for investors living abroad, ITIN loans are for people living and working inside the U.S. (often undocumented or on specific visa statuses) who pay taxes. If you have an Individual Taxpayer Identification Number (ITIN) instead of an SSN, you can buy a primary residence. These lenders look at your history of paying taxes and bills in the U.S. to approve you.

Requirements

-

Valid ITIN: Must have an active ITIN letter from the IRS.

-

Employment: Usually 2 years of work history in the U.S. (same line of work preferred).

-

Tax Returns: 1 or 2 years of tax returns filed using your ITIN.

-

Credit: Traditional credit isn't needed. They may accept "alternative credit" like 12 months of on-time rent or utility bills.

Also Read: Best ITIN Mortgage Lenders Near Me: How to Choose?

Bridge Loan

Best for: Buyers who need temporary financing to "bridge" a gap between selling one property and buying another, or to stabilize an investment.

A Bridge Loan is a strategic tool. Let's say you need to buy a U.S. property now, but your money is tied up in a property sale in your home country that will close in three months. A bridge loan gives you the cash to buy the U.S. home immediately. Once your funds arrive, you pay off the bridge loan. It's also used to buy an empty building, find a tenant, and then refinance into a long-term loan.

Requirements

-

Strong Exit Plan: The lender needs to know exactly where the money is coming from to pay them off in 6-12 months.

-

Down Payment: Typically 30-35%.

-

Property Type: Usually available for both residential and commercial investment properties.

-

Speed: These can close nearly as fast as hard money.

Portfolio Loans for Foreign Nationals

Best for: Borrowers with unique scenarios that require a flexible, "common sense" lender.

Portfolio lenders are usually small community banks or private funds that keep their loans on their own books instead of selling them to Wall Street. Because they keep the risk, they make the rules. If you have a complicated financial situation, perhaps your income comes from three different countries and a trust fund, a portfolio lender is the one who will actually sit down, listen to your story, and make a decision based on the "big picture" rather than a checklist.

Requirements

-

Relationship: They often require you to open a deposit account (checking/savings) with their bank, sometimes with a minimum balance ($100k+).

-

Flexibility: Down payment and rates are negotiable based on the strength of your relationship.

-

Manual Underwriting: A human reviews your file, not a computer algorithm.

Commercial Mortgage for Foreign Nationals

Best for: Investors purchasing multifamily buildings (5+ units), office spaces, retail centers, or hotels.

Once you graduate from buying single houses to buying apartment complexes or strip malls, you enter the world of Commercial Mortgages. Here, the rules change. The valuation is strictly based on the Net Operating Income (NOI) of the building. Lenders love foreign investors for commercial deals, but they will scrutinize the property's financials heavily. This is for serious wealth building and scaling.

Requirements

-

Property Financials: You must provide Rent Rolls and Profit & Loss (P&L) statements for the building.

-

Experience: Lenders often require you to have prior experience managing commercial real estate (or hire a professional property management company).

-

Entity: You must buy the property in a U.S. LLC or Corporation.

-

LTV: Lower leverage, typically 60-70% Loan-to-Value.

