Foreign National Mortgage: Definition, Requirements, Process

"Can I actually buy a house in the USA?" This is the number one question I get from friends and clients living abroad. The short answer is a resounding yes. There are no citizenship requirements for owning US property. However, financing that purchase is a different story. If you don't have a US credit history, a standard bank loan won't work for you. This is where Foreign National Mortgage loans come in. In this guide, I will walk you through exactly how these loans work, what you need to qualify, and how to navigate the process without headaches.

Can Foreign Nationals Get a Mortgage?

Absolutely. While government-backed loans, like FHA or conventional loans, are typically reserved for US citizens and Green Card holders, the private market offers specialized options for you. These are often categorized as Non-QM (Non-Qualified Mortgage) loans. You are not limited to paying all cash.

However, lending guidelines can vary significantly based on your visa status and financial background. If you are unsure whether you meet the specific criteria, I highly recommend visiting Bluerate. You can book a free online consultation with local Loan Officers who specialize in international borrowers to get a personalized assessment.

What is a Foreign National Loan?

Think of a Foreign National Loan as a bridge for global investors. It is a specialized mortgage product designed for non-residents who live outside the US but wish to purchase a vacation home or an investment property (rental) in the states.

From my professional experience, the most popular type of foreign national loan is the DSCR (Debt Service Coverage Ratio) loan. This is a game-changer. Instead of asking for your foreign tax returns or employment letters, which can be a nightmare to translate and verify, lenders focus on the property itself.

Also Read:

- DSCR Loan Requirements: Ratio, Credit Score, Down Payment, Type

- DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

- DSCR Formula: How to Calculate DSCR in Real Estate?

- Best DSCR Lenders Near Me: Highlights, Pros & Cons

Who is this for?

- Real Estate Investors: Looking to diversify assets into US dollars.

- Vacationers: People who want a holiday home in Florida, California, or New York.

- Newcomers: Recent arrivals who haven't built a US credit score yet.

These loans are typically for investment properties. If you plan to live in the home as your primary residence without a valid long-term visa, you might face stricter restrictions.

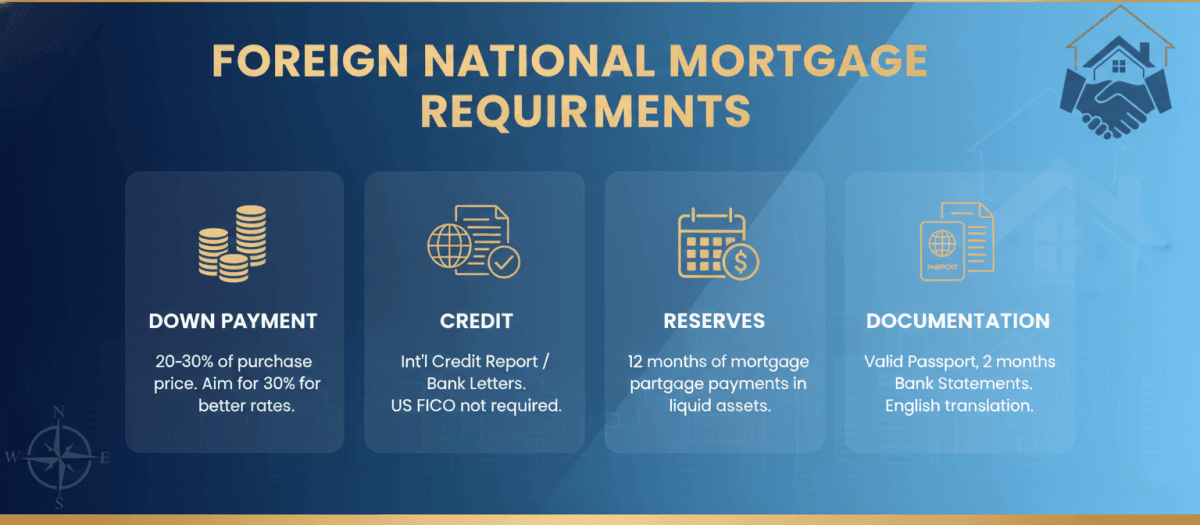

Foreign National Mortgage Requirements

Let's get into the nitty-gritty. Since lenders cannot rely on a US credit score to measure risk, they require other forms of security. Based on current market standards in 2025-2026, here is what you typically need:

-

Down Payment: This is the biggest hurdle. Expect to put down 20% to 30%. I always advise clients to aim for 30% because it often unlocks a better interest rate.

-

Credit: If you don't have a US FICO score, don't worry. Lenders will often accept an International Credit Report or credit reference letters (from your landlord or bank in your home country). Some DSCR programs don't require a credit score at all.

-

Reserves: Lenders want to ensure you don't run out of cash. Foreign nationals typically need to show 12 months of mortgage payments in liquid assets as reserves, though this can vary by loan-to-value ratio and lender.