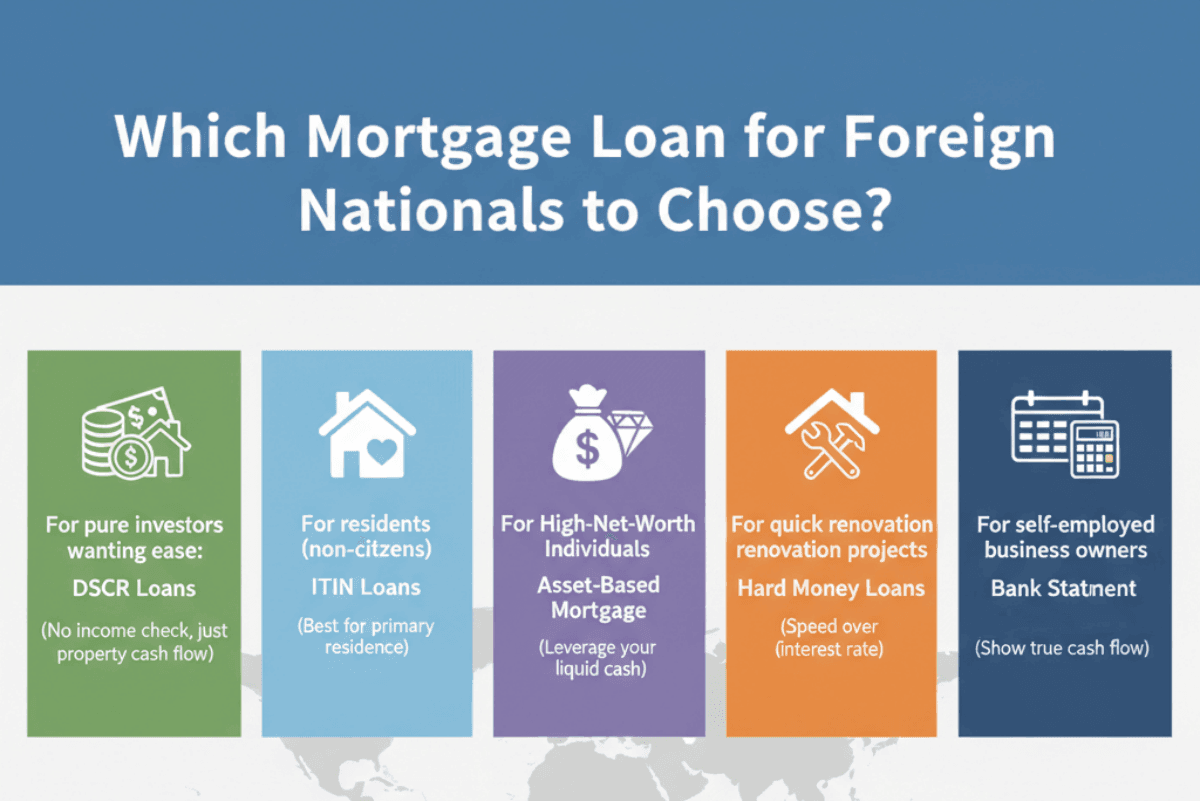

Which Mortgage Loan for Foreign Nationals to Choose?

Choosing the right loan depends entirely on your goal and your residency status. Here is my quick recommendation guide to help you decide:

-

For pure investors wanting ease: Choose DSCR Loans. (No income check, just property cash flow).

-

For residents (non-citizens) wanting a home: Choose ITIN Loans. (Best for primary residence).

-

For High-Net-Worth Individuals: Choose Asset-Based Mortgage. (Leverage your liquid cash).

-

For quick renovation projects: Choose Hard Money Loans. (Speed over interest rate).

-

For self-employed business owners: Choose Bank Statement Loans. (Show true cash flow).

If you are still unsure which bucket you fall into, or if you want to see which lender offers the best rate for your specific scenario, I strongly suggest using Bluerate. A quick search there can save you weeks of confusion.