-

Documentation: A valid passport. A U.S. visa is not required for foreign national loans. You will also need two months of bank statements. Ensure all documents are translated into English by a certified translator.

Also Read: Best Foreign National Mortgage Lenders: How to Choose?

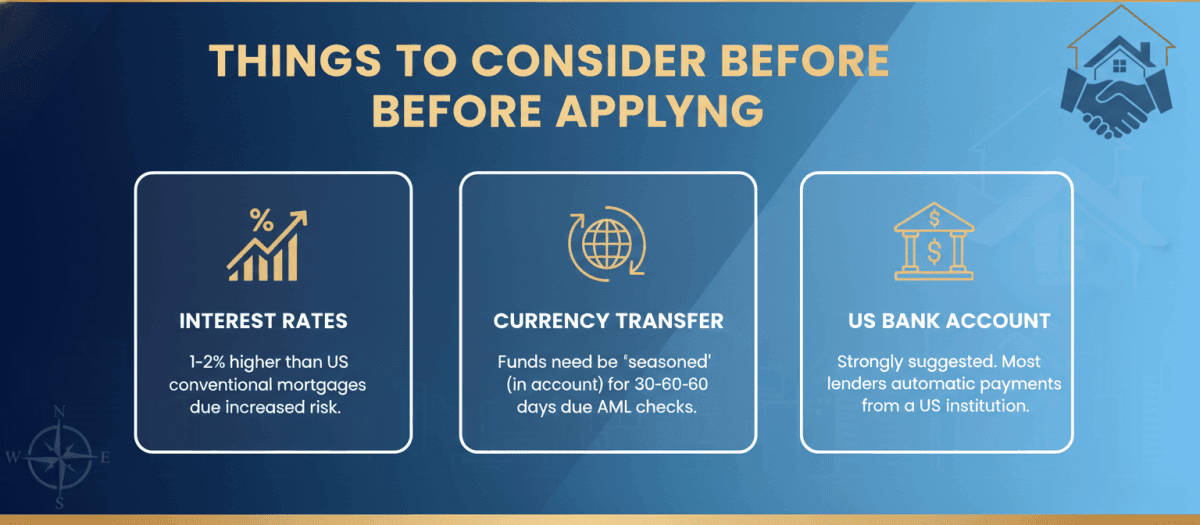

Things to Consider Before Applying

Before you dive into the application, I want to manage your expectations regarding costs and logistics. This helps build a realistic plan.

-

Interest Rates: Because these loans carry higher risk for the lender, the interest rates are generally 1% to 2% higher than standard US conventional mortgages. View this as the cost of doing business without US income verification.

-

Currency Transfer: Moving large sums of money internationally triggers Anti-Money Laundering (AML) checks. Your funds usually need to be "seasoned" (sitting in your account) for at least 30-60 days.

-

US Bank Account: I strongly suggest opening a US bank account as soon as possible. Most lenders require you to set up automatic mortgage payments from a US institution.

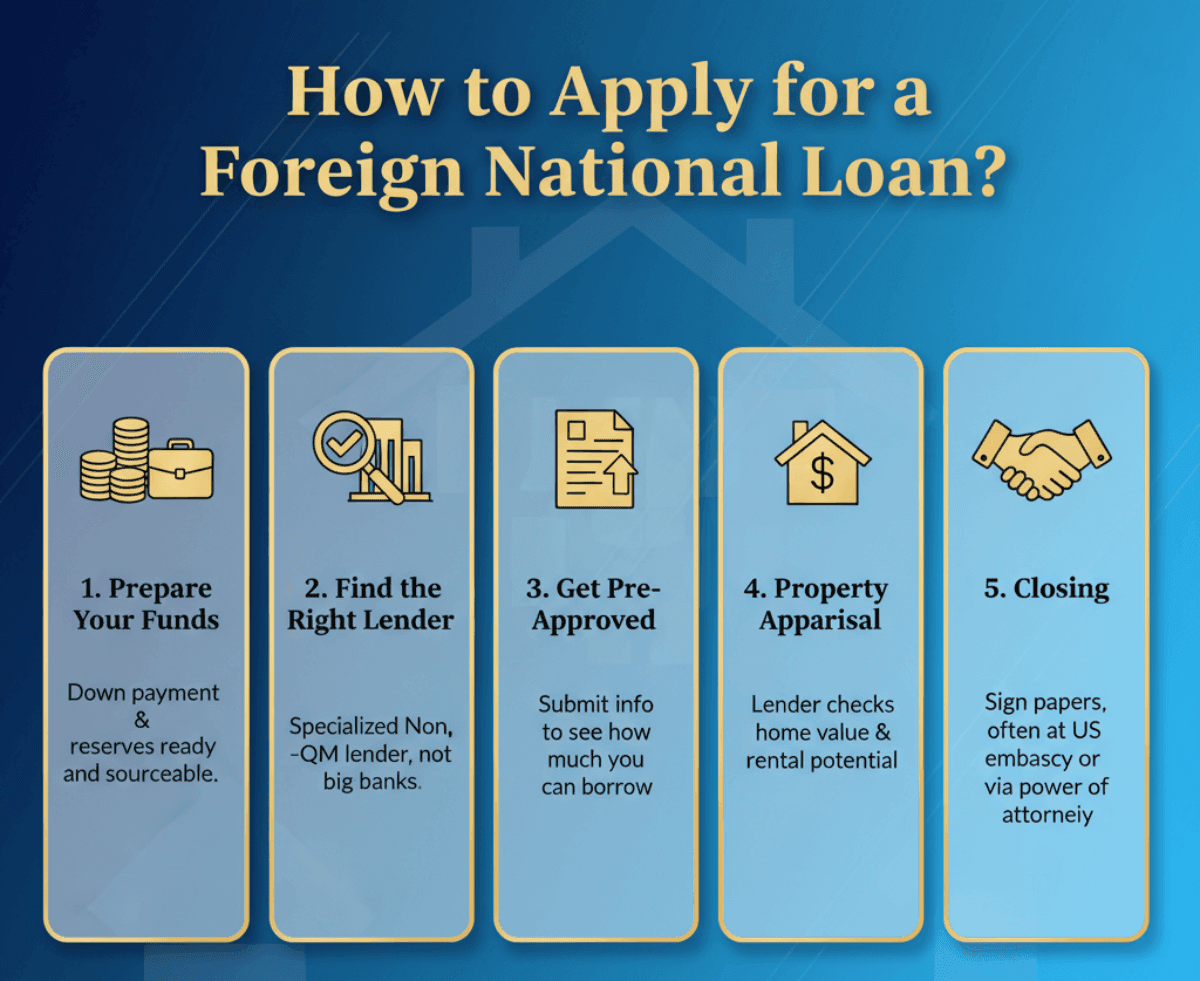

How to Apply for a Foreign National Loan?

The process is slightly different from applying for a domestic loan, but it doesn't have to be difficult. Here is the roadmap:

-

Prepare Your Funds: Ensure your down payment and reserves are ready and sourceable.

-

Find the Right Lender: Most big banks, like Chase or BoA, do not offer these specific loans. You need a specialized Non-QM lender.

-

Get Pre-Approved: Submit your basic info to see how much you can borrow.

-

Property Appraisal: The lender will check the value and rental potential of the home.

-

Closing: Sign the papers, which often can be done at a US embassy or via power of attorney.

Instead of searching blindly, you can use Bluerate to compare rates from multiple lenders. It allows you to submit one application and shop around, which saves time and ensures you aren't overpaying.

Pros and Cons of Foreign National Mortgage

To help you make an objective decision, here is a breakdown of the advantages and disadvantages.

Pros:

-

Access to US Market: You can invest in one of the world's most stable real estate markets without full cash.

-

Leverage: You keep your liquidity. Using the bank's money increases your potential Return on Investment (ROI).

-

Simplified Income documentation: With DSCR options, you avoid the hassle of proving foreign income.

Cons:

-

Higher Entry Cost: A 30% down payment is significant capital to tie up.

-

Higher Interest Rates: Monthly payments will be higher compared to US resident loans.

-

Closing Costs: You may face slightly higher closing fees and reserve requirements.

FAQs About Foreign National Mortgage Loan

Q1. Can a foreign national buy a house in the US?

Yes, absolutely. The United States does not restrict foreign nationals from owning land or property. You have the same property rights as a US citizen.

Q2. Can banks lend to non-U.S. citizens?

Yes, but typically not traditional commercial banks. You will usually need to work with specialized mortgage lenders or private lenders who offer Non-QM/Foreign National programs.

Q3. Do I need an ITIN number to buy a house?

An ITIN is often required by lenders for foreign nationals to process the mortgage application and meet tax reporting requirements, though it's not needed for the purchase itself if paying cash. It is best to apply for one early.

Also Read:

- ITIN Mortgage Loan Guide 2026: Definition, Requirements, Process

- 8 Best ITIN Mortgage Lenders Near Me: How to Choose?

Q4. How long does the closing process take?

It generally takes longer than a standard loan. Expect the process to take 30 to 45 days, sometimes up to 60 days, due to the time required for verifying international documents and transferring funds.

Q5. Can I use the property as an Airbnb?

Yes, many Foreign National loans, especially DSCR loans, allow for short-term rental strategies like Airbnb. However, make sure the lender knows your plan upfront, as some have specific rules for short-term rentals.

Conclusion

Buying a home in the US as a foreign national is a strategic move for wealth preservation and growth. While the requirements, like a larger down payment and verified reserves, are stricter than for locals, the process is transparent and achievable. You don't need a green card. You just need the right guidance.

If you are ready to take the next step, don't let the paperwork scare you. I recommend visiting Bluerate to consult with experienced loan officers. You can compare rates, get pre-approved online, and even track your entire loan origination process from your dashboard. It makes a complex cross-border transaction feel simple and secure.