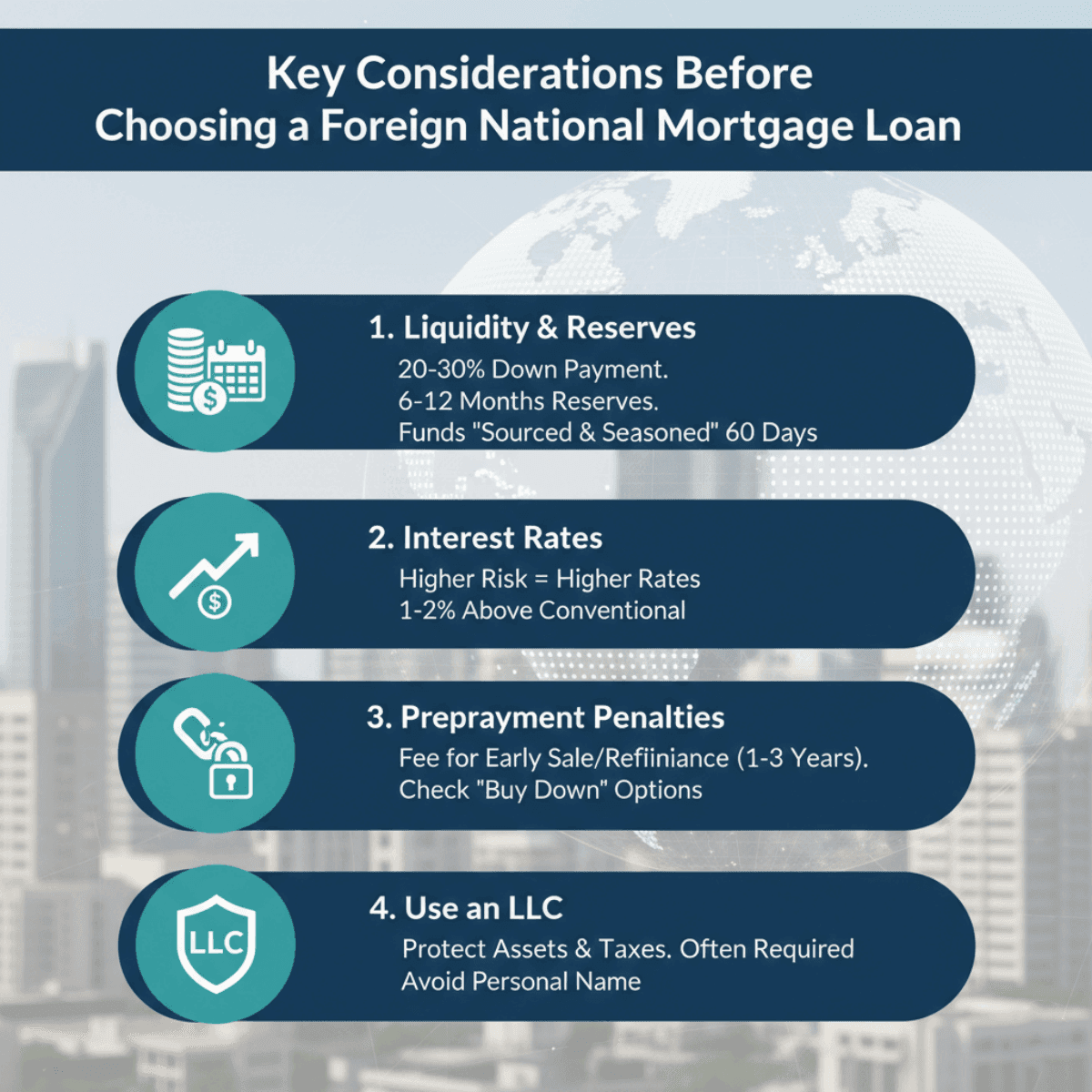

Key Considerations Before Choosing a Foreign National Mortgage Loan

Before you sign any papers, there are a few "fine print" details you need to be aware of. These are the things that often trip up foreign buyers in 2026:

-

Liquidity & Reserves: Cash is king. Unlike U.S. citizens who can sometimes buy with 3% down, you will need 20-30% down. Plus, lenders require "Reserves", usually 6 to 12 months of mortgage payments sitting in a liquid bank account. This money needs to be "sourced and seasoned" in your account for 60 days to comply with Anti-Money Laundering (AML) laws.

-

Interest Rates: Be realistic. Because you don't have a U.S. credit history, you are considered "higher risk." Expect your interest rate to be 1% to 2% higher than a standard conventional loan.

-

Prepayment Penalties: This is crucial. Many investment loans, especially DSCR and Non-QM, come with a prepayment penalty for the first 1 to 3 years. This means if you sell the house or refinance too soon, you pay a fee. Always check if you can "buy down" this penalty.

-

Use an LLC: Most lenders will actually require or strongly suggest you close the loan in the name of a U.S. LLC (Limited Liability Company). This protects your personal assets and offers tax advantages. Do not buy in your personal name unless necessary.

Conclusion

Buying U.S. real estate as a foreign national in 2026 is not only possible, it is a streamlined and well-established path to wealth. Whether you choose a DSCR loan for your rental portfolio or an ITIN loan for your family home, the financing tools are there, you just need to know where to look.

The biggest hurdle is often finding a lender who understands your unique international profile and won't overcharge you. Don't try to navigate this maze alone. I recommend visiting Bluerate.ai today. You can connect with experienced non-qm loan officers for a free consultation, compare specialized rates tailored for foreign nationals, and streamline your entire application process.